信用证范本及详解(重点)

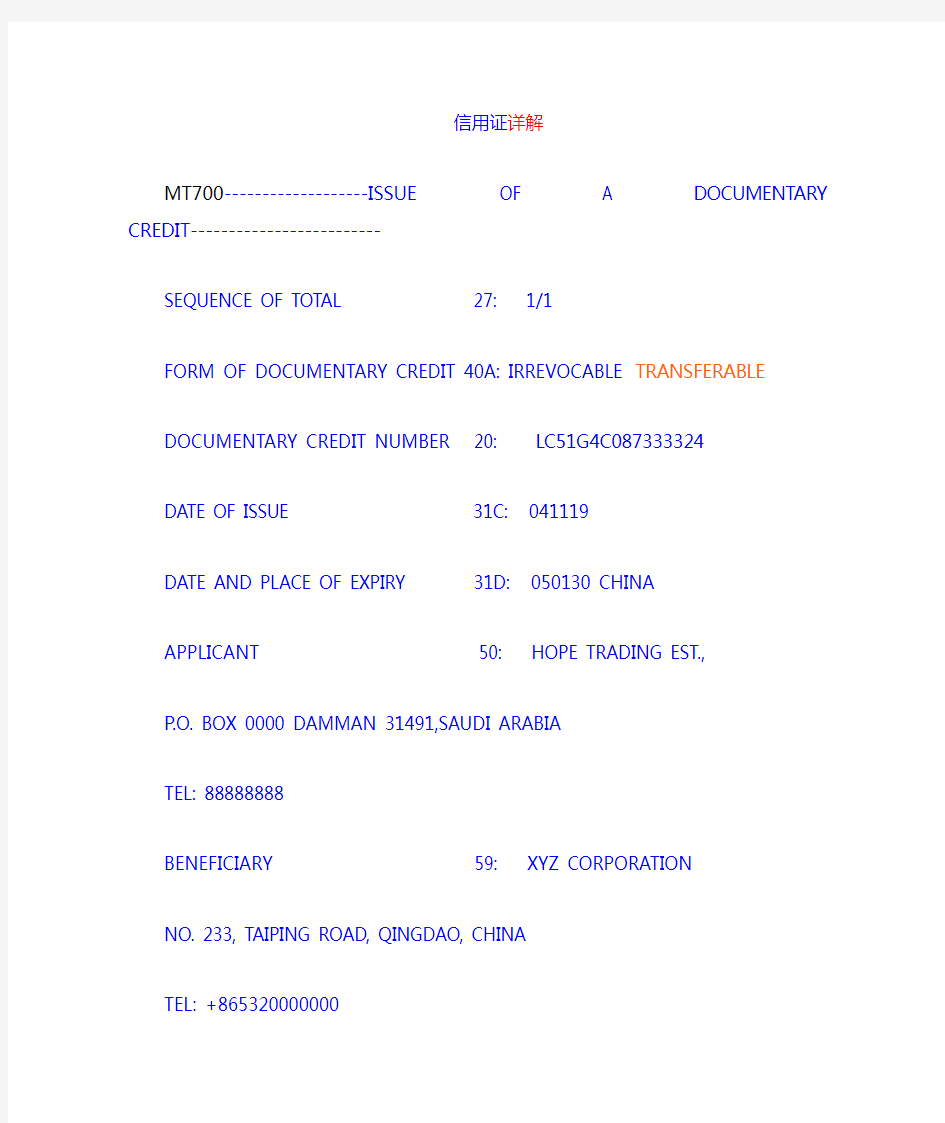

信用证详解

MT700-------------------ISSUE OF A DOCUMENTARY CREDIT-------------------------

SEQUENCE OF TOTAL 27: 1/1

FORM OF DOCUMENTARY CREDIT 40A: IRREVOCABLE TRANSFERABLE DOCUMENTARY CREDIT NUMBER 20: LC51G4C087333324

DA TE OF ISSUE 31C: 041119

DA TE AND PLACE OF EXPIRY 31D: 050130 CHINA

APPLICANT 50: HOPE TRADING EST.,

P.O. BOX 0000 DAMMAN 31491,SAUDI

ARABIA

TEL: 88888888

BENEFICIARY 59: XYZ CORPORA TION

NO. 233, TAIPING ROAD, QINGDAO,

CHINA

TEL: +865320000000

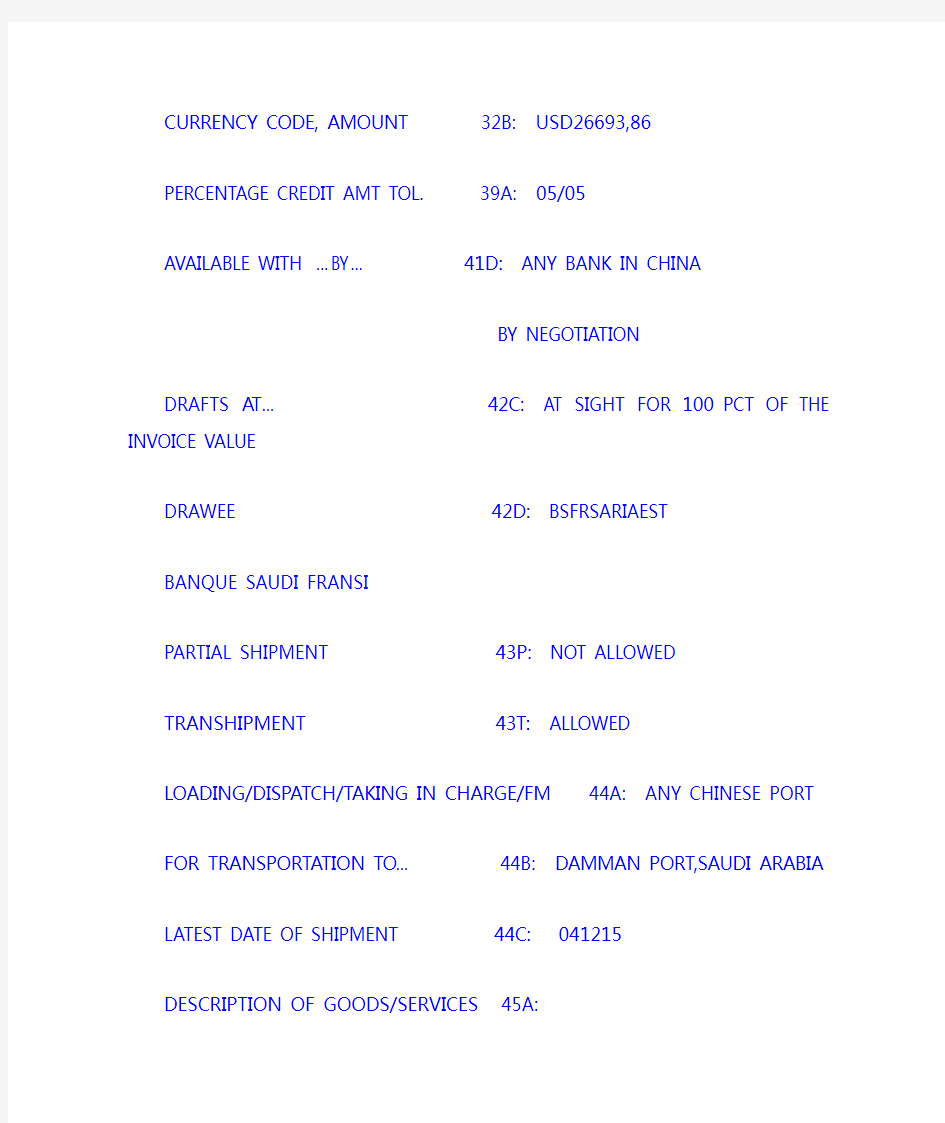

CURRENCY CODE, AMOUNT 32B: USD26693,86

PERCENTAGE CREDIT AMT TOL. 39A: 05/05

A V AILABLE WITH …BY…41D: ANY BANK IN CHINA

BY NEGOTIATION

DRAFTS AT…42C: AT SIGHT FOR 100 PCT OF THE INVOICE

V ALUE

DRAWEE 42D: BSFRSARIAEST

BANQUE SAUDI FRANSI

PARTIAL SHIPMENT 43P: NOT ALLOWED

TRANSHIPMENT 43T: ALLOWED

LOADING/DISPATCH/TAKING IN CHARGE/FM 44A: ANY CHINESE PORT

FOR TRANSPORTATION TO…44B: DAMMAN PORT,SAUDI ARABIA LATEST DATE OF SHIPMENT 44C: 041215

DESCRIPTION OF GOODS/SERVICES 45A:

FROZEN CHICKEN BREAST MEAT , A GRADE,

PACKING: 1KG X 12/CARTON,

UNIT PRICE: USD1800.00/MT CIF HAMBURG, GERMANY

QUANTITY: 2000CARTONS/24MTS

DOCUMENTS REQUIRED: 46A:

1.MANUALL Y SIGNED COMMERCIAL INVOICE IN 5 COPIES, THE

ORIGINAL MUST BE CERTIFIED BY CHAMBER OF COMMERCE

AND LEGALIZED BY SAUDI CONSULATE/EMBASSY IN CHINA.

THE COMMERCIAL INVOICE MUST SHOW THA T:

-THE GOODS ARE LESS THAN 30 DAYS OLD AT THE TIME OF

LOADING

-NAME OF THE COUTRY OF ORIGIN TO BE SHOWED

CLEARL Y ON EACH POL YBAG AND ON EACH OUTER

