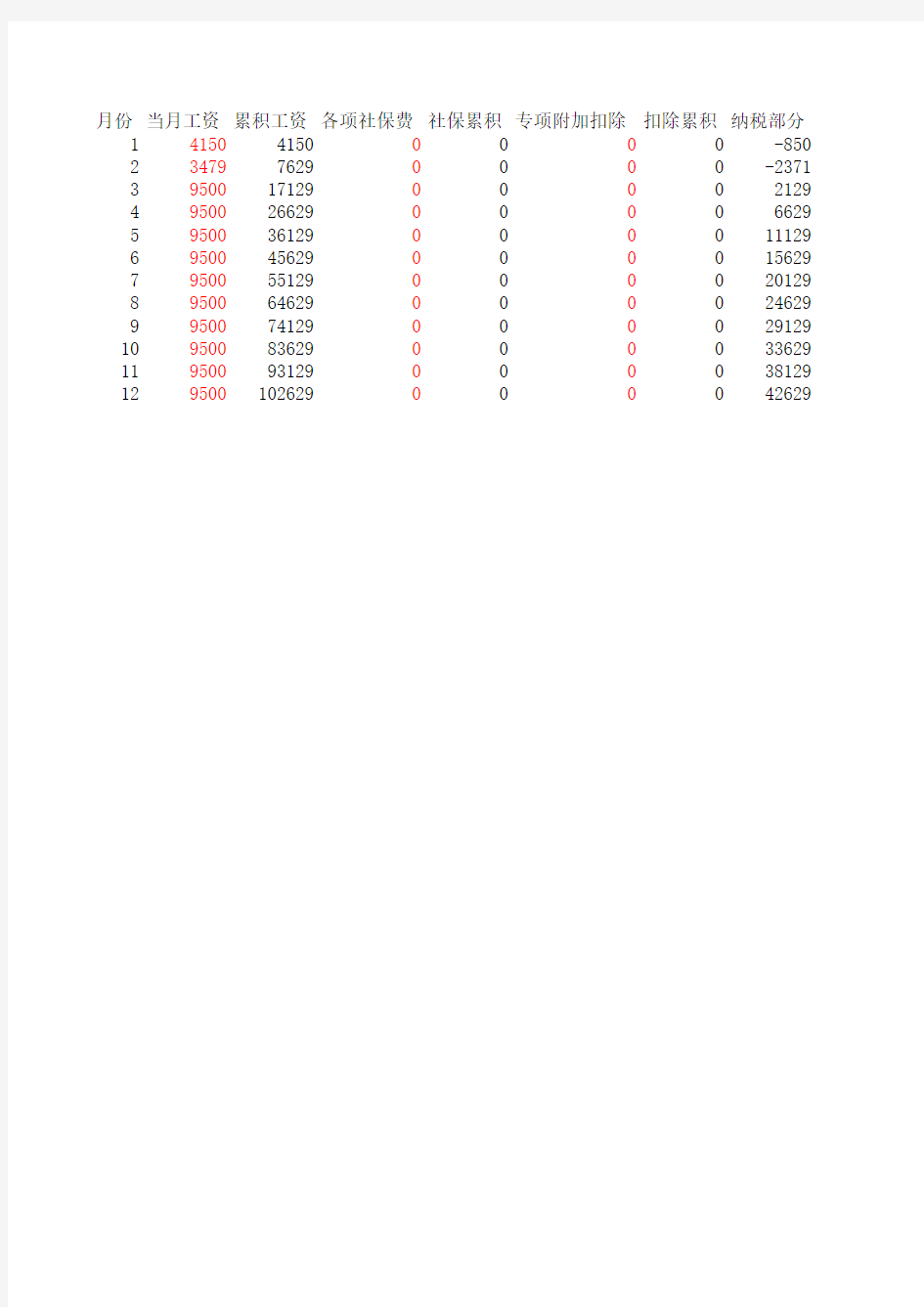

2019年新个税计算表(工资、逐月薪金)

月份当月工资累积工资各项社保费社保累积专项附加扣除扣除累积纳税部分1415041500000-850 2347976290000-2371 395001712900002129 495002662900006629 5950036129000011129 6950045629000015629 7950055129000020129 8950064629000024629 9950074129000029129 10950083629000033629 11950093129000038129 129500102629000042629

税率速算扣除数累积应交税款已交税款本月应补(退)税款本月税后收入3%0004150 3%00003479 3%063.87063.879436.13 3%0198.8763.871359365 3%0333.87198.871359365 3%0468.87333.871359365 3%0603.87468.871359365 3%0738.87603.871359365 3%0873.87738.871359365 3%01008.87873.871359365 10%25201292.91008.87284.039215.97 10%25201742.91292.94509050

相关主题