国际经济学理论与政策--双语各章练习

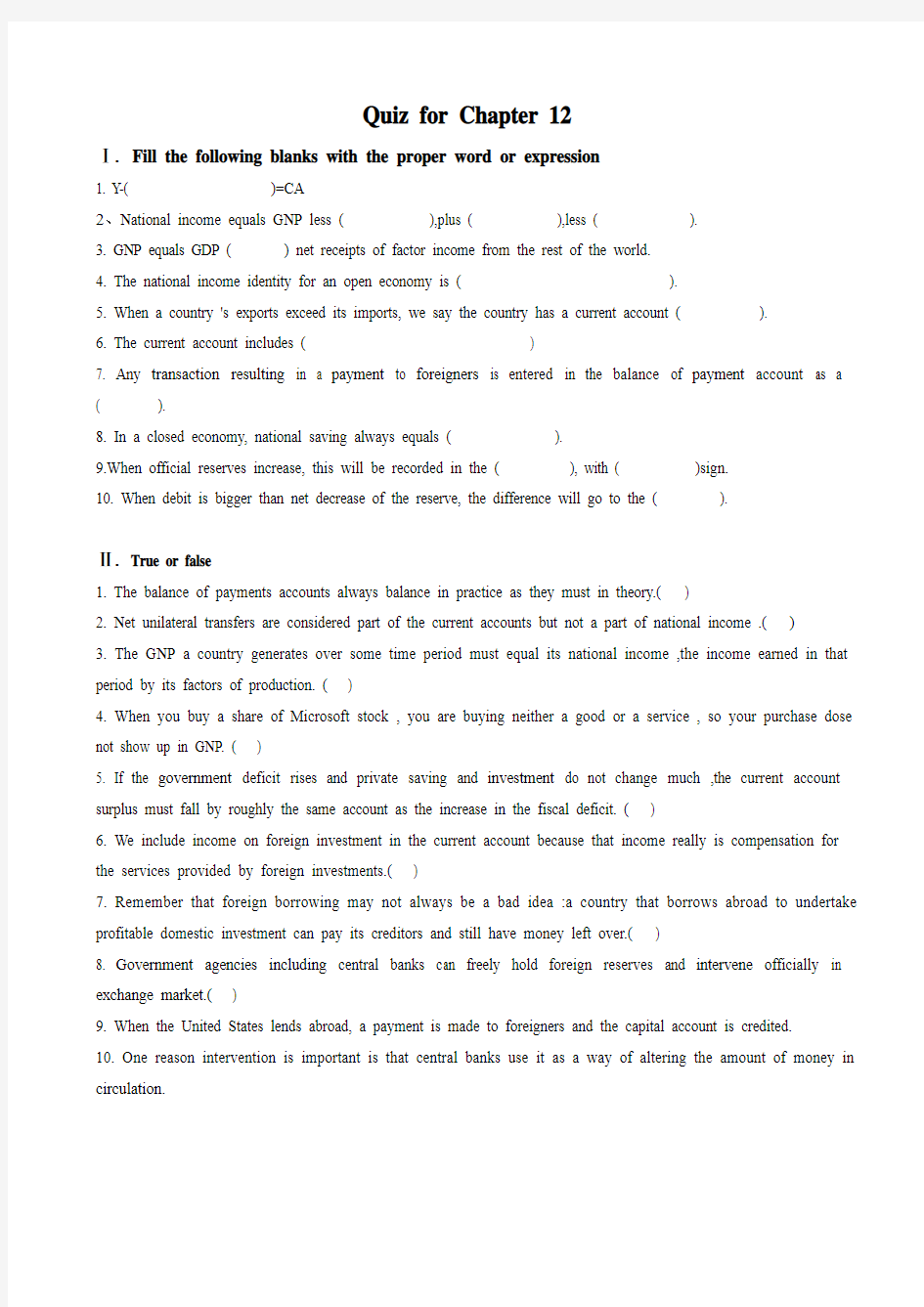

Quiz for Chapter 12

Ⅰ. Fill the following blanks with the proper word or expression

1. Y-( )=CA

2、National income equals GNP less ( ),plus ( ),less ( ).

3. GNP equals GDP ( ) net receipts of factor income from the rest of the world.

4. The national income identity for an open economy is ( ).

5. When a country 's exports exceed its imports, we say the country has a current account ( ).

6. The current account includes ( )

7. Any transaction resulting in a payment to foreigners is entered in the balance of payment account as a ( ).

8. In a closed economy, national saving always equals ( ).

9.When official reserves increase, this will be recorded in the ( ), with ( )sign.

10. When debit is bigger than net decrease of the reserve, the difference will go to the ( ).

Ⅱ. True or false

1. The balance of payments accounts always balance in practice as they must in theory.( )

2. Net unilateral transfers are considered part of the current accounts but not a part of national income .( )

3. The GNP a country generates over some time period must equal its national income ,the income earned in that period by its factors of production. ( )

4. When you buy a share of Microsoft stock , you are buying neither a good or a service , so your purchase dose not show up in GNP. ( )

5. If the government deficit rises and private saving and investment do not change much ,the current account surplus must fall by roughly the same account as the increase in the fiscal deficit. ( )

6. We include income on foreign investment in the current account because that income really is compensation for the services provided by foreign investments.( )

7. Remember that foreign borrowing may not always be a bad idea :a country that borrows abroad to undertake profitable domestic investment can pay its creditors and still have money left over.( )

8. Government agencies including central banks can freely hold foreign reserves and intervene officially in exchange market.( )

9. When the United States lends abroad, a payment is made to foreigners and the capital account is credited.

10. One reason intervention is important is that central banks use it as a way of altering the amount of money in circulation.

Ⅲ. Answer the following questions:

1.Why account keepers adds the account a statistical discrepancy to the balance of payment?

2.The nation of Pecunia had a current account deficit of $1 billion and a nonreserve financial account surplus

of $550 million in 2005.

(1)What was the balance of payments of Pecunia in that year? What happened to the country’s net foreign

assets?

(2)Assume that foreign central banks neither buy nor sell Pecunian assets. How did the Pecunian central banks

had purchased $600 million of Pecunian assets in 2005? How would this official intervention show up in the balance of payments accounts?

(3)How would your answer to (2) change if you learned that foreign central banks had purchased enter foreign

balance of payments accounts?

Ⅳ. Fill the following blanks:

China's balance of payment in 2000

Quiz for Chapter 13

Ⅰ. Fill the following blanks with the proper word or expression

1. Changes in exchange rates are described as or .

2. Foreign exchange deals sometimes specify a value date farther away than two-days-30 days, 90days, 180 days, or even several years. The exchange rates quoted in such transactions are called

3. is the most liquid of assets

4. The ease with which the asset can be sold or exchange for goods, we call the character is

5. A foreign is a spot sale of a currency combined with a forward repurchase of the currency.

6. The foreign exchange market is in when deposits of all currencies offer the same expected rate of

return.

7. The price of one currency in terms of another is called an

8. All else equal, a in the expected future exchange rate causes a rise in the current exchange rate.

9. is the percentage increase in value, it offers over some time period.

10. All else equal, an in the interest paid on deposits of a currency causes that currency to

appreciate against foreign currencies.

Ⅱ. True or false

1. A rate of appreciation of the dollar against the euro is the rate of depreciation of the euro against dollar.( )

2. The exchange rate quoted as the price of foreign currency in terms of domestic currency is called direct quotation. ( )

3. all else equal, an appreciation of a country's currency makes its goods cheaper for foreigners. ( )

4. The foreign exchange market is in equilibrium when deposits of all currencies offer the same expected rate of return. ( )

5. All else equal., When a country's currency depreciated, domestic residents find that imports from abroad are more expensive. ( )

6. Central bank is at the center of the foreign exchange market.( )

7. A depreciation of the dollar against euro today makes euro deposit less attractive on the condition that expected future dollar/euro rate and interest rates do not change.( )

8. all else equal, a decrease of the interest paid on deposit of US dollars causes dollars to appreciate against foreign currency.( )

9. New York. is the largest foreign exchange market in the world. ( )

10. A fall in the expected future exchange rate causes a fall in the current exchange rate.

Ⅲ. Answer the following questions:

1. Currently, the spot exchange rate is US$1=SF1.50 and the expected exchange rate for six month is SF1.55. the interest rate is 8% in the US per annum and 10% in the Switzerland per annum. (1)Determine whether interest rate parity is currently holding.

