Asset pricing Model1

Asset pricing Model: CAPM : equilibrium of all individual investor: its assumptions: individual investors are price takers, rational mean-variance optimisers, single period, investments are limited to traded financial assets, no tax & transaction cost,

info are free and easy to get & homogeneous expectations. E r i=r f+β(E r m?r f) reward to risk ratio: (E

r m?r f)

?m2

=

market risk premium market variance =E r p=w k E r k

k

,βp=w kβk

k, SML: slope= E r m?r f=

market risk premium,SML=E r i=r f+β(E r m?r f),βi= cov r j,r m

?m2

, in market portfolio, β=1, CAPM establishes relationship b/w risk and E(r) for securities, att he equilibrium, that investors form portfolio consisting of riskless assets and market portfolio, combination vary from investor to investor depending upon individual presference for expected risk and return., at equilibrium .E r i=r f+β(E r m?r f). Zero β model, it drops assumption of borrowing at risk free rate: E r i=

r f+(E r m?r f) cov r j,r m

?m2

,Single index Model:r i=αi+r f+βr m?r f+e i Liquidity and the CAPM :Acharya

and Pedersen :E r i=kE Cr f+λ(β+βL1(lqiuidity betas)?βL2?βL3)

E r i expect cost of illiquidity kE Cr f adjustmentfor average olding period over all security,λ:market risk premi average market illiquidity cost,β:measure of systematic market risk,βL1,,βL2,βL3:lqiuidity betas, In real world, CAPM doesn?t capture risk adequately.APT : assumption: not strong as CAPM, single period investment horizon, with no tax, investor can freely borrow or lend at r f, investor can select portfolio based on mean and variance of return, , capital markets are pferfectly competitive and no transaction cost or tax, stochastic process generating set returns can be expressed as a linear function of set of K risk factors or indexes. It assumes that in equilibrium, the return on a zero-investment, zero-systematic-risk portfolio is zero when the unique effects are diversified away, : E(r j) = λ0 + b j1λ1 + b j2λ2 + b j3λ3 + b j4λ4 + ... + b jnλn E(r j) = the

asset's expected rate of return, λ0= the risk-free rate/ expected return on asset with zero systematic risk ,b j = the sensitivity of the asset's return to the particular factor, λ1 = the risk premium associated with the particular factor One Factor Model: linear fuction, Two Factor Model: will calculate each factor separated, e.g: change in inflation is 1%, growth in real GNP is 2%, 3% return on zero-systematic risk asset, b x1 is portfolio x to changes in the rate of inflation= 0.5, b y1=2, b x2 is portfolio x changes in the growth rate of real GNP=1.5, b y2=1.75, E(x)=0.03+0.01(0.5)+(0.02)(1.5)=6.5%, E(y)=8.5%

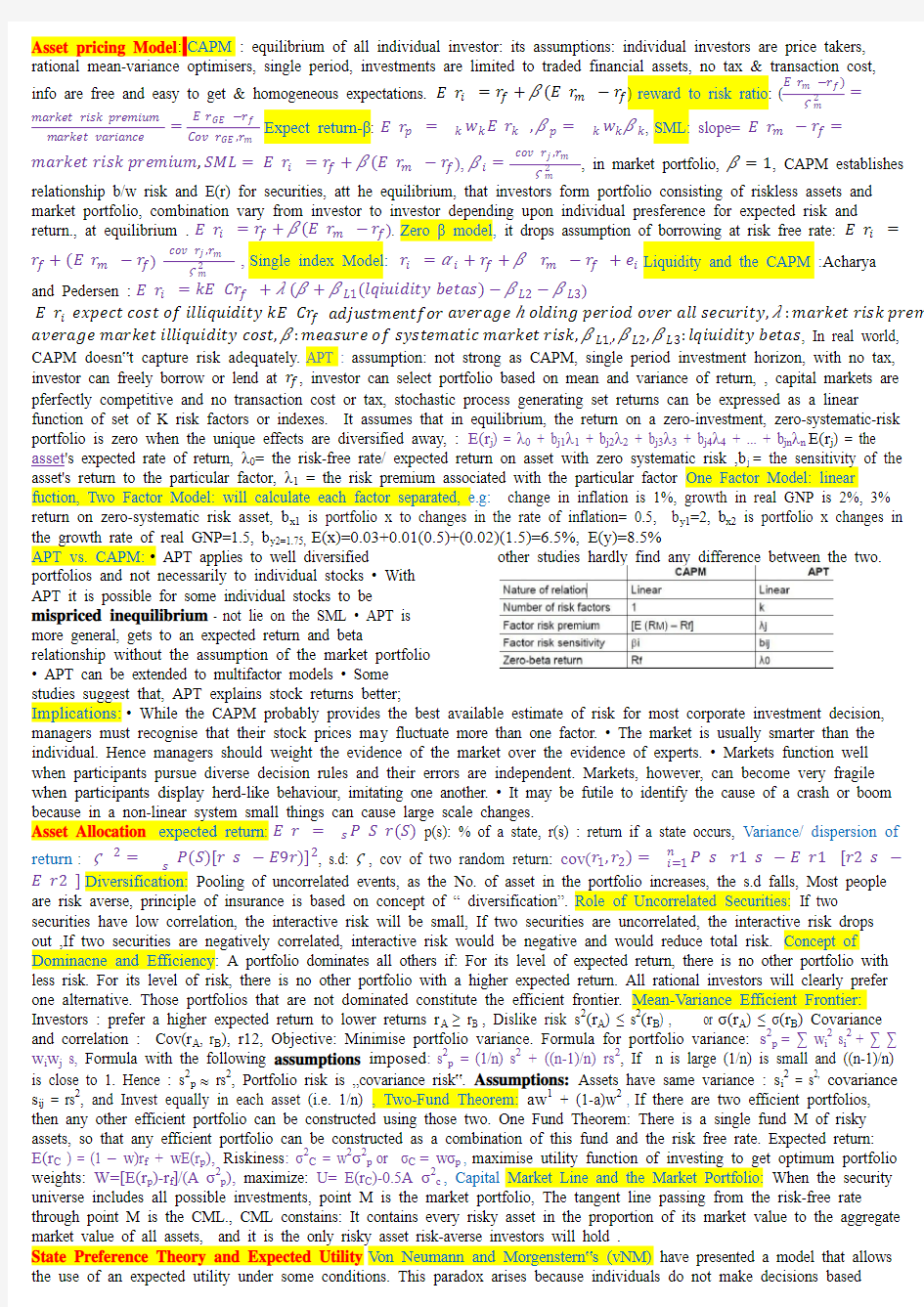

APT vs. CAPM:? APT applies to well diversified

portfolios and not necessarily to individual stocks ? With

APT it is possible for some individual stocks to be

mispriced inequilibrium- not lie on the SML ? APT is

more general, gets to an expected return and beta

relationship without the assumption of the market portfolio

? APT can be extended to multifactor models ? Some

studies suggest that, APT explains stock returns better;

other studies hardly find any difference between the two.

Implications:? While the CAPM probably provides the best available estimate of risk for most corporate investment decision, managers must recognise that their stock prices ma y fluctuate more than one factor. ? The market is usually smarter than the individual. Hence managers should weight the evidence of the market over the evidence of experts. ? Markets function well

when participants pursue diverse decision rules and their errors are independent. Markets, however, can become very fragile when participants display herd-like behaviour, imitating one another. ? It may be futile to identify the cause of a crash or boom because in a non-linear system small things can cause large scale changes.

Asset Allocation expected return: E r=P S r(S)

s p(s): % of a state, r(s) : return if a state occurs, Variance/ dispersion of

return : ?2=P(S)[r s?E9r)]2

s , s.d: ?, cov of two random return: cov(r1,r2)=P s r1s?E r1[r2s?

n

i=1

E r2]Diversification: Pooling of uncorrelated events, as the No. of asset in the portfolio increases, the s.d falls, Most people are risk averse, principle of insurance is based on concept of “ diversification”.Role of Uncorrelated Securities: If two securities have low correlation, the interactive risk will be small, If two securities are uncorrelated, the interactive risk drops out ,If two securities are negatively correlated, interactive risk would be negative and would reduce total risk. Concept of Dominacne and Efficiency: A portfolio dominates all others if: For its level of expected return, there is no other portfolio with less risk. For its level of risk, there is no other portfolio with a higher expected return. All rational investors will clearly prefer one alternative. Those portfolios that are not dominated constitute the efficient frontier. Mean-Variance Efficient Frontier: Investors : prefer a higher expected return to lower returns r A≥ r B , Dislike risk s2(r A) ≤ s2(r B) , or σ(r A) ≤ σ(r B) Covariance and correlation : Cov(r A, r B), r12, Objective: Minimise portfolio variance. Formula for portfolio variance: s2p= ∑ w i2 s i2+ ∑ ∑ w i w j s, Formula with the following assumptions imposed: s2p = (1/n) s2 + ((n-1)/n) rs2, If n is large (1/n) is small and ((n-1)/n) is close to 1. Hence : s2p rs2, Portfolio risk is …covariance risk?. Assumptions: Assets have same variance : s i2 = s2, covariance s ij = rs2, and Invest equally in each asset (i.e. 1/n) , Two-Fund Theorem: aw1 + (1-a)w2 , If there are two efficient portfolios, then any other efficient portfolio can be constructed using those two. One Fund Theorem: There is a single fund M of risky assets, so that any efficient portfolio can be constructed as a combination of this fund and the risk free rate. Expected return:

E(r C ) = (1 – w)r f + wE(r p), Riskiness: σ2C = w2σ2p or σC= wσp, maximise utility function of investing to get optimum portfolio weights: W=[E(r p)-r f]/(A σ2p), maximize: U= E(r C)-0.5A σ2c, Capital Market Line and the Market Portfolio: When the security universe includes all possible investments, point M is the market portfolio, The tangent line passing from the risk-free rate through point M is the CML., CML constains: It contains every risky asset in the proportion of its market value to the aggregate market value of all assets, and it is the only risky asset risk-averse investors will hold .