MASTER CARTON

-FOB VALUE, FREIGHT CHARGES SEPARATEL Y AND TOATL C AND F V ALUE

2.FULL SET INCLUDING 2 NON-NEGOTIABLE COPIES) OF CLEAN

ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER AND BLANK ENDORSED, MARKED “FREIGHT PREPAID”

NOTIFYING APPLICANT. THE BILL OF LADING MUST SHOW THE FOLLOWING: (A) THE NAME, FULL ADDRESS AND TELEPHONE NUMBER OF SHIPPING AGENT AT THE PORT OF DISCHARGE. (B) THE AGE OF THE VESSEL AND ITS YEAR OF BUILT. (C) THE SEAL NUMBER(S) OF THE FCL REEFER CONTAINER(S).

3. A CERTIFICATE ISSUED AND SIGNED BY THE OWNER, AGENT,

CAPTAIN OR COMPANY OF THE VESEL/PLANE/TRUCK APPENDED TO THE BILL OF LADING/AIRE W AYBILL/TRUCK WAYBILL LEGALIZED BY SAUDI EMBASSY/CONSULATE STA TING: (1) NAME OF VESSEL.........PREVIOUS NAME.........(IN CASE OF SEA), NAME OF PLANE/FLIGHT NO..........(IN CASE OF AIR), NAME OF THE TRUCK COMPANY/TRUCK NO.........(IN CASE OF LAND), (2) NA TIONALITY OF VESSEL/PLANE/TRUCK (3)

OWNER OF VESSEL………(IN CASE OF SEA) OWNER OF PLANE/COMPANY………(IN CASE OF AIR) OWNER OF TRUCK/COMPANY………(IN CASE OF LAND), (4) VESSEL/PLANE/TRUCK WILL CALL OR PASS THROUGH THE FOLLOWING PORTS/AIRPORTS/BORDERS ENROUTE TO SAUDI ARABIA: 1………2………3………4……….(PLEASE LIST PORTS/AIRPORTS/BORDERS)

THE UNDERSIGNED (THE OWNER, AGENT, CAPTAIN OR COMPANY OF THE VESSEL/PLANE/TRUCK) ACCORDINGL Y DECLARES THAT THE INFORMATIONS PROVIDED (IN RESPONESES TO 1 TO 4) ABOVE ARE CORRECT AND COMPLETE AND THAT THE VESSEL/PLANE/TRUCK SHALL NOT CALL AT OR ANCHOR ON ANY OTHER PORTS/AIRPORTS/BORDERS OTHER THAN THAT MENTIONED ABOVE ENROUTE TO SAUDI ARABIA.