(2)If it is not holding, what will happen in the foreign exchange market?.

(3)If the expected exchange rate is unchanged, what is the spot rate when foreign exchange rate is in equilibrium?

2.Suppose the dollar interest rate and the pound sterling interest rate are the same, 5 percent per year. What is the relation between the current equilibrium $/£exchange rate and its expected future level? Suppose the expected future $/£exchange rate, $1.52 per poun d, remains constant as Britain’s interest rate rises to 10 percent per year. If the U.S. interest rate also remains constant, what is the new equilibrium $/£exchange rate?

Quiz for Chapter 14

Ⅰ. Fill the following blanks with the proper word or expression

1. M1 includes __________.

2. An economy ' s money supply is controlled by _________________.

3. Three main factors that determine aggregate money demand are

4. When money supply equals money demand, we say that the money market is _______________________.

5. A rise in the average value of transactions carried out by a household or firm cause its demand for money to .

6. is an important phenomenon because it helps explain why exchange rates move so sharply from day to day.

7. If the economy is initially at full employment, a permanent increase in the money supply eventually be followed by in the price level.

8. Overshooting is a direct consequence of the short-run

9. An economy’s is the position it would eventually reach if no new economic shocks occurred during the adjustment to full employment.

10. All else equal, a permanent in a country’s money supply causes a proportional long-run depreciation of its currency against foreign currencies.

Ⅱ. True or false

1. An increase in real output lowers the interest rate. ( )

2. In the short run, a reduction in a country's money supply causes its currency to appreciate in the foreign exchange market. ( )

3. All else equal, an increase in a country 's money supply causes a proportional increase in its price level in the long run. ( )

3. All else equal, a rise in the interest rate causes the demand for money to fall. ( )

4. If there is initially an excess demand of money, the interest rate falls in the short-run. ( )

5. A rise in the average value of transactions carried out by a household or firm causes its demand for money to fall. ( )

6. Given the price level and out put, an increase in the money supply lowers the interest rate. ( )

7. A change in the supply of money has effect on the long-run values of the interest rate or real output. ( )

8.The higher the interest rate, the more you sacrifice by holding wealth in the form of money. ( )

9. An increase in real output lowers the interest rate, given the price level and the money supply( )

10. An economy experiences inflation when its price level is falling. ( )

Ⅲ. Answer the following questions:

1. What is the short-run effect on the exchange rate when US government increases the money supply? (expectations about future exchange rate are unchanged)

2. Please draw a group of pictures to show the time paths of U.S. economic variables after a permanent increase in the U.S. money supply growth rate according to the following:

(1)The u.s. decided to increase the money supply growth rate permanently.

The vertical axis is money supply and the horizontal axis is time.

(2)The interest rate change,. The vertical axis is Dollar interest rate and the horizontal axis is time.

(3)The price level change. The vertical axis is U.S price level and the horizontal axis is time.

(4)The exchange rate change,. The vertical axis is the Dollar/Euro exchange rate and the horizontal axis is time.

Ⅳ. CALCULATION

Suppose that the spot rate is €1 = US$1.2468 -78 and the six-month forward rate is €1 = US$1.2523-33, the interest rate per annum is 4% in the euro zone and 6% in the US. After carrying out interest arbitrage with €5,000,000 borrowed at the above-mentioned rate, please calculate your net interest arbitrage profit ( other costs ignored ).

Quiz for Chapter 15

Ⅰ. Fill the following blanks with the proper word or expression

1. The equation for real interest parity is .

2. The long-run relationship between inflation and interest rates is called .

3. The equation for absolute PPP is _________________________.

4. The equation for relative PPP is _________________________.

5. The law of_______________ states that under free competition and in the absence of trade impediments, a good must sell for a single price regardless of where in the world it is sold.

6. Equation $/$/()/E US q E P P ∈∈=? shows that at unchanged output prices, nominal depreciation implies real .

7. According to Fisher effect, if U.S. inflation were to rise, then U.S. dollar interest rates would_________________.

8. _________________is the relative price of two output baskets, while _________________is the relative price of two currencies.

9. Transport costs and government trade restrictions make it expensive to move goods between markets located in different countries and therefore weaken the _________________mechanism underlying PPP.

10. refer to those goods and services that can never be traded internationally at a profit.

Ⅱ. True or false

1. According to monetary approach, a rise in the interest rate on dollar will lead to the depreciation of the dollar in the long run.( )

2. According to monetary approach, a rise in European output causes the Euro to appreciate. ( )

3. When demand for American products rises, there will be a long-run real depreciation of the dollar. ( )

4. According to monetary approach, a rise in European output causes the Euro to appreciate. ( )

5. When European output supply increases, there will be an appreciation of the euro. ( )

6. Expected real interest rates are the same in different countries when relative PPP is expected to hold. ( )

7. Based on the monetary approach, other things equal, a permanent rise in the U.S. money supply causes a proportional long-run appreciation of the dollar against euro. ( )

8. At unchanged output prices, nominal depreciation implies real appreciation. ( )

9. Departures from PPP may be even greater in the short run than in the long run because many prices in the economy are sticky and take time to adjust fully. ( )

10. If all U.S. prices increase by 10% and the dollar depreciates against foreign currencies by 10%, absolute PPP will be satisfied (assuming there are no changes abroad) for any domestic and foreign choices of price level indexes. ( )

Ⅲ. Answer the following questions:

1. Suppose America’s inflation rate is 6% over one year, but the inflation rate in Italy is 12%. According to relative PPP, what should happen over the year to the dollar’s exchange rate against the lira?

2.How to explain the problems with PPP? Give the reasons.

Quiz for Chapter 16

Ⅰ. Fill the following blanks with the proper word or expression

1. The aggregate demand for an open economy’s output consists of four components:

2. The current account balance is determined by two main factors: and

3. Equilibrium in the economy as a whole requires equilibrium in the as well as in the

4. An temporary increase in the money supply causes a of the domestic currency, of output, and therefore in employment.

5. Given a fixed exchange rate, when government demand increases, DD schedule will shift

6. A reduction in money demand would shift AA ___________.

7. __________ policy works through changes in government spending or taxes.

8. If the economy starts at long-run equilibrium, a permanent change in fiscal policy has no net effect on .

9. J-curve effects amplify the of exchange rates

10. Because a permanent fiscal expansion changes exchange-rate expectations, the effect on output is

if the economy stats in long-run equilibrium.

Ⅱ. True or false

1. If there is a decline in investment demand, the DD schedule will shift to the right. ( )

2. The effect of real exchange rate increase on IM is ambiguous. ( )

3. A temporary increase in the money supply, which does not alter the long-run expected exchange rate, causes a depreciation of the currency and a rise in output. Temporary fiscal expansion also has the same result. ( )

4. Other things equal, a real depreciation of the home currency lowers aggregate demand for home output. ( )

5. The DD Schedule shows all exchange rate and output levels at which the output market is in short-run equilibrium. DD Schedule slopes upward. ( )

6. A permanent fiscal expansion does not changes exchange-rate expectations. ( )

7. Since the effect is the same of that of an increase in G, an increase in T must cause the DD Schedule to shift rightward. ( )

8. A rise in R* causes an upward shift of AA. ( )

9. Either an increase in the money supply or temporary fiscal ease can be used to maintain full employment. The two polices have no different effects at all. ( )

10.If exports and imports adjust gradually to real exchange rate changes, the current account may follow a J-curve pattern after a real currency appreciation, first worsening and then improving. ( )

11. The greater the upward shift of the asset market equilibrium schedule, the greater the appreciation of the currency. ( )

12. Monetary expansion causes the current account balance to decrease in the short run. ( )

13. Expansionary fiscal policy reduces the current account balance. ( )

Ⅲ. Answer the following questions:

1. A new government is elected and announces that once it is inaugurated, it will increase the money supply. Use the DD-AA model to study the economy’s response to this announcement.

