会计英语案例

会计英语案例

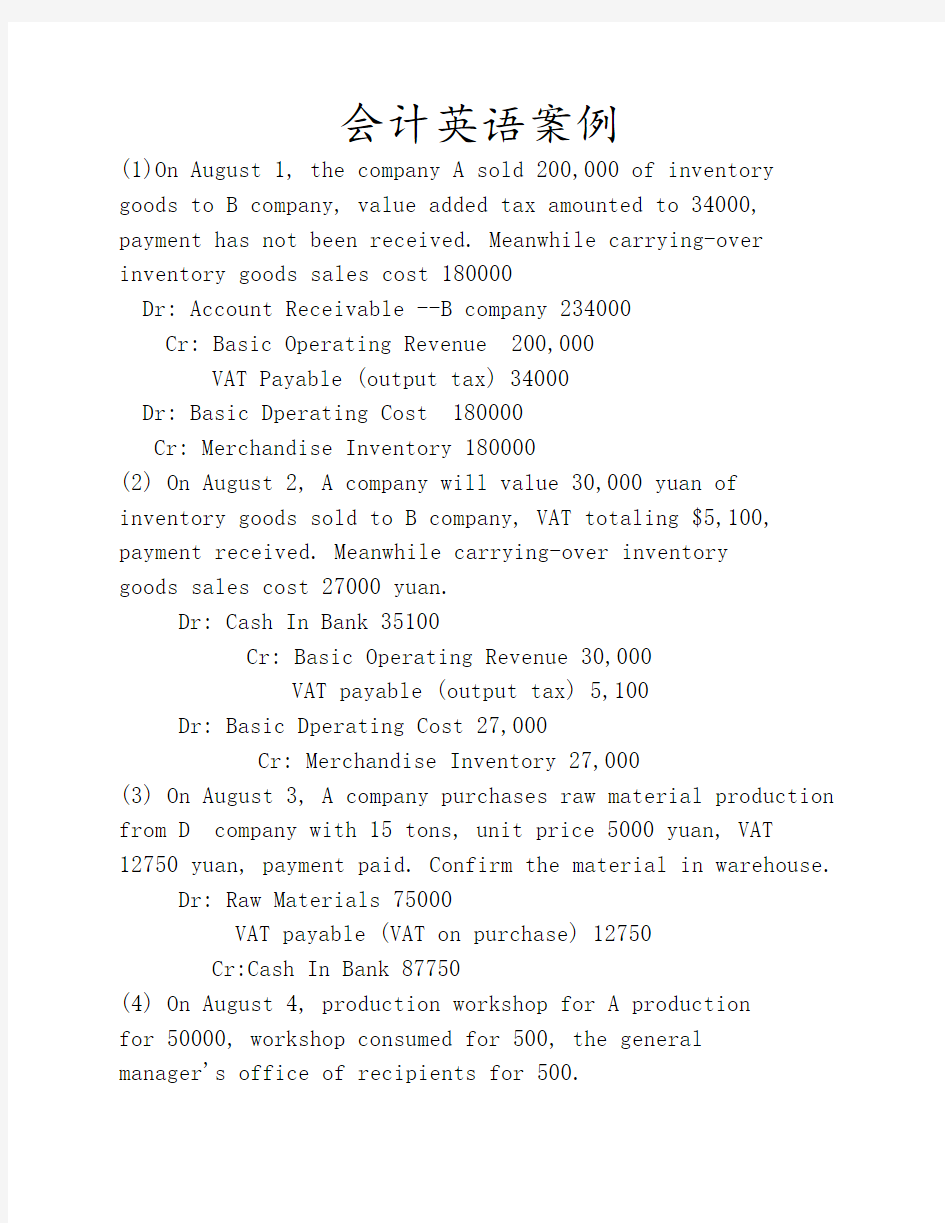

(1)On August 1, the company A sold 200,000 of inventory goods to B company, value added tax amounted to 34000, payment has not been received. Meanwhile carrying-over inventory goods sales cost 180000

Dr: Account Receivable --B company 234000

Cr: Basic Operating Revenue 200,000

VAT Payable (output tax) 34000

Dr: Basic Dperating Cost 180000

Cr: Merchandise Inventory 180000

(2) On August 2, A company will value 30,000 yuan of

inventory goods sold to B company, VAT totaling $5,100, payment received. Meanwhile carrying-over inventory

goods sales cost 27000 yuan.

