中国银行木薯开立信用证英文申请

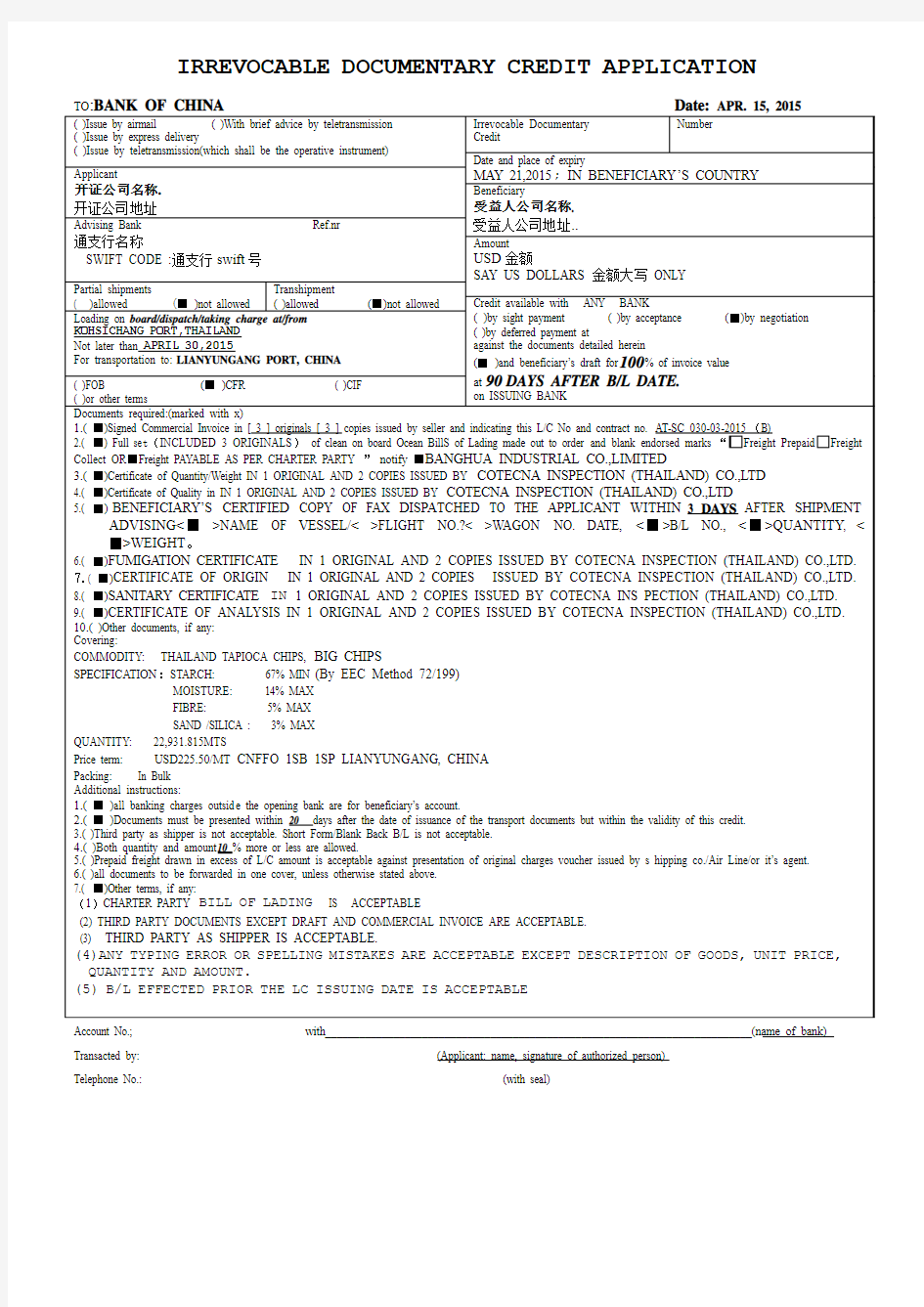

IRREVOCABLE DOCUMENTARY CREDIT APPLICATION

Account No.; with___________________________________________________________________________(name of bank) Transacted by: (Applicant: name, signature of authorized person)

Telephone No.: (with seal)