2. Please use AA and DD sch edules to describe “The adjustment to a permanent increase in the money supply. ” The original point is at full employment.

The vertical axis is exchange rate, the horizontal axis is output.

3. If an economy does not start out at full employment, is it still true that a permanent change in fiscal policy has no current effect on output? Please use AA and DD schedules to describe it.

Quiz for Chapter 17

Ⅰ. Fill the following blanks with the proper word or expression

1. Any central bank purchase of assets automatically results in an in the domestic money supply.

2. The condition of the foreign exchange market equilibrium under a fixed exchange rate is .

3. Under a fixed exchange rate, central bank policy tools is more effective.

4. The expectation of a future devaluation causes a in the home interest rate above the world level.

5. The main factor that may lead to imperfect asset substitutability in the foreign exchange market is .

6. Between the end of World War II and 1973, was the main reserve currency.

7. Under a gold standard, each country fixes the price of its currency in terms of .

8. Under a _________, central bank monetary policy tools are powerless to affect the economy’s money supply or its output.

9. A system which governments may attempt to moderate exchange rate movements without keeping exchange

rates rigidly fixed is____________.

10. Half way between the gold standard and a pure reserve currency standard is the __________.

Ⅱ. True or false

1. Any central bank sale of assets automatically causes the money supply to decline. ( )

2. If central banks are not sterilizing and the home country has a balance of payments surplus, any increase in the home central bank’s foreign asse ts implies an decreased home money supply. ( )

3. Under a fixed exchange rate, central bank monetary policy tools are powerful to affect the economy’s money supply. ( )

4. The expectation of a future revaluation causes a rise in foreign reserves. ( )

5 When domestic and foreign currency bonds are imperfect substitutes, equilibrium in the foreign market requires that the domestic interest rate equal the expected domestic currency return on foreign bonds subtract a risk premium. ( )

6. Between the end of World War II and 1973, the exchange rate system was one in which exchange rate between any two currencies were floating. ( )

7. Under the reserve currency standard, the center country has to intervene the exchange rate. ( )

8. The central bank can negate the money supply effect of intervention through sterilization.( )

9. A system of managed floating allows the central bank to retain some ability to control the domestic money supply, but at the cost of greater exchange rate instability.( )

10. A world system of fixed exchange rates in which countries peg the prices of their currencies in terms of a reserve currency does not involve a striking asymmetry.()

Ⅲ. Answer the following questions:

1. Why governments sometimes choose to devalue their currencies?

2. How does fiscal expansion affect a country’s output and the central bank’s balance sheet under fixed exchange rate?

3. Can you think of reasons why a government might willingly sacrifice some of its ability to use monetary policy so that it can have stable exchange rates?

4. Explain why temporary and permanent fiscal expansions do not have different effects under fixed exchange rates, as they do under floating.

Quiz for Chapter 18—21

Ⅰ. Fill the following blanks with the proper word or expression

1. The channels of interdependence depend, in turn, on the monetary and exchange rate arrangements that countries adopt-a set of institutions called the ().

2. In open economies, policymakers are motivated by the goals of internal and external balance. Simply defined, ( )requires the full employment of a country’s resources and domestic price level stability.

3. A country is said to be in( ) when the sum of its current and its no reserve capital accounts equals zero, so that the current account balance is financed entirely by international lending without reserve movements.

4. The gold standard contains some powerful automatic mechanisms that contribute to the simultaneous achievement of balance of payments equilibrium by all countries .That mechanisms is( ).

5. ( ) is one currency that may be freely exchanged for foreign currencies.

6、Under the Bretoon Woods system ,( ) or ( )can be used to influence output and thus help the government achieve its internal goal of full employment.

7、Fiscal policy is also called ( ),because it alters the level of the economy’s total demand for goods and services.; The accompanying exchange rate adjustment is called ( ), Because it changes the direction of demand ,shifting it between domestic output and imports.

8、Bretton Woods system give ( )the leading position in the world economy.

9、Bretton Woods system require that other currency should peg with ( )

10、Under the fixed rate system, if the exchange rate change, the foreign reserves will ( )

11、( ) symmetry and exchange rate as automatic stabilizers are the advantages of floating rate system.

12、( ) predict the collapse of the Bretton Woods system.

13、The level of ( ) in the European Union is too small to cushion member countries from adverse economic events.

14、The ( ) schedule shows the relationship between the monetary efficiency gain and the degree of economic integration.

Ⅱ. True or false

1. In an open economy, macroeconomic policy has two basic goals, internal balance (full employment with price stability) and external balance (avoiding excessive imbalances in international payments)( )

2. The gold standard era starts in 1861 and end in 1914.( )

3. The countries with the weak investment opportunities should be net importers of currently available output (and thus have current account surpluses), while countries with the good investment opportunities should be net exporters of current output (and have current account deficits).( )

4. Each member of IMF contributed to the Fund an amount of gold equal in value to three-fourth of its quota. The

remaining one-fourths of its quota took the form of a contribution of its own national currency. ( )

5、Balance of payment crisis became increasingly frequent and violent throughout the 1960 and early 1970s.The events led to the Bretoon Woods system’s collapse.()

6、One interpretation of the Bretoon Woods system’s collapse is that the foreign countries were forced to import US. Inflation through the mechanism to stabilize their price levels and regain internal balance, they had to abandon fixed exchange rates and allow their currency to float.()

7、Speculation on changes in exchange rats could lead to instability in foreign exchange markets . ()

8.Under the fixed rate system, the government is required to use foreign reserve to stabilize exchange rate.

()

9.The U.S. Federal Reserve played the leading role in determining their owns domestic money supply.

()

10.Advocates of floating argued that floating rates would allow each country to choose its own desired long-run inflation rate rather than passively importing the inflation rate established abroad. ()

11.The eight original participant in the EMS’s exchange rate mechanism------France, German, Italy, Belgium, Denmark, Ireland, Luxembourg, and the Netherlands. ( )

国际经济学双语习题

International Economics, 8e (Krugman) Chapter 1 Introduction 1.1 What Is International Economics About? 1) Historians of economic thought often describe ________ written by ________ and published in ________ as the first real exposition of an economic model. A) "Of the Balance of Trade," David Hume, 1776 B) "Wealth of Nations," David Hume, 1758 C) "Wealth of Nations," Adam Smith, 1758 D) "Wealth of Nations," Adam Smith, 1776 E) "Of the Balance of Trade," David Hume, 1758 Answer: E Question Status: Previous Edition 2) From 1959 to 2004, A) the U.S. economy roughly tripled in size. B) U.S. imports roughly tripled in size. C) the share of US Trade in the economy roughly tripled in size. D) U.S. Imports roughly tripled as compared to U.S. exports. E) U.S. exports roughly tripled in size. Answer: C Question Status: Previous Edition 3) The United States is less dependent on trade than most other countries because A) the United States is a relatively large country. B) the United States is a "Superpower." C) the military power of the United States makes it less dependent on anything. D) the United States invests in many other countries. E) many countries invest in the United States. Answer: A Question Status: Previous Edition 4) Ancient theories of international economics from the 18th and 19th Centuries are A) not relevant to current policy analysis. B) are only of moderate relevance in today's modern international economy. C) are highly relevant in today's modern international economy. D) are the only theories that actually relevant to modern international economy. E) are not well understood by modern mathematically oriented theorists. Answer: C Question Status: Previous Edition 5) An important insight of international trade theory is that when countries exchange goods and services one with the other it A) is always beneficial to both countries. B) is usually beneficial to both countries. C) is typically beneficial only to the low wage trade partner country. D) is typically harmful to the technologically lagging country. E) tends to create unemployment in both countries. Answer: B Question Status: Previous Edition