WRITTEN ON THE………………………. DAY/MONTH/YEAR

SAUDI EMBASSY/CONSULATE SIGNA TURE OF VESSEL’S

SEAL AND SIGNAURE /PLANE’S/TRUCK’S OWNER

AGENT, CAPTAIN THIS CERTIFICATE IS NOT REQUIRED IF SHIPMENT IS EFFECTED ON NA TIONAL SHIPPING COMPANY OF SAUDI ARABIA OR

UNITED ARAB SHIPPING CO. (SAG) OR SAUDI ARABIAN

AIRLINES.

4.PACKING LIST IN 3 COPIES

5.CERTIFICATE OF QUALITY ISSUED BY CIQ, STATING THAT THE

GOODS ARE UP TO EU STANDARDS

6.CERTIFICATE OF ORIGIN FORM A ISSUED BY CIQ

7.CERTIFICATE OF ORIGIN ISSUED BY CHAMBER OF COMMERCE

IN THE NAME OF APPLICANT IN ONE ORIGINAL PLUS TWO DUPLICATES, THE ORIGINAL MUST BE CERTIFIED BY CHAMBER OF COMMERCE AND LEGALIZED BY SAUDI CONSULATE/EMBASSY IN CHINA STATING THE COUNTRY OF ORIGIN, NAME AND FULL ADDRESS OF THE MANUFACTURER/PRODUCER AND SHIPPER, CONFIRMING THAT THE GOODS RELEV ANT TO THIS L/C ARE OF CHINESE ORIGIN. 8.ONE COPY OF FAX SENT TO THE APPLICANT ADVISING

SHIPMENT IN DETAILS WITHIN 5 WORKING DAYS OF SHIPMENT IS MADE. A TRANSMISION REPORT IS ALSO REQUIRED.

9.HALAL SLAUGHTERING CERTIFICATE IN ONE ORIGINAL PLUS

ONE DUPLICATE CERTIFIED BY CHAMBER OF COMMERCE AND LEGALIZED BY SAUDI EMMBASSY/CONSULATE IN CHINA SHOWING/EVIDENCING THE FOLLOWING:

-PRODUCTION/EXPIRY DATES OF GOODS

-SLAUGHTERING DATE

10.CERTIFICATE ISSUED BY OWNER, MASTER OR AGENTS STATING

THAT THE CARRYING VESSEL WAS BUILT IN ……(INDICATE THE YEAR OF BUILT) AND IS NOT EXCEEDING 15 YEARS OF AGE AT THE DATE OF LOADING AND THAT ITS CARGO GEAR ARE SUITABLE TO DISCHARGE AT SAUDI ARABIAN PORT.

OTHERWISE, A CERTIFICATE FOR CARGO GEAR AND TACKLE V ALID AS A T THE DATE OF LOADING SHOWING THE AGE OF THE VESSEL AND ITS YEAR OF BUILT ISSUED BY ONE THE FOLLOWING SOCIETIES, ORIGINAL OR COPY OF WHICH MUST ACCOMPANY THE DOCUMENTS PRESENTED FOR NEGOTIATION:

AMERICAN BUREAU OF SHIPPING BUREAU VERITAS

HELIENIC REGISTER OF SHIPPING DET NORSKE VERITAS LLOYD’S REGISTER OF SHIPPING GERMANISCHER LLOYD REGISTRO ITALIANO NA V ALE NIPPON KAIJI KYOKAI KOREAN REGISTER OF SHIPPING POLSKI REJESTR STA TKOW (REQUIREMENT OF CARGO GEAR AND TACKLE MAY BE DISREGARDED IN CASE OF CONTAINERS, BULK, ROLL-ON ROLL-OFF OR ANY OTHER GEARLESS VESSEL, PROVIDED A DECLARA TION IS OBTAINED FROM ONE OF THE ABOVE SOCIETES TO THE EFFECTTHAT THE CARRIER HAS NO GEAR ON BOARD)

11.DECALARATION OF NON-WOOD PACKING, OR CERTIFICATE OF

HEAT TREATMENT ISSUED BY GOVERNMENT AOTHORITY IF

WOOD PACKING INCLUDED.

ADDITIONAL CONTITIONS 47A

1. A DISCREPANCY FEE OF USD54,00 OR ITS EQUIV ALENT WILL BE

DEDUCTED FROM THE PROCEEDS IF DOCUMENTS ARE

PRESENTED WITH DISCREPANCY(IES).

2.INSURANCE COVERED BY THE APPLICANT.

3.ALL DOCUMENTS REQUIRED MUST BEAR THE NUMBER OF

THIS CREDIT.

4.ALL DOCUMENTS MUST BE MADE OUT IN ENGLISH

LANGUAGE.

5.EACH NEGOTIATION UNDER THIS CREDIT MUST BE NOTED ON

THE REVERSE OF THIS INSTRUMENT BY THE NEGOTIATING

BANK.

6.BILL OF LADING ISSUED BY FREIGHT FORWARDER NOT

ACCEPATABLE.

7.BILL OF LADING SHOWING COSTS ADDITIONAL TO THE

FREIGHT CHARGES NOT ACCEPTABLE.

8.REPRODUCED DOCUMENTS BY MEANS OF REPROGRAPHIC,

AUTOMA TED, COMPUTERIZED SYSTEM,CARBON COPES OR

PHOTOCOPY MACHINE ARE NOT ACCEPTABLE, UNLESS SUCH

DOCUMENTS BEARING ORIGINAL SIGNATURE(S) AND STAMP(S)

OF THE ISSUER(S) AND THE PARTY(IES)/ AUTHORITY(IES)

WHOM THEIR COUNTERSIGNATURE(S)/ CERTIFICATION/

LEGALIZATION ARE REQUIRED AS STIPULATED IN THIS LETTER

OF CREDIT.