State Preference Theory and Expected Utility Von Neumann and Morgenstern?s (vNM) have presented a model that allows the use of an expected utility under some conditions. This paradox arises because individuals do not make decisions based

purely on wealth, but rather on the utility of their expected wealth. E(x)= a i x i n i =1 Exp Utility = E[U(W)]Difference between maximising wealth vs. maximising utility? Utility: An economic term referring to the total satisfaction received from

consuming a good or service. Wealth: A measure of the value of all of the assets of worth owned by a person, community, company or country. Fair gamble: it means: cost to play the gambles= expect value of the outcome., unfair gambles: means outcome less the cost to play. St. Petersburg Paradox: if the E(X)= 1=∞n i =1 one would pay a “ fair” price to play a fair game., paradox arises because individuals do not make decisions based purely on wealth, but rather on the utility of their

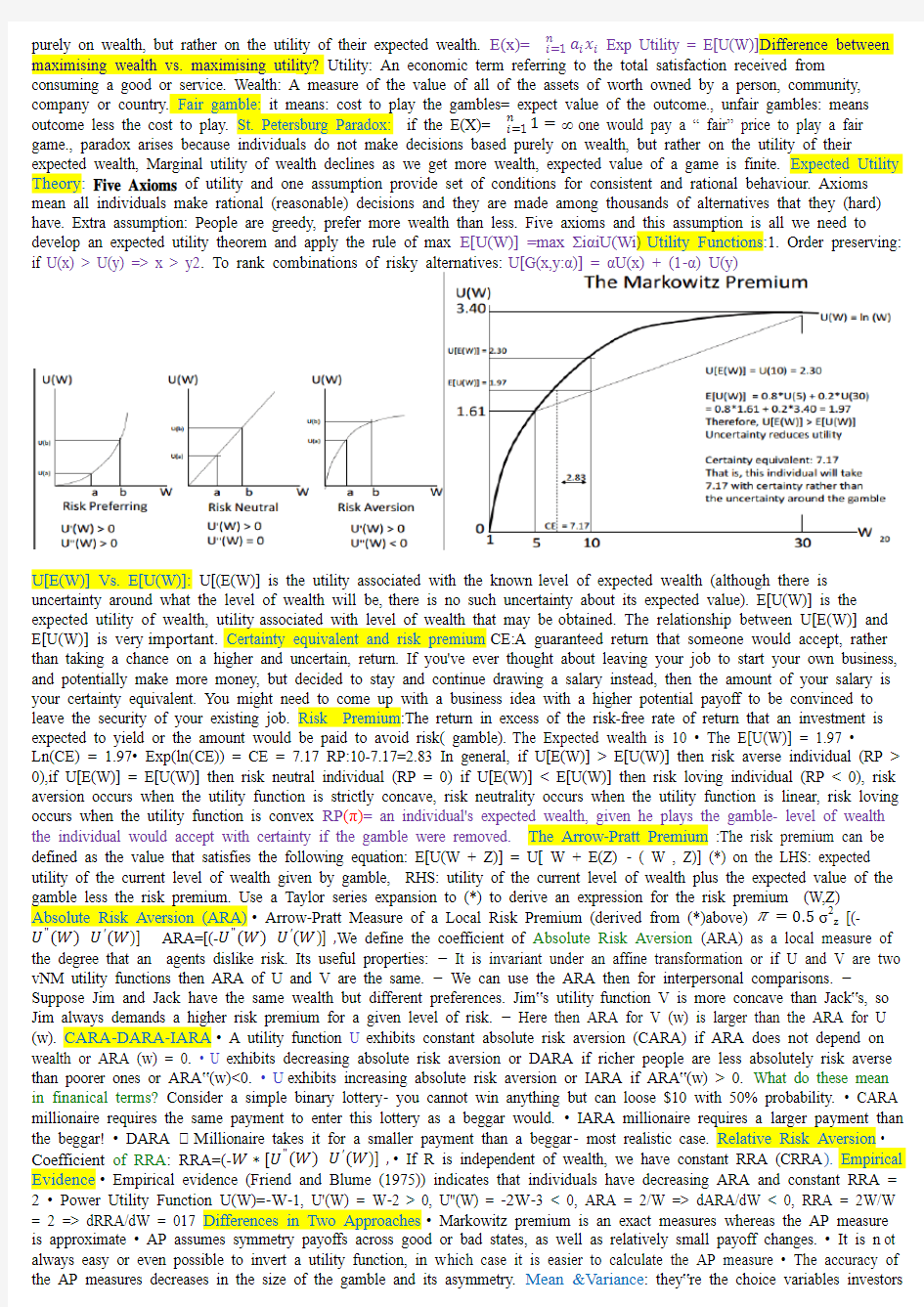

expected wealth, Marginal utility of wealth declines as we get more wealth, expected value of a game is finite. Expected Utility Theory: Five Axioms of utility and one assumption provide set of conditions for consistent and rational behaviour. Axioms mean all individuals make rational (reasonable) decisions and they are made among thousands of alternatives that they (hard) have. Extra assumption: People are greedy, prefer more wealth than less. Five axioms and this assumption is all we need to develop an expected utility theorem and apply the rule of max E[U(W)] =max ΣiαiU(Wi ) Utility Functions:1. Order preserving: if U(x) > U(y) => x > y2. To rank combinations of risky alternatives: U[G(x,y:α)] = αU(x) + (1‐α) U(y)

U[E(W)] Vs. E[U(W)]: U[(E(W)] is the utility associated with the known level of expected wealth (although there is uncertainty around what the level of wealth will be, there is no such uncertainty about its expected value). E[U(W)] is the expected utility of wealth, utility associated with level of wealth that may be obtained. The relationship between U[E(W)] and E[U(W)] is very important. Certainty equivalent and risk premium CE:A guaranteed return that someone would accept, rather than taking a chance on a higher and uncertain, return. If you've ever thought about leaving your job to start your own business, and potentially make more money, but decided to stay and continue drawing a salary instead, then the amount of your salary is your certainty equivalent. You might need to come up with a business idea with a higher potential payoff to be convinced to leave the security of your existing job. Risk Premium :The return in excess of the risk-free rate of return that an investment is expected to yield or the amount would be paid to avoid risk( gamble). The Expected wealth is 10 ? The E[U(W)] = 1.97 ?

Ln(CE) = 1.97? Exp(ln(CE)) = CE = 7.17 RP:10-7.17=2.83 In general, if U[E(W)] > E[U(W)] then risk averse individual (RP > 0),if U[E(W)] = E[U(W)] then risk neutral individual (RP = 0) if U[E(W)] < E[U(W)] then risk loving individual (RP < 0), risk aversion occurs when the utility function is strictly concave, risk neutrality occurs when the utility function is linear, risk loving occurs when the utility function is convex RP (π)= an individual's expected wealth, given he plays the gamble- level of wealth the individual would accept with certainty if the gamble were removed. The Arrow ‐Pratt Premium :The risk premium can be defined as the value that satisfies the following equation: E[U(W + Z)] = U[ W + E(Z) ‐ ( W , Z)] (*) on the LHS: expected utility of the current level of wealth given by gamble, RHS: utility of the current level of wealth plus the expected value of the gamble less the risk premium. Use a Taylor series expansion to (*) to derive an expression for the risk premium (W,Z) Absolute Risk Aversion (ARA) ? Arrow ‐Pratt Measure of a Local Risk Premium (derived from (*)above) π=0.5 σ2z [(-

U "(W )U ′(W )] ARA=[(-U "(W )U ′(W )] , We define the coefficient of Absolute Risk Aversion (ARA) as a local measure of the degree that an agents dislike risk. Its useful properties: ? It is invariant under an affine transformation or if U and V are two vNM utility functions then ARA of U and V are the same. ? We can use the ARA then for interpersonal comparisons. ?

Suppose Jim and Jack have the same wealth but different preferences. Jim?s utility function V is more concave than Jack?s, so Jim always demands a higher risk premium for a given level of risk. ? Here then ARA for V (w) is larger than the ARA for U (w). CARA ‐DARA ‐IARA ? A utility function U exhibits constant absolute risk aversion (CARA) if ARA does not depend on wealth or ARA (w) = 0. ? U exhibits decreasing absolute risk aversion or DARA if richer people are less absolutely risk averse than poorer ones or ARA?(w)<0. ? U exhibits increasing absolute risk aversion or IARA if ARA?(w) > 0. What do these mean in finanical terms? Consider a simple binary lottery ‐ you cannot win anything but can loose $10 with 50% probability. ? CARA millionaire requires the same payment to enter this lottery as a beggar would. ? IARA millionaire requires a larger payment than the beggar! ? DARA M illionaire takes it for a smaller payment than a beggar ‐ most realistic case. Relative Risk Aversion ? Coefficient of RRA : RRA=(-W ?[U "(W )U ′(W )] , ? If R is independent of wealth, we have constant RRA (CRRA ). Empirical Evidence ? Empirical evidence (Friend and Blume (1975)) indicates that individuals have decreasing ARA and constant RRA = 2 ? Power Utility Function U(W)=‐W ‐1, U'(W) = W ‐2 > 0, U"(W) = ‐2W ‐3 < 0, ARA = 2/W => dARA/dW < 0, RRA = 2W/W = 2 => dRRA/dW = 017 Differences in Two Approaches ? Markowitz premium is an exact measures whereas the AP measure is approximate ? AP assumes symmetry payoffs across good or bad states, as well as relatively small payoff changes. ? It is n ot always easy or even possible to invert a utility function, in w hich case it is easier to calculate the AP measure ? The accuracy of the AP measures decreases in the size of the gamble and its asymmetry. Mean &Variance : they?re the choice variables investors

concern about in order to max E[U(w)]. Mean‐Variance Utility ? Many researchers (Markowitz ,Sharpe etc.) used mean variance utility functions. But is it compatible with vNM theory?? The answer is yes, approximately, under some conditions.? What are these conditions?– U is quadratic e.g. when U =aw‐bw2, belongs to the linear distribution class, risk is small, asset returns are joint normal.? We will not go into the details of these issues here.? The most relevant justification for