开立信用证申请书

开立信用证申请书 申请人:___________ 日期:___________

开立信用证申请书 中国银行: 我公司已办妥一切进口手续,现请贵行按我公司开证申请书内容开出不可撤销跟单信用证,为此我公司愿不可撤销地承担有关责任如下: 一、我公司同意贵行依照国际商会第500号出版物《跟单信用证统一惯例》办理该信用证项下一切事宜,并同意承担由此产生的一切责任。 二、我公司保证按时向贵行支付该证项下的货款、手续费、利息及一切费用等(包括国外受益人拒绝承担的有关银行费用)所需的外汇和人民币资金。 三、我公司保证在贵行单到通知书中规定的期限之内通知贵行办理对外付款/承兑,否则贵行可认为我公司已接受单据,同意付款/承兑。 四、我公司保证在单证表面相符的条件下办理有关付款/承兑手续。如因单证有不符之处而拒绝付款/承兑,我公司保证在贵行单到通知书中规定的日期之前将全套单据如数退还贵行并附书面拒付理由,由贵行按国际惯例确定能否对外拒付。如贵行确定我公司所提拒付理由不成立,或虽然拒付理由成立,但我公司未能退回全套单据,或拒付单据退到贵行已超过单到通知书中规定的期限,贵行有权主动办理对外付款/承兑,并从我公司帐户中扣款。 五、该信用证及其项下业务往来函电及单据如因邮、电或其它方式传递过程中发生遗失、延误、错漏,贵行当不负责。 六、该信用证如需修改、由我公司向贵行提出书面申请,由贵行根据具体情况确定能否办理修改。我公司确认所有修改当由信用证受益人接受时才能生效。 七、我公司在收到贵行开出的信用证、修改书副本后,保证及时与原申请书核对,如有不符之处,保证在接到副本之日起,两个工作日内通知贵行。如未通知,当视为正确无误。

中国银行开立国际信用证申请书

APPLICATION FOR ISSUING LETTER OF CREDIT 【此开立信用证申请书为年字号()开立信用证合同() 国际结算贸易融资和保函业务总协议项下不可分割的附件之一】 DATE: L/C NO. To:Bank of China Limited Wenzhou Branch Please issue on our behalf and for our account the following IRREVOCABLE LETTER OF CREDIT Dear Sirs: We hereby issue our IRREVOCABLE LETTER OF CREDIT in beneficiary’s favour available with BANK ( )by sight payment/( )by acceptance/ ( ) by negotiation/( )by deferred payment at against the documents detailed herein/( )and beneficiary’s draft(s) drawn( )at sight ( )on us for % of invoice value marked as drawn under this L/C accompanied by following documents marked with X; 1.( ) Signed Commercial Invoice in original indicating contract no SC2009-MEG-0610 . 2.( ) Full set 3/3 of clean on board ocean Bills of Lading plus one copy made out to order and blank endorsed marked “Freight PAYABLE AS PER CHARTER PARTY” and notify Sino Coast Limited. 3.( ) Air Waybills consigned to marked “freight( )to collect/ ( )prepaid “indicating actual flight no. actual flight date and notifying 4.( ) Full set of original Insurance Policy/certificate for 110%of the invoice value, showing claims payable in china, in currency of the credit,blank endorsed,covering( )ocean marine transportation/( )air transportation/( )overland