Dr: Cash In Bank 35100

Cr: Basic Operating Revenue 30,000

VAT payable (output tax) 5,100

Dr: Basic Dperating Cost 27,000

Cr: Merchandise Inventory 27,000

(3) On August 3, A company purchases raw material production from D company with 15 tons, unit price 5000 yuan, VAT 12750 yuan, payment paid. Confirm the material in warehouse.

Dr: Raw Materials 75000

VAT payable (VAT on purchase) 12750

Cr:Cash In Bank 87750

(4) On August 4, production workshop for A production

for 50000, workshop consumed for 500, the general

manager's office of recipients for 500.

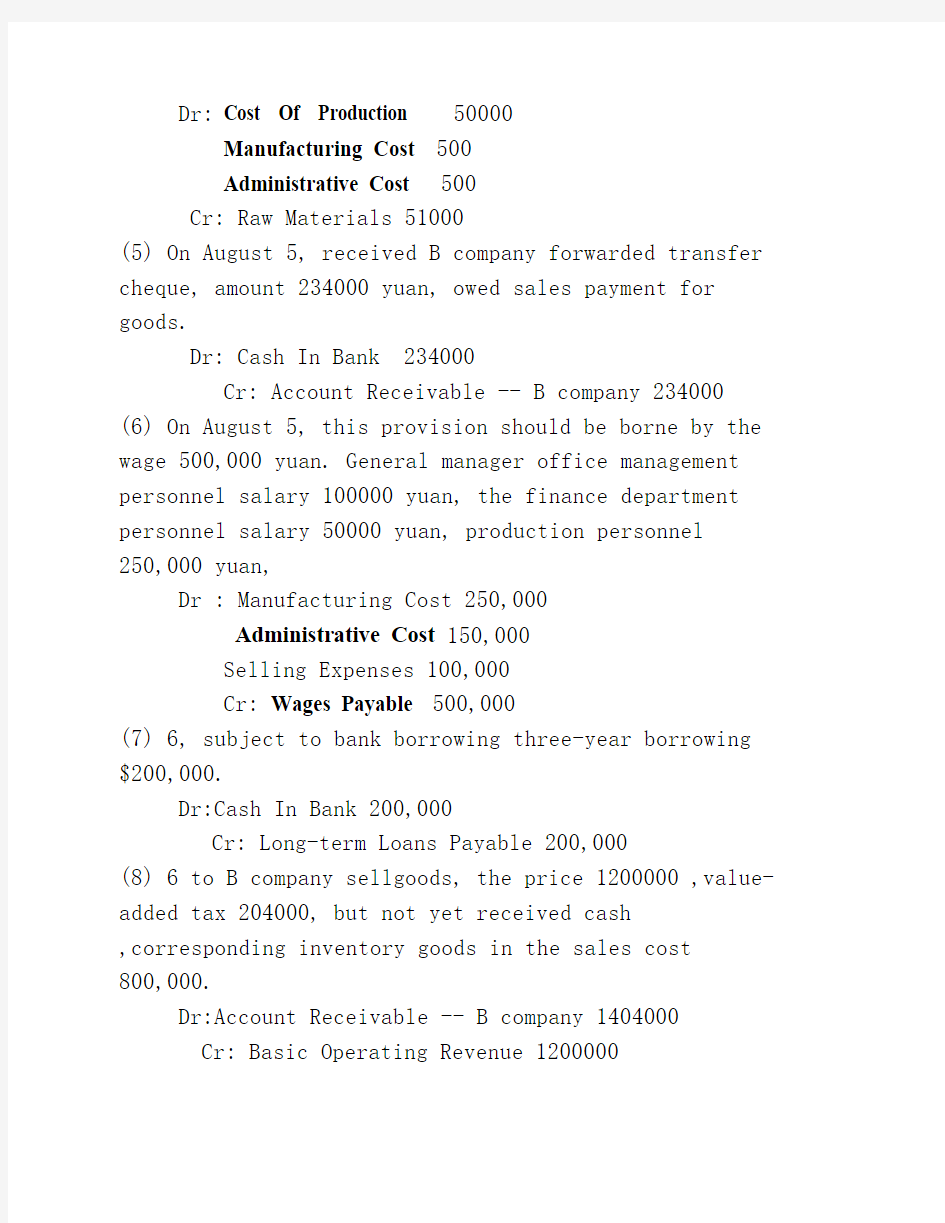

Dr: Cost Of Production 50000

Manufacturing Cost 500

Administrative Cost 500

Cr: Raw Materials 51000

(5) On August 5, received B company forwarded transfer cheque, amount 234000 yuan, owed sales payment for goods.

Dr: Cash In Bank 234000

Cr: Account Receivable -- B company 234000 (6) On August 5, this provision should be borne by the wage 500,000 yuan. General manager office management personnel salary 100000 yuan, the finance department personnel salary 50000 yuan, production personnel

250,000 yuan,

Dr : Manufacturing Cost 250,000

Administrative Cost 150,000

Selling Expenses 100,000

Cr: Wages Payable 500,000

(7) 6, subject to bank borrowing three-year borrowing $200,000.

Dr:Cash In Bank 200,000

Cr: Long-term Loans Payable 200,000

(8) 6 to B company sellgoods, the price 1200000 ,value-added tax 204000, but not yet received cash

,corresponding inventory goods in the sales cost

800,000.

Dr:Account Receivable -- B company 1404000

Cr: Basic Operating Revenue 1200000

VAT Payable (output tax) 204000

Dr: Basic Dperating Cost 800,000

Cr: Merchandise Inventory 800,000

(9) 7, marketing material batch, cost 3000, price 4000 yuan, VAT 680 yuan, receive cash a cheque, payment in the bank.

Dr:Cash In Bank 4680

