SM Ch05 SWFT2013

CHAPTER 5

CORPORATIONS: EARNINGS & PROFITS AND DIVIDEND DISTRIBUTIONS

SOLUTIONS TO PROBLEM MATERIALS

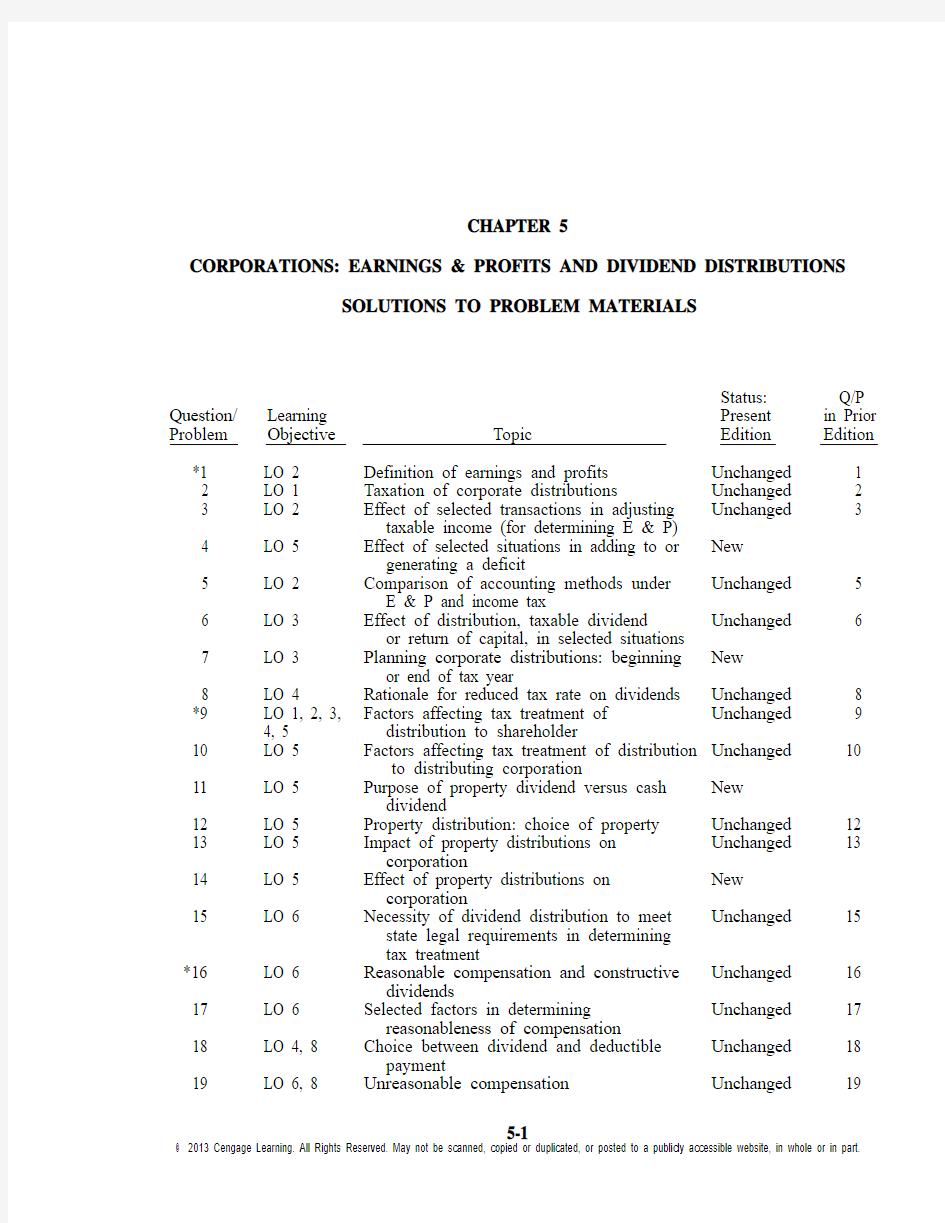

Status: Q/P Question/ Learning Present in Prior Problem Objective Topic Edition Edition

*1 LO 2 Definition of earnings and profits Unchanged 1

2 LO 1 Taxation of corporate distributions Unchanged 2

3 LO 2 Effect of selected transactions in adjusting Unchanged 3

taxable income (for determining E & P)

4 LO

5 Effect of selected situations in adding to or New

generating a deficit

5 LO 2 Comparison of accounting methods under Unchanged 5

E & P and income tax

6 LO 3 Effect of distribution, taxable dividend Unchanged 6

or return of capital, in selected situations

7 LO 3 Planning corporate distributions: beginning New

or end of tax year

8 LO 4 Rationale for reduced tax rate on dividends Unchanged 8

*9 LO 1, 2, 3, Factors affecting tax treatment of Unchanged 9 4, 5 distribution to shareholder