信用证开证申请书范文

信用证开证申请书范文 中国银行: 我公司已办妥一切进口手续,现请贵行按我公司开证申请书内容开出不可撤销跟单信用证,为此我公司愿不可撤销地承担有关责任如下: 一、我公司同意贵行依照国际商会第500号出版物《跟单信用证统一惯例》办理该信用证项下一切事宜,并同意承担由此产生的一切责任。 二、我公司保证按时向贵行支付该证项下的货款、手续费、利息及一切费用等(包括国外受益人拒绝承担的有关银行费用)所需的外汇和人民币资金。 三、我公司保证在贵行单到通知书中规定的期限之内通知贵行办理对外付款/承兑,否则贵行可认为我公司已接受单据,同意付款/承兑。 四、我公司保证在单证表面相符的条件下办理有关付款/承兑手续。如因单证有不符之处而拒绝付款/承兑,我公司保证在贵行单到通知书中规定的日期之前将全套单据如数退还贵行并附书面拒付理由,由贵行按国际惯例确定能否对外拒付。如贵行确定我公司所提拒付理由不成立,或虽然拒付理由成立,但我公司未能退回全套单据,或拒付单据退到贵行已超过单到通知书中规定的期限,贵行有权主动办理对外付款/承兑,并从我公司帐户中扣款。 五、该信用证及其项下业务往来函电及单据如因邮、电或其它方式传递过程中发生遗失、延误、错漏,贵行当不负责。 六、该信用证如需修改、由我公司向贵行提出书面申请,由贵行根据具体情况确定能否办理修改。我公司确认所有修改当由信用证受益人接受时才能生效。 七、我公司在收到贵行开出的信用证、修改书副本后,保证及时与原申请书核对,如有不符之处,保证在接到副本之日起,两个工作日内通知贵行。如未通知,当视为正确无误。 八、如因申请书字迹不清或词意含混而引起的一切后果由我公司负责。 开证申请人(签字盖章) 13-4-4

外贸单证操作中行香港分行信用证申请书

APPLICATION FOR IRREVOCABLE DOCUMENTARY CREDIT TO: BANK OF CHINA (HONG KONG) LIMITED Date :

