罗斯公司理财第九版第十二章课后答案1-17对应版

公司理财罗斯课后习题答案

公司理财罗斯课后习题答案集团标准化工作小组 [Q8QX9QT-X8QQB8Q8-NQ8QJ8-M8QMN]第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

Cha07罗斯公司理财第九版原版书课后习题

Cha07罗斯公司理财第九版原版书课后习题to abandon, and timing options.4. Decision trees represent an approach for valuing projects with these hidden, or real, options.Concept Questions1. Forecasting Risk What is forecasting risk? In general, would the degree of forecasting risk begreater for a new product or a cost-cutting proposal? Why?2. Sensitivity Analysis and Scenario Analysis What is the essential difference betweensensitivity analysis and scenario analysis?3. Marginal Cash Flows A coworker claims that looking at all this marginal this and incrementalthat is just a bunch of nonsense, and states, “Listen, if our average revenue doesn’t exceed our average cost, then we will have a negative cash flow, and we will go broke!” How do you respond?4. Break-Even Point As a shareholder of a firm that is contemplating a new project, would yoube more concerned with the accounting break-even point, the cash break-even point (the point at which operating cash flow is zero), or the financial break-even point? Why?5. Break-Even Point Assume a firm is considering a new project that requires an initialinvestment and has equal sales and costs over its life. Will the project reach the accounting, cash, or financial break-even point first? Which will it reach next? Last? Will this order always apply?6. Real Options Why does traditional NPV analysis tend to underestimate the true value of acapital budgeting project?7. Real Options The Mango Republic has just liberalized its markets and is now permittingforeign investors. Tesla Manufacturing has analyzed starting a project in the country and has determined that the project hasa negative NPV. Why might the company go ahead with the project? What type of option is most likely to add value to this project?8. Sensitivity Analysis and Breakeven How does sensitivity analysis interact with break-evenanalysis?9. Option to Wait An option can often have more than one source of value. Consider a loggingcompany. The company can log the timber today or wait another year (or more) to log the timber.What advantages would waiting one year potentially have?10. Project Analysis You are discussing a project analysis witha coworker. The project involvesreal options, such as expanding the project if successful, or abandoning the project if it fails. Your coworker makes the following statement: “This analysis is ridiculous. We looked at expanding or abandoning the project in two years, but there are many other options we should consider. For example, we could expand in one year, and expand further in two years. Or we could expand in one year, and abandon the project in two years. There are too many options for us to examine.Because of this, anything this analysis would give us is worthless.” How would you evaluate this statement? Considering that with any capital budgeting project there are an infinite number of real options, when do you stop the option analysis on an individual project?Questions and Problems: connect?BASIC (Questions 1–10)1. Sensitivity Analysis and Break-Even Point We are evaluating a project that costs$724,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 75,000 units per year. Price per unit is $39, variable cost per unit is $23, and fixed costs are $850,000 per year. The tax rate is 35 percent, and we require a 15 percent return on this project.1. Calculate the accounting break-even point.2. Calculate the base-case cash flow and NPV. What is the sensitivity of NPV to changes inthe sales figure? Explain what your answer tells you about a 500-unit decrease in projected sales.3. What is the sensitivity of OCF to changes in the variable cost figure? Explain what youranswer tells you about a $1 decrease in estimated variable costs.2. Scenario Analysis In the previous problem, suppose the projections given for price, quantity,variable costs, and fixed costs are all accurate to w ithin ±10 percent. Calculate the best-case and worst-case NPV figures.3. Calculating Breakeven In each of the following cases, find the unknown variable. Ignoretaxes.4. Financial Breakeven L.J.’s Toys Inc. just purchased a $250,000 machine to produce toy cars.The machine will be fully depreciated by the straight-line method over its five-year economic life.Each toy sells for $25. The variable cost per toy is $6, and the firm incurs fixed costs of $360,000 each year. The corporate tax rate for the company is 34 percent. The appropriate discount rate is12 percent. What is the financial break-even point for the project?5. Option to Wait Your company is deciding whether to invest in a new machine. The newmachine will increase cash flow by $340,000 per year. You believe the technology used in the machine has a 10-year life; in other words, no matter when you purchase the machine, it will be obsolete 10 years from today. The machine is currently priced at $1,800,000. The cost of the machine will decline by $130,000 per year until it reaches $1,150,000, where it will remain. If your required return is 12 percent, should you purchase the machine? If so, when should you purchase it?6. Decision Trees Ang Electronics, Inc., has developed a new DVDR. If the DVDR is successful,the present value of the payoff (when the product is brought to market) is $22 million. If the DVDR fails, the present value of the payoff is $9 million. If the product goes directly to market, there is a50 percent chance of success. Alternatively, Ang can delay the launch by one year and spend $1.5million to test market the DVDR. Test marketing would allow the firm to improve the product and increase the probability of success to 80 percent. The appropriate discount rate is 11 percent.Should the firm conduct test marketing?7. Decision Trees The manager for a growing firm is considering the launch of a new product. Ifthe product goes directly to market, there is a 50 percent chance of success. For $135,000 the manager can conduct a focus group that will increase the product’s chance of success to 65 percent. Alternatively, the manager has the option to pay a consulting firm $400,000 to research the market and refine the product. The consulting firm successfully launches new products 85 percent of the time. If the firm successfully launches the product, the payoff will be $1.5 million. If the product is a failure, the NPV is zero. Which action will result in the highest expected payoff to the firm?8. Decision Trees B&B has a new baby powder ready to market. If the firm goes directly to themarket with the product, there is only a 55 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $1.8 million. By going through research, B&B will be able to better target potential customers and will increase the probability of success to 70 percent. If successful, the baby powder will bring a present value profit (at time of initial selling) of $28 million. If unsuccessful, the present value payoff is only $4 million. Should the firm conduct customer segment research or go directly to market? The appropriate discount rate is15 percent.9. Financial Break-Even Analysis You are considering investing in a company that cultivatesabalone for sale to local restaurants. Use the following information:The discount rate for the company is 15 percent, the initial investment in equipment is $360,000, and the project’s economic life is seven years. Assume the equipment is depreciated on a straight-line basis over the project’s life.1. What is the accounting break-even level for the project?2. What is the financial break-even level for the project?10. Financial Breakeven Niko has purchased a brand new machine to produce its High Flight lineof shoes. The machine has an economic life of five years. The depreciation schedule for the machine is straight-line with no salvage value. The machine costs $390,000. The sales price per pair of shoes is $60, while the variable cost is $14. $185,000 of fixed costs per year are attributed to the machine. Assume that the corporate tax rate is 34 percent and the appropriate discount rate is 8 percent. What is the financial break-even point?INTERMEDIATE (Questions 11–25)11. Break-Even Intuition Consider a project with a required return of R percent that costs $I andwill last for N years. The project uses straight-line depreciation to zero over the N-year life; there are neither salvage value nor net working capital requirements.1. At the accounting break-even level of output, what is the IRR of this project? The paybackperiod? The NPV?2. At the cash break-even level of output, what is the IRR of this project? The paybackperiod? The NPV?3. At the financial break-even level of output, what is the IRR of this project? The paybackperiod? The NPV?12. Sensitivity Analysis Consider a four-year project with the following information: Initial fixedasset investment = $380,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $54; variable costs = $42; fixed costs = $185,000; quantity sold = 90,000 units; tax rate = 34 percent. How sensitive is OCF to changes in quantity sold?13. Project Analysis You are considering a new product launch. The project will cost $960,000,have a four-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 240 units per year; price per unit will be $25,000; variable cost per unit will be $19,500; and fixed costs will be $830,000 per year. The required return on the project is 15 percent, and the relevant tax rate is 35 percent.1. Based on your experience, you think the unit sales, variable cost, and fixed costprojections given here are probably accurate to within ±10 percent. What are the upper and lower bounds for these projections? What is the base-case NPV? What are the best-case and worst-case scenarios?2. Evaluate the sensitivity of your base-case NPV to changes in fixed costs.3. What is the accounting break-even level of output for this project?14. Project Analysis McGilla Golf has decided to sell a newline of golf clubs. The clubs will sell for$750 per set and have a variable cost of $390 per set. The company has spent $150,000 for a