10 LO 5 Factors affecting tax treatment of distribution Unchanged 10

to distributing corporation

11 LO 5 Purpose of property dividend versus cash New

dividend

12 LO 5 Property distribution: choice of property Unchanged 12

13 LO 5 Impact of property distributions on Unchanged 13

corporation

14 LO 5 Effect of property distributions on New

corporation

15 LO 6 Necessity of dividend distribution to meet Unchanged 15

state legal requirements in determining

tax treatment

*16 LO 6 Reasonable compensation and constructive Unchanged 16

dividends

17 LO 6 Selected factors in determining Unchanged 17

reasonableness of compensation

18 LO 4, 8 Choice between dividend and deductible Unchanged 18

payment

19 LO 6, 8 Unreasonable compensation Unchanged 19

5-1

5-2 2013 Corporations Volume/Solutions Manual

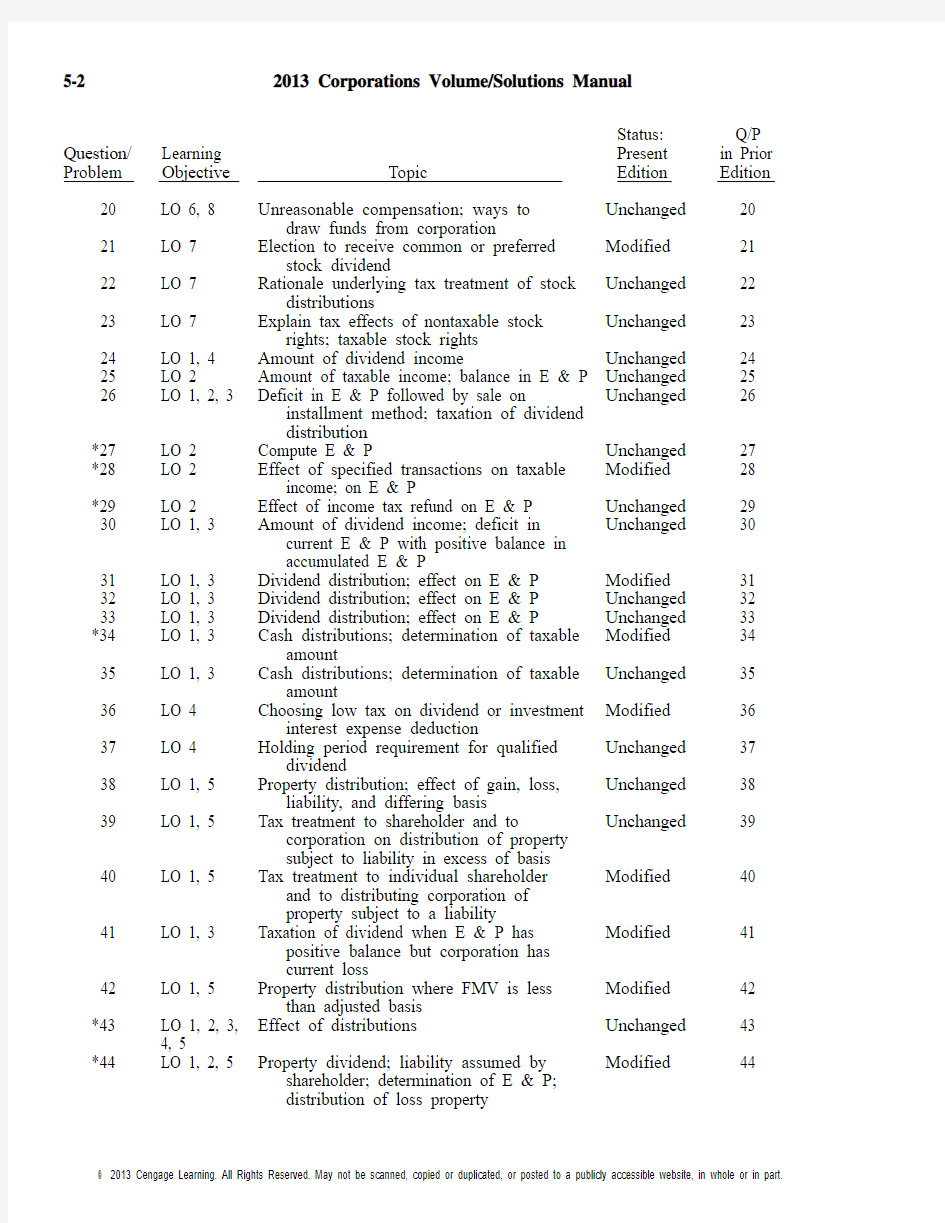

Status: Q/P Question/ Learning Present in Prior Problem Objective Topic Edition Edition

20 LO 6, 8 Unreasonable compensation; ways to Unchanged 20

draw funds from corporation

21 LO 7 Election to receive common or preferred Modified 21

stock dividend

22 LO 7 Rationale underlying tax treatment of stock Unchanged 22

distributions

23 LO 7 Explain tax effects of nontaxable stock Unchanged 23

rights; taxable stock rights

24 LO 1, 4 Amount of dividend income Unchanged 24

25 LO 2 Amount of taxable income; balance in E & P Unchanged 25

26 LO 1, 2, 3 Deficit in E & P followed by sale on Unchanged 26

installment method; taxation of dividend

distribution

*27 LO 2 Compute E & P Unchanged 27 *28 LO 2 Effect of specified transactions on taxable Modified 28

income; on E & P

*29 LO 2 Effect of income tax refund on E & P Unchanged 29

30 LO 1, 3 Amount of dividend income; deficit in Unchanged 30

current E & P with positive balance in

accumulated E & P

31 LO 1, 3 Dividend distribution; effect on E & P Modified 31

32 LO 1, 3 Dividend distribution; effect on E & P Unchanged 32

33 LO 1, 3 Dividend distribution; effect on E & P Unchanged 33

*34 LO 1, 3 Cash distributions; determination of taxable Modified 34

amount

35 LO 1, 3 Cash distributions; determination of taxable Unchanged 35

amount

36 LO 4 Choosing low tax on dividend or investment Modified 36

interest expense deduction

37 LO 4 Holding period requirement for qualified Unchanged 37

dividend

38 LO 1, 5 Property distribution; effect of gain, loss, Unchanged 38

liability, and differing basis

39 LO 1, 5 Tax treatment to shareholder and to Unchanged 39

corporation on distribution of property

subject to liability in excess of basis

40 LO 1, 5 Tax treatment to individual shareholder Modified 40

and to distributing corporation of

property subject to a liability

41 LO 1, 3 Taxation of dividend when E & P has Modified 41

positive balance but corporation has

current loss

42 LO 1, 5 Property distribution where FMV is less Modified 42

than adjusted basis

*43 LO 1, 2, 3, Effect of distributions Unchanged 43 4, 5

*44 LO 1, 2, 5 Property dividend; liability assumed by Modified 44

shareholder; determination of E & P;

distribution of loss property

Corporations: Earnings & Profits and Dividend Distributions 5-3

Status: Q/P Question/ Learning Present in Prior Problem Objective Topic Edition Edition

45 LO 5 Property distribution to corporate share- Unchanged 45

holder, basis in excess of FMV; liability

assumed by shareholder

46 LO 6 Bona fide loan to shareholder Unchanged 46

47 LO 6 Constructive dividends Unchanged 47

48 LO 7 Basis of taxable preferred stock dividend Unchanged 48

49 LO 7 Stock dividend; basis allocation; gain on sale Modified 49

*50 LO 7 Stock rights; basis allocation; gain on sale Unchanged 50

51 LO 4, 8 Choosing between a dividend and a Modified 51

deductible payment

52 LO 1, 3, 8 Source of dividend distribution Unchanged 52

*The solution to this problem is available on a transparency master.

Status: Q/P Research Present in Prior Problem Topic Edition Edition

1 Salary reimbursement (Oswald) agreement Modified 1

2 Dividend in anticipation of corporate sale Unchanged 2

3 Effect of large dividend on corporate shareholder Unchanged 3

4 Effect of a change in accounting method on E & P Unchanged 4

5 Internet activity Unchanged 5

6 Internet activity Unchanged 6

7 Internet activity Unchanged 7

5-4 2013 Corporations Volume/Solutions Manual

CHECK FIGURES

24. Dividend income $200,000 each,

Mason reduces basis in stock to

$12,000, Sarah reduces stock basis to

zero and capital gain $12,000.

25.a. $1,380,000.

25.b. $2,240,000.

26. $500,000 taxable dividend; $300,000

capital gain.

27. $330,200.

28.a. $10,000; no effect.

28.b. ($24,000); $22,400.

28.c. No effect; $120,000.

28.d. $6,000; $14,000.

28.e. ($45,000); $45,000.

28.f. ($100,000); $80,000.

28.g. No effect; ($20,000).

28.h. ($80,000); ($10,000).

28.i. No effect; ($80,000).

29. Subtract $12,000 in 2012; add $7,000

in 2013.

30. $100,000 taxable dividend, $60,000

capital gain.