国际经济学课后答案解析

第一章绪论 1、列举出体现当前国际经济学问题的一些重要事件,他们为什么重要?他们都是怎么影响中国与欧、美、日的经济和政治关系的?当前的国际金融危机最能体现国际经济学问题,其深刻地影响了世界各国的金融、实体经济、政治等领域,也影响了各国之间的关系因此显得尤为重要;其对中国与欧、美、日的政治和经济关系的影响为:减少中国对上述国家的出口,影响中国外汇储备,贸易摩擦加剧,经济联系加强,因而也会导致中国与上述国家在政治上的对话与合作。 2、我们如何评价一国与他国之间的相互依赖程度?我们可以通过一国的对外贸易依存度来评价该国与他国之间的相互依赖程度,也可以通过其他方式来评价比如一国政府政策的溢出效应和回震效应以及对外贸易对国民生活水平的影响。 3、国际贸易理论及国际贸易政策研究的内容是什么?为什么说他们是国际经济学的微观方面?国际贸易理论分析贸易的基础和所得,国际贸易政策考察贸易限制和新保护主义的原因和效果。国际贸易理论和政策是国际经济学的微观方面,因为他们把国家看作基本单位,并研究单个商品的(相对)价格。 4、什么是外汇交易市场及国际收支平衡表?调节国际收支平衡意味着什么?为什么说他们是国际经济学的宏观方面?什么是宏观开放经济学及国际金融?外汇交易市场描述一国货币与他国货币交换的框架,国际收支平衡表测度了一国与外部世界交易的总收入与总支出的情况。调节国际收支平衡意味着调节一国与外部世界交易出现的不均衡(赤字或盈余);由于国际收支平衡表涉及总收入和总支出,调节政策影响国家收入水平和价格总指数,因而他们是国际经济学的宏观方面;外汇交易及国际收支平衡调节涉及总收入和总支出,调整政策影响国家收入水平和价格总指数,这些内容被称为宏观开放经济学或国际金融。 5、浏览报刊并做下列题目:(1)找出5条有关国际经济学的新闻(2)每条新闻对中国经济的重要性或影响(3)每条新闻对你个人有何影响 A (1) 国际金融危机: 影响中国整体经济,降低出口、增加失业、经济减速等 (2) 美国大选:影响中美未来经济政治关系 (3) 石油价格持续下跌:影响中国的能源价格及相关产业 (4) 可口可乐收购汇源被商务部否决:《反垄断法》的第一次实施,加强经济法治 (5) 各国政府经济刺激方案:对中国经济产生外部性效应B 以上5条新闻对个人影响为:影响个人消费水平和就业前景 第二章比较优势理论 1、重商主义者的贸易观点如何?他们的国家财富概念与现在有何不同?重商主义者主张政府应当竭尽所能孤立出口,不主张甚至限制商品(尤其是奢侈类消费品)。重商主义者认为国家富强的方法是尽量使出口大于进口,而出超的结果是金银等贵重金属流入,而一个国家拥有越多的金银,就越富有越强大。现在认为一个国家生产力即生产商品的能力越高则一国越富强 2、亚当.斯密主张的贸易基础和贸易模式分别是什么?贸易所得是如何产生的?斯密倡导什么样的国际贸易基础?他认为政府在经济生活中的适当功能是什么?亚当.斯密主张的贸易基础是绝对优势;贸易模式为两国通过专门生产自己有绝对优势的产品并用其中一部分来交换器有绝对劣势的商品。通过生产绝对优势商品并交换,资源可以被最有效的使用,而且两种商品的产出会有很大的增长,通过交换就会消费比以前更多的商品从而产生了贸易所得;斯密倡导自由贸易,主张自由放任也就是政府尽可能少干涉经济

《国际经济学》篇章精选练习题及答案(DOC)

第1章绪论 重点问题:国际经济学的产生、发展、对象及其其他经济学科的关系 单选 1.国际经济学分析的最基本的出发点是(B) A经济增长 B经济自然增长 C制度创新的经济增长 D经济发展 2.经济发展是(D) A经济结构的变革 B社会和政治体制的变革 C经济自然增长 D制度创新的经济增长 3.国际经济最基本的出发点是(B ) A社会分工 B国际分工 C产业内分工 D产业之间的分工和合作 4.国际经济交往的主要方式是(A) A生产要跨国界流动 B国际分工 C商品跨国界流通 D开放经济 第2章古典国际贸易理论 重点问题:绝对利益说的基本内容及其评价比较利益说的基本内容及其评价 单选 1.在斯密的绝对优势贸易理论中,(C)。 A所有产品均具有绝对优势的国家最终将获得全部黄金和白银 B具有绝对优势的国家将获得大量贸易余额 C如果两个国家分别出口本国劳动成本相对较低的产品,将同时从贸易中获益 D如果一国不用关税壁垒保护本国产业,将丧失绝对优势 2.李嘉图的比较优势理论指出,(B)。 A贸易导致不完全专业化 B即使一个国家不具有绝对成本优势,也可以从出口绝对成本劣势相对较小的产品中获益 C与不具备绝对成本优势的国家相比,具有绝对成本优势的国家可以从贸易中获利更多 D只有具备比较优势的国家才能获得贸易余额 3.如果一个阿根廷工人能生产3蒲式耳小麦或1辆汽车,而一个巴西工人能生产4蒲式耳小麦或2辆汽车,则(D)。 A巴西在小麦和汽车生产上都具有绝对优势,而阿根廷没有比较优势 B阿根廷在小麦和汽车生产上都具有绝对优势,而巴西没有比较优势 C巴西在小麦和汽车生产上都具有绝对优势,而阿根廷在汽车生产上具有比较优势 D巴西在小麦和汽车生产上都具有绝对优势,而阿根廷在小麦生产上具有比较优势 4.根据比较优势原理的政策经验,一国从国际贸易中获益的条件是(B)。 A制造大量出口顺差 B以较低的机会成本进口商品而不是在国内生产 C本国比贸易伙伴强大 D本国相对于贸易伙伴具备绝对效率优势 5.比较利益理论认为国际贸易的驱动力是( A ) A.劳动生产率的差异 B.技术水平的差异 C.产品品质的差异 D.价格的差异 6.在比较利益模型中,两种参与贸易商品的国际比价( C ) A.在两国贸易前的两种商品的国内比价之上 B.在两国贸易前的两种商品的国内比价之下 C.在两国贸易前的两种商品的国内比价之间 D.与贸易前的任何一个国家的国内比价相同 简答: 1.请从国际贸易实际出发评价绝对利益说 P20 斯密的绝对利益学说揭示了在自由市场经济条件下,国际贸易产生的原因在于两国之间劳动生产率的绝对差异,按照绝对利益学说的原则进行国际分工,贸易的参与者与整个世界会因此而获得利益。这一学说在一定程度上反映出了国际贸易中的某些规律,为产业资本的发展提供了相应的理论支撑,具有重要的实践意义和理论意义。 从国际贸易实际出发的评价斯密的绝对利益学说在实践中运用存在着一个必要的假设前提:一国要参加国际贸易,就必然要有至少一种产品与贸易伙伴相比处于劳动生产率绝对高或生产所耗费的劳动绝对低的地位上,以便利用劳动生产率的绝对差异进人国际市场。如果一国在所有的产品生产上,劳动生产率均低于贸易对象国,该国便不具备参加国际分工的条件,或者在国际贸易中没有任何的利益获得。这一点在理论上过于绝对,在实践中也不符合实际情况(发展中国家劳动生产率很可能在所有产品上都不如发达国家,但仍然在进行国际贸易),实际上陷入了理论与实践的两难境地:如果没有超过贸易对手的高劳动生产率部门,该国便被排除在国际贸易的大门之外,或者在贸易中本国的生产部门将被对方的竞争击垮。显然,世界贸易的历史与现实并不完全、普遍地符合斯密这样的假设。