Terms and Conditions of Application For Documentary Credit ("Credit") In consideration of the issuance of the Credit by Bank of China (Hong Kong) Limited (the "Bank"), the applicant of this application (the "Applicant") agrees to the following conditions :- 1.This application and the Credit to be issued are subject to the Uniform Customs and Practice for Documentary Credits of the International Chamber of Commerce as are in effect from time to time (the "UCP"), the Master Agreement for Bills Transactions and Trade Finance and any other agreement(s) previously signed and delivered to the Bank by the Applicant, if any. In case of conflict, terms of this application shall prevail to the extent of conflict. 2.The Applicant undertakes to pay and reimburse the Bank any sum in connection with the Credit upon the Bank's demand and irrevocably authorises the Bank to debit the Applicant's account(s) for any such sum at any time the Bank thinks appropriate. Such sum includes interest, costs, expenses, commissions, reimbursement claims from any nominated bank or confirming bank and any payment, prepayment or purchase effected by the Bank in connection with the Credit, all irrespective of any alleged discrepancies in the presented documents and/or any fraud that may be alleged at any time or discovered subsequent to such payment, negotiation, prepayment or purchase by any nominated bank, confirming bank or the Bank. 3.The Applicant acknowledges and agrees that upon issuance of the Credit, the Bank may, in its sole and absolute discretion, earmark both the documentary credit issuance and trust receipt credit facilities extended by the Bank. 4.All documents presented under the Credit and the relevant goods will be automatically pledged to the Bank as security for the Applicant's liabilities and obligations owing to the Bank but the risk of the goods shall be with the Applicant at all times. 5.All the terms and conditions of the Credit must be identical to that of the master credit detailed overleaf ("Master Credit"), if any, except as otherwise agreed by the Bank. 6.The Applicant undertakes to present all export documents under the Master Credit to the Bank for issuing bank's payment or the Bank's negotiation, purchase or prepayment under the Credit. 7.The Bank is irrevocably authorized (but is not obliged) to (i) utilize documents presented under the Credit for the drawing of the Master Credit; (ii) negotiate the presented documents, prepay the deferred payment undertaking incurred by the Bank or purchase the draft accepted by the Bank (the "Financing") under the Master Credit; and (iii) directly apply the Financing proceeds of the Master Credit to settle the corresponding drawing(s) under the Credit without first crediting such proceeds to the Applicant's account with the Bank, irrespective of discrepancies that may appear on the documents presented under the Credit (all of which, if any, are hereby waived). 8.The Applicant agrees that the Bank may, at its sole discretion and without consent from the Applicant, amend the terms and conditions of the Credit stated in this application and/or insert additional terms and conditions into the Credit as the Bank thinks appropriate. The Bank may, subject to the beneficiary's consent, cancel the whole or any unused balance of the Credit. 9.The Applicant agrees and acknowledges that it is the sole responsibility of the Applicant to (i) ensure the clarity, enforceability or effectiveness of any terms or requirements incorporated in the Credit; and (ii) comply with all applicable laws and regulations regarding the underlying transaction to which the Credit relates and obtain any necessary documents and approvals from any governmental or regulatory bodies and produce such documents or approvals to the Bank upon request. The Bank is not responsible for advising and has no duty whatsoever to advise the Applicant on such issues. The Bank shall not be liable to the Applicant for any direct, indirect, special or consequential loss or damage, costs, expenses or other claims for compensation whatsoever which arise out of such issues. 10.Notwithstanding any instruction(s) stipulated in this application, the Bank may, at its sole discretion, restrict, name or instruct any correspondent to be the advising, confirming or nominated bank in respect of the Credit. 11.The Applicant agrees that the Bank is fully entitled to reject any discrepant documents presented under the Credit notwithstanding that the Applicant may have waived such discrepancy. 12.If the Applicant instructs the Bank to permit T/T reimbursement in the Credit, the Bank is irrevocably authorised to pay and/or reimburse the relevant claiming bank or reimbursing bank upon receipt of a claim from such bank even prior to the Bank's receipt of the presented documents. The Applicant shall bear all relevant risks (including non-receipt and non-compliance risks of the presented documents) and shall reimburse and indemnify the Bank for any payment made under the Credit. 13.Any action taken or omitted by the Bank or by any of its correspondents or agents under or in connection with the Credit shall be binding on the Applicant and shall not place the Bank or its correspondents or agents under any liability to the Applicant. 14.The Applicant agrees and undertakes to examine the customer copy of the Credit issued by the Bank and irrevocably agrees that failure to give a notice of objection about the contents of the Credit within 5 calendar days after the customer copy of the Credit is sent to the Applicant shall be deemed to be its waiver of any rights to raise objections or pursue any remedies against the Bank in respect of the Credit. 15.Each of the persons signing this application (in his own personal capacity and as authorized representative(s) of the Applicant) warrants and represents to the Bank that this application is made for the purpose of facilitating the acquisition of the goods mentioned overleaf and for no other purpose and acknowledges that the Bank will rely on such warranty and representation when assessing this application. 16.The Bank may, at any time and at its absolute discretion without giving any reason therefor, by giving 3 ca lendar days’ prior written notice to the Applicant, convert all or any outstanding indebtedness, liabilities and/or obligations (actual or contingent) owing by the Applicant as a result of the issuance of the Credit into (i) Hong Kong dollars; or (ii) the currency stipulated in the Bank's credit facilities agreement(s) in respect of documentary credit issuance. The conversion shall be made at the prevailing rate of exchange as the Bank may determine conclusively. The Bank may, after such conversion, adjust the applicable interest rate in accordance with the market condition but in any event not less than the interest margin charged by the Bank before conversion. 17.The Applicant further undertakes that it shall indemnify the Bank and the Bank's delegate(s) on demand (on a full indemnity basis) against all liabilities, losses, payments, damages, demands, claims, expenses and costs (including legal fees), proceedings or actions which the Bank or the Bank's delegate(s) may incur or suffer under or in connection with this application and the Credit. 18.If this application is executed by more than one party, the obligations and liabilities of each of the parties are primary as well as joint and several and the Bank will be at liberty to release, compound with or otherwise vary or agree to vary the liability of any one without prejudicing or affecting the Bank's rights and remedies against the others. 19.This application is governed by and shall be construed in accordance with the laws of the Hong Kong Special Administrative Region and the Applicant agrees to submit to the non-exclusive jurisdiction of the Hong Kong Courts.

