Problem Set 1_fixedincome

Problem Set 1: Fixed Income securities

ECONM2035 : Asset Pricing

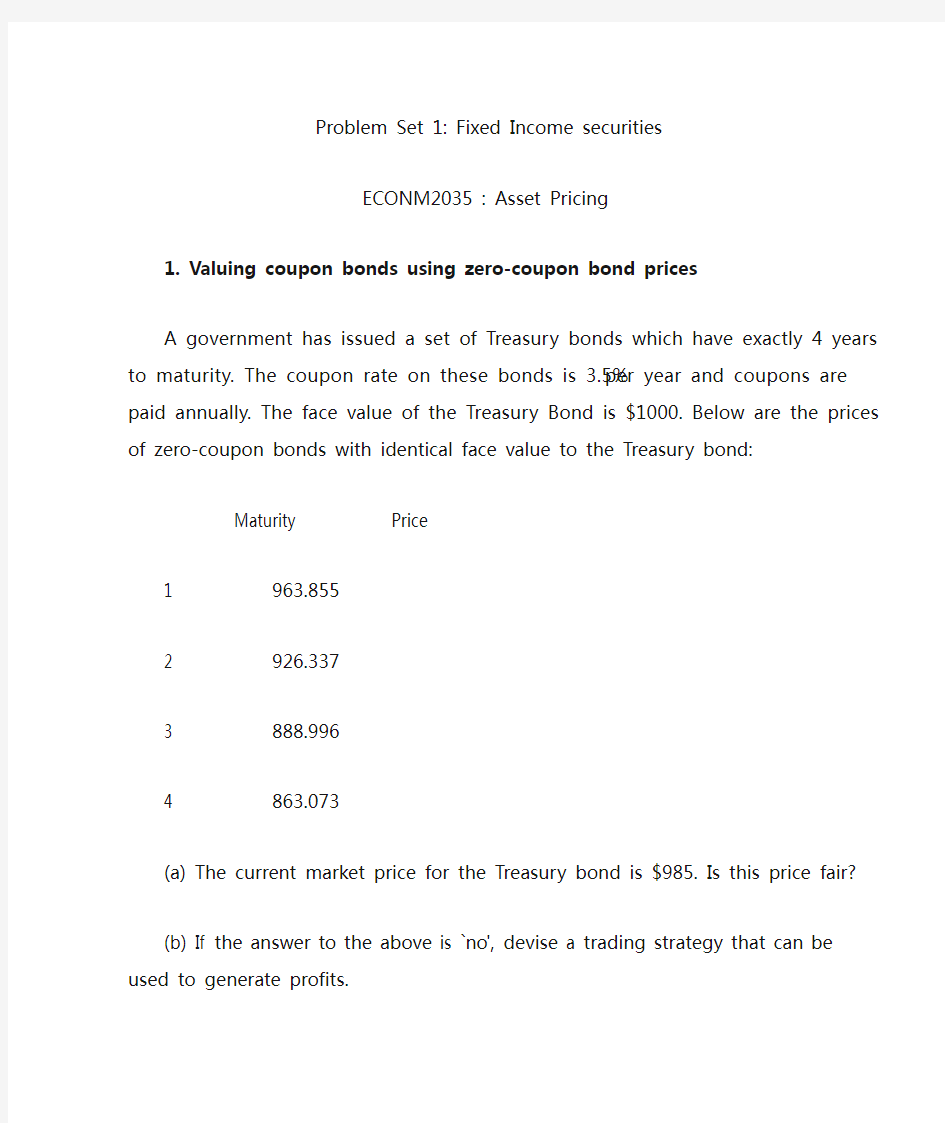

1. Valuing coupon bonds using zero-coupon bond prices

A government has issued a set of Treasury bonds which have exactly 4 years to maturity. The coupon rate on these bonds is 3.5% per year and coupons are paid annually. The face value of the Treasury Bond is $1000. Below are the prices of zero-coupon bonds with identical face value to the Treasury bond:

Maturity Price

1 963.855

2 926.337

3 888.996

4 863.073

(a) The current market price for the Treasury bond is $985. Is this price fair?

(b) If the answer to the above is `no', devise a trading strategy that can be used to generate profits.

(c) Given the relative levels of the bond's fair value and its face value, what can one say about the yield to maturity on the bond?