31. Return of capital $50,000.

32. Taxable dividend $80,000 and return of

capital $40,000.

33.a. Taxable dividend $30,000 each.

33.b. ($145,000) accumulated E & P balance.

34.a. $70,000; $60,000.

34.b. $30,000; $180,000.

34.c. $150,000; $0.

34.d. $60,000; $70,000.

34.e. $90,000; $40,000.

35. Mike dividend income $237,500,

$62,500 reduces basis in stock and

capital gain $112,500 on sale; Steve

dividend $42,500 and $57,500

reduction in basis.

37. $1,000 ordinary income.

38.a. Silver $12,000 gain; Heather $54,000

dividend, $54,000 land basis; ending

E & P $34,000. 38.b. Silver $12,000 gain; Heather $12,000

dividend, $54,000 land basis; ending

E & P $0.

38.c. Silver $12,000 gain; Heather $8,000

dividend; ending E & P $80,000;

Heather land basis $54,000.

38.d. Heather $54,000 dividend and $54,000

land basis; Silver ending E & P

$14,000.

38.e. Silver $12,800 taxable gain; Heather

$14,000 dividend and $14,000

furniture basis; ending E & P $70,800.

39.a. $150,000.

39.b. $0.

40. Lime reduces E & P by $230,000;

Harry taxable dividend $180,000 and

land basis $300,000.

41. $28,000 dividend and $12,000 return

of capital.

42. Roy dividend $55,000 and basis in land

$55,000; Cornflower $0 loss

recognized and E & P reduced $70,000.

44.a. $70,000.

44.b. $202,500.

44.c. $140,000.

44.d. $128,500 taxable dividend; E & P is

$202,500.

45.a. Dividend income $20,000, dividends

received deduction $16,000, basis

$100,000 in land.

45.b. $80,000.

48. Preferred stock basis is $40,000;

holding period starts at receipt.

49. $14,000 long-term capital gain.

50. Long-term capital gain on sale $1,935

and new stock basis $7,560.

51.a. $3,900.

51.b. $10,200.

51.c. Kristen is better off with bonus; Egret

is better off with bonus.

51.d. Pay bonus.

Corporations: Earnings & Profits and Dividend Distributions 5-5 DISCUSSION QUESTIONS

1. ―Earnings and profits‖ is the factor that fixes the upper limit on the amount of dividend

income shareholders recognize as a result of a distribution from the corporation. It represents the corporation‘s economic ability to pay a dividend without impairing its capital. ??Earnings and profits‖ is similar to the accounting concept of ―retained earnings.‖ However, E & P and retained earnings differ because E & P is computed using tax rules while retained earnings is computed using financial accounting rules. For example, a stock dividend that decreases the retained earnings account does not decrease E & P. E & P is increased for all items of income.

It is decreased for deductible and nondeductible items, such as capital losses, income taxes, and expenses incurred to produce tax-exempt income. p. 5-3 and Concept Summary 5.1

2. At least six factors impact the tax treatment of corporate distributions. These factors are:

?The availability of earnings to be distributed.

?The basis of the stock in the hands of the shareholder.

?The character of the property being distributed.

?Whether the shareholder gives up ownership in return for the distribution.

?Whether the distribution is liquidating or nonliquidating in character.

?Whether the assets distributed are subject to any liabilities or whether the shareholder assumes any liabilities in the distribution.

?Whether the distribution is a ―qualified dividend‖ for purposes of the reduced tax rate on dividend income.

p. 5-2

3. a. Taxable income for 2013 is increased by the amount of the capital loss carryover

because the loss reduced E & P in 2012.

b. Taxable income is reduced by the nondeductible meal expenses.

c. To determine current E & P for 2012, taxable income is increased by the interest

received on municipal bonds.

d. Taxable income is reduced by the nondeductible lobbying expenses.

e. Taxable income is reduced by the loss on sale between related parties.

f. Taxable income is increased by the Federal income tax refund when computing E & P

for 2012.

pp. 5-3 to 5-6 and Concept Summary 5.1

4. a. In general, the payment of dividends can neither generate nor add to a deficit in E & P.

Because the distribution of depreciated property does not create a loss at the corporate

level, the general rule holds true: a deficit is neither generated nor increased.

b. An operating loss can both generate and add to a deficit in E & P. Deficits can only

arise through corporate losses.

p. 5-15

5-6 2013 Corporations Volume/Solutions Manual

5. The accounting methods employed when computing E & P are considerably more

conservative than the methods allowed when computing taxable income. First, rather than allowing the taxpayer to carry forward NOLs, capital losses, and charitable contributions, these deductions are accelerated to the year realized. Second, the computation of E & P does not allow use of the installment method. Third, more conservative depreciation methods are used—in particular, ADS depreciation rather than MACRS is mandated. A portion of § 179 expense is deferred when computing E & P (only 20% of the expense is allowed as a deduction each year over a five-year period). A variety of other more conservative accounting methods are required when computing E & P (e.g., cost depletion, percentage of completion for long-term contracts, and capitalization and amortization of mining exploration and development costs and intangible drilling costs). pp. 5-4 to 5-6

6. a. If a distributing corporation has a deficit in accumulated E & P and a positive amount

in current E & P, a distribution during the year is a taxable dividend to the extent of

current E & P.

b. If the corporation has a positive amount in accumulated E & P and a deficit in current

E & P, a distribution either is a taxable dividend or a return of capital, depending on

the resulting balance in E & P when current and accumulated E & P are netted. The

accounts are netted at the date of distribution. If the resulting balance is zero or a

deficit, the distribution results in a tax-free recovery of basis or capital gain. If a

positive balance results, the distribution represents a dividend to that extent. For

netting purposes, current E & P is determined as of the date of the distribution by

ratably allocating the loss over the entire year, unless the loss can be shown to have

otherwise occurred.

c. If there is a deficit in both current and accumulated E & P, a corporate distribution is

treated as a return of capital to the extent of the shareholder‘s basis in his or her stock.

Any excess is a capital gain.

d. If there is a positive amount in both current and accumulated E & P, to the extent of

the positive balance in both amounts, the distribution is a taxable dividend.

Concept Summary 5.2

7. This is not a valid statement. When a deficit exists in current E & P and a positive balance

exists in accumulated E & P, the accounts are netted at the date of distribution. Furthermore, unless the taxpayer can show otherwise, a deficit in current E & P is deemed to accrue ratably throughout the year. In this case, there is no deficit on January 1, so the distribution is a dividend to the extent of accumulated E & P. p. 5-9

8. The reduced tax on dividends is intended to lessen the effect of several existing distortions and to

stimulate the economy. The distortions arise from the double tax on corporate income and include

(1) an incentive to invest in non-corporate businesses rather than corporations, (2) an incentive for

corporations to finance operations through debt rather than equity, and (3) an incentive to retain more earnings than necessary. It has been estimated that reducing the tax on dividends will stimulate the economy significantly, leading to gains of up to $25 billion annually (if the tax were dropped completely). Because debt financing would not be as heavily relied upon, the reduced tax on dividends should make the economy more robust in economic downturns. The competitiveness of the U.S. in the international markets should also be improved. This comes about because most of our trading partners do not impose a double tax on corporate source earnings. p. 5-10

Corporations: Earnings & Profits and Dividend Distributions 5-7 9. A variety of factors should be considered, including:

?What is the E & P of Red Corporation?

