Tutorial+Solutions_Week+8_+Equity+Accounting

ACCT2542 – Corporate Financial Reporting and Analysis

Session 2, 2009

Solutions to Tutorial Questions for Tutorials held in:

Week 8 – Accounting for Associates

PLEASE NOTE THAT THESE SOLUTIONS ARE NOT AVAILABLE TO STUDENTS UNTIL THE END OF ALL RELEVANT TUTORIALS

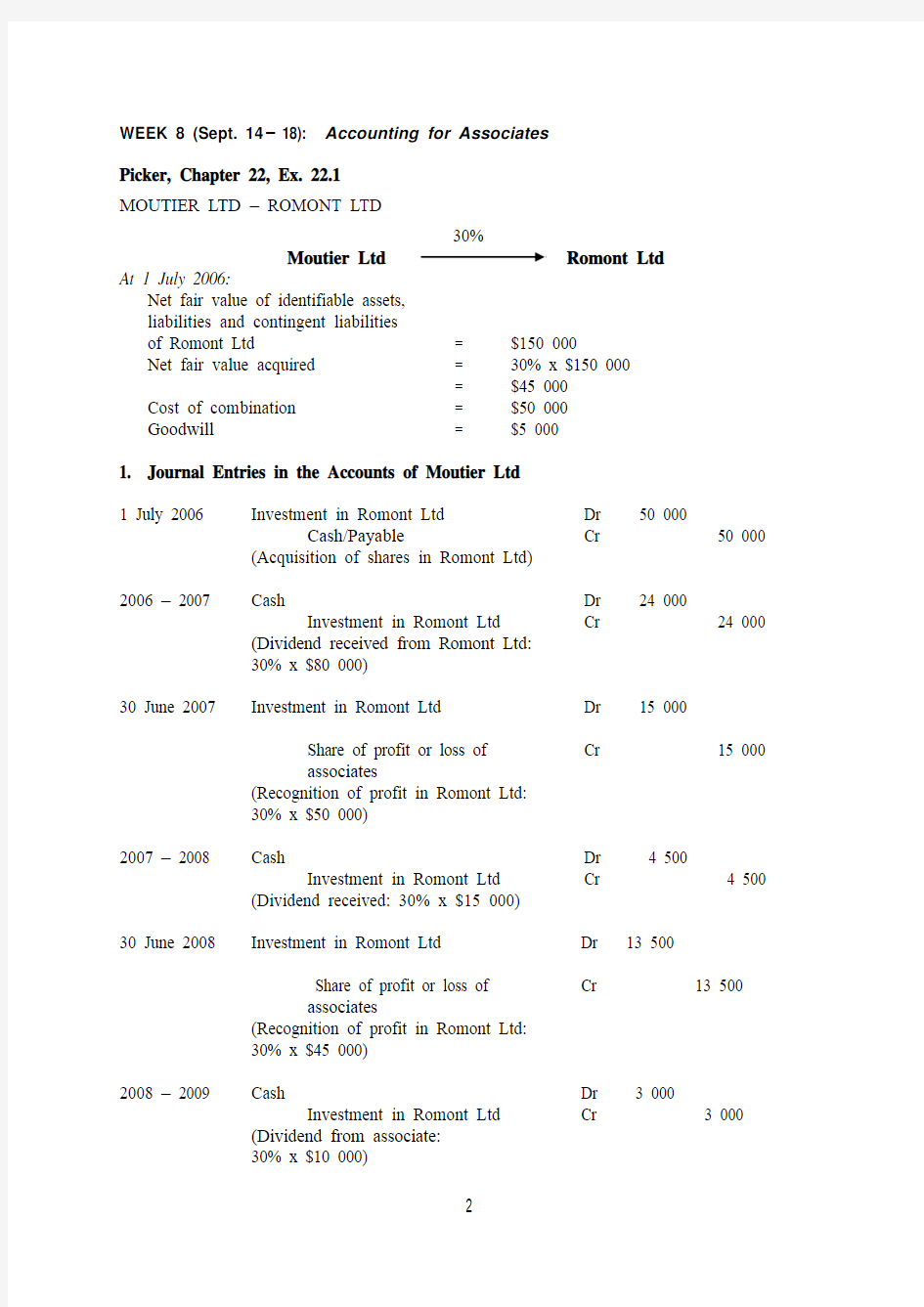

WEEK 8 (Sept. 14 – 18): Accounting for Associates

Picker, Chapter 22, Ex. 22.1

MOUTIER LTD – ROMONT LTD

30%

Moutier Ltd Romont Ltd

At 1 July 2006:

Net fair value of identifiable assets,

liabilities and contingent liabilities

of Romont Ltd = $150 000

Net fair value acquired = 30% x $150 000

= $45 000

Cost of combination = $50 000

Goodwill = $5 000

1. Journal Entries in the Accounts of Moutier Ltd

1 July 2006 Investment in Romont Ltd Dr 50 000

Cash/Payable Cr 50 000 (Acquisition of shares in Romont Ltd)

2006 – 2007 Cash Dr 24 000

Investment in Romont Ltd Cr 24 000 (Dividend received from Romont Ltd:

30% x $80 000)

30 June 2007 Investment in Romont Ltd Dr 15 000

Cr 15 000

Share of profit or loss of

associates

(Recognition of profit in Romont Ltd:

30% x $50 000)

2007 – 2008 Cash Dr 4 500

Investment in Romont Ltd Cr 4 500 (Dividend received: 30% x $15 000)

30 June 2008 Investment in Romont Ltd Dr 13 500

Cr 13 500

Share of profit or loss of

associates

(Recognition of profit in Romont Ltd:

30% x $45 000)

2008 – 2009 Cash Dr 3 000

Investment in Romont Ltd Cr 3 000 (Dividend from associate:

30% x $10 000)

Investment in Romont Ltd * Dr 12 000

Cr 12 000

Share of profit or loss of

associates

(Recognition of profit in Romont Ltd:

30% x $40 000)

2. Consolidation Worksheet Entries

30 June 2007:

Investment in Romont Ltd Dr 15 000

Share of profit or loss of associates Cr 15 000 (30% x $50 000)

Dividend revenue Dr 6 000

Investment in Romont Ltd Cr 6 000 (30% x $20 000)

30 June 2008:

Investment in Romont Ltd Dr 9 000

Retained earnings (1/7/07) Cr 9 000 (30% x $30 000)

Investment in Romont Ltd Dr 13 500

Share of profits or losses of associates Cr 13 500 (30% x $45 000)

Dividend revenue Dr 4 500

Investment in Romont Ltd Cr 4 500 (30% x $15 000)

30 June 2009:

Investment in Romont Ltd Dr 18 000

Retained earnings (1/7/08) Cr 18 000 (30% [$30 000 + $30 000])

Investment in Romont Ltd Dr 12 000

Share of profit or loss of associates Cr 12 000 (30% x $40 000)

Dividend revenue Dr 3 000

Investment in Romont Ltd Cr 3 000 (30% x $10 000)

Deegan Chapter 33, Question 17

33.17 Calculations

Cost as per ABC’s accounts$50 000

Add back dividend from pre-acquisition profits 10 000 see workings

Original cost of investment 60 000

Net assets acquired at 1/7/04 Share capital 100 000

Retained earnings 40 000

Total 140 000

@40% 56 000

Goodwill $4 000

Pre-acquisition dividend

A dividend of $80 000 was paid by DEF. All current-year earnings are paid first as

dividends. Current year earnings are $55 000. Thus, the balance of $25 000 must be

pre-acquisition which would have been off-set against the investment cost on the basis

of the proportional interest in the pre-acquisition dividend. The proportional interest

in the pre-acquisition dividend was $10 000 (25 000 × 40%). It is assumed that the

cost of the investment was reduced by the interest in the pre-acquisition dividend.

Equity accounting result

40% of current year profit of $55 000 $22 000 Less dividend from current year profits, $55 000×40% 22 000 Share of equity accounted results 0 Add cost 50 000 Equity accounting value of investment $50 000 The equity accounting entries would therefore be:

Dr Investment in DEF Ltd 22 000

Cr Share of associated company’s profits22 000 Dr Dividend revenue 22 000

Cr Investment in DEF Ltd 22 000