mean‐variance is probably the case of small risks. Then, we may use a second order Taylor approximation of the vNM utility function.? In other words, any risk‐averse vNM utility function can locally be approximated with a quadratic function.? The expectation of a quadratic utility function can be evaluated with the mean and variance. Stochastic Dominance & Utility? Stochastic “denotes the process of selecting from among a group of theoretically possible alternatives those elements or fact ors whose combination will most closely approximate a desired result” ? The most general efficien cy criteria relies only on the assumption that utility is non-decreasing in return, or investors prefers more of at least one good to less. ? Portfolios are efficient if they are not dominated by other portfolios, are inefficient if at least one other port folio dominates them. ? Rational investors prefer efficient investments. Concept of Dominance & Efficiency: a portfolio dominates all others if: for its lvl of expected return, there?s no other portfolio with less risk., for its lvl of risk, no others has higher expected return, all rational investor will clearly prefer one alternative, and those portfolios that are not dominated constitute the efficient frontier. Futures pricing & hedging: S0: Spot price today F0: Futures or forward price today T: Time until delivery date r: Risk-free interest rate for maturity T ? Long & Short Hedges: A long futures (short) hedge is appropriate when you know you will purchase (sell) an asset in the future and want to lock in the price. Short Selling: involes sellin g securities you don?t own.-your broker borrows the securities from another client and sells them in the market in the usual way.- at some stage you must buy the securities to be replaced in the account of the client. Basis Risk: Basis is usually defined as the spot price-the futures price. Forward vs Future Price: when the maturity & asset price are the same, forward & futures prices are usually assumed to be equal (Euro $ futures are an exception), when interest rates are uncertain they are, in theory, slightly different: a strong +ve correlation b/w interest rates and the asset price implies the future price is slightly higher than the forward price, a strong –ve correlation implies the reverse. Forward Price: F0=S0e rT,Assuption: theoretical no-arbitrage relationship b/w F0 and S0 must hold., when investment gives a known income: F0=(S0?I)e rT, if income is unknow F0=S0e(r?q)T where q is the average exp. yield during the life of the contract (continuously compounding)/ average dividend yield. Forward contract: it is worth zero( except for bid-offer spread effects) when is 1st negotiated. Later it may have a +ve/-ve value, long forward contract:

F0?K e?rT, short forward contract is:K?F0e?rT Hedging? Hedging: eliminating unwanted risk ?Arguments in favor: Companies should focus on their main business and minimize risks arising from interest rates, exchange rates, etc. ? Arguments against: Shareholders are usually well diversified & can make their own hedging decisions.? Ex plaining a situation where there is a loss on the hedge and a gain on the underlying can be difficult. Long Hedge for Purchasing of an Asset:? Define F1 : Futures price at time hedge is set up, F2 : Futures price at time asset is purchased, S2 : Asset price at time of purchase, b2 : Basis at time of purchase, Cost of asset: S2, Gain on Futures: F2-F1, net amount pai: S2 -( F2-F1)=F1 + b2 , Short Hedge for Sale of an Asset: Define: F1 : Futures price at time hedge is set up, F2 : Futures price at time asset is sold,S2 : Asset price at time of sale, b2 : Basis at time of sale, Price of asset: S2, Gain on Futures:F1?F2, net amount pai: S2 +( F1?F2)=F1 + b2 , Choice of Contract ? Choose a delivery month that is as close as possible to, but later than, the end of the life of the hedge? When there is no futures contract on the asset being hedged, choose the contract whose futures price is most highly correlated with the asset price. This is known as cross hedging. Optimal Hedge Ratio: ?=ρ?S

?F

?S is the standard deviation of ΔS, the change in thespot price during the hedging period, ?F is the standard deviation of ΔF, the change in thefutures price during the hedging period, ρ is the coefficient of corrrlation b/w ΔS & ΔF, Optimal No. of Contract :Q A Size of position being hedged (units), Q F Size of one futures contract (units), V A= Value of position being hedged (=spot price time QA), V F =Value of one futures contract (=futures price times QF), Tailing the hedge Adjusting the number of futures so the present market exposure of

the hedge offsets the underlying exposure. Optimal No. of contracts if no tailing adjustment: = ?Qa

Qf , Optimal after tailing: = ?Va

Vf

,

Imperfect Hedging (Cross hedging) asset being hedged and the asset underlying the futures contract are not identical, the futures contract usd to hedge is closed out before the delivery date. Hedging a stock portfolio using index futures: βV a

V F

ADV of Hedging:want to be out of the mkt for a while avoids the costs of selling and repurchasing the portfolio.Stack and Roll ? In its simplest form, a stack‐and‐roll hedge involves repeatedly buying a bundle, or “stack,” of short dated futures or forward contracts to hedge a longer‐term exposure.? Initially we enter into futures contracts to hedge exposures up to a time horizon? Just before maturity we close them out an replace them with new contract reflecting the new exposure Liquidity Issues? In any hedging situation there is a danger that losses will be realized on the hedge while the gains on the underlying exposure are unrealized ? This can create liquidity problems ? One example is Metallgesellschaft which sold long term fixed‐price contracts on heating oil and gasoline and hedged using stack and roll.Index Arbitrage? When F0 > S0e(r‐q)T an arbitrageur buys the stocks underlying the index and sells futures. ? When F0 < S0e(r‐q)T an arbitrageur buys futures and shorts or sells underlying stocks.? Index arbitrage involves simultaneous trades in futures and many different stocks. ? Very often a computer is used. ? Occasionally simultaneous trades are not possible and the theoretical no‐arbitrage relationship between F0 and S0 does not hold. Futures and Forward on Currencies: F0=S0e(r?r f)T, Consumption Assets: storage is –ve income: F0≤S0e(r?u)T where u is the storage cost per unit time as a % of the asset value, Alternatively: F0≤(S0+U)e(rT where U is the present vaulue of the storage costs. Cost of Carry:The cost of carry, c, is the storage cost plus the interest costs less the income earned ? For an investment asset F0=S0e cT, for a consumption asset:F0≤S0e cT, convenience yield on the consumption asset y: F0=

S0e(c?y)T Fu tures Prices & Expected Future Spot Prices? Suppose k is the expected return required by investors in an asset? We can invest F0e–r T at the risk‐free rate and enter into a long futures contract to create a cash inflow of ST at maturity, This shows: F0=ES t e r?k T,Futures Prices & Future Spot Prices No Systematic Risk k = r F0 = E(ST), +ve Systematic Risk k > r

F0 < E(ST), -ve Systematic Risk k < r F0 > E(ST) ?Positive systematic risk: stock indices ? Negative systematic risk: gold (at least for some periods)Duration Matching? Duration is a measure by which a bank?s asset or liability portfolio increases or decreases as the result of a 1% change in interest rate. ? Duration ma tching involves hedging against interest rate risk by

matching the durations of assets and liabilities ? It provides protection against small parallel shifts in the zero curve.

Duration‐Based Hedge Ratio V F:Contract price for interest rate futures, D F: Duration of asset underlying futures at maturity,P: Value of portfolio being hedged,D p Duration of portfolio at hedge maturity, P D p/V F D F, Limitations of Duration Based

Hedging? Assumes that only parallel shift in yield curve take place? Assumes that yield curve changes are small? When

T‐Bond futures is used assumes there will be no change in the cheapest‐to‐deliver bond.

Swaps:Definition: A swap is an agreement to exchange cash flows at specified future times according to certain specified rules. The use of an interest rate swap: ? Converting a liability from fixed rate to floating rate or floating rate to fixed rate? Converting

an investment from fixed rate to floating rate or floating rate to fixed rate.Day Count? A day count convention is specified for fixed and floating payment. Confirmations: ? it is specify the terms of a transaction? The Internat ional Swaps and Derivatives has developed Master Agreements that can be used to cover all agreements between two counterparties ? Governments now

require central clearing to be used for most standardised derivatives. e.g on borrowing/ loan: Aand B offered $20mill 5yr loan: at following: fixed: 5% (A), 6.4% (B), floating, LIBOR+0.1%(A), LIBOR=0.6%(B) and A requires, floating, B requires fix, F.I charges 0.1%

benefits: 1.4%-0.5%-0.1%=0.8%, each receive 0.4% benefits for A, the floating: LIBOR-0.3% or reciving extra 0.3% on fix, B would pay

5.4%=

6.4%-0.6%-0.4% e.g2: if XY< offer 5million on 10-investment: Fixed: 8%(X), 8.8% (Y), both floating is LIBOR:

F.I charge 0.2%Credit Risk: A swap is worth zero to a company initially, at future time its value is liable to be either +ve or –ve, the company has CR exposure only when its value is +ve. Credit Risk vs. Market Risk: CR arises from the % of a default by the counterparty, MR arises from movements in the market variables such as interest rates and exchange rates, A complication is that the CR in a swap is contingent on the values of market variable. , A company?s position in a swap has CR only when the value of the swap to the company is +ve. expected loss from a default on swap vs. the expected loss from a default on a loan. On swap it loss less than a loan, in an interst rate swap, financial institiutiion?s exposure depends on the difference b/w a fixed-rate of interest and a floating –rate of interest, it has no exposure to the notional principal, where in Loan the whole principal can be lost. Bank finds that its assets are not matched with its liablilites, it?s taking floating-rate deposits and making fixed-rate loans, how can swaps be used to offset bank. The bank is paying a floating-rate on the deposits and receiving a fixed-rate on the loans, it can offset its risk by entering into interest rate swaps in which it contracts to pay fixed and receiving floating. How to value a swap that is the exchange of a floating rate in one currency for a fixed rate in another currency? The floating payments can be valued in currency A by(i) assuming that the forward rates are realized, and (ii) discounting the resulting C.F at appropriate currency A discount rates, suppose that the value is Va, the fixed payments can be valued in currency B by discounting them at the appropriate currency B discount rates, suppose that the value is Vb, IF Q is the current exchange rate, the value of the swap in currency A is Va-QVb, or otherwise. Similarity on Currency Swaps and Interst rate swaps: both can be valued either as the difference b/w 2 bonds or as a portfolio of forward contracts.Valuation of an Interest Rate Swap? Initially interest rate swaps worth close to zero? At later times they can be valued as the difference between the value of a fixed‐rate bond and the value of a floating‐rate bond.? The fixed rate bond is valued in the usual way? Floating rate bond is valued by noting that it is at par immediately after the next payment date? Alternatively, they can be valued as a portfolio of forward rate agreements (FRAs) Mechanics of Options Markets:Option Types: 1) A call is an option to buy, 2)A put is an option to sell, 3)A European option can be exercised only at the end of its life, 4)An American option can be exercised at any time,Option Positions: 1)Long call 2)Long put 3)Short call 4)Short put. Notation: c: European call option price, p, European put price. C: American call option price, P : American put price, K strike price, T; life of option, s: volatility of stock price, s0: stock price today, s t: stock price at option maturity, D: PV of dividends paid during life of option, r: Risk-free rate for maturity T with cont. comp. Dividends & Stock Splits: N option with strike price of K,,: no adjustments are made to the option terms for cash dividends, where there is n for m stock split, the strike price is reduce to mK/n, no. of option is increase to nN/m, and stock dividends are handled similarly to stock splits. Margins: they are reuired when options are sold, when a naked option is written the margin is greater of: a total of 100% of the proceeds of the sale+ 20% of the underlying share price-the amount (if any) by which the option is out of the money, or A total of 100% of the proceeds of the sale + 10% of the underlying share price (call) or exercise price( put). Market Makers: Most exchanges use market makers to facilitate options trading, a MM quotes both bid and ask prices when requested, the MM d oesn?t know whether the individual requesting the quotes wants to buy or sell, the trading system of many exchanges can be characterised as a mixture of an order driven and quote driven markets. Warrants: it?s options that are issued by a corp or F.I, the No. of warrants outstanding is determined by the size of the original issue and changes only when they are exercised or when they expire. The issuer settles up with the holder when a warrant is exercised, when call warrants are issued by a corp on its own stock, exercise will usually lead to new treasury stock being issued. Employee Stock Option: they are a form of

remuneration issued by a company to its executives, they are usually at the money when issued, when options are exercised the company issues more stock and sells it to the option holder for the strike price, expensed on the income statement. Convertible Bonds, they are regular bonds that can be exchanged for equity at certain times in the future according to a predetermined

exchange ratio, usually a convertible is callable,the call provision is way in which the issuer can force conversion at a time earlier than the holder might otherwise choose. Lower Bound for Eup Call& Put option price: No: dividend: c≥S0?

Ke?rt,p≥Ke?rt?S0 with dividend: c≥S0?D?Ke?rt,p≥D+Ke?rt?S0

Early Exercise: Calls on a Non-dividend Paying stock: Since c0+Ke?rT=p0+S0→c≥S0?Ke?rt, Also, c0≥C0, therefore: C≥S0?Ke?rt, it means American call must worth more than its instrinsic value, a call options market value consists of C= instrinsic value+ time value. C=S?K+K?Ke?rT+P Puts on Non-Divd: P=K?S+K?Ke?rT?K+ P, when a put option is sufficiently deep in the money, Ke?rT?K will be –vely large relative to the value of call, and time

value of European put option will be –ve, In tht case, the European put will sell for less than its intrinsic value, however, its American couterpart can?t sell for less than its intrinsic value, which implies that an Ame rican put option can be worth more than an otherwise identical european option.

CE傻瓜教程全九课

CE傻瓜教程一:基本操作 先简单介绍下什么叫CE,CE的全称是Cheat Engine,最新的版本是(作者是 Dark Byte)CE是目前最优秀的游戏修改器,不是之一,这个工具绝对值得你去学习(只要花一点时间就够了)。 忘记金山游侠,GM8,FPE之类的修改工具的吧,CE会让你爱不释手。 一、先下载CE ,这个汉化版相当不错哦(不需要安装),推荐各位下载使用。 二、打开CE目录下的2个文件: 三、附加进程(图示): CE傻瓜教程二:精确数值扫描

接着第一关的操作 按下一步进入教程第二关,需要扫描的精确数值是100 现在开始搜索精确数值 100 数值中输入100点击首次扫描按钮 一般游戏就是4字节,这里不需要改动,默认就好。 这次扫描我们得到 59 个结果,里面肯定有我们要找的那个血值,不过好像太多了。

关键一步:回到 Tutorial 点击打我按钮,此时血值已有变化了: 我们再输入 96 点击再次扫描按钮结果只剩1个(这就是我们要找的),我们双击此地址将其添加到地址栏: 只有1个结果了,这个就是我们要找的内存地址,双击将其加入到地址栏

图示操作: 把 95 改成 1000 点击确定按钮

此时教程的下一步按钮变成可用 闯关成功。 操作虽然简单,但是大家需要明白这其实是一个筛选的过程,这样操作就能把地址找出来。本关的小技巧: 1、双击下图对应位置可快速更改数值。 2、双击地址可快速将其加入到地址栏 CE傻瓜教程三:未知初始数值 第3关的密码是 419482

这一关很重要,因为某些游戏中血显示的不是数字而是血条,这样的话教程2中的方法就失效了。 本关就你要教会你如何修改这些讨厌的未知数 此时点击新扫描然后选择未知初始数值 点击首次扫描然后出现了肯定是N多的结果,因为太多了,CE没有显示出来。 老办法,回到 Tutorial ,点击打我 ,CE会告诉你血量减了多少,比如-1

皇帝成长计划2详细CE修改方法,含时间锁定等

皇帝成长计划2 CE尽量详尽修改方法详解 申明:此修改教程并非对原游戏不尊重。实则喜爱该游戏,但是针对该游戏对新手难度过高,或者某些有其他特殊喜好比如无限刷妃子的人来说,要在正常游戏流程中实现略有困难。固愿用一些非常规手段来使更多的人先上手该游戏。教程并不商用。转载请注明出 处。 前言 看到这个攻略的你,也许用过CE,也许没有用过CE,如果熟练使用过CE的人可以跳过前言。 修改所需工具:皇帝成长计划2桌面版/绝迹皇帝成长计划2辅助工具。(两者可任选其一,推荐使用皇帝成长计划2桌面版。)CE修改器。(修改器) 如果你从未接触过CE,或者使用并不熟练,只是一知半解。那么我希望你仔细看完前言的CE介绍。因为我写攻略,一般不是告诉你要怎么去做怎么去做。这样你下次使用或者要改其他的东西,也许还要再看攻略,依旧不知道该如何去改。我的目的不是告诉你要怎么做,而是要告诉你为什么这么做。 首先,CE是一款十分强大的内存修改器。它不是皇帝成长计划2的专用修改器。而是目前市面上基本大部分游戏都能通过它修改的一款通用修改器。 CE的原理其实很简单。一个游戏中是由千千万万个数据组成的。你若想改变其中一个数据,比如皇帝成长计划2。你想改自己的文学值。你首先要做的就是能在这千千万万个数据中,找到你要改的文学值那个数据在哪里。(比如你要去买馅饼。你都不知道卖馅饼的店铺在哪里,你又何谈买什么馅饼。一个道理。话糙理不糙。)

那么我们首先要做的就是定位到这个数据的位置。那么如何在CE 中定位出这个数据的位置呢? 其实很简单。数据都是不断在发生变化的。它的值不是固定的。比如你玩打怪游戏,你有3滴血,被怪打了一下,血变成了2滴。因 为你通过游戏改变了这些数据,那么我们就可以通过改变的数据而 找到这个数据的位置。 所以我们在用CE的过程其实就是寻找某个数据位置的过程。只有 先找到,才能修改它。 如果你能立刻明白了这个道理,那么下面的修改你能用的得心应手。如果你还不能很明白,不要紧。我们先通过一些简单的修改, 来让你理解这个过程。 教程1、CE修改器的基础使用方法。(包涵皇帝成长计划2基本属性,如文学、武术、才艺、道德、体能等数值的修改。) 首先打开皇帝成长计划2桌面版,或者绝迹皇帝成长计划2辅助, 打开其游戏界面。进入到游戏里面。(输入账号密码,选择好剧本,或者继续游戏等,要进入到游戏,不是账号输入界面。)

摄像头接口分类及

摄像头接口分类及基础知识

一、Camera 工作原理介绍 1.结构 2.工作原理 外部光线穿过 lens 后,经过 color filter 滤波后照射到 Sensor 面上, Sensor 将从 le ns 上传导过来的光线转换为电信号,再通过内部的 AD 转换为数字信号。如果 Sensor 没有集成 DSP,则通过 DVP 的方式传输到 baseband,此时的数据格式是 RAW DATA。如果集成了 DS P, RAW DATA 数据经过 AWB、则 color matr ix、 lens shading、 gamma、 sharpness、 A E 和 de-noise 处理,后输出 YUV 或者 RGB 格式的数据。 最后会由 CPU 送到 framebuffer 中进行显示,这样我们就看到 camera 拍摄到的景象了。3. YUV 与 YCbCr . 一般来说,camera 主要是由lens 和 senso r IC 两部分组成,其中有的 sensor IC 集成了 DSP,有的没有集成,但也需要外部 DSP 处

理。细分的来讲,camera 设备由下边几部分构成: 1) lens(镜头)一般 camera 的镜头结构是有几片透镜组成,分有塑胶透镜(Plastic)和玻璃透镜(Glass) ,通常镜头结构有:1P,2 P,1G1P,1G3P,2G2P,4G 等。 2) sensor(图像传感器) Senor 是一种半导体芯片,有两种类型:CCD(Charge Coupled Device)即电荷耦合器件的缩写和 CMOS(Co mplementary Metal-Oxide Semiconductor)互补金属氧化物半导体。Sensor 将从 lens 上传导过来的光线转换为电信号,再通过内部的AD 转换为数字信号。由于 Sensor 的每个 pi xel 只能感光 R 光或者 B 光或者 G 光,因此每个像素此时存贮的是单色的,我们称之为 R AW DATA 数据。要想将每个像素的 RAW DATA 数据还原成三基色,就需要 ISP 来处理。 注:

常用摄像机的分类

常用摄像机的分类 根据不同感光芯片划分 我们知道感光芯片是摄像机的核心部件,目前摄像机常用的感光芯片有ccd和cmos 两种: 1.ccd摄像机,ccd称为电荷耦合器件,ccd实际上只是一个把从图像半导体中出来的电子有组织地储存起来的方法。 2.cmos摄像机,cmos称为“互补金属氧化物半导体”,cmos实际上只是将晶体管放在硅块上的技术,没有更多的含义。 尽管ccd表示“电荷耦合器件”而cmos表示“互补金属氧化物半导体”,但是不论ccd或者cmos对于图像感应都没有用,真正感应的传感器称做“图像半导体”,ccd和cmos传感器实际使用的都是同一种传感器“图像半导体”,图像半导体是一个p n结合半导体,能够转换光线的光子爆炸结合处成为成比例数量的电子。电子的数量被计算信号的电压,光线进入图像半导体得越多,电子产生的也越多,从传感器输出的电压也越高。 因为人眼能看到1lux照度(满月的夜晚)以下的目标,ccd传感器通常能看到的照度范围在0.1~3lux,是cmos传感器感光度的3到10倍,所以目前一般ccd摄像机的图像质量要优于cmos摄像机。 cmos可以将光敏元件、放大器、a/d转换器、存储器、数字信号处理器和计算机接口控制电路集成在一块硅片上,具有结构简单、处理功能多、速度快、耗电低、成本低等特点。cmos摄像机存在成像质量差、像敏单元尺寸小、填充率低等问题,1989年后出现了“有源像敏单元”结构,不仅有光敏元件和像敏单元的寻址开关,而且还有信号放大和处理等电路,提高了光电灵敏度、减小了噪声,扩大了动态范围,使得一些参数与ccd摄像机相近,而在功能、功耗、尺寸和价格方面要优于ccd,逐步得到广泛的应用。cmos传感器可以做得非常大并有和ccd传感器同样的感光度,因此非常适用于特殊应用。cmos传感器不需要复杂的处理过程,直接将图像半导体产生的电子转变成电压信号,因此就非常快,这个优点使得cmos传感器对于高帧摄像机非常有用,高帧速度能达到400到100000帧/秒。 按输出图像信号格式划分 模拟摄像机 模拟摄像机所输出的信号形式为标准的模拟量视频信号,需要配专用的图像采集卡才能转化为计算机可以处理的数字信息。模拟摄像机一般用于电视摄像和监控领域,具有通

修改必用装备 CE使用方法

修改必用装备CE使用方法 3:在软件中找到点击进入找到桌面版本的造梦3 4:修改(具体修改方式以下会一一列明) 一:修改等级 1:使进入修改器CE修改 2:将“数值类型”修改为“文本” 3:在上面空白处输入wpxt 点击首次扫描 4:全选右边所有搜索出来的值(点第一个然后左键点住往下拉) 5:点击(所有的都到了下面编辑框) 6:点击下面编辑框任意一个CTRL+A全选 7:再全选蓝色部分右键→更改记录→值修改为jyys 8:点击桌面游戏进入神秘商店购买(注:如不是则退出继续进入直到第一个变成经验药水为止) 9:用道具无限的方式将该道具无限复制(嘿嘿..然后你懂的….) 二:修改时装 1:使进入修改器CE修改 2:将“数值类型”修改为“文本” 3:在上面空白处输入wplvdyl 4:全选右边所有搜索出来的值下拉编辑框全选修改为jlzlwsz精良转轮王时装或者jlnmwsz精良牛魔王时装。 5:进入游戏到神兽森林打到小龙女处珍珠商店购买到第四个时装。保存退出。 6:重进造梦进入炼丹炉点击装备合成就行(虽然只有一个时装,但是可以无限合成)三:修改玲珑玉制作书 1.准备好1品生命丹材料(3个放入合成栏) 2:使进入修改器CE修改 3:将“数值类型”修改为“文本” 4:在上面空白处输入wpsmd1 5:全选右边所有搜索出来的值下拉编辑框全选修改为llyzzs

6:合成(成功)(注:制作书的名字是一品生命丹) 7:保存游戏退出游戏(关掉游戏)重新进入 8:成功之后用修改道具的方法修改玉衡石天枢石 9:最好加上需要的灵珠或者攻击石等合成(建议多刷几种不同属性的玲珑玉) 四:修改强化石4 修改强化石4之前背包里必须有强化石4 否则无法修改 1.准备好1品生命丹材料(3个放入合成栏) 2:使进入修改器CE修改 3:将“数值类型”修改为“文本” 4:在上面空白处输入wpsmd1 5:全选右边所有搜索出来的值下拉编辑框全选修改为wpqhs4 6:合成(成功)(注:制作书的名字是一品生命丹) 7:保存游戏退出游戏(关掉游戏)重新进入 8:成功 注:此物品无法无限只能耍无限的1品生命丹材料然后合成 五:100%强化7 1:将物品强化至5. 2:强化6的时候,将3个强化石,神恩符,幸运符,强化物品放入强化栏中 3:将“数值类型”修改为“双浮点数”搜索0.075,全部拉下改成1,强化6成功!4:强化7的时候,将3个强化石,神恩符,幸运符,强化物品放入强化栏中 5:将“数值类型”修改为“双浮点数”搜索0.0217500 全部拉下改成1,强化7成功 沙僧的瘴气是1.2000 悟空的烈焰是1.2000 八戒巨石破是1.5000 六:修改宠物丹 1:使进入修改器CE修改

摄像机类型与功能

摄像机类型与功能 电视监控系统的前端设备主要包括了:摄像机、镜头、云台、防护罩、支架、控制解码器、射灯等; 1:摄像机的选择 如果监视目标照度不高,对监视图像清晰度要求较高时,宜选用黑白CCD摄像机; 如果要求彩色监视时,因考虑加辅助照明装置或选用彩色�;黑白自动转换的CCD摄像机,这种摄像机当监视目标照度不能满足彩色摄像机要求时自动转化黑白摄像。 1>彩色摄像机:适用于景物细部辨别,信息量一般是黑白摄像机的10倍 2>黑白摄像机:适用于管线不住地区及夜间无法安装照明设备的地区 2:摄像机功能和工作原理 1>分辨率:表示摄像机分配率图像细节的能力,通常用电视线TVL表示,黑白摄像机水平清晰度一般选择450TVL左右; (1)25万像素左右,彩色分辨率为330线、黑白分配率420线左右的低档型; (2)25~38万像素之间,彩色分配率为420线,黑白分配率在500线上下的中档型 (3)38万以上,彩色分配率大于或者等于480线、黑白分配率,570线以上的高分配率2>灵敏度:在镜头光圈大小一定的情况下,获取规定信号电平所需要的最低靶面照度。 (1)普通型:正常工作所需照度为1~31 ux (2)月光型:正常工作所需照度为 0.1 lux左右 (3)星光型:正常工作所需照度为0.01 lux以下 (4)红外照明型:原则上可以为零照度,采用红外光源成像 3>信噪比:视频信号电平与噪声平之比,衡量摄像机质量的重要指标; 信噪比越高,图像越干净,质量就越高,通常在45~55dB之间; 4>工作温度:-10~+50dB是绝大多数摄像机生产厂家的温度指标 5>电源电压:国外摄像机交流电压适应范围是198~264V抗电源电压变化能力较强,国内摄像机交流电压适应范围一般是200~240,抗电源电压变化能力较弱;

扫盲7--安防摄像头6mm与3mm镜头的差异

安防摄像头6mm与3mm镜头的差异 差异肯定是有的,具体如下: 摄像机镜头是视频监视系统的最关键设备,它的质量(指标)优劣直接影响摄像机的整机指标,因此,摄像机镜头的选择是否恰当既关系到系统质量,又关系到工程造价。 镜头相当于人眼的晶状体,如果没有晶状体,人眼看不到任何物体;如果没有镜头,那么摄像头所输出的图像就是白茫茫的一片,没有清晰的图像输出,这与我们家用摄像机和照相机的原理是一致的。当人眼的肌肉无法将晶状体拉伸至正常位置时,也就是人们常说的近视眼,眼前的景物就变得模糊不清;摄像头与镜头的配合也有类似现象,当图像变得不清楚时,可以调整摄像头的后焦点,改变CCD芯片与镜头基准面的距离(相当于调整人眼晶状体的位置),可以将模糊的图像变得清晰。由此可见,镜头在闭路监控系统中的作用是非常重要的。工程设计人员和施工人员都要经常与镜头打交道: 设计人员要根据物距、成像大小计算镜头焦距,施工人员经常进行现场调试,其中一部分就是把镜头调整到最佳状态。 1、镜头的分类 按外形功能分按尺寸大小分按光圈分按变焦类型分按焦距长矩分球面镜头1 ” 25mm自动光圈电动变焦长焦距镜头 非球面镜头手动变焦标准镜头 针孔镜头固定焦距xx 鱼眼镜头 (1)以镜头安装分类所有的摄象机镜头均是螺纹口的,CCD摄象机的镜头安装有两种工业标准,即C安装座和CS安装座。两者螺纹部分相同,但两者从镜头到感光表面的距离不同。