marketing study that determined the company will sell 55,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 12,000 sets of its high-priced clubs. The high-priced clubs sell at $1,100 and have variable costs of $620. The company will also increase sales of its cheap clubs by 15,000 sets. The cheap clubs sell for $400 and have variable costs of $210 per set. The fixed costs each year will be $8,100,000. The company has also spent $1,000,000 on research and development for the new clubs. The plant and equipment required will cost $18,900,000 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $1,400,000 that will be returned at the end of the project. The tax rate is 40 percent, and the cost of capital is 14 percent. Calculate the payback period, the NPV, and the IRR.15. Scenario Analysis In the previous problem, you feel that the values are accurate to withinonly ±10 percent. What are the best-case and worst-case NPVs? (Hint: The price and variable costs for the two existing sets of clubs are known with certainty; only the sales gained or lost are uncertain.)16. Sensitivity Analysis McGilla Golf would like to know the sensitivity of NPV to changes in theprice of the new clubs and the quantity of new clubs sold. What is the sensitivity of the NPV to each of these variables?17. Abandonment Value We are examining a new project. We expect to sell 9,000 units per yearat $50 net cash flow apiece for the next 10 years. In otherwords, the annual operating cash flow is projected to be $50 × 9,000 = $450,000. The relevant discount rate is 16 percent, and the initial investment required is $1,900,000.1. What is the base-case NPV?2. After the first year, the project can be dismantled and sold for $1,300,000. If expectedsales are revised based on the first year’s performance, when would it make sense to abandon the investment? In other words, at what level of expected sales would it make sense to abandon the project?3. Explain how the $1,300,000 abandonment value can be viewed as the opportunity cost ofkeeping the project in one year.18. Abandonment In the previous problem, suppose you think it is likely that expected sales willbe revised upward to 11,000 units if the first year is a success and revised downward to 4,000 units if the first year is not a success.1. If success and failure are equally likely, what is the NPV of the project? Consider thepossibility of abandonment in answering.2. What is the value of the option to abandon?19. Abandonment and Expansion In the previous problem, suppose the scale of the project canbe doubled in one year in the sense that twice as many units can be produced and sold. Naturally, expansion would be desirable only if the project were a success. This implies that if the project is a success, projected sales after expansion will be 22,000. Again assuming that success and failure are equally likely,what is the NPV of the project? Note that abandonment is still an option if the project is a failure. What is the value of the option to expand?20. Break-Even Analysis Your buddy comes to you with a sure-fire way to make some quickmoney and help pay off your student loans. His idea is to sell T-shirts with the words “I get” on them. “You get it?” He says, “You see all those bumper stickers and T-shirts that say ‘got milk’ or ‘got surf.’ So this says, ‘I get.’ It’s funn y! All we have to do is buy a used silk screen press for $3,200 and we are in business!” Assume there are no fixed costs, and you depreciate the $3,200 in the first period. Taxes are 30 percent.1. What is the accounting break-even point if each shirt costs $7 to make and you can sellthem for $10 apiece?Now assume one year has passed and you have sold 5,000 shirts! You find out that the Dairy Farmers of America have copyrighted the “got milk” slogan and are requiring you to pay $12,000 to continue operations. You expect this craze will last for another three years and that your discount rate is 12 percent.2. What is the financial break-even point for your enterprise now?21. Decision Trees Young screenwriter Carl Draper has just finished his first script. It has action,drama, and humor, and he thinks it will be a blockbuster. He takes the script to every motion picture studio in town and tries to sell it but to no avail. Finally, ACME studios offers to buy the script for either (a) $12,000 or (b) 1 pe rcent of the movie’s profits. There are two decisions the studio will have to make. First is to decide if the script is good or bad, and second if the movieis good or bad. First, there is a 90 percent chance that the script is bad. If it is bad, the studio does nothing more and throws the script out. If the script is good, they will shoot the movie. After the movie is shot, the studio will review it, and there is a 70 percent chance that the movie is bad. If the movie is bad, the movie will not be promoted and will not turn a profit. If the movie is good, the studio will promote heavily; the average profit for this type of movie is $20 million. Carl rejects the $12,000 and says he wants the 1 percent of profits. Was