国际经济学试题及答案

三、名词解释 1.生产者剩余 答:生产者剩余是指生产者愿意接受的价格和实际接受的价格之间的差额。 2.罗伯津斯基定理 答:罗伯津斯基定理是指在生产两种产品的情况下,如果商品的国际比价保持不变,一种生产要素增加所导致的密集使用该生产要素的产品产量增 加,会同时减少另外一种产品的产量。 3.产品生命周期 答:产品生命周期是指新产品经历发明、应用、推广到市场饱和、产品衰落,进而被其他产品所替代四个阶段。 4.购买力平价 答:购买力平价是指两种货币之间的汇率决定于它们单位货币购买力之间的比例。 5.市场内部化 答:市场内部化是指企业为减少交易成本,减少生产和投资风险,而将该跨国界的各交易过程变成企业内部的行为。 6.黄金输送点 答:黄金输送点包括黄金输入点和黄金输出点,是黄金输入、输出的价格上限和下限,它限制着一个国家货币对外汇率的波动幅度。 7.要素禀赋 答:要素禀赋,即要素的丰裕程度,是指在不同国家之间,由于要素的稀缺程度不同导致的可利用生产要素价格相对低廉的状况。赫克歇尔-俄林 定理认为,要素禀赋构成一个国家比较优势的基础 8.比较优势 答:比较优势也称为比较成本或比较利益,是由英国古典经济学家大卫李·嘉图提出的。李嘉图通过两个国家两种产品的模型阐明,比较优势是一国 在绝对优势基础上的相对较大的优势,在绝对劣势基础上的相对较小的 劣势,遵循“两利相权取其重,两弊相衡取其轻”的原则。根据各自的 比较优势来来确定国际分工并进行贸易往来,双方便都可以获得比较利 益。 9.人力资本 答:所谓人力资本是资本与劳动力结合而形成的一种新的生产要素,然们通过劳动力进行投资(如进行教育、职业培训、保健等),可以提高原有 劳动力的素质和技能,劳动生产率得到提升,从而对一个国家参加国际 分工的比较优势产生作用与影响。 10.布雷顿森林体系 答:布雷顿森林体系是指从第二次世界大战结束到1971年所实行的金汇兑本位制。这一以美元为中心的固定汇率制度的特征简而言之便是“美元

国际经济学练习题

一、名词解释:(每题3分,共30分) 1、生产可能性边界:它表示在一定的技术条件下,一国的全部资源所能生产的各种物品或劳务的最优产量组合。 2、社会无差异曲线:指通过个体无差异曲线的加总,来构造一条可反映整个社会需求条件与福利的无差异曲线,即社会无差异曲线。 3、要素禀赋:指一国所拥有的两种生产要素的相对比例,这是一个相对的概念,与其所拥有的生产要素的绝对数量无关。如果一国的要素禀赋(K/L)大于他国,则称该国为资本(相对)丰富或劳动(相对)稀缺的国家;反过来,他国则为劳动丰富或资本稀缺的国家。 4、要素密集度:指生产某种产品所投入两种生产要素的比例,是个相对的概念,与生产要素的绝对投入量无关。 5、机会成本:指在一国的生产可能性边界上,为生产一单位的某一种产品所必须放弃的其他产品的生产数量。 6、边际转换率:企业在生产两种产品的情况下,每增加一个单位的这种产品,会使另一种产品的产量减少多少。它就是产品转换曲线的斜率。由于边际收益递减规律在起作用,产品的边际转换率会随该产品的增加而递增。严格的定义是生产一单位某产品必须先减少另一产品的数量.是经济学的一个概念。 7、SS定理:即斯托珀-萨缪尔森定理,指某一商品相对价格的上升,将导致该密集商品使用的生产要素的实际价格或报酬提高,而另一种生产要素的实际价格或报酬则下降。S-S定理的引申,即国际贸易会提高该国丰富要素所有者的实际收入,降低稀缺要素所有者的实际收入。 8、要素价格均等化:指国际贸易通过商品价格的均等化,会导致要素价格的均等化,从而在世界范围实现资源的最佳配置,同时由于要素价格的变动,国际贸易会影响一国收入分配格局,即相对丰富要素的所有者会从国际贸易中获利,而相对稀缺要素的所有者会因贸易而受损。 9、罗伯津斯基定理:在商品相对价格不变的前提下,某一要素的增加会导致密集使用该要素的部门的生产的增加,而另一部门的生产则会下降。 10、悲惨增长: 如果转移至他国的那部分利益超出了增长利益,那么总的福利效果为负,此国的福利水平将低于增长前,称为“悲惨增长”。或开放条件下,如果一国要素积累导致经济增长偏向出口部门,那么经济增长对增长国的福利会产生两种截然不同的影响效果。一方面,经济增长意味着国民收入的提高,国民福利的改善;另一方面,经济增长又可能使本国的贸易条件恶化,对本国福利产生不利影响。在这种情况下,经济增长的净福利取决于上述两种影响效应的力量对比。如果如果转移至他国的那部分利益超出了增长利益,即后者影响效果高于前者,那么该国净福利水平将低于经济增长前,这种情形被称为“悲惨的增长”。 11、里昂惕夫之谜:按照H-O理论模型,资本丰裕的国家应进口劳动密集型产品,出口资本密集型产品,而经里昂惕夫研究美国1947年进出口情况得出结论,美国出口劳动密集型产品,进口资本密集型产品,这一结果与H-O理论恰恰相反,故称为“里昂惕夫之谜”。 14、重叠需求:指收入水平相似的国家,对某种产品需求档次相同的那部分需求。 15、规模经济:在产出的某一范围内,平均产品成本随着产出的增加而递减。 16、外部规模经济:指产业规模经济,即某一产业大量的企业集中在一个小的国家或者集中在一个国家的一个地区,出现较大的产业规模,能提高效率,降低成本,增加收入。 17、关税:一国政府从自身的经济利益出发,依据本国的海关法和海关税则,对通过其边境的进出口商品所征收的赋税。 18、配额:一国政府为保护本国工业,规定在一定时期内对某种商品的进口数量或进口金额加以限制。 19、出口补贴:一国政府为鼓励某种商品的出口,对该商品的出口所给予的直接补助或间接补助。 20、倾销:指在不同国家市场间进行的一种价格歧视行为,是指出口商以低于本国国内价格或成本的价格向国外销售商品的行为。 21、自由贸易区:两个或两个以上的国家或行政上独立的经济体之间通过达成协议,相互取消进口关税和与关税具有同等效力的其他措施而形成的区域经济一体化组织。 22、贸易创造:成员国之间相互取消关税和非关税壁垒所带来的贸易规模的扩大。 23、贸易转移:建立关税同盟之后成员国之间的相互贸易代替了成员国与非成员国之间的贸易,从而造成贸易方向的转移。 24、国际收支:是在一定时期内(通常为一年)一国居民与世界其他国家居民之间的全部经济交易的系统记录。进行国际收支统计的主要目的是使政府当局了解本国的国际债权债务地位,从而为制定货币政策提供信息。 25、外汇:(1)动态含义,是指一个国家的货币,借助于各种国际货币结算工具,通过特定的金融机构,兑换成另外一个国家的货币,以清偿国际间债权债务关系的一个交易过程。 (2)静态含义,①广义:泛指一切以外国货币表示的资产,如外国货币、外币的有价证券、外币支付凭证②狭义:指以外币表示的可以进行国际间结算的支付手段,包括以外币表示的银行汇票、支票、银行存款等。人们通常所说的外汇就是指这一狭义概念。 26、汇率:是以一国货币表示的另一国货币的价格,或把一国货币折算成另一国货币的比率,也称汇价、外汇牌价或外汇行市。 29、汇率制度:指一个国家的货币当局对本国货币汇率变动的基本方式所作出的规定。按照汇率变动幅度的大小,汇率制度可分为固定汇率制和浮动汇率制。 30、外汇管制:一国政府为了防止资金外流或流入,改善本国的国际收支和稳定本国货币汇率,授权有关货币金融当局(一般是中央银行或专门的外汇管理机构)对外汇买卖和国际结算所采取的限制性措施。

中南财大国际经济学双语期末试卷

中南财经政法大学——学年第—-学期期末考试试卷 国际经济学(闭卷)卷 学院专业年级班级课堂号姓名 (单选,共20题,每题2分) 1, Under Ricardian model, If one country's wage level is very high relative to the other's (the relative wage exceeding the relative productivity ratios), then ( ) A.it is not possible that producers in each will find export markets profitable. B.it is not possible that consumers in both countries will enhance their respective welfares through imports. C.it is not possible that both countries will find gains from trade. D.it is possible that both will enjoy the conventional gains from trade. 2, According to Ricardo, a country will have a comparative advantage in the product in which its ( ) https://www.360docs.net/doc/3817545718.html,bor productivity is relatively low. https://www.360docs.net/doc/3817545718.html,bor productivity is relatively high. https://www.360docs.net/doc/3817545718.html,bor mobility is relatively low. https://www.360docs.net/doc/3817545718.html,bor mobility is relatively high. 3, If Australia has more land per worker, and Belgium has more capital per worker, then if trade were to open up between these two countries, ( ) A.Australia would export the land-intensive product. B.Belgium would import the capital-intensive product. C.Both countries would export some of each product. D.Trade would not continue since Belgium is a smaller country. 4, Under The Specific Factors model, At the production point the production possibility frontier is tangent to a line whose slope is ( ) A.the price of manufactures. B.the relative wage. C.the real wage. D.the relative price of manufactures. 5, The Heckscher-Ohlin model predicts all of the following except: A.which country will export which product. ( ) B.which factor of production within each country will gain from trade. C.the volume of trade. D.that wages will tend to become equal in both trading countries.