C安装座: 从镜头安装基准面到焦点的距离是 17.526mm。CS安装座: 特种C安装,此时应将摄象机前部的垫圈取下再安装镜头。其镜头安装基准面到焦点的距离是 12.5mm。如果要将一个C安装座镜头安装到一个CS安装座摄象机上时,则需要使用镜头转换器。 (2)以摄象机镜头规格分类摄象机镜头规格应视摄象机的CCD尺寸而定,两者应相对应。 即摄象机的CCD靶面大小为1/2英寸时,镜头应选1/2英寸。摄象机的CCD靶面大小为1/3英寸时,镜头应选1/3英寸。摄象机的CCD靶面大小为1/4英寸时,镜头应选1/4英寸。如果镜头尺寸与摄象机CCD靶面尺寸不一致时,观察角度将不符合设计要求,或者发生画面在焦点以外等问题。 (3)以镜头光圈分类镜头有手动光圈(manualiris)和自动光圈(autoiris)之分,配合摄象机使用,手动光圈镜头适合于亮度不变的应用场合,自动光圈镜头因亮度变更时其光圈亦作自动调整,故适用亮度变化的场合。自动光圈镜头有两类: 一类是将一个视频信号及电源从摄象机输送到透镜来控制镜头上的光圈,称为视频输入型,另一类则利用摄象机上的直流电压来直接控制光圈,称为DC 输入型。自动光圈镜头上的ALC(自动镜头控制)调整用于设定测光系统,可以整个画面的平均亮度,也可以画面中最亮部分(峰值)来设定基准信号强度,供给自动光圈调整使用。一般而言,ALC已在出厂时经过设定,可不作调整,但是对于拍摄景物中包含有一个亮度极高的目标时,明亮目标物之影像可能会造成"白电平削波"现象,而使得全部屏幕变成白色,此时可以调节ALC来变换画面。另外,自动光圈镜头装有光圈环,转动光圈环时,通过镜头的光通量会发生变化,光通量即光圈,一般用F表示,其取值为镜头焦距与镜头通光口径之比,即:

详解CE游戏修改工具教程

详解CE游戏修改工具教程 学习各种高级外挂制作技术,马上去百度搜索(魔鬼作坊),点击第一个站进入,快速成为做挂达人。 CE是我见过的最优秀的游戏作弊工具。它的优点多不胜数,虽然单独从搜索游戏里面的数值来说,它并不比其他同类软件强多少,但它不仅仅是个游戏修改工具,它还有其他游戏修改软件所没有的一些特点,它有强大的反汇编功能,这个是别的游戏工具中几乎没有的;还有,它本身就自带了外挂制作工具,可以直接由它生成外挂。 在这个教程里面,你不会看到任何图片,因为我觉得我能用纯文字教你使用CE,如果你觉得没有图片就一定学不会,我想你没必要看下去了,因为我没空做图片,并且我觉得文字已经足够表达,没必要用多余的图片。 还有如果你喜欢这个入门教程,你可以把它转载到任何地方,但在转载之前,请你征得本人的同意,并且在转载时注明作者为CCB。 好了,废话少说,进入正题吧。 其实,使用CE的基本步骤,可以简单到一句话: 1.运行CE-> 2.运行游戏-> 3.在CE中指定要修改的游戏-> 4.首次搜索一个数值-> 5.回游戏中让这个数值增加或减少- >6.回CE按数值增减的情况再次搜索->7.重复5和6直到得到一个或很少的几个结果->8.在这几个结果中判断哪一个是真正的结果。 而下面的这个教程,就是要对上面说的这些步骤进行详细的解释,然后再用一个具体的例子来让大家真正掌握CE的用法。 当然,要用一个具体的例子来讲解CE的用法,需要一个游戏,以这个游戏的修改来讲解。不过,如果真正的用一个游戏来做例子,那么大家也得找到我用的游戏,就算找得到,还有可能要安装,确实比较麻烦。 幸好,CE本身带了一个TUTORIAL,就是教程的意思,不过这个TUTORIAL,本身也是一个程序,它是作者为了让使用的人进行练习而编写的,它不但会一步一步地教你怎么用CE,而且它本身也和游戏差不多,除了没有游戏的画面。 如果你能使用CE按这个TUTORIAL的要求对它进行修改,我想你也应该能用CE对真正的游戏进行修改了。 OK,LET'S GO!

摄像头接口分类及基础知识

摄像头接口分类及基础 知识 Revised as of 23 November 2020

一、Camera 工作原理介绍 1.结构 2.工作原理 外部光线穿过 lens 后,经过 color filter 滤波后照射到 Sensor 面上, S ensor 将从 lens 上传导过来的光线转换为电信号,再通过内部的 AD 转换为数字信号。如果 Sensor 没有集成 DSP,则通过 DVP 的方式传输到 baseban d,此时的数据格式是 RAW DATA。如果集成了 DSP, RAW DATA 数据经过 AW B、则 color matrix、 lens shading、 gamma、 sharpness、 AE 和 de-noi se 处理,后输出 YUV 或者 RGB 格式的数据。 最后会由 CPU 送到 framebuffer 中进行显示,这样我们就看到 camera 拍摄到的景象了。 3. YUV 与 YCbCr . 一般来说,camera主要是由lens 和 sensor IC 两部分组成,其中有的 senso r IC 集成了 DSP,有的没有集成,但也需要外部 DSP 处理。细分的来讲,ca mera 设备由下边几部分构成: 1) lens(镜头)一般 camera 的镜头结构是有几片透镜组成,分有塑胶透镜(Plastic)和玻璃透镜(Glass) ,通常镜头结构有:1P,2P,1G1P,1G3P,2G2P,4 G 等。 2) sensor(图像传感器) Senor 是一种半导体芯片,有两种类型:CCD(Cha rge Coupled Device)即电荷耦合器件的缩写和 CMOS(Complementary Metal-Oxide Semiconductor)互补金属氧化物半导体。Sensor 将从 lens 上传导过

摄像机分类

摄像机分类 1.按质量档级分类: 防水数码摄象机 (1) 广播级摄像机:广播级摄像机一般用于电视台和节目制作中心,其质量要求较高,如清晰度700-800线,信噪比60dB以上,从镜头到摄像器件,电路等都是优等的,当然其价格相当惊人,一般在10万元以上,如BVP-70P,D V-700P等。 (2) 业务级摄像机:业务级摄像机一般常用于教育部门的电化教育及工业监视等系统中。其性能指标也比较优良,开始采用单管(如DXC-1640),双管(DXC-1800),现在多为三管(DXC-M3A)或三片CCD(如DXC-3000P,DXC-6000P,DXC-M7,DXC-537)价格相对较低,教育部门能承受,一般在10万元以下。 (3) 家用级摄像机:这个档级的摄像机种类繁多,主要特点是体积小,重量轻,功能多,使用操作简便,价格低廉,一般在1万元左右。其质量等级比不上广播级或业务级,多为单片CCD摄录一体机。在教学中也常使用此档级的摄象机制作节目或开展微格教学等。 到目前为止已发展到四种记录格式: VHS-C NV-G200 NV-G300 ①VHS S-VHS M8000 M9000 S-VHS-C NV-S700

VHS(VIDEO HOME SYSTEM)是1976年由日本JVC公司等联合发表的。代表机型有 家用级摄像机 M5,M7,M1000,M3000等。1982年又发表了VHS-C型摄录一体机,由于所用录象带体积减小,使得设想摄象机整体体积减小,更便于旅游携带。198 7年发表S-VHS型高带摄录一体机,清晰度达400线。随后还发表了S-VHS -C摄录一体机,即小型高带摄录一体机。 ②β→ED-β(500线) β型摄象机和录象机是由日本SONY公司等研制,由于其录象机在竞争中被VHS击败,在中国并未得到推广和发展。 ③8mm→Hi8 8mm摄录一体机由日本SONY公司,在1984年发表。磁带的宽度为8m m(1/3英寸),由于磁带体积减小,与录音带尺寸相差无几,因而摄录一体机的体积大大减小,称为掌中宝。在1989年又发表了Hi8型,即高带8mm,称为“超8”。 ④DV格式 最初是由日本和世界55个厂家制定的“消费用数字录象机规格”,简称“DV 格式”。采用6 mm(1/4英寸)宽度的录象带,利用数字压缩的方法,将亮度和色度信号分别记录。清晰度达500线。价格一般在2万元左右。 目前这种格式又发展了两种专业档级的录象格式。即以松下公司为代表的DVC-PRO格式和以SONY公司为代表的DVCAM格式。摄录一体机的价格大约在10万元左右。 2.按使用分类:

监控摄像头全参数详细介绍大全

监控摄像头参数详细介绍大全 一、不可小瞧的镜头 镜头是摄像机的眼睛,为了适应不同的监控环境和要求,需要配置不同规格的镜头。比如在室内的重点监视,要进行清晰且大视场角度的图像捕捉,得配置广角镜头;在室外的停车场,既要看到停车场全貌,又要能看到汽车的细部,这时候需要广角和变焦镜头,在边境线、海防线的监控,需要超远图像拍摄。 1、镜头的主要参数 焦距(f):焦距是镜头和感光元件之间的距离,通过改变镜头的焦距,可以改变镜头的放大倍数,改变拍摄图像的大小。当物体与镜头的距离很远的时候,我们可用下面公式表达:镜头的放大倍数≈焦距/物距。增加镜头的焦距,放大倍数增大了,可以将远景拉近,画面的范围小了,远景的细节看得更清楚了;如果减少镜头的焦距,放大倍数减少了,画面的范围扩大了,能看到更大的场景。 镜头的主要参数 视场角:在工程实际中,我们常用水平视场角来反映画面的拍摄范围。焦距f越大,视场角越小,在感光元件上形成的画面范围越小;反之,焦距f 越小,视场角越大,在感光元件上形成的画面范围越大。 光圈:光圈安装在镜头的后部,光圈开得越大,通过镜头的光量就越大,图像的清晰度越高;光圈开得越小,通过镜头的光量就越小,图像的清晰度越低。通常用F(光通量)来表示。F=焦距(f)/通光孔径。在摄像机的技术指标中,我们可以常常看到6mm/F1.4这样的参数,它表示镜头的焦距为6mm,光通量为1.4,这时我们可以很容易地计算出通光孔径为4.29mm。在焦距f相同的情况下,F值越小,光圈越大,到达CCD芯片的光通量就越大,镜头越好。 2、镜头的分类 按视角的大小分类 按光圈分类 二、提高图像清晰的根本在于提高摄像机的感光能力 1、感光元件的作用 目前,主流监控摄像机的感光元件采用CCD元件,实际上就是光电转换元件。和以前的CMOS感光元件相比,CCD的感光度是CMOS的3到10倍,因此CCD芯片可以接受到更多的光信号,转换为电信号后,经视频处理电路滤波、放