?Has E & P been accurately determined for tax purposes?

?How much E & P is allocated to each shareholder‘s distribution?

?How will the distribution affect Red Corporation‘s E & P?

?Is the distribution in partial or complete liquidation of Red Corporation?

?Does the distribution qualify as a stock redemption for tax purposes?

?What is the tax basis to the shareholders of Red Corporation stock?

Also important is the nature of the shareholder. In the case of a corporate shareholder (Orange Corporation in this situation), a dividends received deduction is available. In contrast, an individual shareholder may qualify for a reduced tax rate.

pp. 5-10 to 5-15 and Chapter 2

10. A variety of factors should be considered, including:

?Is the distributed property appreciated or depreciated?

?What is the character of the property being distributed?

?Is the distributed property secured by debt?

?Is the distribution in complete liquidation of Red Corporation?

?Does the distribution qualify as a stock redemption for tax purposes?

pp. 5-12 to 5-15

11. Ochre‘s board of directors may have decided to distribute a property dividend in lieu of cash

for various reasons. For example, the shareholders could want a particular property that is held by the corporation, or the corporation may be strapped for cash but still wants to distribute a dividend to its shareholders. p. 5-12

12. Distributing machine C triggers taxable gain of $8,000 for Seagull Corporation, while

distributing A produces a nondeductible loss of $7,000. To preserve the loss on A and avoid recognizing gain on C, Seagull should consider selling A and then distributing cash to the second shareholder. Seagull should also distribute machine B because there will be no gain on the distribution and no nondeductible loss. pp. 5-13 and 5-14

13. All distributions of appreciated property generate gain to the distributing corporation. In effect,

the corporation is treated as if it had sold the property to the shareholder for its fair market value. The distributing corporation does not recognize loss on distributions of property. If the distributed property is subject to a liability in excess of basis or the shareholder assumes

5-8 2013 Corporations Volume/Solutions Manual

such a liability, a special rule applies. For purposes of determining gain on the distribution, the fair market value of the property is treated as not being less than the amount of the liability.

Further, corporate distributions reduce E & P by the amount of money distributed or by the greater of the fair market value or the adjusted basis of property distributed, less the amount of any liability on the property. E & P is increased by gain recognized on appreciated property distributed as a property dividend.

Under no circumstances can a corporate distribution create/generate a deficit in E & P or add to an existing deficit in E & P.

Examples 15 to 21

14. For distributions of appreciated property, gain is recognized. But the classification of the gain

does not matter as both capital gains and depreciation recapture gains are taxed at the same rate to corporations. However, a capital gain could be offset against unused capital losses.

Thus, the character of appreciated property distributed would matter only if Tangerine has unused capital losses. A distribution of property with a fair market value less than adjusted basis does not trigger a loss, so the character of the property (capital asset versus depreciable property) does not matter. However, Tangerine might be better off disposing of the loss property before making a distribution to avoid losing the tax benefit of any built-in loss.

Example 16 and see the discussion in Chapter 2.

15. A distribution by a corporation to its shareholders can be treated as a dividend for Federal

income tax purposes even though it is not formally declared or designated as a dividend. Also, it need not be issued pro rata to all shareholders. Nor must the distribution satisfy the legal requirements of a dividend as set forth by applicable state law. The key factor determining dividend status is a measurable economic benefit conveyed to the shareholder. This benefit, when described as a constructive dividend, is distinguishable from actual corporate distributions of cash and property in form only. p. 5-15

16. Because of Mike‘s relationship with Judy, the IRS may argue that any excessive

compensation paid to Mike or Judy is a constructive dividend. Imputed interest on the loan to Judy may also be a dividend. The following questions are relevant:

?Are the salary payments to Judy and Mike reasonable?

?What are Judy‘s and Mike‘s qualifications?

?What are the nature and scope of Judy‘s and Mike‘s work?

?How does the overall salary paid to Judy and Mike compare with the company‘s gross and net income?

?What is the corporation‘s salary policy towards all employees?

?Regarding the advance to Judy, was it a bona fide loan?

?Was the loan evidenced by a written instrument?

?Was collateral or other security provided?

?What is Judy‘s financial capacity to repay the loan?

Corporations: Earnings & Profits and Dividend Distributions 5-9 ?What is Parakeet‘s dividend-paying history?

?What is the amount of imputed interest on the loan to Judy?

pp. 5-16, 15-17, and Examples 22 and 30

17. a. The determination of the reasonableness of compensation paid to an employee who is

not a shareholder but is related to the sole owner of the corporate-employer should be

made in the same manner as that for a shareholder-employee. The same factors used to

determine the reasonableness of salary paid to the owner should be used to determine

the reasonableness of salary paid to the related employees.

b. That the employee-shareholder does not have a college degree should be relevant only

with respect to the nature and scope of the employee‘s w ork. Is a college education

usually required for the type of work performed?

c. The fact that the employee-shareholder has another full-time job might indicate that

salary paid is excessive.

d. If the employee-shareholder was underpaid in the past, a portion of current salary

could be for service rendered in prior years.

e. If a corporation has substantial E & P and has never paid a dividend, it is more likely

that a constructive dividend may be found.

f. Disproportionately large year-end bonuses, related to profit, paid to shareholder-

employees would be vulnerable to constructive dividend treatment.

p. 5-16 and Example 30

18. Danielle would prefer a dividend because she would have $42,500 after tax [$50,000 dividend

–($50,000 ×15% tax rate)]. If paid a bonus, only $36,000 after tax [$50,000 bonus –($50,000 × 28% tax rate)] results. However, this ignores the effect of the payments on Orange Corporation. If Orange paid Danielle a deductible bonus, it would save $17,000 ($50,000 deduction for bonus payment x 34% tax rate) in taxes. (There is no deduction for a dividend payment.) Since Danielle is $6,500 better off with a dividend ($42,500 after tax from a dividend – $36,000 after tax with a bonus) and Orange is $17,000 better off with a bonus, overall the two parties are $10,500 better off with a bonus ($17,000 benefit from bonus for Orange – $6,500 benefit from a dividend for Danielle). As Danielle is the sole shareholder of the corporation, she is in a position to choose the bonus alternative. Examples 28 and 29 19. The salaries paid to Chris and Joey are vulnerable to constructive dividend treatment since

neither shareholder appears to have earned them. There is also a problem regarding the $600,000 salary payment to Samantha. Why is she receiving $350,000 more than Jack when it appears they share equally in managing the company‘s operations? Although Samantha is not

a shareholder, her relationship to Chris and Joey is enough of a tie-in to raise the unreasonable

compensation issue.