9.NEGOTIATION/ PAYMENT UNDER RESERVE/GUARANTEE

STRICTL Y PROHIBITED.

10.DOCUMENTS ISSUED PRIOR TO THE DA TE OF THIS L/C NOT

ACCEPTABLE.

11.GOODS MUST BE CONTAINERIZED IN 40 FT REEFER

CONTAINERS(REEFER TEMPERATURE BELOW –18 DEGREE

CENTIGRADE) AND BILL OF LADING MUST EVIDENCE THE

SAME.

12.QUANTITY 5 PCT MORE OR LESS ARE ALLOWED

13.STALE BILLS OF LADING ARE NOT ACCEPTABLE.

14.NOTWITHSTANDING THE PROVISIONS OF UCP 500. IF WE GIVE

NOTICE OF REFUSAL OF DOCUMENTS PRESENTED UNDER THIS

CREDIT WE SHALL HOWEVER RETAIN THE RIGHT TO ACCEPT A

WAIVER OF DISCREPANCIES FROM THE APPLICANT AND SUBJECT

TO SUCH WAIVER BEING ACCEPTABLE TO US TO RELEASE

DOCUMENTS AGAINST THAT WAIVER WITHOUT REFERENCE TO

THE PRESENTER PROVIDED THAT NO WRITTEN INSTRUCTIONS TO

THE CONTRARY HA VE BEEN RECEIVED BY US FROM THE

PRESENTER BEFORE THE RELEASE OF THE DOCUMENTS. AND

SUCH RELEASE PRIOR TO RECEIPT OF CONTRARY INSTRUCTIONS

SHALL NOT CONSTITUTE A FAILURE ON OUR PART TO HOLD THE

COCUMENTS AT THE PRESENTER’S RISK AND DISPOSAL AND WE

WILL HA VE NO LIABILITY TO PRESENTER IN RESPECT OF ANY

SUCH RELEASE

CHARGES 71B: ALL BANING CHARGES OUTSIDE THE

OPENING BANK ARE FOR

BENEFICIARY’S ACCOUNT

PERIOD FOR PRESENTA TIONS 48: DOCUMENTS MUST BE PRESENTED

FOR NEGOTIATION WITHIN 15 DAYS

AFTER BILL OF LADING DATE, BUT

WITHIN THE V ALIDITY OF THIS

CREDIT.

CONFIRMATION INSTRUCTION 49: WITHOUT

ADVISE THROUGH BANK 57A: BANK OF CHINA, SHANDONG BR. REIMBURSEMENT BANK 53A: CITIBANK,NY,NEW YORK

INSTR. TO PAY/ACPT/NGG BANK 78:

1.ALL DOCUMENTS ARE TO BE FORWARDED TO BANQUE SAUDI

FRANSI, EASTERN REGIONAL MANAGEMENT, KING ABDUL

AZIZ STREET, P.O.BOX 397, ALKHOBAR 31952,SAUDI ARABIA,

TEL: (03) 8871111, FAX (03) 8821855, SEIFT: BSERSARIEST. IN

TWO CONSECUTIVE LOTS.

2.UPON RECEIPT OF ALL DOCUEMNTS IN ORDER, WE WILL DUL Y

HONOUR/ACCEPT THE DRAFTS AND EFFECT THE PAYMENT AS

INSTRUCTED AT MATURITY.

SENDER TO RECEIVER INFO 72: THIS LC IS SUBJECT TO UCP 1993 ICC

PUB. NO. 500. THIS IS OPERATIVE

INSTRUCMENT AND NO MAIL

CONFIRMATION WILL FOLLOW.

(信用证修改)

MT707------------------AMENDMENT TO A DOCUMENTARY CREDIT--------------------- SENDER’S REFERENCE 20: LC51G4C087333324

RECEIVER’S REFERENCE 21: NONREF

NUMBER OF AMENDMENT 26E: 01

BENIFICIARY (BEF. AMENDMENT) 59: XYZ CORPORATION

NEW DATE OF EXPIRY 31E: 050220

INCREASE OF D/C AMOUNT 32B: USD12300,00

NEW D/C AMOUNT AFTER AMEND 34B: USD38993.86

NARRA TIVE 79:

1.THE INCREASED AMOUNT IS TO COVER 24MT FROZEN

CHICKEN, BREAST MEAT, A GRADE, PACKING: 1KG X 12/CARTON,

2.THE INCREASED QUANTITY AS ABOVE MUST BE SHIPPED NOT

EARLIER THAN JAN. 31,2005.

SENDER TO RECEIVER INFO 72: /BENCON/

国际贸易信用证样本中英文对照

信用证样本中英文对照 Issue of a Documentary Credit、BKCHCNBJA08ESESSION:000ISN:000000 BANK OF CHINA LIAONING NO.5ZHONGSHANSQUARE ZHONGSHANDISTRICT DALIAN CHINA-------开证行 Destination Bank通知行 : KOEXKRSEXXXMESSAGETYPE:700 KOREAEXCHANGEBANK SEOUL 178.2KA,ULCHIRO,CHUNG-KO--------通知行 Type of Documentary Credit 40A IRREVOCABLE--------信用证性质为不可撤消 Letter of Credit Number 20 LC84E0081/99------信用证号码,一般做单时都要求注此号 Date of Issue开证日期 31G 990916------开证日期 Date and Place of Expiry(失效日期和地点) 31D 991015KOREA-------失效时间地点 Applicant Bank开证行 51D BANK OF CHINA LIAONING BRANCH----开证行 Applicant开证申请人 50 DALIANWEIDATRADINGCO.,LTD.------开证申请人 Beneficiary受益人 59 SANGYONG CORPORATION CPOBOX110 SEOUL KOREA-------受益人 Currency Code,Amount信用证总额 32B USD1,146,725.04-------信用证总额 Availablewith...by... 41