this a good decision by Carl?22. Option to Wait Hickock Mining is evaluating when to open a gold mine. The mine has 60,000ounces of gold left that can be mined, and mining operations will produce 7,500 ounces per year.The required return on the gold mine is 12 percent, and it will cost $14 million to open the mine.When the mine is opened, the company will sign a contract that will guarantee the price of gold for the remaining life of the mine. If the mine is opened today, each ounce of gold will generate an aftertax cash flow of $450 per ounce. If the company waits one year, there is a 60 percent probability that the contract price will generate an aftertax cash flow of $500 per ounce and a 40 percent probability that the aftertax cash flow will be $410 per ounce. What is the value of the option to wait?23. Abandonment Decisions Allied Products, Inc., is considering a new product launch. The firmexpects to have an annual operating cash flow of $22 million for the next 10 years. Allied Products uses a discount rate of 19 percent for new product launches. The initial investment is $84 million.Assume that the project has no salvage value at the end of its economic life.1. What is the NPV of the new product?2. After the first year, the project can be dismantled and sold for $30 million. If theestimates of remaining cash flows are revised based on the first year’s experience, at what level of expected cash flows does it make sense to abandon the project?24. Expansion Decisions Applied Nanotech is thinking about introducing a new surface cleaningmachine. The marketing department has come up with the estimate that Applied Nanotech can sell15 units per year at $410,000 net cash flow per unit for the next five years. The engineeringdepartment has come up with the estimate that developing the machine will take a $17 million initial investment. The finance department has estimated that a 25 percent discount rate should beused.1. What is the base-case NPV?2. If unsuccessful, after the first year the project can be dismantled and will have an aftertaxsalvage value of $11 million. Also, after the first year, expected cash flows will be revised up to 20 units per year or to 0 units, with equal probability. What is the revised NPV?25. Scenario Analysis You are the financial analyst for a tennis racket manufacturer. Thecompany is considering using a graphitelike material in its tennis rackets. The company has estimated the information in the following table about the market for a racket with the newmaterial. The company expects to sell the racket for six years. The equipment required for the project has no salvage value. The required return for projects of this type is 13 percent, and the company has a 40 percent tax rate. Should you recommend the project?CHALLENGE (Questions 26–30)26. Scenario Analysis Consider a project to supply Detroit with 55,000 tons of machine screwsannually for automobile production. You will need an initial $1,700,000 investment in threading equipment to get the project started; the project will last for five years. The accounting department estimates that annual fixed costs will be $520,000 and that variable costs should be $220 per ton;accounting will depreciate the initial fixed asset investment straight-line to zero over the five-year project life. It also estimates a salvage value of $300,000 after dismantling costs. The marketing department estimates that the automakers will let the contract at a selling price of $245 per ton.The engineering department estimates you will need an initial net working capital investment of $600,000. You require a 13 percent return and face a marginal tax rate of 38 percent on this project.1. What is the estimated OCF for this project? The NPV? Should you pursue this project?2. Suppose you believe that the accounting department’sinitial cost and salvage valueprojections are accurate only to within ±15 percent; the marketing department’s price estimate is accurate only to within ±10 percent; and the engineering department’s net working capital estimate is accurate only to within ±5 p ercent. What is your worst-case scenario for this project? Your best-case scenario? Do you still want to pursue the project? 27. Sensitivity Analysis In Problem 26, suppose you’re confident about your own projections, butyou’re a little unsure about Detroit’s actual machine screw requirements. What is the sensitivity of the project OCF to changes in the quantity supplied? What about the sensitivity of NPV to changes in quantity supplied? Given the sensitivity number you calculated, is there some minimum level of output below which you wouldn’t want to operate? Why?28. Abandonment Decisions Consider the following project for Hand Clapper, Inc. The companyis considering a four-year project to manufacture clap-command garage door openers. This project requires an initial investment of $10 million that will be depreciated straight-line to zero over the project’s life. An initial investment in net working capital of $1.3 million is required to support spare parts