Cr: Other Operating Revennue 4000

VAT Payable (output tax) 680

Dr:Other Operating Cost 3000

Raw Materials 3000

(10) 8 sales to B company materials, materials price 165,000, value-added tax 28050, at the same time receive transfer cheque, the materials cost 100000.

Dr:Cash In Bank 193050

Cr: Other Revenue 165000

VAT Payable (output tax) 28050

Dr: Other Operating cost 100,000

Cr: Raw Material 100,000

(11) 8, prescribing transfer cheque, pay fee 80 000 .

Dr:Selling Expenses 80,000

Cr:Cash In Bank 80,000

(12) 10, A will cash cheque 500,000 yuan, issuing this month salary.

Dr: Wages Payable 500,000

Cr:Cash In Bank 500,000

(13) 15, prescribing transfer cheque, pay housing for repairs to 8 000 yuan, including workshop 3 000 yuan,

the factory department 5 000 yuan.

Dr: Manufacturing Cost 3000

Administrative Cost 5000

Cr:Cash In Bank 8,000

(14) 18, receive a bank requisition, pay bank settlement poundage 8 600 yuan.

Dr: Finance Expenses 8600

Cr: Cash In Bank 8600

(15) 20, last month from the bank borrow a month of borrowing $100,000 expired, month interest rates, open transfer cheque 4%, return principal and interest.

Dr: Short-term Loans Payable 100,000

Finance Expenses 4000

Cr:Cash In Bank 104000

(16) 20, prescribing transfer cheque, payment 10,000 yuan, including bill workshop 1500 yuan, office of general manager, sales department 3500 5000 yuan.

Dr: Manufacturing Costs 1,500

Administrative Cost 3,500

Selling Expenses 5000

Cr:Cash In Bank 10000

(17), 26 provision for fixed assets depreciation cost, including this month, workshop 29 20,000 yuan, general manager office 8 000 yuan, sales department 2 000 yuan.

Dr: Manufacturing Cost 29,000

Administrative Cost 8,000

Selling Expenses 2000

Cr: Accumulated depreciation 39000

(18) 31, The cost of the project finishs 50% included

in the cost of inventory goods.