备用信用证格式

备用信用证格式 STANDBY LETTER OF CREDIT 备用信用证 To : Financing Bank 提供资金的银行 This is an irrevocable Standby Letter of Credit No. 此份为不可撤消备用信用证: issued on_____________ by China Minsheng Banking Corp. Ltd. ,xxx Branch(hereunder referred to as the “Issuing Bank”) 月____日开立。由中国民生银行xxx分行(以下简称为开证行)于____年____ Beneficiary : ___Financing Bank__________________________________ 受益人:___提供资金的银行___ Applicant : _______________________________________ 开证申请人:______ Amount : __(in words)__________________ ( __in figure____________________) 金额:(大写)______(数字______) Expiry Date :_________________at Issuing Bank’s Counter 到期日:______(以开证行柜台日期为准) . At the request and for account of (hereunder referred to as the “Applicant”)

信用证样本及翻译

信用证样本(1) Name of Issuing Bank The French Issuing Bank 38 rue Francois ler 75008 Paris, France To: The American Exporter Co. Inc. 17 Main Street Tampa, Florida Place and date of issue Paris, 1 January 2006 This Credit is advised through The American Advising Bank, 486 Commerce Avenue, Tampa, Florida Dear Sirs, By request of account of The French Importer Co. 89 rue du Comnerce Paris, France we hereby issue an Irrevocable Documentary Credit No. 12345 for USD 100,000 (say US Dollars one hundred thousand only) to expire on March 29, 2006 in American available with the American Advising Bank, Tampa by negotiation at sight against beneficiary's draft(s) drawn on The French Issuing Bank and the documents detailed herein: (1)Commercial Invoice, one original and three copies. (2)Multimodal Transport Document issued to the order of the French Importer Co. marked freight prepaid and notify XYZ Custom House Broker Inc. (3)Insurance Certificate covering the Institute Cargo Clauses and the Institute War and Strike Clauses for 110% of the invoice value blank endorsed. (4)Certificate of Origin evidence goods to be of U.S.A. Origin. (5)Packing List Evidencing transportation of Machines and spare parts as per pro-forma invoice number 657 dated January 3, 2006 from Tampa, Florida to Paris, France not late than March 15,2006- CIP INCOTERMS 1990. Partial shipment is allowed. Transshipment is allowed. Documents to be presented within 10 days after the date of the transport documents but within the validity of the credit. We hereby engage with drawers and/or bona fide holders that drafts drawn and negotiated in conformity with the terms of Credit will be fully honored on presentation. The number and the date of the Credit and the name of our bank must be quoted on all drafts required. Bank to bank instructions :… Yours faithfully The French Issuing Bank, Paris (signature)

信用证范本

第三节信用证付款 ?一、信用证的含义 ?二、信用证的当事人 ?三、信用证的内容 ?四、信用证的收付程序 ?五、信用证的性质和特点 ?六、信用证的种类 一、信用证的含义 UCP600 ?Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation. ?信用证是一种银行开立的有条件的承诺付款的书面文件。 Honour means: ?a. to pay at sight if the credit is available by sight payment. ?b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment. ?c. to a ccept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance. ?在国际贸易中,信用证通常是开证银行根据进口人的请求和指示,授权出口人凭所提交的符合信用证规定的单据,和开立以该行或其指定的银行为付款人的不超过规定金额的汇票(有的信用证可以不用汇票),向其或其指定的银行收款,并保证向出口人或其指定人进行付款,或承兑并支付出口人开立的汇票。 二、信用证的当事人 开证申请人(applicant) ?Applicant means the party on whose request the credit is issued. 开证行(opening bank; issuing bank) ?Issuing bank means the bank that issues a credit at the request of an applicant or on its own behalf.

信用证样本中英文对照1

跟单信用证:目前采用SWIFT格式,依据《UCP600》规定,例样如下: FROM:CITIBANK INTERNATIONAL,LOS ANGELES, U.S.A. 开证行:花旗银行美国洛杉矶 TO:BANK OF CHINA QINGDAO BRANCH,QINGDAO,CHINA 通知行:中国银行青岛分行中国青岛 :27: SEQUENCE OF TOTAL 1/1 :27: 电文序列、报文页次1/1 :40A: FORM OF DOCUMENTARY CREDIT IRREVOCABLE :40A: 跟单信用证格式不可撤销 :20: DOCUMENTARY CREDIT NUMBER CRED1523349 :20: 跟单信用证号CRED1523349 :3lC: DATE OF ISSUE 070906 :31C: 开证日期070906 :40E:APPLICABLE RULES UCP LATEST VERSION :40E: 适用规则《UCP》最新版本 :31D: DATE AND PLACE OF EXPIRY 071102 U.S.A. :31D: 有效期和有效地点071102 美国 :50: APPLICANT UNITED OVERSEAS TEXTILE CORP. 220E 8TH STREET A682 LOS ANGELES U.S.A. :50: 开证申请人美国大华纺织公司 220栋,8号街,682室 洛杉矶 美国 :59: BENEFICIARY QINGDAO QINGHAI CO.,LTD.

186 CHONGQIN ROAD QINGDAO 266002 CHINA :59: 受益人青岛青海有限公司 重庆路186号 中国青岛266002(邮编) :32B: CURRENCY CODE, AMOUNT: USD58575,00 :32B: 货币代码和金额58575.00美元 :39A:PRECENTAGE CREDIT AMOUNT TOLERANCE 10/10 :39A: 信用证金额上下浮动百分比10/10(10%) :41A: A V AILABLE WITH.. BY.. CITIUS33LAX BY DEFERRED PAYMENT :41A: 兑付方式花旗银行洛杉矶分行以延期付款方式兑付 :42P: DEFERRED PAYMENT DETAILS AT 90 DAYS AFTER B/L DATE :42P: 延期付款细节提单签发日后90天 :43P: PARTIAL SHIPMENTS NOT ALLOWED :43P: 分批装运不允许 :43T: TRANSSHIPMENT NOT ALLOWED :43T: 转运不允许 :44E: PORT OF LOADING/AIRPORT OF DEPARTURE QINGDAO PORT,CHINA :44E: 装运港/始发航空站中国青岛港 :44F: PORT OF DISCHARGE/AIRPORT OF DESTINATION LOS ANGELES PORT,U.S.A. :44F: 卸货港/目的航空站美国洛杉矶港 :44C: LATEST DATE OF SHIPMENT 071017 :44C: 最晚装运期071017 :45A: DESCRIPTION OF GOODS AND/OR SERVICES +TRADE TERMS: CIF LOS ANGELES PORT,U.S.A. ORIGIN:CHINA + 71000M OF 100% POLYESTER WOVEN DYED FABRIC