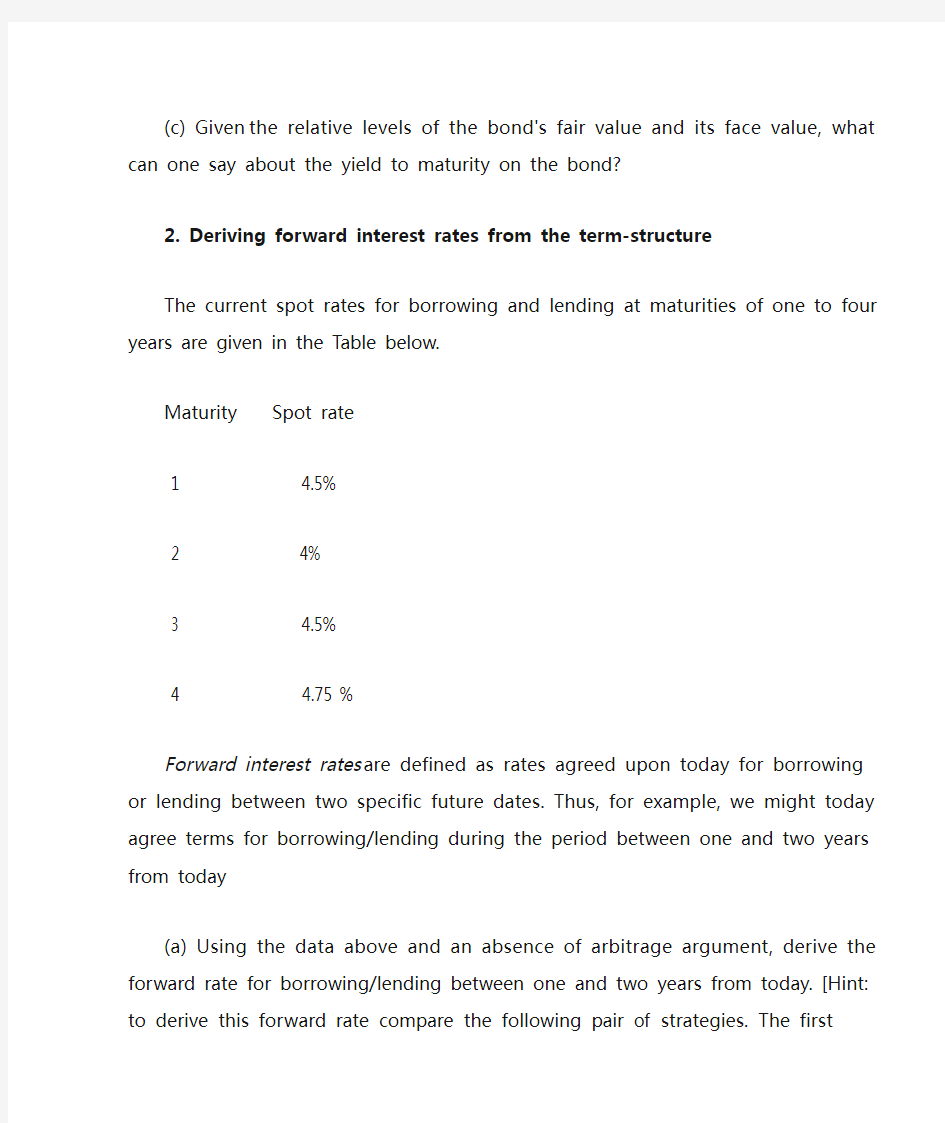

2. Deriving forward interest rates from the term-structure

The current spot rates for borrowing and lending at maturities of one to four years are given in the Table below.

Maturity Spot rate

1 4.5%

2 4%

3 4.5%

4 4.7

5 %

Forward interest rates are defined as rates agreed upon today for borrowing or lending between two specific future dates. Thus, for example, we might today agree terms for borrowing/lending during the period between one and two years from today (a) Using the data above and an absence of arbitrage argument, derive the forward rate for borrowing/lending between one and two years from today. [Hint: to derive this forward rate compare the following pair of strategies. The first entails investing $1 for two years at the two-year spot rate. For the second, you invest $1 for one year at the one year spot rate and then invest the proceeds at the forward rate for lending between one and two years from today. Given that all of the rates used in these calculations should be known as of today, both investments are risk-free.]

(b) Similarly, derive the forward rate for borrowing/lending between two and three years from today.

(c) If the market forward rate for two to three years from today was at 5%, design a trading strategy that guarantees an investor a risk-less profit.

3. Bond valuation using the term-structure

The current US term structure of interest rates is as given below:

Maturity Spot rate

0.5 2.75%

1.0

2.5%

1.5 2%

2.0 2.25 %

2.5 2%

3.0 1.75%

Compute the fair price of a bond with 3 years to maturity, an annual coupon rate of 6% and semi-annual coupon payments. The bond's face value is $10,000.

4. Yield to maturity calculations

A bond with 2 years to maturity, face value $100, an annual coupon rate of 5% and semi-annual coupon payments trades on the market at $105.89. Calculate the yield to maturity on this bond to an accuracy of one tenth of a percentage point.

5. Credit ratings

The following table gives a set of US firms along with the credit ratings assigned

to them by Standard and Poor's:

Company Ticker Rating

Coca-Cola KO A+

Ford F B-

General Electric GE AAA

Goldman Sachs GS AA-

McDonald's MCD A

Using the information available from the S&P website, interpret the meanings of these ratings and their implications for each firm's ability to repay its debt. Identify the companies which have investment grade ratings. Explain how you would expect the yield on the firms' debt to be linked to their ratings.