Furthermore, Green Corporation has never distributed a dividend although it has substantial

E & P. Given the dividend history and the salary disparities, the IRS might successfully argue

that all of the salary paid to Joey and Chris, as well as the $350,000 paid to Samantha (beyond the amount paid to Jack), is unreasonable.

Example 30

5-10 2013 Corporations Volume/Solutions Manual

20. There would be a problem if Katrina makes the pledge because Condor Corporation will have

satisfied Katrina‘s obligation. Condor‘s payment to the charity may be treated as indirect compensation to her. Thus, Katrina should not have made the pledge. Instead have the corporation make the contribution directly. In determining whether Condor has paid Katrina ―unreasonable‖ compensation, both the direct compensation of $500,000 and the indirect payment of $150,000 made on her behalf will be considered. Examples 31 and 32

21. Hoffman, Raabe, Smith, and Maloney, CPAs

5191 Natorp Boulevard

Mason, OH 45040

November 16, 2012

Raptor Corporation

1812 S. Camino Seco

Tucson, AZ 85710

Dear President of Raptor Corporation:

This letter is in response to your question with respect to the stock dividend distributed to your shareholders. Our conclusion is based upon the facts as outlined in your November 14 letter. Any change in facts may cause our conclusion to be inaccurate.

Your shareholders have taxable income equal to the fair market value of the stock dividend.

Distributions of preferred stock to some common shareholders and of common stock to other common shareholders is a taxable event.

Should you need more information or need to clarify our conclusion, do not hesitate to contact me.

Sincerely yours,

Jon S. Davis, CPA

Partner

TAX FILE MEMORANDUM

November 16, 2012

FROM: Jon S. Davis

SUBJECT: Raptor Corporation

Based on the facts summarized in a letter (dated November 14) from the president of Raptor Corporation, the following occurred. Raptor Corporation declared a dividend permitting its shareholders to elect to receive either 9 shares of cumulative preferred stock or 3 additional shares of Raptor common stock for every 10 shares of common stock held at the time of the dividend declaration. One shareholder elected to receive preferred stock while all other shareholders chose the common stock dividend.

At issue: Is the distribution of a stock dividend taxable if some of the shareholders elect to

Corporations: Earnings & Profits and Dividend Distributions 5-11 Analysis: Section 305 governs the taxability of stock dividends. It provides that stock dividends are not taxable if they represent pro rata distributions on common stock. However, this general rule has five exceptions, one of which applies in the current situation. In particular, a distribution of preferred stock to some common shareholders and of common stock to other common shareholders is a taxable event.

Conclusion: The shareholder has taxable income equal to the fair market value of the stock dividend.

pp. 5-18 and 5-19

22. The rules that determine the tax treatment of stock distributions are based on the proportionate

interest concept. Stock distributions are generally excluded from income because the proportionate ownership interest of the shareholder is not changed by the distribution. Thus, § 305, which is based on this doctrine, excludes from gross income pro rata distributions of stock or stock rights paid on common stock. Conversely, stock dividends are taxable when shareholders‘ proportionate interests in the corporation may change as a result of the stock distribution. This is the case for each of the five exceptions listed in §305(b). pp. 5-18 and 5-19

23. If stock rights are nontaxable and the value of the rights is less than 15% of the value of the

old stock, the basis of the rights is zero unless the shareholder elects to have some of the basis in the formerly held stock allocated to the rights. If the fair market value of the rights is 15% or more of the value of the old stock and the rights are exercised or sold, the shareholder must allocate some of the basis in the formerly held stock to the rights.

Taxable stock rights produce taxable income to the shareholder to the extent of the fair market value of the rights. The fair market value then becomes the shareholder‘s basis in the rights.

If the rights are exercised, the holding period for the new stock begins on the date the rights (whether taxable or nontaxable) are exercised. The basis of the new stock is the basis of the rights plus the amount of any other consideration given.

pp. 5-19 and 5-20

PROBLEMS

24. Sarah and Mason each have dividend income of $200,000 {[$240,000 (accumulated E & P) +

$160,000 (current E & P)] ÷ 2}. The dividend income will be subject to the reduced tax rate on dividends available to individuals. The remaining $40,000 of the $440,000 distribution reduces the basis ($20,000 each) in the shareholders‘ stock with any excess treated as a capital gain. Thus, Sarah reduces her $8,000 stock basis to zero and has a capital gain of $12,000, while Mason reduces his stock basis from $32,000 to $12,000 and has no income tax consequences. Example 1

25. a. Capon reports the $600,000 dividend as gross income but claims a dividends received

deduction under § 243 of $420,000 (70% × $600,000). None of the other items affect

taxable income. Thus, taxable income is $1,380,000 ($1,200,000 taxable income

before dividends + $600,000 dividend – $420,000 dividends received deduction).

b. Capon Corporation‘s E & P as of December 31 is $2,240,000, computed as follows:

$400,000 (beginning balance in E & P) + $1,380,000 (taxable income) + $420,000

5-12 2013 Corporations Volume/Solutions Manual

(dividends received deduction) + $90,000 (tax-exempt interest) – $50,000 (interest on

indebtedness to purchase tax-exempt bonds).

pp. 5-3 and 5-4

26. Robert reports a $500,000 taxable dividend and a $300,000 capital gain. The $600,000 gain

on the sale of the land increases current E & P. Current E & P before the distribution is $500,000 [$600,000 (gain on sale) –$100,000 (current year deficit)]. The current E & P balance triggers dividend treatment for $500,000 of the distribution. Of the remaining $450,000 distributed, $150,000 is a tax-free recovery of basis and $300,000 is taxed as capital gain. After the distribution, Robert‘s stock basis is $0. pp. 5-4, 5-9, and Examples 1 and 6 27. Sparrow Corporation‘s current E & P is computed as follows:

Taxable income $330,000

Federal income tax liability (112,000)

Interest income from tax-exempts 5,000

Disallowed portion of meals and entertainment expenses (1,500)

Life insurance premiums paid, net of increase in

cash surrender value ($3,500 – $700) (2,800)

Proceeds from life insurance policy, net of cash

surrender value ($130,000 – $20,000) 110,000

Excess capital losses (13,000)

Excess of MACRS depreciation over E & P

depreciation ($26,000 – $16,000) 10,000

Allowable portion of 2011 § 179

expenses (20% ? $100,000) (20,000)

Dividends received deduction (70% ? $25,000) 17,500

LIFO recapture adjustment 10,000

Installment sale gain (3,000)*

Current E & P $330,200

*[($40,000 sales price – $32,000 adjusted basis)/$40,000 sales price] ? $15,000

Concept Summary 5.1

28. Taxable Income E & P Increase

Increase (Decrease) (Decrease)

a.

b. ($24,000) $22,400*

c. No effect $120,000

d. $6,000 $14,000**

e. ($45,000) $45,000

f. ($100,000) $80,000***

g. No effect ($20,000)?

h. ($80,000) ($10,000)??

i. No effect ($80,000)

*Although mining exploration costs are deductible in full under the income tax, they must be amortized over 120 months when computing E & P. Since $200 per month is amortizable ($24,000/120 months), $1,600 is currently deductible for E & P purposes ($200 × 8 months).