备用信用证格式

STANDBY LETTER OF CREDIT To : Financing Bank This is an Irrevocable Standby Letter of Credit No. issued on_____________ by China Minsheng Banking Corp. Ltd. ,xxx Branch Beneficiary : ___Financing Bank__________________________________ Applicant : _______________________________________ Amount : __(in words)__________________ ( __in figure____________________) Expiry Date :_________________a t Credit Issuing Bank’s Counter . At the request and for account of (hereunder referred to as the “Applicant”) we, China Minsheng Banking Corp. Ltd. ,xxx Branch, hereby establish our unconditional Irrevocable Standby Letter Of Credit No._______________ in favour of you (Financing Bank), for the maximum amount of ( __in figure__ USD xxx.xx_)_(in words Say United States Dollars xxx only) covering the principal sum with accrued interest, accrued default interest and other banking chargers which (hereinafter referred to as the “Borrower” ) owes to you as its indebtedness pursuant to the Loan Agreements/ Banking Facilities reference No. between the Borrower and you. This Standby Letter Of Credit is available with L/C Issuing Bank By Payment against presentation of: --Your demand claiming for payment by authenticated swift stating that the amount drawn hereunder represents and covers the unpaid indebtedness due to Financing Bank by _____(the name of borrower)____________________ arising out of the Loan Agreements/ Banking Facilities reference No. granted to them, showing the number and the date of this Irrevocable Standby Letter of Credit. . Other Terms And Conditions: - Partial and multiple drawings are permitted - All demands made hereunder must be presented to Credit Issuing Bank on or before the Expiry date __________ after which this standby letter of credit automatically becomes null and void. - Notwithstanding Article 36 of UCP 600, if this Irrevocable Standby Letter of Credit expires during an interruption of business as described in Article 36,we hereby specifically authorize and agree to effect payment if the claims drawn in respect of this Irrevocable Standby Letter of Credit is presented within 30days after the resumption of business. . Reimbursement Instruction: - On receipt of complied documents, we shall effect payment to you not exceeding the above maximum amount as per your payment instructions. . This Standby Letter of Credit is subject to the Uniform Customs and Practice for Documentary Credits (2007 revision, International Chamber of Commerce, Paris, France, Publication no. 600). We hereby engage with you that authenticated swift demand drawn under and in compliance with the terms of this Standby Letter of Credit will be duly honored upon presentation to us.

信用证样本(中英文对照)

信用证样本(中英文对照) 信用证样本: 以下信用证内容源自华利陶瓷厂与一塞浦路斯客户所开立并顺利支付的信用证TO:BANK OF CYPRUS LTD LETTERS OF CREDIT DEPARTMENT NTCOSIA COMMERCIAL OPERATIONS CENTER INTERNATIONAL DIVISION ****** ****** TEL:****** FAX:****** TELEX:2451 & 4933 KYPRIA CY SWIFT:BCYPCY2N DA TE:23 MARCH 2005 APPLICATION FOR THE ISSUANCE OF A LETTER OF CREDIT SWIFT MT700 SENT TO:MT700转送至 STANDARD CHARTERD BANK UNIT 1-8 52/F SHUN NIND SQUARE O1 W ANG COMMERCIAL CENTRE,SHEN NAN ROAD EAST,SHENZHEN 518008 - CHINA 渣打银行深圳分行 深南东路5002号 信兴广场地王商业大厦52楼1-8单元 电话:82461688 :27: SEQUENCE OF TOTAL序列号 1/1 指只有一张电文 :40A: FORM OF DOCUMENTARY CREDIT跟单信用证形式IRREVOCABLE 不可撤消的信用证 :20OCUMENTARY CREDIT NUMBER信用证号码 00143-01-0053557 :31C: DATE OF ISSUE开证日 如果这项没有填,则开证日期为电文的发送日期。 :31DA TE AND PLACE OF EXPIRY信用证有效期 050622 IN CHINA 050622在中国到期 :50: APPLICANT 信用证开证审请人

备用信用证格式

Form of standby letter of credit 备用信用证 At the request of _______(Hereunder referred to as the applicant )we________(address ________________) hereby issue our irrevocable standby letter of credit no.:__________on__________in favor of china everybright bank. for the amount of USD_____________only(united states dollats ___million thousand_____under the loan agreement NO.___________ between china everybright bank and the applicant. The standby letter of credit is available upon china everybright bank's presentation of swift message or tested telex certifying that the amount claimet under this standby letter of credit NO.__________represents and covers the unpaid indebtedness, interests and other charges thereon due to china everybright bank arising out of its ranting loan facility to the applicant(chich is equivalent to the principal amount of___plus accrued interests, and other bank charges payable by the applicant) we will effect payment to you within seven banking days upon receiving the swift or tested telex in compliance with the above terms. The standby letter of credit shall exprire on___ This stand by letter of credit is subject to the uniform customs and practice for documentary credit(1993 revision),and internatonal chamber of commerce publication NO.500. 在要求_______(以下统称为申请人 )we________ (地址 ________________) 在此问题,我们不可撤销的备用信用证,信用证号码.:__________ on__________(填写银行)中国everybright银行。 对于数额usd(金额)_____________only (美国dollats ___million thousand_____under了贷款协议。信用证号码.___________ 中美之间everybright银行和申请人。 备用信用证是可根据中国everybright银行的介绍迅速讯息或电传检验证明金额claimet根据本备用信用证no.__________represents等领域,涵盖未付债务,利益和其他收费 就此,由于中国everybright银行所产生的,其ranting贷款给申请人(chich相当于本金的利息of___plus累算利益,和其他银行的收费,由申请人) 我们将有关款项,你在7天内,银行收到后,迅速或测试电传遵守上述条款。