Dr: Cost Of Production 34000

Cr: Manufacturing Expenses 34000

Dr: Merchandise Inventory 17,000

Cr: Cost Of Production17,000

(19) 31, profit and loss of this month each account balance into "profit of the current year" account, and calculates the total profit.

Dr: Basic Operating Revenue 1430000

Other Operating Revenue 169000

Cr: Current Year Profit 1599000

Dr: Current Year Profit 1476600

Cr: Basic Operating Cost 1007000

Other Operating Cost 103000

Administrative Cost 167000

Selling Expenses187000

Finance Expenses 12600

Profit total = 1599000-1476600= 122400

(20) 31, according to 25% of total profits payable income tax calculated, and takes "income taxes" account value into "profit of the current year," net

calculating profit.

Dr: Income Tax Expenses 30600

Cr: Income Tax Payable 30600

Dr: Current Year Profit 30600

Cr: Income Tax Expenses 30600

Dr: Current Year Profit 91800

Cr: Undistributed Profit 91800

Net profit 122400-30600= 91800

(21) 31, according to the net profit of 15% and 50% respectively surplus reserve and provision to investors profits.

Dr: Profit Distribution -- the Statutory Reserve

7717.5

Any Surplus Reserve 3858.75

Dividends Payable 38587.5. -

Cr: Legal Surplus Reserve 7717.5

Any Surplus Reserve 3858.75

Dividends Payable 38587.5

(22) carryover from the profit of the current year and profit distribution other account balances into profit distribution - undistributed profit general ledger.

Dr: Profit Distribution - Undistributed Profit

50163.75

Cr:Profit Distribution -- the Statutory Reserve 7717.5

Any Surplus Reserve 3858.75

Dividends Payable 38587.5.

Posting

Account Receivable Basic Operating Revenue

234000 234000 143000 200000

1404000 30000

1404000 1200000 0

Tax Payable Finance Expenses

12750 34000 8600 12600

5100 4000

204000

680 0

28050

30600

289680

Accumulation Depreciation Current Year Profit 39000 1476600 1599000

39000 30600

91800

Short-term Loans Payable Basic Dperating Cost 100000 180000 1007000

27000

100000 800000

0 Merchandise Inventory Cash In Bank

17000 180000 35100 87750

27000 234000 80000

800000 200000 500000

990000 4680 8000

19305 8600

104000

10000

131520

Income Tax Raw Material

30600 30600 75000 51000

3000

0 100000

79000

Manufacturing Cost Administrative Cost

500 34000 500 167000

3000 150000

1500 5000

29000 3500

0 8000

Inappropriate Profit Wages Payable

59670 91800 500000 500000

Blance Sheet August 31,2010

Assets

QM QC Liabilities and Owners'Equity QM Cash

788,480920,000Short-term Loans Payable 400,000500,000Accounts

Receivoble

200,400600,000Tax Payable 509,680220,000Inventory

548,0001,300,000Dividends Payable 45900Fix Assets

600,000600,000Long-term Loans Payable 800,000600,000Less;Accumlation

Deprecation

39,000 Total Liabilities 1,755,5801,320,000

Owners'Equity

Capital Stock 2,000,0002,000,000

Surplus Reserve 11,370100,000

Undistributed Profit 32,130Total Fix Assets 561,000600,000Total Owners'Equity

214,5902,100,000

32130 0

Long-term Loans Payable Other Operating Cost 200000 3000 103000

100000

200000 0

Other Operating Revenue

Selling Expenses

169000 4000 100000 187000

165000 80000

5000

0 2000

Dividends Payable Surplus Reserue

45900 9180

4590

45900

13770

Cost Of Production 50000 11050

150000 5950

100000

22100

11900

317000

Total Assets3,901,4803,420,000Total Liabilities

and Owners'Equity

3,901,4803,420,000

A Company

Income Statement

August 31,2010

Operating Revenue1,599,000 Cost of Good Sold111,000 Administrative Cost167,000 Selling Expenses187,000 Financed Expenses126,000 Total Profit122,400 Income Tax Expense30,600 Net Income91,800