信用证开立申请书

不可撤销信用证开证申请书 不可撤销信用证开证申请书 进口方与出口方签订国际贸易货物进出口合同并确认以信用证为结算方式后,即由进口方向有关银行申请开立信用证。开证申请是整个进口信用证处理实务的第一个环节,进口方应根据合同规定的时间或在规定的装船前一定时间内申请开证,并填制开证申请书,开证行根据有关规定收取开证押金和开证费用后开出信用证。 开证申请人(进口方)在向开证行申请开证时必须填制开证申请书。开证申请书是开证申请人对开证行的付款指示,也是开证申请人与开证行之间的一种书面契约,它规定了开证申请人与开证行的责任。在这一契约中,开证行只是开证申请人的付款代理人。 开证申请书主要依据贸易合同中的有关主要条款填制,申请人填制后附合同副本一并提交银行,供银行参考、核对。但信用证一经开立则独立于合同,因而在填写开证申请时应审慎查核合同的主要条款,并将其列入申请书中。 一般情况下,开证申请书都由开证银行事先印就,以便申请人直接填制。开证申请书通常为一式两联,申请人除填写正面内容外,还须签具背面的“开证申请人承诺书”。 TO 致_________________________行。 填写开证行名称。 Date 申请开证日期。如:050428。 Issue by airmail 以信开的形式开立信用证。 选择此种方式,开证行以航邮将信用证寄给通知行。 With brief advice by teletransmission 以简电开的形式开立信用证。 选择此种方式,开证行将信用证主要内容发电预先通知受益人,银行承担必须使其生效的责任,但简电本身并非信用证的有效文本,不能凭以议付或付款,银行随后寄出的“证实书”才是正式的信用证。 Issue by express delivery 以信开的形式开立信用证。 选择此种方式,开证行以快递(如:DHL)将信用证寄给通知行。 Issue by teletransmission (which shall be the operative instrument) 以全电开的形式开立信用证。 选择此种方式,开证行将信用证的全部内容加注密押后发出,该电讯文本为有效的信用证正本。如今大多用“全电开证”的方式开立信用证。 Credit No. 信用证号码,由银行填写。

中国银行流水单翻译模板

BANK OF CHINA Debit card transaction details history list Trading range: Print date: 20xx/xx/xx Print branches: xxxxx Print teller:xxxxxxx Account number: Customer number: Account name: Account opening date: 20xx/xx/xx Deposit bank: xxxxx Product Line: xxxx Subclass: xxxx Value date: 20xx/xx/xx Expiry date: Bankbook number: Bank of China Co.,Ltd xxx City xxx Road Branch (seal) Trade date Currency Trade type Transaction amount Account balance Reciprocal account number Rev erse Teller Branches Abstract CNY Interest CNY ATM Withdrawal ATM settlement fund of BANCS CNY ATM Withdrawal ATM settlement fund of BANCS CNY ATM Withdrawal ATM settlement fund of BANCS CNY ATM Withdrawal ATM settlement fund of BANCS CNY ATM Withdrawal ATM settlement fund of BANCS CNY ATM Withdrawal ATM settlement fund of BANCS CNY Transfer

信用证开证申请书的填写

信用证开证申请书的填写 信用证开证申请书的填写 不可撤销信用证开证申请书 进口方与出口方签订国际贸易货物进出口合同并确认以信用证为结算方式后,即由进口方向有关银行申请开立信用证。开证申请是整个进口信用证处理实务的第一个环节,进口方应根据合同规定的时间或在规定的装船前一定时间内申请开证,并填制开证申请书,开证行根据有关规定收取开证押金和开证费用后开出信用证。 开证申请人(进口方)在向开证行申请开证时必须填制开证申请书。开证申请书是开证申请人对开证行的付款指示,也是开证申请人与开证行之间的一种书面契约,它规定了开证申请人与开证行的责任。在这一契约中,开证行只是开证申请人的付款代理人。 开证申请书主要依据贸易合同中的有关主要条款填制,申请人填制后附合同副本一并提交银行,供银行参考、核对。但信用证一经开立则独立于合同,因而在填写开证申请时应审慎查核合同的主要条款,并将其列入申请书中。 一般情况下,开证申请书都由开证银行事先印就,以便申请人直接填制。开证申请书通常为一式两联,申请人除填写正面内容外,还须签具背面的“开证申请人承诺书”。 TO 致 ___________________________ 行0 填写开证行名称。 Date 申请开证日期。如:050428o Issue by airmail 以信开的形式开立信用证。