完美的监控摄像头分类

目前道路监控摄像头种类繁多,监控摄像头分类1/2英寸CCD监控摄像头应用的较多,主要有日本JVC、Ikegami池上、松下、索尼、英国贝克尔、三星等国际品牌和一些国内品牌。一些大中城市道路监控系统选用的监控摄像头还是以国外知名品牌为主,其中JVCTK-C14811/2彩色监控摄像头在道路监控市场上一直占据着很大的市场份额,被广大的智能交通系统集成商、甲方所认可。然而日本池上公司的ICD-828道路监控摄像头凭借着高品质、色彩还原真实、高可靠性等特点在实际应用中成为目前性价比最好的道路监控摄像头。 日本池上公司是世界著名的监控摄像头制造商,其广播电视监控摄像头一直名列世界第一,并于1961年开设生产监控摄像头。池上公司将广播电视监控摄像头中的低垂直光斑技术、背光补偿中黑伽玛、拐点自动最佳调整技术及针对道路钠蒸汽灯自动白平衡调整等技术应用到道路监控摄像头中,加上池上一贯的高品质、高可靠性等特色,使这款道路监控摄像头成为道路监控摄像头中的精品。 ICD-8281/2英寸彩色道路监控摄像头,具有水平分辨率530线,垂直光斑指标为-126dB(池上广播级监控摄像机为-135dB)。在监控摄像头中很少看到垂直光斑这项指标,其实光斑是CCD传感器的一个特性,在传感器中没有任何东西阻止强光穿射的曝光和在CCD上产生更多的电子,结果是在图像中强烈的光出现时通常垂直斑纹也出现,在图像中遮盖了相关的细节。该款监控摄像头的最低照度是0.15Lux/F1.4/50IRE/AGCON,信噪比大于52dB。在公安部安全与警用产品质量检测中心检测的2台产品最低照度为 0.11Lux/F1.4/50IRE/AGCON和0.09Lux,信噪比为57dB和59dB,而专业广播电视监控摄像头信噪比在60~65dB。为便于工程商安装调试监控摄像头,池上

勇士的信仰修改必用装备 CE使用方法

麻痹药剂+巫毒娃娃+腾空击+绿叶标记+木魔舞修改必用装备CE使用方法 3:在软件中找到点击进入找到桌面版本的造梦3 4:修改(具体修改方式以下会一一列明) 一:修改等级 1:使进入修改器CE修改 2:将“数值类型”修改为“文本” 3:在上面空白处输入wpxt 点击首次扫描 4:全选右边所有搜索出来的值(点第一个然后左键点住往下拉) 5:点击(所有的都到了下面编辑框) 6:点击下面编辑框任意一个CTRL+A全选 7:再全选蓝色部分右键→更改记录→值修改为jyys 8:点击桌面游戏进入神秘商店购买(注:如不是则退出继续进入直到第一个变成经验药水为止)9:用道具无限的方式将该道具无限复制(嘿嘿..然后你懂的….) 二:修改时装 1:使进入修改器CE修改 2:将“数值类型”修改为“文本” 3:在上面空白处输入wplvdyl 4:全选右边所有搜索出来的值下拉编辑框全选修改为jlzlwsz精良转轮王时装或者jlnmwsz精良牛魔王时装。 5:进入游戏到神兽森林打到小龙女处珍珠商店购买到第四个时装。保存退出。 6:重进造梦进入炼丹炉点击装备合成就行(虽然只有一个时装,但是可以无限合成) 三:修改玲珑玉制作书 1.准备好1品生命丹材料(3个放入合成栏) 2:使进入修改器CE修改 3:将“数值类型”修改为“文本” 4:在上面空白处输入wpsmd1 5:全选右边所有搜索出来的值下拉编辑框全选修改为llyzzs 6:合成(成功)(注:制作书的名字是一品生命丹) 7:保存游戏退出游戏(关掉游戏)重新进入 8:成功之后用修改道具的方法修改玉衡石天枢石 9:最好加上需要的灵珠或者攻击石等合成(建议多刷几种不同属性的玲珑玉) 四:修改强化石4 修改强化石4之前背包里必须有强化石4 否则无法修改 1.准备好1品生命丹材料(3个放入合成栏) 2:使进入修改器CE修改 3:将“数值类型”修改为“文本” 4:在上面空白处输入wpsmd1 5:全选右边所有搜索出来的值下拉编辑框全选修改为wpqhs4 6:合成(成功)(注:制作书的名字是一品生命丹) 7:保存游戏退出游戏(关掉游戏)重新进入 8:成功 注:此物品无法无限只能耍无限的1品生命丹材料然后合成

摄像头接口分类及基础知识

一、Camera 工作原理介绍 1.结构? 2.工作原理 外部光线穿过 lens 后,经过 color filter 滤波后照射到 Sensor 面上, Sensor 将从lens 上传导过来的光线转换为电信号,再通过内部的 AD 转换为数字信号。如果 Sensor 没有集成 DSP,则通过 DVP 的方式传输到 baseband,此时的数据格式是 RAW DATA。如果集成了 DSP, RAW DATA 数据经过 AWB、则 color matrix、 lens shading、 gamma、sharpness、 AE 和 de-noise 处理,后输出 YUV 或者 RGB 格式的数据。 最后会由 CPU 送到 framebuffer 中进行显示,这样我们就看到 camera 拍摄到的景象了。 3. YUV 与 YCbCr . 一般来说,camera主要是由lens 和 sensor IC 两部分组成,其中有的 sensor IC 集成了 DSP,有的没有集成,但也需要外部 DSP 处理。细分的来讲,camera 设备由下边几部分构成: 1) lens(镜头)一般 camera 的镜头结构是有几片透镜组成,分有塑胶透镜(Plastic)和玻璃透镜(Glass) ,通常镜头结构有:1P,2P,1G1P,1G3P,2G2P,4G 等。 2) sensor(图像传感器) Senor 是一种半导体芯片,有两种类型:CCD(Charge Couple d Device)即电荷耦合器件的缩写和 CMOS(Complementary Metal-Oxide Semiconducto r)互补金属氧化物半导体。Sensor 将从 lens 上传导过来的光线转换为电信号,再通过内部的 AD 转换为数字信号。由于 Sensor 的每个 pixel 只能感光 R 光或者 B 光或者 G 光,因此每个像素此时存贮的是单色的,我们称之为 RAW DATA 数据。要想将每个像素的 RAW DATA 数据还原成三基色,就需要 ISP 来处理。 注: CCD传感器,电荷信号先传送,后放大,再A/D,成像质量灵敏度高、分辨率好、噪声小;处理速度慢;造价高,工艺复杂。 CMOS传感器,电荷信号先放大,后A/D,再传送;成像质量灵敏度低、噪声明显;处理速度快;造价低,工艺简单。

监控摄像头参数详解

监控摄像头参数详解 一、不可小瞧的镜头 镜头是摄像机的眼睛,为了适应不同的监控环境和要求,需要配置不同规格的镜头。比如在室内的重点监视,要进行清晰且大视场角度的图像捕捉,得配置广角镜头;在室外的停车场,既要看到停车场全貌,又要能看到汽车的细部,这时候需要广角和变焦镜头,在边境线、海防线的监控,需要超远图像拍摄。 1、镜头的主要参数 焦距(f):焦距是镜头和感光元件之间的距离,通过改变镜头的焦距,可以改变镜头的放大倍数,改变拍摄图像的大小。当物体与镜头的距离很远的时候,我们可用下面公式表达:镜头的放大倍数≈焦距/物距。增加镜头的焦距,放大倍数增大了,可以将远景拉近,画面的范围小了,远景的细节看得更清楚了;如果减少镜头的焦距,放大倍数减少了,画面的范围扩大了,能看到更大的场景。 视场角:在工程实际中,我们常用水平视场角来反映画面的拍摄范围。焦距f越大,视场角越小,在感光元件上形成的画面范围越小;反之,焦距f越小,视场角越大,在感光元件上形成的画面范围越大。 光圈:光圈安装在镜头的后部,光圈开得越大,通过镜头的光量就越大,图像的清晰度越高;光圈开得越小,通过镜头的光量就越小,图像的清晰度越低。通常用F(光通量)来表示。F=焦距(f)/通光孔径。在摄像机的技术指标中,我们可以常常看到6mm/F1.4这样的参数,它表示镜头的焦距为6mm,光通量为1.4,这时我们可以很容易地计算出通光孔径为4.29mm。在焦距f相同的情况下,F值越小,光圈越大,到达CCD芯片的光通量就越大,镜头越好。 2、镜头的分类

按视角的大小分类 按光圈分类 二、提高图像清晰的根本在于提高摄像机的感光能力 1、感光元件的作用 目前,主流监控摄像机的感光元件采用CCD元件,实际上就是光电转换元件。和以前的CMOS感光元件相比,CCD的感光度是CMOS的3到10倍,因此CCD 芯片可以接受到更多的光信号,转换为电信号后,经视频处理电路滤波、放大形成视频信号输出。接受到的光信号越强,视频信号的幅值就越大。视频信号连接到监视器或电视机的视频输入端便可以看到视频图像。提高图像清晰的根本就在于提高摄像机的感光能力。 2、镜头与CCD感光元件的配置 在图一中我们可以看到,CCD传感器上形成的图像比原始图像小,CCD芯片成像面的尺寸规格不同,形成的图像大小也不同。 CCD的成像尺寸常用的有1/2英寸、1/3英寸,CCD的尺寸规格决定了摄像机的规格。 CCD的成像尺寸,也就是摄像机画面宽度和高度的比例与电视机画面宽度和高度比例一样,通常为4:3。这样保证了摄像机的视频图像在显示器上的图像不变形。镜头的规格也分为1/2英寸、1/3英寸等,1/2英寸的镜头可用于1/2英寸、1/3英寸的摄像机;而1/3英寸的镜头只能用于1/3英寸的摄像机,不能用于1/2英寸的摄像机,这是因为1/3英寸镜头光通量只有1/2英寸镜头光通量的44%,不能满足1/2英寸的摄像机的光通量要求。

ce修改教程

工具主要用于法师和弓箭- - 其他职业都只是好看,我也没弄打包只保留改移动攻击速度(没多大用改完后出不来招,以及等级修改等级修改唯一作用就是接些提前的任务)第一步:进入游戏 第二步:启动ce 载入进程载入龙之谷进程 启动这个 然后 点这个 选择龙之谷的进程 之后点打开进程 下面蓝字的可以跳过是手动修改方法 点手动添加地址 选择指针 在下面两个地址中第一个填上基址第二个填上偏移 我已经打包好了 在这里我只说技能偏移的吧(战士和祭祀攻击和技能偏移是一个地址) 偏移2268 弓箭手用 偏移2280 法师 偏移2250 战士和牧师