会计英语的常用术语

会计英语的常用术语 1.accounting n.会计;会计学 account n..账,账目a/c;账户 e.g.T-account: T型账户;account payable应付账款receivable 应收账款);accountant n.会计人员,会计师CPA (certified public accountant)注册会计师 2.Accounting concepts 会计的基本前提 1)accounting entity 会计主体;entity 实体,主体 2)going concern 持续经营 3)accounting period 会计分期 financial year/ fiscal year 会计年度(financial adj.财务的,金融的;fiscal adj.财政的)4)money measurement货币计量 人民币RMB¥美元US$ 英镑£法国法郎FFr *权责发生制accrual basis. accrual n.本身是应计未付的意思, accrue v.应计未付,应计未收, e.g.accrued liabilities,应计未付负债 3.Quality of accounting information 会计信息质量要求 (1)可靠性reliability (2)相关性relevance (3)可理解性understandability (4)可比性comparability (5)实质重于形式substance over form (6)重要性materiality (7)谨慎性prudence (8)及时性timeliness 4.Elements of accounting会计要素 1)Assets: 资产 –current assets 流动资产 cash and cash equivalents 现金及现金等价物(bank deposit) inventory存货receivable应收账款prepaid expense 预付费用 –non-current assets 固定资产 property (land and building)不动产, plant 厂房, equipment 设备(PPE) e.g.The total assets owned by Wilson company on December 31, 2006 was US$1,500,000. 2)Liabilities: 负债 funds provided by the creditors. creditor债权人,赊销方 –current liabilities 当期负债 non-current liabilities 长期负债 total liabilities account payable应付账款loan贷款advance from customers 预收款 bond债券(由政府发行, government bond /treasury bond政府债券,国库券)debenture债券(由有限公司发行) 3)Owners’equity: 所有者权益(Net assets) funds provided by the investors. Investor 投资者

(精)会计英语大全

第一讲会计英语的常用术语 1.account n..账,账目a/c;账户 e.g.T-account: T型账户;account payable应付账款receivable 应收账款); 2.Accounting concepts 会计的基本前提 1)accounting entity 会计主体;entity 实体,主体 2)going concern 持续经营 3)accounting period 会计分期 financial year/ fiscal year 会计年度(financial adj.财务的,金融的;fiscal adj.财政的)4)money measurement货币计量 *权责发生制accrual basis. accrual n.本身是应计未付的意思, accrue v.应计未付,应计未收, e.g.accrued liabilities,应计未付负债 3.Quality of accounting information 会计信息质量要求 (1)可靠性reliability (2)相关性relevance (3)可理解性understandability (4)可比性comparability (5)实质重于形式substance over form (6)重要性materiality (7)谨慎性prudence (8)及时性timeliness 4.Elements of accounting会计要素 1)Assets: 资产 – current assets 流动资产 cash and cash equivalents 现金及现金等价物(bank deposit) inventory存货receivable应收账款prepaid expense 预付费用 – non-current assets 固定资产 property (land and building)不动产, plant 厂房, equipment 设备(PPE) e.g.The total assets owned by Wilson company on December 31, 2006 was US$1,500,000. 2)Liabilities: 负债 funds provided by the creditors. creditor债权人,赊销方 – current liabilities 当期负债 non-current liabilities 长期负债 total liabilities account payable应付账款loan贷款advance from customers 预收款 bond债券(由政府发行, government bond /treasury bond政府债券,国库券)debenture债券(由有限公司发行) 3)Owners’ equity: 所有者权益(Net assets) funds provided by the investors. Investor 投资者 – paid in capital (contributed capital)实收资本 – shares /capital stock (u.s.)股票 retained earnings 留存收益