选择此种方式,开证行以航邮将信用证寄给通知行。 With brief advice by teletransmission 以简电开的形式开立信用证。 选择此种方式,开证行将信用证主要内容发电预先通知受益人,银行承担必须使其生效的责任,但简电本身并非信用证的有效文本,不能凭以议付或付款,银行随后寄出的“证实书”才是正式的信用证。 Issue by express delivery 以信开的形式开立信用证。 选择此种方式,开证行以快递(如:DHL将信用证寄给通知行。 Issue by teletra nsmissi on (which shall be the operative instrument) 以全电开的形式开立信用证。 选择此种方式,开证行将信用证的全部内容加注密押后发出,该电讯文本为有效的信用证正本。如今大多用“全电开证”的方式开立信用证。 Credit No. 信用证号码,由银行填写。 Date and place of expiry 信用证有效期及地点,地点填受益人所在国家。 女口:050815 IN THE BENEFICIARY S COUNTRY. Applica nt 填写开证申请人名称及地址。 开证申请人(applicant)又称开证人(opener),系指向银行提出申请开立信用证的人,一般为进口人,就是买卖合同的买方。开证申请人为信用证交易的发起人。 Ben eficiary (Full n ame and address) 填写受益人全称和详细地址。 受益人指信用证上所指定的有权使用该信用证的人。一般为出口人,也就是买卖合同的卖方。 Advis ing Bank 填写通知行名址。 如果该信用证需要通过收报行以外的另一家银行转递、通知或加具保兑后给受益人,

开立国际信用证申请书

开立国际信用证申请书 编号: 致: 现我司因业务需要,依据我司与贵行/社签署的编号为的《最高额贸易融资合同》及其“附件1:用于开立国际信用证业务”,向贵行/社申请开立信用证。由于此产生的权利义务,均按照前述合同及其附件和本申请书的约定办理。 第一条信用证的内容 信用证的内容见编号为的IRREVOCABLE DOCUMENTARY CREDIT APPLICATION(英文格式)。 第二条备付款项 我司将于信用证约定的付款日或贵行/社要求的其他日期(以日期较前者为准)前个银行工作日内将备付款项足额存入其在贵行/社开立的账户(账号:),以用于信用证项下对外付款,贵行/社亦有权主动借记我司在贵行/社的外币或人民币账户作为备付款对外付款。 第三条垫款利率和计息 □对人民币垫款,从垫款之日起,以计收利息并按月计收复利。 □对外币垫款,从垫款之日起,在贵行/社规定的当期一年以内(含一年)固定贷款利率%的基础上加收%计收利息,自垫款之日起按月计收复利。 □其他方式:。 第四条费用 我司将按时向贵行/社支付因叙作本申请书项下业务而产生的相关费用,该费用的计收依据、标准和方式等按贵行/社有关规定执行。 我司将通过以下方式支付上述费用: □在贵行/社通知后个银行工作日内通过支付。 □授权贵行/社直接从我司账户(账号:)中扣收。 □其他方式:。 对于提交此申请书时不能预见、在信用证开出后发生的应由我司承担的费用(包括受益人拒绝承担的银行费用),我司将以与上述相同的方式向贵行/社支付。 第五条担保(备注:据实作选择性填写,不适用条款需删除) 1、本申请书项下债务的担保为: □本申请书对应的担保合同编号为,由其提供最高额担保。 □其他担保方式。 2、提供保证金质押的,按下列方式办理:

信用证修改申请书

信用证修改申请书 信用证修改申请书一: 编号: 申请 日期:年月日 银行: 我单位申请对在规行开立的____号信用证做第____次修改。 本次信用证修改通知方式:信开通知□ 电开通知□ 原证金额:_____ 原证受益人:_____ 我单位业务编号:_____ 我单位和同号:_____ 本次修改包括以下内容: (1)、 (2)、

(3)、 (4)、 (5)、 (6)、 (7)、 原证其他条款不变。 联系人: 电话: 申请人签章 注:本申请书一式三联,第一联受理回单;第二联修改依据;第三联修改存查。用途及联次应分别印在信用证修改申请书右端括弧内和括弧与编号之间。 信用证修改申请书二: 编号:年字号