--------------------华丽分割线----------------------------------下面继续 点第二个 选择对应的职业的加载表 例如法师点 攻击加速就是 中的就可以。战士和祭祀除外(因为他们点完就攻击不了)效果就是攻击无延迟如ak47般- -。。。 其它的不要锁定否则容易引起游戏崩溃 更改移动速度方法 点右键的设置热键

301是正常速度 我们把快捷键修改为左shift 速度修改为500就是这样 然后每次进图后或出图后按下shift都可以加速数值越高速度越快 等级修改没什么用 双击出现 自己改吧 下面技能修改我做好的偏移只需要设置热键就好了 点右键设置热键

就是按Z键出现黑洞 把下面都也都设置热键设置不同的 例如197 这个设置成X键游戏中按下就这样 ------------------------华丽分割线-------------------------- 所注意的是必须配合普通攻击使用先普通攻击到怪攻击才能生效更多技能需要自己去摸索建议测试数值在150-250左右之间这之间技能相对较多 测试的方法可以 先锁定一个然后双击这里. 设置数值。如果技能卡住设置成0 就好了 恩….写到这里就结束了,最后希望大家不要把辅助用于和外人pk 影响游戏平衡 最后祝大家多爆A装S 装BY..devil-***** 名字日文怎么打忘记了- -….

摄像机镜头的分类和详细介绍

摄像机镜头的分类和详细介绍 镜头是电视监控系统中必不可少的部件,镜头与CCD摄像机配合,可以将远距离目标成像在摄像机的CCD靶面上。 镜头的种类繁多,从焦距上分类,可分为短焦距、中焦距、和焦距和变焦距镜头;从视场的大小分类,可分为广角、标准、远摄镜头;从结构上分类,还可分为固定光圈定焦镜头、手动光圈定焦镜头、自动光圈定焦镜头、手动变焦镜头、自动光圈电动变焦镜头、电动三可变镜头(指光圈、焦距、聚焦这三者均可变)等类型。由于镜头选择得合适与否,直接关系到摄像质量的优劣,因此,在实际应用中必须合理选择镜头。 镜头的种类有许多种,每一种镜头都有其特点。根据功能与结构的不同,这些镜头的价格相差非常大,如电动变焦镜头要比普通定焦镜头的价格高约10倍,因此,只有正确了解各种镜头的特性,才能更加灵活地选择镜头。 A、固定光圈定焦镜头 固定光圈定焦镜头是相对较为简单的一种镜头,该镜头上只有一个可手动调整的对焦调整环(环上标有若干距离参考值),左右旋转该环可使成在 CCD靶面上的像最为清晰,此时在监视器屏幕上得到图像也最为清晰。 由于是固定光圈镜头,因此在镜头上没有光圈调整环,也就是说该镜头的光圈是不可调整的,因而进入镜头的光通量是不能通过简单地改变镜头因素而改变,而只

能通过改变被摄现场的光照度来调整,如增减被摄现场的照明灯光等。这种镜头一般应用于光照度比较均匀的场合,如室内全天以灯光照明为主的场合,在其他场合则需与带有自动电子快门功能的CCD摄像机合用(当然,目前市面上绝大多数的CCD 摄像机均带有自动电子快门功能),通过电子快门的调整来模拟光通量的改变。 B、手动光圈定焦镜头 手动光圈定焦镜头比固定光圈定焦镜头增加了光圈调整环,其光圈调整范围一般可从F1. 2或F1. 4到全关闭,能很方便地适应被摄现场的光照度,然而由于光圈的调整是通过手动人为地进行的,一旦摄像机安装完毕,位置固定下来,再频繁地调整光圈就不那么容易了,因此,这种镜头一般也是应用于光照度比较均匀的场合,而在其他场合则也需与带有自动电子快门功能的CCD摄像机合用,如早晚与中午、晴天与阴天等光照度变化比较大的场合,通过电子快门的调整来模拟光通量的改变。 C、自动光圈定焦镜头 自动光圈定焦镜头在结构上有了比较大的改变,它相当于在手动光圈定焦镜头的光圈调整环上增加一个由齿轮啮合传动的微型电动机,并从其驱动电路上引出3芯或4芯线传送给自动光圈镜头,至使镜头内的微型电动机相应做正向或反向转动,从而高速光圈的大小。自动光圈镜头又分为含放大器(视频驱动型)与不含放大器(直流驱动型)两种规格。 D、手动变焦镜头 顾名思义,手动变焦镜头的焦距是可变的,它有一个焦距调整环,可以在一定范围内调整镜头的焦距,其变比一般为2~3倍,焦距一般在3. 6~8 mm。在实际工程应用中,通过手动调节镜头的变焦环,可以方便地选择监视现场的视场角,如:可选择对整个房间的监视或是选择对房间内某个局部区域的监视。当对于监视现场的环境情况不十分了解时,采用这种镜头显然是非常重要的了。 对于大多数电视监控系统工程来说,当摄像机安装位置固定下来后,再频繁地手

摄像头接口分类与基础知识

一、Camera 工作原理介绍 1.结构 2.工作原理 外部光线穿过 lens 后,经过 color filter 滤波后照射到 Sensor 面上, Sensor 将从 lens 上传导过来的光线转换为电信号,再通过部的AD 转换为数字信号。如果Sensor 没有集成 DSP,则通过 DVP 的方式传输到 baseband,此时的数据格式是 RAW DATA。如果集成了 DSP, RAW DATA 数据经过 AWB、则 color matrix、 lens shading、 gamma、 sharpness、 AE 和 de-noise 处理,后输出 YUV 或者 RGB 格式的数据。 最后会由CPU 送到framebuffer 中进行显示,这样我们就看到camera 拍摄到的景象了。 3. YUV 与 YCbCr . 一般来说,camera 主要是由lens 和 sensor IC 两部分组成,其中有的 sensor IC 集成了 DSP,有的没有集成,但也需要外部 DSP 处理。细分的来讲,camera 设备由下边几部分构成: 1) lens(镜头)一般 camera 的镜头结构是有几片透镜组成,分有塑胶透镜(Plasti c)和玻璃透镜(Glass) ,通常镜头结构有:1P,2P,1G1P,1G3P,2G2P,4G 等。 2) sensor(图像传感器) Senor 是一种半导体芯片,有两种类型:CCD(Charge Coup led Device)即电荷耦合器件的缩写和 CMOS(Complementary Metal-Oxide Semicond uctor)互补金属氧化物半导体。Sensor 将从 lens 上传导过来的光线转换为电信号,再通过部的 AD 转换为数字信号。由于 Sensor 的每个 pixel 只能感光 R 光或者 B 光或者 G 光,因此每个像素此时存贮的是单色的,我们称之为 RAW DATA 数据。要想将每个像素的 RAW DATA 数据还原成三基色,就需要 ISP 来处理。 注: CCD传感器,电荷信号先传送,后放大,再A/D,成像质量灵敏度高、分辨率好、噪声小;处理速度慢;造价高,工艺复杂。 CMOS传感器,电荷信号先放大,后A/D,再传送;成像质量灵敏度低、噪声明显;处理速度快;造价低,工艺简单。

监控摄像头全参数详细介绍大全.doc

介 绍 大全 监 细 参数详 控 摄 像头 头 一、不可小瞧的镜 境和要求,需要配置不同 镜头 不同的监控环 像机的眼睛,为了适应 是摄 行清晰且大视 ,要进 像捕捉,得 场角度的图 视 头 规格的镜 。比如在室内的重点监 部, 场全貌,又要能看到汽车的细 ;在室外的停车场,既要看到停车 配置广角镜 头 的监 。 、海防线 控,需要超远图像拍摄 境线 头,在边 这时 候需要广角和变焦镜 1、镜头的主要参数 镜头 的焦距, 的距离,通过改变 焦距(f):焦距是镜头和感光元件之间 图像的大小。当物体与镜 拍摄 头的距离很远 的时 的放大倍数,改变 可以改变 镜头 头的焦距, 可用下面公式表达:镜头的放大倍数≈焦距/物距。增加镜 候,我们 节看得更清楚了; 景拉近,画面的范围小了,远景的细 放大倍数增大了,可以将远 头的焦距,放大倍数减少了,画面的范围 扩大了,能看到更大的场景。 如果减少镜 的主要参数 镜头 。 常用水平视场角来反映画面的拍摄 范围 视场 角:在工程实际中,我们 焦距f越大,视场角越小,在感光元件上形成的画面范围越小;反之,焦距f 越大。 越小,视 场角越大,在感光元件上形成的画面范围 镜头 的光量就越大, 光圈:光圈安装在镜头的后部,光圈开得越大,通过 的光量就越小,图像的清晰度越低。 镜头 图像的清晰度越高;光圈开得越小,通过 像机的技术指标 中, 通常用F(光通量)来表示。F=焦距(f)/通光孔径。在摄 头的焦距为 6mm,光通量为 样的参数,它表示镜 可以常常看到6mm/F1.4这 我们 1.4,这时我们可以很容易地计算出通光孔径为4.29mm。在焦距f相同的情况下, F值越小,光圈越大,到达CCD芯片的光通量就越大,镜头越好。 2、镜头的分类 角的大小分类 按视 按光圈分类 像机的感光能力 二、提高图像清晰的根本在于提高摄 1、感光元件的作用 际上就是光电转换 目前,主流监 像机的感光元件采用CCD元件,实 控摄 元件。和以前的CMOS感光元件相比,CCD的感光度是CMOS的3到10倍,因此CCD芯片可以接受到更多的光信号,转换为电信号后,经视频处理电路滤波、放