兴业银行备用信用证格式

附件四: FORM OF STANDBY LETTER OF CREDIT/GUARANTEE AT THE REQUEST OF (1) (HEREUNDER REFERED TO AS `THE APPLICANT'),WE HEREBY ISSUE OUR IRREVOCABLE STANDBY LETTER OF CREDIT/GUARANTEE NO. (2) IN YOUR FAVOUR FOR CREDIT FACILITIES GRANTED TO (3) (“BORROWER”)INCLUSIVE OF ALL ACCRUED INTERESTS AND CHARGES UP TO THE MAXIMUM AGGREGATE AMOUNT OF (4) WHICH ARE OR MAY BECOME PAYABLE TO YOU BY THE BORROWER UNDER THE LOAN AGREEMENT NO.___(5)_____BETWEEN YOU AND THE BORROWER. THIS STANDBY LETTER OF CREDIT/GUARANTEE IS AVAILABLE AGAINST PRESENTATION OF YOUR TESTED TELEX OR SWIFT TO US STATING THAT THE AMOUNT OF SUCH CLAIM(S) REPRESENTS AND COVERS THE UNPAID BALANCE OF INDEBTEDNESS IN CONNECTION WITH YOUR GRANTING LOAN FACILITY TO THE BORROWER. WE HEREBY UNDERTAKE THAT ALL CLAIM REQUEST PRESENTED UNDER AND IN COMPLIANCE WITH TERMS AND CONDITIONS OF THIS STANDBY LETTER OF CREDIT/GUARANTEE SHALL BE DULY HONOURED, AND WE SHALL WITHIN FIVE BANKING DAYS,REMIT THE PROCEEDS TO YOU IN ACCORDANCE WITH YOUR INSTRUCTION. THE BUYING RATE OF (6) TO RENMINBI QUOTED BY INDUSTRIAL BANK CO., LTD. ON THE DATE OF YOUR DRAWING SHALL BE USED FOR THE CALCULATION OF YOUR DRAWING AMOUNT.** PARTIAL DRAWINGS ARE ACCEPTABLE. OUR LIABILITY UNDER THIS STANDBY LETTER OF CREDIT/GUARANTEE SHALL BE REDUCED AUTOMATICALLY AND PROPORTIONALLY TO THE SUM PLUS INTEREST ALREADY PAID BY THE BORROWER AND/OR BY US. THIS STANDBY LETTER OF CREDIT/GUARANTEE WILL BE EFFECTIVE FROM (7) AND EXPIRE ON (8) AT THE COUNTER OF INDUSTRIAL BANK CO., LTD.____(9)_____BRANCH. THIS UNDERTAKING IS NOT SUBJECT TO ANY CONTRACT, AGREEMENT, CONDITION OR QUALIFICATION. OUR OBLIGATIONS AND LIABILITIES UNDER THIS STANDBY

备用信用证样本

备用信用证样本(交通银行的融资性备用信用证样本): To: Bank of communications, SHENYANG Branch From: XYZ BANK Date: 20 DECEMBER 2004 Standby Letter of Credit With reference to the loan agreement no. 2004HN028 (hereinafter referred to as "the agreement" ) signed between Bank of Communications, SHENYANG Branch (hereinafter referred to as "the lender" ) and LIAONING ABC CO., LTD (hereinafter referred to as "the borrower" )for a principal amount of RMB2,000,000 (in words),we hereby issue our irrevocable standby letter of credit no. in the lender's favor for amount of the HONGKONG AABBCC CORPORATION which has its registered office at AS 8 FL. 2SEC. CHARACTER RD. HONGKONG for an amount up to UNITED STA TES DOLLARS THREE MILLION ONLY.(USD3,000,000) which covers the principal amount of the agreement plus interest accrued from aforesaid principal amount and other charges all of which the borrower has undertaken to pay the lender. The exchange rate will be the buying rate of USD/RMB quoted by Bank of Communications on the date of our payment. In the case that the guaranteed amount is not sufficient to satisfy your claim due to the exchange rate fluctuation between USD and RMB we hereby agree to increase the amount of this standby L/C accordingly. Partial drawing and multiple drawing are allowed under this standby L/C. This standby letter of credit is available by sight payment. We engage with you that upon receipt of your draft(s) and your signed statement or tested telex statement or SWIFT stating that the amount in USD represents the unpaid balance of indebtedness due to you by the borrower, we will pay you within 7 banking days the amount specified in your statement or SWIFT. All drafts drawn hereunder must be marked drawn under XYZ Bank standby letter of credit no. dated 20 DECEMBER 2004. This standby letter of? is? credit? will come into effect on 20 DECEMBER 2004 and expire on 09 DECEMBER 2005 at the counter of bank of Communications , SHENYANG branch. This standby letter of credit is subject to Uniform Customs and Practice for Document Credits(1993 revision) International Chamber of Commerce Publication No.500. 案例来说明备用信用证是如何帮助公司融资的以及其中相应的风险。 中国公司A在上海投资某大型项目时碰到了资金短缺的问题,面临着选择:要么在短时间内筹集到资金并投入该项目,要么放弃该项目,但是如果选择放弃,A公司先期投入的资金则全部转为不可弥补的损失。经过深思熟虑,A公司决定向B银行贷款,继续该项目。B银行发放贷款的前提是借款人必须向银行提供与贷款相同数额的担保。但是,A公司没有可供担保的财产。 这时候,C公司出现了。C公司是一家美国的投资公司。在其为客户提供的融资工具中,备用信用证是被经常使用的一种方式。C公司为A公司设计的方案是这样的:假设A公司需要100万美元。C公司与A公司事先签订一个委托开证协议,由A公司委托C公司开出备用信用证,A公司支付一般相当于开证金额