国际经济学复习题

国际贸易部分 一、单项选择题 1.重商主义的基本观点是一种( ) A.国际金融的“乘数理论” B.国际贸易的“零和理论” C.国际金融的“杠杆原理” D.国际贸易的“绝对优势理论” 2.比较利益理论认为国际贸易的驱动力是( ) A.劳动生产率的差异 B.技术水平的差异 C.产品品质的差异 D.价格的差异 3.不能解释产业内贸易现象的理论有( ) A.重叠需求理论 B.要素比例理论 C.规模经济理论 D.垄断竞争理论 4.能反映规模经济理论本意的是( ) A.规模报酬递减 B.规模报酬递增 C.规模报酬不变 D.规模成本递增 5.一种产品的竞争优势并非长期固定在某一个特定的国家,而是从技术发明国转向生产成本较低的国家,描述这一现象的理论是() A.雁形模式理论 B.产品周期理论 C.示范效应理论 D.大宗产品理论 6.下列不属于保护贸易学说的理论有( ) A.幼稚工业理论 B.贸易条件恶化论 C.国内市场失灵论 D.资源禀赋论 7.最佳关税水平应等于( ) A.零进口关税 B.零进口关税与禁止性关税之间的水平 C.禁止性关税 D.禁止性关税以上 8.最佳关税的长期目标是() A.从外国垄断厂商那里抽取部分垄断租 B.保护和发展本国工业 C.阻止国外商品进口 D.增加本国财政收入 9.从历史发展看,最为成功的国际卡特尔是( ) A.烟草贸易公司 B.铁路运输公司 C.橡胶生产国组织 D.石油输出国组织 10.从国际经济资源流动的难度看,最容易流动的要素是( ) A.商品 B.资本 C.人员 D.技术 11.国际经济学理论体系发展阶段不包括() A.重商主义 B.古典的自由贸易论及其自由贸易的政策 C.现代国际经济理论 D.重农主义 12.从国际贸易对生产要素分配的影响来看,国际贸易有利于() A.生产进口竞争品中密集使用的生产要素收入的增加 B.生产进口竞争品中密集使用的共同生产要素收入的增加 C.生产出口品中密集使用的共同生产要素收入的增加 D.生产出口品中密集使用的生产要素收入的增加 13.一国利用原材料或资源密集型产品的出口增加本国收入,进而提高本国的储蓄和投资水平,带动经济发展。该理论被称为() A.剩余物质出口理论 B.大宗产品贸易理论 C.比较优势理论 D.产品生命周期理论

国际经济学最新理论.pdf

1新李嘉图主义的国际贸易理论 以斯蒂德曼为代表的新李嘉图主义的国际贸易理论坚持并继承了李嘉图的比较利益论,认为贸易的真正来源在于各国的比较优势的差异,而并非资源禀赋的差距。新李嘉图主义以一种比较动态的、长期均衡的分析来解释国际贸易。新李嘉图主义贸易理论把收入分配置于突出位置,并贯穿分析的始终。新李嘉图主义的国际贸易理论与李嘉图理论不同主要在于:李嘉图是从各国生产的角度即从各国的生产特点不同和劳动效率的高低不同上来解释比较优势的差异;新李嘉图主义不仅从各国生产的角度来分析和比较各国的比较优势的差异,而且强调要从各国分配领域,从经济增长、经济发展的动态角度来分析和比较各国比较优势的不同。 2克鲁格曼的贸易理论 保罗·克鲁格曼提出“规模经济作为国际贸易产生原因”的解释,他在产业内贸易理论有关基本假设和结论的基础上,通过建立各种模型深入阐述了规模经济、不完全竞争市场结构与国际贸易的关系,成功的解释了战后国际贸易的新格局。克鲁格曼认为在“张伯伦垄断竞争”模式下的市场体系中,产业部门的扩张是通过更大的规模经济而实现的,在这种情况之下,每个国家都以其产品供应世界需求,因而得到了双向的产业内贸易,若各国拥有相同的要素禀赋,就不存在产业间贸易,而存在大量的产业内贸易。克鲁格曼又考察了规模经济、产品差异与贸易型式的关系。其“产业内专业化分工与得自贸易的利益”理论模型从根本上打破了传统理论中完全竞争和规模收益不变这两个基本假定,使新贸易理论向规范化方向迈进了重要一步。 新贸易政策理论的发展 贸易政策理论是较早发展起来的国际经济学理论之一。早在20世纪20年代末,作为“新重商主义”代表的凯恩斯在国际贸易方面主张政府干预对外经济贸易活动,利用贸易顺差保持国内充分就业。20世纪70年代之后,以弗雷德曼为代表的新自由主义占据了经济理论的中心位置,主张政府应该对国际贸易进行适度的干预。 1贸易保护理论的新发展 20世纪90年代以来,随着国际贸易的扩大和经济全球化的发展,各国在贸易领域的竞争日趋激烈,在这种形势下,各种形式的保护主义纷纷出现。目前较为代表性的新贸易保护主义包括: (1)以英国学者蒂姆.朗和科林.海兹为代表的地区经济主义新贸易保护论认为:自由贸易无法解决贸易与发展、贸易与环境等问题,因此必须用新的贸易保护主义取代它。新贸易保护主义主张首先要加强地区间合作,实行地区性贸易保护主义。新贸易保护主义还主张一国根据预期的出口量控制进口量并且要使两者严格平衡,并制定高标准的进出口限制规则。 (2)国际劳动力价格均等化新贸易保护论的基本观点是:由于西方发达国家的工资水平远远超过发展中国家,如果西方国家不对发展中国家实行贸易限制,将会造成发达国家工人的工资水平向低收入国家的工资水平看齐,从而导致发达国家生活水平的下降,因此发达国家应该对发展中国家的劳动密集性产品实行贸易限制。 (3)环境优先新贸易保护论主要表现在借保护世界环境之名限制国外产品的进口,保护本国衰退的劣势产业,其主要论点是:由于生态系统面临巨大威胁,在国际贸易中应该优先考虑保护环境,减少污染产品的生产与销售,为了保护环境任何国家都可以设置关税和非关税壁垒控制污染产品进出口,同时任何产品都应将环境和资源费用计入成本,使环境和资源成本内在化。 2国际贸易的内生性增长的新理论 以哈伯勒代表的经济学家认为,国际贸易是新观念、新技术、新管理和其他技能的传播媒介,国际贸易可以充分利用没有开发的国内资源,刺激国内生产者提高效率,同时通过市场规模的扩大,贸易使劳动具有了经济规模性,因此国际贸易可以称为“经济增长的动力”。为了从国际贸易和经济增长的长期关系角度进一步揭示国际贸易产生的正面作用,经济学家罗莫和卢卡斯提出了内生性增长理论,他们认为一国减少贸易壁垒并促进国际贸易后,将长期取得加快经济增长和发展的效应,这主要因为国际贸易可以使该国加快技术引进、吸收、开发以及创新过程,扩大生产经济规模,减少价格扭曲提高资源利用率等。 3不完全市场竞争下的新贸易政策理论 不完全竞争的贸易政策理论认为市场结构的类型决定了行业的竞争程度和贸易形式,因此依据国内外市场结构的状况来选择指定贸易政策可以在贸易自由化进程中最大限度的保护国家利益。80年代初以来,以布兰德、斯本色、赫尔普曼和克鲁格曼等为代表的经济学家提出了以“战略性贸易”为核心的新贸易理论,新贸易理论认为,在规模收益可变和不完全竞争的市场结构下,政府干预的贸易政策只要使用得当能够使一国从相对自由贸易中获益。新贸易理论对市场运行的优化、干预政策的制定等均具有积极的理论意义。 国际金融理论和政策 1997年发生在东亚地区并波及到整个世界的金融危机,推动国际经济学界对国际金融一体化发展、国家货币政策、国际资本流动、汇率制度等问题进行深入研究和探索,目前具有代表性的国际金融和政策理论有国际金融安全、克鲁格曼的货币汇率理论、国际货币一体化等。