致:中国银行股份有限公司行 现我司因业务需要,依据我司与贵行签署的编号为________ ___ __的□《授信额度协议》/□《授信业务总协议》及其附件1:用于开立国际信用证和编号为的《开立国际信用证申请书》/□《开立国际信用证合同》,向贵行申请修改由贵行开立的编号为的信用证。由于此产生的权利义务,均按照前述协议及其附件/合同、申请书和本申请书的约定办理。 第一条信用证的修改内容 信用证的修改内容见随附英文。 第二条增加保证金 我司将通过以下第种方式向贵行交付本笔业务下增加的保证金: (1)、在本申请书被贵行接受之日起个银行工作日内通过交纳。(2)、授权贵行直接从我司账户(账号:)中扣收。 (3)、其他方式:。 保证金补交金额为(币种) (大写) ,(小写) 。 第三条费用 我司将按时向贵行支付因本申请书项下信用证修改而产生的有

关费用,该费用的计收依据、标准和方式等按贵行有关规定执行。 我司将通过以下第种方式支付上述费用: (1)、在本申请书被贵行接受之日起个银行工作日内通过交纳。 (2)、授权贵行直接从我司账户(账号:)中扣收。 (3)、其他方式:。对于提交此申请书时不能预见、在信用证修改后发生的应由我司承担的费用(包括受益人拒绝承担的银行费用),我司将以与上述相同的方式向贵行支付。 申请人:有权签字人:年月日 担保人意见:(备注:适用于因修改而加重申请人债务的情形,若不适用则删除) 我司同意上述申请人即就该信用证向贵行提出的修改,并兹确认在该信用证修改后继续依据编号为的《合同》的约定向贵行承担担保责任。 担保人:有权签字人:年月日 银行意见:有权签字人/ 经办人:年月日 信用证修改申请书三:

填制信用证开证申请书

填制信用证开证申请书 题目要求和说明 题目名称填写开证申请书 基本要求根据下述给出的条件填写开证申请书,要求格式清楚、条款明确、内容完整。 下载模板信用证开证申请书01 相关说明相关资料: DA TE: MAY 25, 2009 THE BUYER: EAST AGENT COMPANY ADDRESS: ROOM 2401,WORLDTRADE MANSION, SANHUAN ROAD 47#,BEIJING, P. R. CHINA THE SELLER: LPG INTERNA TION CORPORATION ADDRESS: 333 BARRON BLVD. , INGLESIDE , ILLINOIS ( UNITED STATES ) NAME OF COMMODITY: MEN’S DENIM UTILITY SHORT SPECIFICATIONS:COLOR: MEDDEST SANDBLAS FABRIC CONTENT: 100% COTTON QUANTITY: 2000 CARTONS PRICE TERM: FOB NEW YORK USD 285/ CARTON TOTAL AMOUNT: USD570,000.00 COUNTRY OF ORIGIN AND MANUFACTURERS: UNITED STA TES OF AMERICA, VICTORY FACTORY PARTIAL SHIPMENT AND TRANSSHIPMENT ARE PROHIBITTED SHIPPING MARK: ST NO.1…UP TIME OF SHIPMENT: BEFORE JUL Y 15,2009 PLACE AND DATE OF EXPIRY: CHINA, JUL Y 30,2009 PORT OF SHIPMENT: NEW YORK PORT OF DESTINATION: XINGANG PORT, TIANJING OF CHINA INSURANCE: TO BE COVERED BY BUYER. PAYMENT: BY IRREVOCABLE FREEL Y NEGOTIABLE L/C AGAINST SIGHT DRAFTS FOR 100PCT OF INVOICE V ALUE AND THE DOCUMENTS DETAILED HEREUNDER. DOCUMETNS: 1.INVOICES IN TRIPLICATE 2.PACKING LIST IN TRIPLICATE 3.FULL SET OF CLEAN ON BOARD BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED NOTIFYING THE APPLICANT WITH FULL NAME AND ADDRESS MARKED FREIGHT COLLECT. 4.CERTIFICATE OF ORIGIN IN DUPLICATE 5.BENEFICIARY’S CERTIFIED COPY OF FAX TO THE APPLICANT WITHIN 1 DAY