信用证样本SWIFT

信用证样本 Own BIC/TID :II: ICBKCNBJZJP BIC identified as: INDUSTRIAL AND COMMERCIAL BANK OF CHINA, JINHUA CITY BRANCH NO 500 BAY1 NORTH ROAD YIWU CITY 321000 ZHEJIANG PROVINCE, CHINA SWIFT Message Type :MT: 700 Issue of Documentary Credit Correspondents BIC/TID :IO: MIDLGB22 3757 401965 980710 2242 N MIDLAND BANK PLC LONDON, U.K. Sequence of Total : 27: 1/1 Form of Documentary Credit :40A: NON TRANSFERABLE Documentary Credit Number : 20: LCBR82791 Date of Issue. :31C: 070701 Applicable Rules. :40E: UCP LATEST VERSION Date and Place of Expiry :31D: 070908 CHINA Applicant : 50: DDD Co., Ltd. UNIT 2208 22/F LAFORD CENTRE 888 WAITER WEST ROAD LONDON SE7 8NJ, U.K. Beneficiary :59: ZHEJIANG YIWU AAA CRAFTS FACTORY NO. 666 BINGW ANG ROAD, YIWU, ZHEJIANG, CHINA P. C. 3211000 Currency code, Amount :32B: USD25000,00 Available with---by---- :41D: ANY BANK BY NEGOTIATION Drafts at ...... :42C: AT SIGHT Drawee :42D: MIDLAND BANK PLC LONDON, U. K. FOR NET INVOICE V ALUE Partial Shipments :43P.. ALLOWED Transshipment :43T: NOT ALLOWED

信用证样本new(中英文对照)

以下信用证内容源自华利陶瓷厂与一塞浦路斯客户所开立并顺利支付的信用证TO:BANK OF CYPRUS LTD LETTERS OF CREDIT DEPARTMENT NTCOSIA COMMERCIAL OPERATIONS CENTER INTERNATIONAL DIVISION ****** ****** TEL:****** FAX:****** TELEX:2451 & 4933 KYPRIA CY SWIFT:BCYPCY2N DATE:23 MARCH 2005 APPLICATION FOR THE ISSUANCE OF A LETTER OF CREDIT SWIFT MT700 SENT TO:MT700转送至 STANDARD CHARTERD BANK UNIT 1-8 52/F SHUN NIND SQUARE O1 WANG COMMERCIAL CENTRE,SHEN NAN ROAD EAST,SHENZHEN 518008 - CHINA 渣打银行深圳分行 深南东路5002号 信兴广场地王商业大厦52楼1-8单元 电话: 27: SEQUENCE OF TOTAL序列号 1/1 指只有一张电文 :40A: FORM OF DOCUMENTARY CREDIT跟单信用证形式 IRREVOCABLE 不可撤消的信用证

:20OCUMENTARY CREDIT NUMBER信用证号码 007 :31C: DATE OF ISSUE开证日 如果这项没有填,则开证日期为电文的发送日期。 :31DATE AND PLACE OF EXPIRY信用证有效期 050622 IN CHINA 050622在中国到期 :50: APPLICANT 信用证开证审请人 ******* NICOSIA 较对应同发票上是一致的 :59: BENEFICIARY 受益人 CHAOZHOU HUALI CERAMICS FACTORY FENGYI INDUSTRIAL DISTRICT, GUXIANG TOWN, CHAOZHOU CITY,GUANGDONG PROVINCE,CHINA.潮州华利陶瓷洁具厂 :32B: CURRENCY CODE,AMOUNT 信用证项下的金额 USD***7841,89 :41D:AVAILABLE WITH....BY.... 议付适用银行 STANDARD CHARTERED BANK CHINA AND/OR AS BELOW 渣打银行或以下的 BY NEGOTIATION 任何议付行 42CRAFTS AT 开汇票 SIGHT 即期 :42A:DRAWEE 付款人 BCYPCY2NO10 BANK OF CYPRUS LTD 塞浦路斯的银行名 :43PARTIAL SHIPMENTS 是否允许分批装运 NOT ALLOWED 不可以 :43T:TRANSHIPMENT转运 ALLOWED允许

信用证开证申请书范文

信用证开证申请书范文 中国银行: 我公司已办妥一切进口手续,现请贵行按我公司开证申请书内容开出不可撤销跟单信用证,为此我公司愿不可撤销地承担有关责任如下: 一、我公司同意贵行依照国际商会第500号出版物《跟单信用证统一惯例》办理该信用证项下一切事宜,并同意承担由此产生的一切责任。 二、我公司保证按时向贵行支付该证项下的货款、手续费、利息及一切费用等(包括国外受益人拒绝承担的有关银行费用)所需的外汇和人民币资金。 三、我公司保证在贵行单到通知书中规定的期限之内通知贵行办理对外付款/承兑,否则贵行可认为我公司已接受单据,同意付款/承兑。 四、我公司保证在单证表面相符的条件下办理有关付款/承兑手续。如因单证有不符之处而拒绝付款/承兑,我公司保证在贵行单到通知书中规定的日期之前将全套单据如数退还贵行并附书面拒付理由,由贵行按国际惯例确定能否对外拒付。如贵行确定我公司所提拒付理由不成立,或虽然拒付理由成立,但我公司未能退回全套单据,或拒付单据退到贵行已超过单到通知书中规定的期限,贵行有权主动办理对外付款/承兑,并从我公司帐户中扣款。 五、该信用证及其项下业务往来函电及单据如因邮、电或其它方式传递过程中发生遗失、延误、错漏,贵行当不负责。 六、该信用证如需修改、由我公司向贵行提出书面申请,由贵行根据具体情况确定能否办理修改。我公司确认所有修改当由信用证受益人接受时才能生效。 七、我公司在收到贵行开出的信用证、修改书副本后,保证及时与原申请书核对,如有不符之处,保证在接到副本之日起,两个工作日内通知贵行。如未通知,当视为正确无误。 八、如因申请书字迹不清或词意含混而引起的一切后果由我公司负责。 开证申请人(签字盖章) 13-4-4