Thus, of the $24,000 income tax deduction, $22,400 is added back to E & P ($24,000 –$1,600 deduction allowed).

Corporations: Earnings & Profits and Dividend Distributions 5-13 **The receipt of a $20,000 dividend will generate a dividends received deduction of $14,000.

The net effect on taxable income is an increase of $6,000. For E & P purposes, the

dividends received deduction is added back.

***Only 20% of current-year § 179 expense is allowed for E & P purposes. Thus, 80% of the amount deducted for income tax purposes is added back.

?In each of the four succeeding years, 20% of the § 179 expense is allowed as a deduction for

E & P purposes.

??ADS straight-line depreciation is allowed for E & P purposes; thus, E & P is decreased by $10,000 (the excess of ADS depreciation over the amount allowed under MACRS).

Concept Summary 5.1

29.To compute Osprey‘s E & P for 2012, the $12,000 of Federal income taxes paid is subtracted

from taxable income. To compute E & P for 2013, Osprey adds $7,000 to taxable income to reflect the Federal income tax refund. Concept Summary 5.1

30.Dividend income is $100,000, tax-free recovery of basis is $40,000, and capital gain is

$60,000. To determine the amount of dividend income, the balances of both accumulated and current E & P as of June 30 must be netted because of the deficit in current E & P. As one-half of the loss (or $230,000) is deemed to have occurred on June 30, the $330,000 in accumulated E & P is reduced by $230,000. The $100,000 balance in E & P triggers dividend income. The remaining $100,000 of the distribution is recovery of capital, reducing basis to zero and then triggering capital gain. Example 11j

31. The shareholder has a return of capital of $50,000. The $50,000 reduces the basis in the Teal

Corporation stock; any excess over basis is capital gain. There is no dividend income because of the absence of E & P. On the date of the sale, E & P is a negative $20,000 [$225,000 (beginning balance in accumulated E & P) – $225,000 (existing deficit in current E & P from sale of the asset) –$20,000 (one-fourth of the $80,000 negative E & P not related to asset sale)]. Thus, the $50,000 distribution constitutes a return of capital. Generally, deficits are allocated pro rata throughout the year unless the parties can prove otherwise. Here the shareholder can prove otherwise. Note:If the $305,000 deficit in E & P were prorated throughout the year, there would have been a taxable dividend of $50,000 because E & P would have a positive balance of $148,750 at the date of distribution [$225,000 (beginning balance in accumulated E & P) –$76,250 (one-fourth the $305,000 deficit for the year)].

Examples 11 and 26

32. Cardinal Corporation has no accumulated E & P at the time of the distribution. The

shareholder has a taxable dividend equal to the current E & P determined at year-end, which was $80,000. The balance of the distribution, $40,000, re duces the shareholder‘s basis in the stock, and any excess over basis results in capital gain. pp. 5-8 to 5-10

33. a. Bunting Corporation and Jennifer each have a taxable dividend of $30,000. Sparrow

Corporation‘s current E & P is $65,000; thus, the entire distribution is a taxable

dividend even though Sparrow has no accumulated E & P. Assuming the taxable

income limitation does not apply, Bunting Corporation is entitled to a dividends

received deduction of $24,000 (80% ×$30,000). Thus, Bunting is only taxed on

$6,000 ($30,000 distribution –$24,000 dividends received deduction). Because

Jennifer is an individual, she pays tax on the entire dividend, subject to the preferential

15%/0% tax rates if the dividend is qualifying.

5-14 2013 Corporations Volume/Solutions Manual

b. To determine Sparrow Corporation‘s accumulated E & P at the end of the year, its

current E & P ($65,000) is reduced by the amount of the distributions ($60,000). The

remaining $5,000 is then netted against the deficit in accumulated E & P of $150,000,

leaving a net deficit of $145,000.

pp. 5-8 to 5-11

34. Dividend Return of

Income Capital

a. $ 70,000 $ 60,000 Taxed to the extent of current E & P.

b. $ 30,000 $180,000 Accumulated E & P and current E & P netted on the

date of distribution.

c. $150,000 $ –0–Taxed to the extent of current and accumulated E & P.

d. $ 60,000 $ 70,000 Accumulated E & P and current E & P are netted on the

date of distribution. There is a dividend to the extent of

any positive balance.

e. $ 90,000 $ 40,000 When the result in current E & P is a deficit for the year,

the deficit is allocated on a pro rata basis to distributions

made during the year. On June 30, E & P is $90,000

[current E & P is a deficit of $30,000 (i.e., 1/2 of

$60,000) netted with accumulated E & P of $120,000].

pp. 5-8 to 5-10

35. The $170,000 in current E & P is allocated on a pro rata basis to the two distributions made

during the year: thus, $127,500 of current E & P is allocated to Mike [$170,000 current E & P ×($300,000 distribution to Mike/$400,000 total distributions)] and $42,500 is allocated to Steve [$170,000 current E & P ×($100,000 distribution to Steve/$400,000 total distributions)].

Accumulated E & P is applied in chronological order beginning with the earliest distribution.

Thus, the entire accumulated E & P balance of $110,000 is allocated to Mike. As a result, $237,500 ($127,500 from current E & P + $110,000 from accumulated E & P) of Mike‘s July

1 distribution is taxed as dividend income. The remaining $62,500 of the $300,000

distribution reduces Mike‘s stock basis to $87,500 ($150,000 basis –$62,500 recovery of capital). Consequently, Mike recognizes a capital gain of $112,500 on the sale of the stock [$200,000 (sales price) –$87,500 (remaining stock basis)]. Of the $100,000 distributed to Steve, $42,500 will be treated as a dividend, and the remaining $57,500 reduces stock basis to $142,500 [$200,000 (original cost) –$57,500 (reduction in basis from the distribution)].

pp. 5-8 to 5-10

36. If Sean does not include the dividend in net investment income, his tax is $1,050 ($7,000

dividend × 15% tax rate). In addition, $7,000 of investment interest expense is not deductible until he has investment income. At that point, the interest expense will generate a tax benefit of $2,450 (35% × $7,000). Thus, excluding the dividend from net investment income yields a current-year tax of $1,050 and a tax savings in the future of $2,450.

If Sean elects to treat the dividend as net investment income, ordinary income of $7,000 and an additional deduction of $7,000 result. His tax liability, therefore, is $0 [($7,000 dividend income – $7,000 interest expense) × 35%]. Ignoring the time element, Sean is better off by using qualifying dividend treatment. Overall, he saves a total of $1,400 in taxes ($2,450 taxes saved in the future – $1,050 tax paid this year). However, because the tax savings will not be

Corporations: Earnings & Profits and Dividend Distributions 5-15 available for many years, Sean should perform a present value analysis. If the expected present value of the $2,450 taxes saved is less than the current tax of $1,050, Sean will be better off electing to include the dividend in investment income.

p. 5-12

37. The $1,000 dividend will be taxed to Judy as ordinary income. Because she did not hold the

stock for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date, the dividend does not qualify for the preferential 15%/0% tax rates.