国际经济学练习题

绪论 一、单项选择题 1.国际经济学产生与发展的客观基础是() A.国际经济活动范围不断扩大B.国际经济关系日益复杂 C.跨越国界的经济活动不断增长D.国与国之间经济联系密切 2.国际经济学的研究对象() A.国际经济活动B.国际经济关系 C.世界范围内的资源配置D.国际经济活动与国际经济关系 3.国际经济学产生的时间() A.20世纪60年代 B.20世纪50年代 C.20世纪40年代 D.20世纪70年代 二、判断改错题 1.国际经济学产生与发展的理论基础是国际贸易理论。() 2.国际经济学是西方经济学的重要组成部分。() 3.国际经济学的微观部分主要讨论世界范围内的资源配置问题。() 4.国际金融理论与政策是站在单个国家角度来研究金融问题的。() 绪论 一、单项选择题 1.C 2.D 3.A 二、判断改错题 1.×。将“国际贸易理论”改为“国际贸易理论与国际金融理论”。 2.×。国际经济学是从西方经济学中独立出来的一门系统科学。 3.√。 4.×。国际金融理论与政策是独立于个别国家之外来研究所有国家参与国际金融市场的问题。 第二章古典国际贸易理论 一、单项选择题 1.主张对外贸易顺差,并将金银视为财富的唯一形式的理论是()A.比较优势理论B.贸易差额理论C.要素禀赋理论D.相互需求理论2.贸易差额论的政策主张中对发展中国家制定贸易政策有借鉴意义的是()A.发展本国工业B.发展本国航运业C.追求贸易顺差 D.对外贸易垄断3.最早对重商主义提出质疑的英国学者是() A.约翰·穆勒 B.亚当·斯密C.大卫·李嘉图D.大卫·休谟

4.甲国使用同样数量资源比乙国能生产更多的X,则乙国在X生产上具有()A.绝对优势B.比较劣势C.绝对劣势D.比较优势 5.甲国生产单位布和小麦分别需要6天和9天,乙国为10天和12天,根据比较优势理论() A.乙国进口小麦B.甲国出口布C.乙国出口布D.甲国出口小麦6.比较优势理论的提出者是() A.约翰·穆勒B.大卫·李嘉图C.亚当·斯密 D.李斯特 7.被称为西方国际贸易理论基石的是() A.贸易差额理论B.绝对优势理论C.比较优势理论 D.相互需求理论8.比较优势理论认为国际贸易产生的主要原因是() A.劳动生产率的相对差异B.技术水平差异 C.需求强度差异D.商品价格差异9.律师打字速度是打字员的两倍却雇佣打字员打字,以下表述错误的是()A.律师在打字上具有绝对优势B.律师在律师咨询上具有比较优势 C.打字员在打字上具有比较优势D.打字员在打字上具有绝对优势 10.按照比较优势理论,大量贸易应发生在() A.发达国家之间 B.发展中国家之间 C.发达国家与发展中国家之间D.需求相似国家之间 二、判断改错题 1.贸易差额论虽然产生时间很早,但并不是严格意义上的国际贸易理论。()2.贸易差额理论的奖出限入政策是针对所有产品而言的。() 3.贸易差额理论是第一个自由贸易理论。() 4.绝对优势理论分析的是国际贸易实践中的一个特例。() 5.具有绝对优势的产品不一定具有比较优势。() 6.根据绝对优势理论,一国两种产品都处于绝对劣势时仍可以参与互利贸易。()7.比较优势理论认为从理论上说所有国家都可以参与互利贸易。() 8.根据比较优势理论,只有当一国生产率达到足够高时,它才能从自由贸易中获益。 () 9.如果贸易发生在一个大国和一个小国之间,贸易后国际市场价格更接近于小国封闭条件下的国内市场价格。() 三、名词解释 1.绝对优势2.比较优势 四、简答题 1.简述绝对优势理论主要内容。 2.简述比较优势理论主要内容。

国际经济学考试题

试卷 编号: 郑州航空工业管理学院2010—2011学年第一学期 课程考试试卷( A )卷 一、单项选择题(本题总计20分,每小题1分) 1.李嘉图的比较优势理论指出,()。 A、贸易导致不完全专业化 B、即使一个国家不具有绝对成本优势,也可以从出口绝对成本劣势相对较小的产品中获益 C、与不具备绝对成本优势的国家相比,具有绝对成本优势的国家可以从贸易中获利更多 D、只有具备比较优势的国家才能获得贸易余额 2.如果一个劳动力丰富的国家与另一资本丰富的国家进行自由贸易,则() A、两国工资水平都会相对资本成本上升 B、两国工资水平都会相对资本成本下降 C、前一国家的工资会相对后一国家上升 D、前一国家的工资会相对后一国家下降 3.如果机会成本是递增而不是固定不变的,国际贸易将导致()。 A、每个国家完全专业化,且生产成本下降 B、每个国家不完全专业化,且出口产品生产成本不变 C、每个国家不完全专业化,且生产出口产品的机会成本上升 D、每个国家不完全专业化,且生产出口产品的机会成本下降 4.()可用于解释发达国家之间的制成品贸易。 A、比较优势学说 B、要素禀赋理论 C、需求重叠理论 D、绝对优势学说5.可以解释产业内贸易现象的理论是()。 A、比较优势学说 B、要素禀赋理论 C、绝对优势学说 D、规模经济理论6.一种产品的竞争优势并非长期固定在某一个特定的国家,而是从技术发明国转向生产成本较低的国家,描述这一现象的理论是()。 A、产品生命周期理论 B、要素禀赋理论 C、需求重叠理论 D、规模经济理论 7、社会无差异曲线用来表示()。 A、一国公民不愿意与别国进行贸易的百分比 B、能够为社会成员提供相同满意感的商品消费组合 C、为多生产一单位其他产品而必须放弃的本来生产产品的数量 D、一国具有比较优势的产品

国际经济学习题及参考答案

国际经济学作业 一、名词解释 幼稚产业:所谓幼稚产业是指某一产业处于发展初期,基础和竞争力薄弱但经过适度保护能够发展成为具有潜在比较优势的新兴产业。 倾销:是指一国(地区)的生产商或出口商以低于其国内市场价格或低于成本价格将其商品抛售到另一国(地区)市场的行为。 提供曲线:也称相互需求曲线,是由马歇尔和艾奇沃斯提出的,它表明一个国家为了进口一定量的商品,必须向其他国家出口一定量的商品,因此提供曲线即对应某一进口量愿意提供的出口量的轨迹。两个国家的提供曲线的交汇点所决定的价格,就是国际商品交换价格(交换比率)。 国际收支:国际收支分为狭义的国际收支和广义的国际收支。狭义的国际收支指一个国家或地区与世界其他国家或地区之间由于贸易、非贸易和资本往来而引起的国际间资金收支流动的行为。包括两种具体形式:直接的货币收支和以货币表示的资产的转移。反映了以货币为媒介的国际间的债权、债务关系。广义的国际收支为系统记载的、在特定时期内(通常为一年)一个国家或经济体的居民与世界其他地方居民的全部各项经济交易,不仅包括外汇收支的国际借贷关系,还包括一定时期全部经济交易与往来。 二、简答题 试画出出口贫困化增长的图形并作出分析 答:出口贫困化增长,是指某国的传统出口产品的出口规模极大地增长,但结果不仅使该国的贸易条件严重恶化,而且该国的国民福利水平也出现下降,这种现象一般出现在发展中国家。