信用证开证申请书

开证申请人承诺书 江苏XXX农村商业银行股份有限公司(含下属分支机构): 我公司已办妥一切进口手续,现请贵行按我公司开证申请书内容开出不可撤销跟单信用证,为此我公司愿不可撤销地承担有关责任如下: 一、我公司同意贵行依照国际商会第600号出版物《跟单信用证统一惯例》办理该 信用证项下一切事宜,并同意承担由此产生的一切责任。 二、我公司保证按时向贵行支付该证项下的货款、手续费、利息及一切费用等(包 括国外受益人拒绝承担的有关银行费用)所需的外汇和人民币资金。 三、我公司保证在贵行单到通知书中规定的期限之内通知贵行办理对外付款/承 兑,否则贵行可认为我公司已接受单据,同意付款/承兑。 四、我公司保证在单证表面相符的条件下办理有关付款/承兑手续。如因单证有不 符之处而拒绝付款/承兑,我公司保证在贵行单到通知书中规定的日期之前将 全套单据如数退还贵行并附书面拒付理由及对单据的处理意见,由贵行按国际 惯例确定能否对外拒付. 如贵行确定我公司所提拒付理由不成立,或虽然拒付 理由成立,但我公司未能退回全套单据,或拒付单据退到贵行已超过单到通知 书中规定的期限,贵行有权主动办理对外付款/承兑,并从我公司账户中扣款。 五、该信用证及其项下业务往来函电及单据如因邮、电或其它方式传递过程中发生 遗失、延误、错漏,贵行当不负责。 六、该信用证如需修改、由我公司向贵行提出书面申请,由贵行根据具体情况确定 能否办理修改。我公司确认所有修改当由信用证受益人接受时才能生效。 七、我公司在收到贵行开出的信用证、修改书副本后,保证及时与原申请书核对, 如有不符之处,保证在接到副本之日起,两个工作日内通知贵行。如未通知, 当视为正确无误。 八、如因申请书字迹不清或词意含混而引起的一切后果由我公司负责。 Page 1 of 5申请人盖章: 法定代表人(负责人) 或授权代理人签字(签章): 年月日

开信用证步骤及样本

填制进口开证申请书的步骤为: 1、DATE(申请开证日期)。在申请书右上角填写实际申请日期。 2、TO(致)。银行印制的申请书上事先都会印就开证银行的名称、地址,银行的SWIFT CODE、TELEX NO等也可同时显示。 3、PLEASE ISSUE ON OUR BEHALF AND/OR FOR OUR ACCOUNT THE FOLLOWING IRREVOABLE LETTER OF CREDIT(请开列以下不可撤销信用证)。如果信用证是保兑或可转让的,应在此加注有关字样。开证方式多为电开(BY TELEX),也可以是信开、快递或简电开立。 4、L/C NUMBER(信用证号码)。此栏由银行填写。 5、APPLICANT(申请人)。填写申请人的全称及详细地址,有的要求注明联系电话、传真号码等。 6、BENEFICIARY(受益人)。填写受益人的全称及详细地址。 7、ADVISING BANK(通知行)。由开证行填写。 8、AMOUNT(信用证金额)。分别用数字和文字两种形式表示,并且表明币制。如果允许有一定比率的上下浮动,要在信用证中明确表示出来。 9、EXPIRY DATE AND PLACE(到期日期和地点),填写信用证的有效期及到期地点。 10、PARTIAL SHIPMENT(分批装运)、TRANSHIPMENT(转运)。根据合同的实际规定打“×”进行选择。 11、LOADING IN CHARGE、FOR TRANSPORT TO、LATEST DATE OF SHIPMENT(装运地/港、目的地/港的名称,最迟装运日期)。按实际填写,如允许有转运地/港,也应清楚标明。 12、CREDIT AVAILABLE WITH/BY(付款方式)。在所提供的即期、承兑、议付和延期付款四种信用证有效兑付方式中选择与合同要求一致的类型。 13、BENEFICIARY'S DRAFT(汇票要求)。金额应根据合同规定填写为:发票金额的一定百分比;发票金额的100%(全部货款都用信用证支付);如部分信用证,部分托收时按信用证下的金额比例填写。付款期限可根据实际填写即期或远期,如属后者必须填写具体的天数。信用证条件下的付款人通常是开证行,也可能是开证行指定的另外一家银行。