Example 12

38. a. Silver recognizes a gain on the distribution of the land to Heather. The amount of the

gain is $12,000 ($54,000 fair market value – $42,000 adjusted basis). Since Silver‘s

gain increases its E & P, it will have $12,000 of current E & P and $76,000 of

accumulated E & P available to apply to the distribution. The entire value of the land

($54,000) is a dividend to Heather, leaving $34,000 of accumulated E & P ($88,000

total E & P at year-end – $54,000 distribution) as the beginning balance for next year.

Heather‘s basis in the land is its fair market value ($54,000).

b. The distribution triggers $12,000 of gain to Silver and creates $12,000 of current

E & P. Consequently, the distribution generates a $12,000 dividend to Heather (to the

extent of current E & P). The remaining $42,000 of the value of the land decreases

Heather‘s stock basis from $56,000 to $14,000 and is a tax-free recovery of capital.

Heather‘s basis in the land is $54,000.

c. Silver recognizes $12,000 of gain and increases current E & P by $12,000, as a result

of the distribution of appreciated land. The amount deemed distributed is the fair

market value of the land, net of the mortgage, or $8,000 ($54,000 fair market value –

$46,000 mortgage). Since there is $12,000 of current E & P and $76,000 of

accumulated E & P, the entire $8,000 distribution is taxed as a dividend. Current

E & P is reduced by the $8,000 distribution, leaving accumulated E & P with a

beginning balance for the following year of $80,000 ($76,000 accumulated E & P +

$12,000 current E & P –$8,000 distribution). He ather‘s basis in the land is its fair

market value ($54,000).

d. While Silver realizes an $8,000 loss, none of the loss is recognized on the distribution.

Heather receives a $54,000 dividend and she takes a basis of $54,000 in the land.

Silver has accumulated E & P at the beginning of the following year of $14,000

[$76,000 accumulated E & P – $62,000 (greater of $62,000 adjusted basis of the land

or $54,000 fair market value)].

e. Silver recognizes gain on the distribution of $12,800 for income tax purposes ($14,000

fair market value – $1,200 adjusted basis for income tax purposes). Current E & P is

increased to $8,800 ($14,000 fair market value –$5,200 adjusted basis for E & P).

Heather receives a $14,000 dividend and takes a $14,000 basis in the furniture.

Silver‘s E & P is reduced by $14,000, leaving $70,800 of accumulated E & P at the

start of the following year ($76,000 accumulated E & P + $8,800 current E & P –

$14,000 distribution).

pp. 5-12 to 5-15

39. a. Peach has a gain of $150,000 on the distribution, computed as follows: $400,000

(liability on the property exceeds fair market value) – $250,000 (basis of the property).

Peach‘s E & P is increased by the $150,000 gain. In addition, E & P is decreased by

$400,000 (representing the deemed fair market value of the property), reduced by the

5-16 2013 Corporations Volume/Solutions Manual

$400,000 liability of the property, or zero. Thus, E & P is $800,000, computed as

follows: $650,000 (beginning E & P balance) + $150,000 (gain on distribution).

b. Karla has dividend income of zero, computed as follows: $400,000 (value of the

property based on liability) – $400,000 (liability on the property). Karla has a basis of

$400,000 in the property.

pp. 5-12 to 5-15

40.Harry has a taxable dividend of $180,000 [$300,000 (fair market value of the land) –

$120,000 (liability assumed)]. Harry‘s basis in the land is $300,000. Lime Corporation does not recognize a loss on the distribution, but the distribution reduces its E & P by $230,000 [$350,000 (adjusted basis of the land) – $120,000 (liability assumed by Harry)]. pp. 5-12 to 5-15

41. To arrive at the taxability of the $40,000 distribution, the balance of both accumulated and

current E & P as of October 1 must be determined and netted. This is necessary because of the deficit in current E & P. Three-fourths of the $36,000 loss, or $27,000, reduces accumulated

E & P to $28,000 as of October 1 ($55,000 –$27,000). Thus, of the $40,000 distribution,

$28,000 is taxed as a dividend and $12,000 represents a return of capital. Example 11

42. Roy has a $55,000 taxable dividend and a $55,000 basis in the land. Cornflower Corporation

does not recognize a loss on the distribution and its E & P is reduced by $70,000. pp. 5-12 to 5-15

43. ?What basis do Eloise and Olivia have in their stock in Cerulean Corporation after their

initial transfers for stock?

?Does Olivia‘s transfer qualify under § 351 of the Code as a nontaxable exchange?

?How is Cerulean Corporation taxed on the property distribution to Eloise?

?How do the distributions to Eloise and to Olivia affect Cerulea n‘s E & P?

?How will Eloise and Olivia be taxed on the distributions?

?What is Olivia‘s basis in her stock when she sells it to Magnus?

?How are Eloise and Magnus taxed on the $90,000 distribution to each?

pp. 5-2 to 5-15 and Chapter 4

44. a. Juan‘s gro ss income from the distribution is $70,000 [$140,000 (value of the property)

– $70,000 (liability)].

b. Petrel‘s E & P after the distribution is $202,500, computed as follows:

Corporations: Earnings & Profits and Dividend Distributions 5-17

Accumulated E & P at start of year $ 85,000

Add:

Taxable income $320,000

Proceeds of term life insurance 150,000

Subtract:

Federal income tax (112,000)

Life insurance premiums (4,500)

Property distribution (220,000)*

Prior-year installment sale income (16,000) 117,500

E & P of Petrel after the distribution $202,500

*E & P is reduced by the greater of the fair market value ($140,000) or adjusted basis

of the property ($290,000), less the amount of liability on the property ($70,000).

c. Juan‘s tax basis for the property is $140,000.

d. If Petrel had sold the business property at its $140,000 fair market value, it would have

recognized a loss of $150,000. This loss would offset $150,000 of taxable income in

the current year, creating Federal tax savings of $58,500 ($150,000 ×0.39). After

paying off the $70,000 loan, Petrel would have a total of $128,500 to distribute to Juan

[$58,500 (tax savings) + $140,000 (sales proceeds) – $70,000 (loan balance)].

Immediately following the property sale and distribution of cash, Petrel‘s E & P

balance would be:

Accumulated E & P at start of year $ 85,000

Add:

Taxable income (reduced by $150,000 loss) $170,000

Proceeds of term life insurance 150,000

Subtract:

Federal income tax (53,500)

Life insurance premiums (4,500)

Cash distribution (128,500)

Prior-year installment sale income (16,000) 117,500

E & P of Petrel after the distribution $202,500

Thus, Juan recognizes a taxable dividend of $128,500. Petrel‘s E & P would be

unchanged.