(财务会计)会计英语词汇

会计科目英文 会计系统 Accounting system 美国会计协会 American Accounting Association 美国注册会计师协会 American Institute of CPAs 审计 Audit 资产负债表 Balance sheet 簿记 Bookkeeping 现金流量预测 Cash flow prospects 内部审计证书Certificate in Internal Auditing 管理会计证书 Certificate in Management Accounting 注册会计师Certificate Public Accountant 成本会计Cost accounting 外部使用者External users 财务会计Financial accounting 财务会计准则委员会Financial Accounting Standards Board 财务预测Financial forecast 公认会计原则Generally accepted accounting principles 通用目的信息 General-purpose information 政府会计办公室Government Accounting Office 损益表 Income statement 内部审计师协会Institute of Internal Auditors 管理会计师协会Institute of Management Accountants 整合性Integrity 内部审计Internal auditing 内部控制结构Internal control structure 国内收入署Internal Revenue Service 内部使用者 Internal users 管理会计Management accounting 投资回报Return of investment 投资报酬Return on investment 证券交易委员会 Securities and Exchange Commission 现金流量表Statement of cash flow 财务状况表Statement of financial position 税务会计 Tax accounting 会计等式Accounting equation 勾稽关系 Articulation 资产 Assets 企业个体Business entity 股本Capital stock 公司Corporation 成本原则Cost principle 债权人Creditor 通货紧缩 Deflation 批露Disclosure 费用Expenses 财务报表Financial statement 筹资活动Financial activities 持续经营假设Going-concern assumption 通货膨涨 Inflation 投资活动Investing activities 负债Liabilities 负现金流量Negative cash flow 经营活动Operating activities 所有者权益Owner’s equity 合伙企业Partnership 正现金流量Positive cash flow 留存利润Retained earning 收入Revenue 独资企业Sole proprietorship 清偿能力Solvency 稳定货币假设Stable-dollar assumption 股东Stockholders

会计专业英语重点1

Unit 1 Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。 Unit 2 Each proprietorship, partnership, and corporation is a separate entity. 每一独资企业、合伙企业和股份公司都是一个单独的主体。 In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred –not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements. 在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。即,收入是在赚取时确认,费用是在发生时确认——而不是在现金转手时。如果现金收付制替代权责发生制,那么收入和费用仅仅依靠各种现金收付活动的时间确定来确认。 Unit 3 During each accounting year ,a sequence of accounting procedures called the accounting cycle is completed. 在每一会计年度内,要依次完成被称为会计循环的会计程序。 Transactions are analyzed on the basis of the business documents known as source documents and are recorded in either the general journal or the special journal, i. e . the sales journal ,the purchases journal (invoice register ) ,cash receipts journal and cash disbursements journal . 根据业务凭证即原始凭证分析各项交易,并记入普通日记账或特种日记账,也就是销货日记账,购货日记账(发票登记簿),现金收入日记账和现金支出日记账。 A trial balance is prepared from the account balance in the ledger to prove the equality of debits and credits. 根据分类账户的余额编制试算平衡表,借以验证借项和贷项是否相等。 A T-account has a left-hand side and a right-hand side, called respectively the debit side and credit side. 一个T 型账户有左方和右方,分别称做借方和贷方。 After transactions are entered ,account balance (the difference between the sum of its debits and the sum of its credits ) can be computed.

会计专业英语重点词汇大全

?accounting 会计、会计学 ?account 账户 ?account for / as 核算 ?certified public accountant / CPA 注册会计师?chief financial officer 财务总监?budgeting 预算 ?auditing 审计 ?agency 机构 ?fair value 公允价值 ?historical cost 历史成本?replacement cost 重置成本?reimbursement 偿还、补偿?executive 行政部门、行政人员?measure 计量 ?tax returns 纳税申报表 ?tax exempt 免税 ?director 懂事长 ?board of director 董事会 ?ethics of accounting 会计职业道德?integrity 诚信 ?competence 能力 ?business transaction 经济交易?account payee 转账支票?accounting data 会计数据、信息?accounting equation 会计等式?account title 会计科目 ?assets 资产 ?liabilities 负债 ?owners’ equity 所有者权益 ?revenue 收入 ?income 收益