inventory; this cost is fully recoverable whenever the project ends. The company believes it can generate $7.35 million in pretax revenues with $2.4 million in total pretax operating costs. The tax rate is 38 percent, and the discount rate is 16 percent. The market value of the equipment over the life of the project is as follows:Lumber is sold by the company for its “pond value.” Pond value is the amount a mill will pay for a log delivered to the mill location. The price paid for logs delivered to a mill is quoted in dollars per thousands of board feet (MBF), and the price depends on the grade of the logs. The forest Bunyan Lumber is evaluatingwas planted by the company 20 years ago and is made up entirely of Douglas fir trees. The table here shows the current price per MBF for the three grades of timber the company feels will come from the stand:Steve believes that the pond value of lumber will increase at the inflation rate. The company is planning to thin the forest today, and it expects to realize a positive cash flow of $1,000 per acre from thinning. The thinning is done to increase the growth rate of the remaining trees, and it is always done 20 years following a planting.The major decision the company faces is when to log the forest. When the company logs the forest, it will immediately replant saplings, which will allow for a future harvest. The longer the forest is allowed to grow, the larger the harvest becomes per acre. Additionally, an older forest has a higher grade of timber. Steve has compiled the following table with the expected harvest per acre in thousands of board feet, along with the breakdown of the timber grades:The company expects to lose 5 percent of the timber it cuts due to defects and breakage.The forest will be clear-cut when the company harvests the timber. This method of harvesting allows for faster growth of replanted trees. All of the harvesting, processing, replanting, andtransportation are to be handled by subcontractors hired by Bunyan Lumber. The cost of the logging is expected to be $140 per MBF. A road system has to be constructed and is expected to cost $50 per MBF on average. Sales preparation and administrative costs, excluding office overhead costs, are expected to be $18 per MBF.As soon as the harvesting is complete, the company will reforest the land. Reforesting costs include the following:All costs are expected to increase at the inflation rate.Assume all cash flows occur at the year of harvest. For example, if the company begins harvesting the timber 20 years from today, the cash flow from the harvest will be received 20 years from today. When the company logs the land, it will immediately replant the land with new saplings. The harvest period chosen will be repeated for the foreseeable future. The company’s nominal required return is 10 percent, and the inflation rate is expected to be 3.7 percent per year. Bunyan Lumber has a 35 percent tax rate.Clear-cutting is a controversial method of forest management. To obtain the necessary permits, Bunyan Lumber has agreed to contribute to a conservation fund every time it harvests the lumber. If the company harvested the forest today, the required contribution would be $250,000. The company has agreed that the required contribution will grow by 3.2 percent per year. When should the company harvest the forest?。

Cha08 罗斯公司理财第九版原版书课后习题

Earlier in the chapter, we saw how bonds were rated based on their credit risk. What you will find if you start looking at bonds of different ratings is that lower-rated bonds have higher yields.We stated earlier in this chapter that a bond’s yield is calculated assuming that all the promised payments will be made. As a result, it is really a promised yield, and it may or may not be what you will earn. In particular, if the issuer defaults, your actual yield will be lower, probably much lower. This fact is particularly important when it comes to junk bonds. Thanks to a clever bit of marketing, such bonds are now commonly called high-yield bonds, which has a much nicer ring to it; but now you recognize that these are really high promised yield bonds.Next, recall that we discussed earlier how municipal bonds are free from most taxes and, as a result, have much lower yields than taxable bonds. Investors demand the extra yield on a taxable bond as compensation for the unfavorable tax treatment. This extra compensation is the taxability premium.Finally, bonds have varying degrees of liquidity. As we discussed earlier, there are an enormous number of bond issues, most of which do not trade on a regular basis. As a result, if you wanted to sell quickly, you would probably not get as good a price as you could otherwise. Investors prefer liquid assets to illiquid ones, so they demand a liquidity premium on top of all the other premiums we have discussed. As a result, all else being the same, less liquid bonds will have higher yields than more liquid bonds.ConclusionIf we combine everything we have discussed, we find that bond yields represent the combined effect of no fewer than