Concept Summary 5.1 and Examples 2, 14, and 20

45. a. Iris Corporation has dividend income of $20,000 [$100,000 (fair market value of the

land) –$80,000 (liability on the land)]. The $20,000 dividend creates a $16,000

dividends received deduction under § 243. Consequently, only $4,000 of the dividend

is subject to tax. Iris Corporation has a basis of $100,000 in the land.

b. Fresia Corporation may not deduct the loss on the land. Its E & P is reduced by

$80,000 [the $160,000 basis of the land (which is greater than the fair market value) –

the $80,000 liability on the land].

Examples 14 and 20

5-18 2013 Corporations Volume/Solutions Manual

46. Advances to shareholders that are not bona fide loans are constructive dividends. Whether an

advance qualifies as a bona fide loan is a question of fact to be determined in light of the particular circumstances.

Positive factors:

?The advance is evidenced by a written instrument.

?The shareholder furnished collateral for the advance.

Negative factors:

?Likely forgone interest here, as the loan is interest-free.

Additional information needed:

?How long has the advance been outstanding?

?Has James made any payments on the advance?

?Can James afford to make payments on the advance?

?What did James do with the funds?

?Does James regularly receive such advances?

It is difficult to determine with the amount of information provided whether the advance is a bona fide loan. The additional information needed and noted above would help determine if a loan or a constructive dividend is involved.

pp. 5-17, 5-18, and Example 22

47. a. The result of this transaction is a realized loss of $50,000 (the difference between basis

of $350,000 and fair market value of $300,000) and a constructive dividend of

$25,000 (the difference between the $300,000 fair market value and the $275,000 paid

for the office building). Due to the application of § 267, Parrot cannot recognize the

realized loss but it does reduce E & P. The constructive dividend also reduces E & P.

Thus, E & P is reduced by $75,000 (the sum of the $50,000 disallowed loss and the

$25,000 constructive dividend).

b. The loan to Jerry generates imputed interest since no interest was charged. The

amount of imputed interest is $13,125 ($250,000 × 7% × 3/4 year) and that amount is

deemed paid as interest to the corporation. The deductibility of the interest by Jerry

depends on how the loan proceeds are used. Parrot has taxable interest income of

$13,125 and is deemed to pay a dividend to Jerry equal to the amount of interest.

Parrot‘s E & P is increased by the amount of interest income and reduced by the

amount of deemed dividend payment.

c. Bargain rentals create constructive dividends to shareholders. In the present case, the

amount of constructive dividends to both Tom and Jerry equals the fair rental value of

the airplane. Thus, Tom has $42,000 (120 hours × $350 hourly rental rate) of dividend

income and Jerry has dividend income of $56,000 (160 hours ×$350 hourly rental

rate). Parrot‘s E & P is reduced by the same amounts.

Corporations: Earnings & Profits and Dividend Distributions 5-19

d. The $11,000 excess amount ($20,000 – $9,000) paid to Tom by Parrot over the fair

rental value of the equipment is treated as a constructive dividend taxable to Tom and

reduces Parrot‘s E & P.

pp. 5-15 to 5-18

48. Because the distribution of preferred stock is taxable to Katie, her basis in the newly acquired

shares is equal to its fair market value of $40,000. The holding period of the preferred stock begins on the date of receipt. p. 5-18

49. Hoffman, Raabe, Smith, and Maloney, CPAs

5191 Natorp Boulevard

Mason, OH 45040

February 17, 2012

Jacob Corcoran

925 Arapahoe Street

Boulder, CO 80304

Dear Mr. Corcoran:

This letter is in response to your question with respect to the sale of the Grebe Corporation stock you received as a nontaxable stock dividend. Our conclusion is based upon the facts as outlined in your February 10 letter. Any change in facts may cause our conclusion to be inaccurate.

Originally, you paid $24,000 for 10,000 shares of stock in Grebe Corporation and last year a nontaxable stock dividend of 2,000 additional shares was received. The 2,000 shares were sold in the current year for $18,000. The gain on the sale of the 2,000 shares is determined by subtracting your basis in the shares sold from the sales price. The tax basis in the 2,000 shares is determined by dividing the $24,000 cost by 12,000 (10,000 original shares plus 2,000 new shares). This results in a basis of $2 per share ($24,000 ÷ 12,000). Your gain of $14,000 is computed as follows: $18,000 (selling price) – $4,000 (tax basis in the 2,000 new shares). The $14,000 gain on the sale is a long-term capital gain. The gain is long term because the original Grebe stock has been held for more than one year.

Should you need more information or need to clarify our conclusion, do not hesitate to contact me.

Sincerely yours,

Jon S. Davis, CPA

Partner

5-20 2013 Corporations Volume/Solutions Manual

TAX FILE MEMORANDUM

February 16, 2012

FROM: Jon S. Davis

SUBJECT: Jacob Corcoran

Today I conferred with Jacob Corcoran regarding his letter of February 10. Two years ago, Mr. Corcoran purchased 10,000 shares of Grebe Corporation for $24,000. Last year, he received a nontaxable stock dividend of 2,000 additional shares. He sold the 2,000 shares this year for $18,000 and has asked me to determine the tax consequences of the sale.

At issue: How is the gain on the sale of shares of stock received as nontaxable stock dividends Conclusion: The shareholder‘s basis in the original 10,000 shares ($24,000) is reallocated to

$2 per share ($24,000 ÷ 12,000 shares). His gain on the sale of the 2,000 shares is $14,000 [$18,000 (selling price) – $4,000 (basis in 2,000 shares)]. The gain is a long-term capital gain because the holding period of the original shares tacks on to the shares received as a nontaxable stock dividend.

pp. 5-18 and 5-19

50.Because the fair market value of the rights is 15% or more of the value of the old stock,

Lauren must allocate her basis in the stock between the stock and the stock rights. Lauren allocates basis as follows:

Fair market value of stock: 300 shares x $110 = $33,000

Fair market value of rights: 150 rights ? $55 = 8,250

$41,250 Basis of stock: $9,000 ? $33,000/$41,250 = $7,200

Basis of rights: $9,000 ? $8,250/$41,250 = $1,800

Basis per right: $1,800 ÷ 150 rights = $12

There is a capital gain on the sale of the rights of $1,935, computed as follows:

Sales price of 45 rights $2,475

Less: Basis of 45 rights (45 ? $12) (540)

Long-term capital gain $1,935

Basis of new stock is $7,560, computed as follows:

105 rights ? $12 $1,260

Additional consideration ($60 ? 105 shares) 6,300

Basis on newly acquired stock $7,560

Holding period of the 105 new shares begins on the date of purchase.

Example 25

51. a. If Kristen were paid a bonus, she would receive $21,600 after tax [$30,000 bonus –

($30,000 × 28% tax rate)]. If the payment is a dividend, she would net $25,500 after