?gains 利得 ?abnormal loss 非常损失 ?bookkeeping 账簿、簿记 ?double-entry system 复式记账法 ?tax bearer 纳税人 ?custom duties 关税 ?consumption tax 消费税 ?service fees earned 服务性收入 ?value added tax / VAT 增值税?enterprise income tax 企业所得税?individual income tax 个人所得税?withdrawal / withdrew 提款、撤资?balance 余额 ?mortgage 抵押 ?incur 产生、招致 ?apportion 分配、分摊 ?accounting cycle会计循环、会计周期?entry分录、记录 ?trial balance试算平衡?worksheet 工作草表、工作底稿?post reference / post .ref过账依据、过账参考?debit 借、借方 ?credit 贷、贷方、信用 ?summary/ explanation 摘要?insurance 保险 ?premium policy 保险单 ?current assets 流动资产 ?long-term assets 长期资产 ?property 财产、物资 ?cash / currency 货币资金、现金

常用会计类英语词汇汇总

常用会计类英语词汇汇总基本词汇 A(1)account账户,报表 A(2)accountingpostulate会计假设 A(3)accountingvaluation会计计价 A(4)accountabilityconcept经营责任概念 A(5)accountancy会计职业 A(6)accountant会计师 A(7)accounting会计 A(8)agencycost代理成本 A(9)accountingbases会计基础 A(10)accountingmanual会计手册 A(11)accountingperiod会计期间 A(12)accountingpolicies会计方针 A(13)accountingrateofreturn会计报酬率 A(14)accountingreferencedate会计参照日 A(15)accountingreferenceperiod会计参照期间 A(16)accrualconcept应计概念 A(17)accrualexpenses应计费用 A(18)acidtestratio速动比率(酸性测试比率) A(19)acquisition收购 A(20)acquisitionaccounting收购会计 A(21)adjustingevents调整事项 A(22)administrativeexpenses行政管理费 A(23)amortization摊销 A(24)analyticalreview分析性复核 A(25)annualequivalentcost年度等量成本法 A(26)annualreportandaccounts年度报告和报表 A(27)appraisalcost检验成本 A(28)appropriationaccount盈余分配账户 A(29)articlesofassociation公司章程细则 A(30)assets资产 A(31)assetscover资产担保 A(32)assetvaluepershare每股资产价值 A(33)associatedcompany联营公司 A(34)attainablestandard可达标准 A(35)attributableprofit可归属利润 A(36)audit审计 A(37)auditreport审计报告 A(38)auditingstandards审计准则 A(39)authorizedsharecapital额定股本 A(40)availablehours可用小时 A(41)avoidablecosts可避免成本 B(42)back-to-backloan易币贷款

财务会计英语

1Accounting会计is an information system.it measures data into reports,and communicates results to people 2Financial accounting财务会计(外部)the branch of accounting that provides information to people outside the firm Management accounting管理会计(内部)the branch of decision makers of a business,such as top executives. 3流动资产包括current assets Cash and Cash equivalents现金及其等价物short-term investments短期投资Inventories存货 Accounts (notes) receivable应收账款(票据)prepaid expenses and other current assets预付账款(其他流动资产) 4The account账户the record of the changes that have occurred in a particular asset liability,or stockholders’ equity during a period. 5Assets资产(cash,accouts receivable,notes expense,land buildings,equipment furniture fixtures) Liabilites负债(notes payable,accounts payable,accrued liabilities

会计专业英语翻译

. 1. Accounting first is an economic calculation. Economic calculation includes both static phenomenon on the economy's stock of the situation, including the situation of the period of dynamic flow, including both pre-calculated plan, but also after the actual calculation. Accounting is a typical example of economic calculation, calculation of economic calculation in addition to accounting, which includes statistical computing and business computing. 2. Accounting is an economic information systems. It would be a company dispersed into the business activities of a group of objective data, providing the company's performance, problems, and enterprise funds, labor, ownership, income, costs, profits, debt, and other information. Clearly, the accounting is to provide financial information-based economy information systems, business is the licensing of a points, thus accounting has been called "corporate language." 3. Accounting is an economic management.The accounting is social production develops to a certain stage of the product development and production is to meet the needs of the management, especially with the development of the commodity economy and the emergence of competition in the market through demand management on the economy activities strict control and supervision. At the same time, the content and form of accounting constantly improve and change, from a purely accounting, scores, mainly for accounting operations, external submit accounting statements, as in prior operating forecasts, decision-making, on the matter of economic activities control and supervision, in hindsight, check. Clearly, accounting whether past, present or future, it is people's economic management activities.