贸易条件变化前,该国生产均衡点为A,消费点为C;由于该国传统出口产品X 的出口规模极大增长,使得该国贸易条件恶化,此时,生产点变为A’,消费点变为C’。由图中的无差异曲线可以看出,该国贸易条件的变化使得它的福利水平低于增长前。这种情形就成为“出口贫困化增长”。 产生出口贫困化增长的原因主要有:(1)该国在该种出口产品的出口量中占到相当大的比重,这样,当其出口大幅度增加时,会导致世界市场上出现供大于求的情况,导致价格大幅下跌。(2)该种产品的需求国的需求弹性很低,当产品价格降低时,需求是并不会相应大幅增长。(3)该国经济结构十分单一,依赖该种产品的出口来促进经济的发展,因此在贸易条件恶化的时候也不能压缩出口,而是进一步扩大出口量从而保持一定的出口收入。 试说明国际贸易中要素密集度逆转的情况 答:这是解释列昂惕夫反论的观点之一,它认为,某种商品在资本丰富的国家属于资本密集型产品,而在劳动力相对丰富的国家则属于劳动密集型产品,如小麦在非洲是劳动密集生产过程的产品,而在美国则是资本密集型的产品,也就是大机器和高效化肥生产的产品。所以,同一种产品是劳动密集型产品还是资本密集型产品并没有绝对的界限。在国外属于劳动密集型的产品,也有可能在国内属于资本密集型的产品。 即如果两种要素在行业间的替代弹性差异很大,以至于两种等产量曲线相交两次,那么,可能产生生产要素密集度逆转的现象。即一种产品在A国是劳动密集型产品在B国是资本密集型产品。可能就无法根据H-O的模式预测贸易模式了。

国际经济学双语习题3说课材料

国际经济学双语习题 3 International Economics, 8e (Krugman) Chapter 3 Labor Productivity and Comparative Advantage: The Ricardian Model 3.1 The Concept of Comparative Advantage 1) Trade between two countries can benefit both countries if A) each country exports that good in which it has a comparative advantage. B) each country enjoys superior terms of trade. C) each country has a more elastic demand for the imported goods. D) each country has a more elastic supply for the exported goods. E) Both C and D. Answe r: A

Question Previous Edition Status: 2) In order to know whether a country has a comparative advantage in the production of one particular product we need information on at least ________ unit labor requirements one A) two B) three C) four D) five E) Answe D r: Previous Edition Question Status: 3) A country engaging in trade according to the principles of comparative advantage gains from trade because it is producing exports indirectly more efficiently than it A) could alternatively. is producing imports indirectly more efficiently than it B) could domestically. is producing exports using fewer labor units. C) is producing imports indirectly using fewer labor units. D) None of the above. E) B Answe r: Previous Edition Question Status:

《国际经济学》复习题及参考答案

《国际经济学》复习题及参考答案 K135班 一、名词解释 1、国际经济学:是研究经济资源或稀缺资源在世界范围内的最优分配,以及在此过程中发生的经济活动和经济关系的科学。 2、倾销:海外的货物以低于同样货物的销售价格在同一时候在国内市场类似条件下的出售。 3、国际收支(广义):在特定的时期(一般为一年)内,一个经济体与世界其他地方的各项经济交易。 4、提供曲线:就是相互需求曲线,表明一个国家为了进口一定量的商品,必须向其他国家出口一定量的商品的交换比率。 5、关税同盟:它是指两个或两个以上的国家通过签订条约或协定取消区域内关税或其他进口限制,并对非同盟国家实行统一的关税率而缔结的同盟。 6、贸易条件:即商品的国际交换比率。也就是单位出口能够换回的进口,用出口价格指数比进口价格指数。 7、外汇管制:一国政府通过法令对本国对外的国际结算和外汇买卖实行管制,用以实现国际收支平衡与本国货币汇率稳定的一种制度。 8、汇率:又称为汇价。是不同货币在外汇买卖过程中形成的交换比率。 9、开放经济:一个经济与其外部存在着经济往来关系,如对外贸易、资金流动、劳动力流动等对外经济关系。 10、资本国际流动:指资本从一个国家、地区或经济体,转移到另一个国家、地区和经济体的过程。 二、判断题 1、如果小国对进口商征收关税,那么关税造成的消费者损失小于国内生产商收益与政府关税收入之和。× 如果小国对进口商征收关税,那么关税造成的消费者损失大于国内生产商收益与政府关税收入之和。 2、李嘉图的比较优势理论指出,即使其中一个国家在所有产品上郡具有绝对成本优势,各国也可以根据比较优势进行专业化生产,然后通过贸易获益。√ 3、贫穷化增长适用于长期以来人口增长快于国内生产总值增长的国家。× 贫穷化增长适用于经济是典型的单一经济,离开单一产品的的生产和出口,该国就会陷入困境的发展中国家。 4、社会无差异曲线用来表示能够为社会成员提供相同满意感的商品消费组合。√ 5、产品生命周期理论认为,若任何国家首先成功推广了一种新产品,则这种新产品将在该国经历整个生命周期。× 产品生命周期理论认为,若任何国家首先成功推广了一种新产品,则这种新产品不会在该国经历整个生命周期。 6、幼稚产业是指那些处于成长阶段尚未成熟,但具有潜在优势的产业。√ 7、跨国企业是指向六个以上不同国家出口的企业。× 跨国企业是指在数个国家设有生产工厂的企业。 8、在实施布雷顿森林体系时期,美元是关键货币。√ 9、区分发展中国家和发达国家的最常用但并不完善的指标是人均GDP。√ 10、若美国经济增长速度高于英国,美元相对于英磅升值。× 若美国的通货膨胀速度低于英国,则美元相对于英磅升值。 11、斯密的绝对优势理论指出在贸易中两个国家均能通过出口其比另一国劳动生产率更高的产品获益。√ 12、共同市场是经济一体化的最高阶段。× 完全的经济一体化是经济一体化的最高阶段。 13、战略性贸易政策常常用来支持处于竞争激烈产业中的企业。× 战略性贸易政策常常包括对高技术企业的补贴和其他支持。 14、布雷顿森林体系要求成员国采取浮动汇率制度。× 布雷顿森林体系要求成员国采取以美元为中心的固定汇率制度。 15、货币分析法认为,国际收支赤字的根本原因是国内货币供给大于国内货币需求。√ 16、在金本位制下,一国的高利率和资本流入将有助于该国自动调整国际收支赤字。√ 17、一价定律认为关税不能影响进口产品价格。× 一价定律认为关税能影响进口产品价格。 18、如果德国的利率高于美国,则马克将在远期市场上贴水卖出。√ 19、从日本进口汽车应记入美国国际收支经常账户的贷方。× 从日本进口汽车应记入美国国际收支经常账户的借方。 20、若美国通货膨胀高于英国,美元相对于英磅贬值。√ 三、选择题 1、设一年前美元对人民币的汇率是1美元等于8.2345元人民币,假设美国的物价比前一年上升8%,而中国的物价水平上升10%,则美元与人民币之间理论上的汇率为( A ) A.8.3870 B.8.085 C.10.2931 D.6.5876 2、列昂惕夫反论包括以下解释,除了( B )。 A美国对劳动密集型进口产品征收高额关税 B美国实际上比其贸易伙伴拥有更多的劳动力 C美国的出口产品密集使用了熟练劳动力 D美国倾向于出口需要大量科学和工程技术投入的高技术产品 3.根据相对购买力平价理论,如果英国的通货膨胀率为10%,美国为4%,那么( C ) A 美元相对于英镑升值4% B美元相对于英镑贬值4% C美元相对于英镑升值6% D美元相对于英镑贬值6% 4、不能解释产业内贸易现象的理论有( C ) A. 垄断竞争理论 B. 规模经济理论