six factors. The first is the real rate of interest. On top of the real rate are five premiums representing compensation for (1) expected future inflation, (2) interest rate risk, (3) default risk, (4) taxability, and (5) lack of liquidity. As a result, determining the appropriate yield on a bond requires careful analysis of each of these factors.Summary and ConclusionsThis chapter has explored bonds, bond yields, and interest rates. We saw that:1. Determining bond prices and yields is an application of basic discounted cash flow principles.2. Bond values move in the direction opposite that of interest rates, leading to potential gains orlosses for bond investors.3. Bonds are rated based on their default risk. Some bonds, such as Treasury bonds, have no riskof default, whereas so-called junk bonds have substantial default risk.4. Almost all bond trading is OTC, with little or no market transparency in many cases. As a result,bond price and volume information can be difficult to find for some types of bonds.5. Bond yields and interest rates reflect six different factors: the real interest rate and fivepremiums that investors demand as compensation for inflation, interest rate risk, default risk, taxability, and lack of liquidity.In closing, we note that bonds are a vital source of financing to governments and corporations of all types. Bond prices and yields are a rich subject, and our one chapter, necessarily, touches on only the most important concepts and ideas. There is a great deal more we could say, but, instead, we will move on to stocks in our next chapter.Concept Questions1. Treasury Bonds Is it true that a U.S. Treasury security is risk-free?2. Interest Rate Risk Which has greater interest rate risk, a 30-year Treasury bond or a 30-year21. Using Bond Quotes Suppose the following bond quote for IOU Corporation appears in thefinancial page of today’s newspaper. Assume the bond has a face value of $1,000 and the current date is April 15, 2010. What is the yield to maturity of the bond? What is the current yield?22. Finding the Maturity You’ve just found a 10 percent coupon bond on the market that sells forpar value. What is the maturity on this bond?CHALLENGE (Questions 23–30)23. Components of Bond Returns Bond P is a premium bond with a 9 percent coupon. Bond D isa 5 percent coupon bond currently selling at a discount. Both bonds make annual payments, havea YTM of 7 percent, and have five years to maturity. What is the current yield for Bond P? For BondD? If interest rates remain unchanged, what is the expected capital gains yield over the next year for Bond P? For Bond D? Explain your answers and the interrelationship among the various types of yields.24. Holding Period Yield The YTM on a bond is the interest rate you earn on your investment ifinterest rates don’t change. If you actually sell the bond before it matures, your realized return is known as the holding period yield (HPY).1. Suppose that today you buy a 9 percent annual coupon bond for $1,140. The bond has 10years to maturity. What rate of return do you expect to earn on your investment?2. Two years from now, the YTM on your bond has declined by 1 percent, and you decide tosell. What price will your bond sell for? What is the HPY on your investment? Compare this yield to the YTM when you first bought the bond. Why are they different?25. Valuing Bonds The Morgan Corporation has two different bonds currently outstanding. Bond Mhas a face value of $20,000 and matures in 20 years. The bond makes no payments for the first six years, then pays $800 every six months over the subsequent eight years, and finally pays $1,000 every six months over the last six years. Bond N also has a face value of $20,000 and a maturity of20 years; it makes no coupon payments over the life of the bond. If the required return on boththese bonds is 8 percent compounded semiannually, what is the current price of Bond M? Of Bond N?26. R eal Cash Flows When Marilyn Monroe died, ex-husband Joe DiMaggio vowed to place freshflowers on her grave every Sunday as long as he lived. The week after she died in 1962, a bunch of fresh flowers that the former baseball player thought appropriate for the star cost about $8.Based on actuarial tables, “Joltin’ Joe” could expect to live for 30 years after the actress died.Assume that the EAR is 10.7 percent. Also, assume that the price of the flowers will increase at 3.5 percent per year, when expressed as an EAR. Assuming that each year has exactly 52 weeks, what is the present value of this commitment? Joe began purchasing flowers the week after Marilyn died.27. Real Cash Flows You are planning to save for retirement over the next 30 years. To save forretirement, you will invest $800 a month in a stock account in real dollars and $400 a month in a bond account in real dollars. The effective annual return of the stock account is expected to be 12 percent, and the bond account will earn 7 percent. When you retire, you will combine your money into an account with an 8 percent effective return. The inflation rate over this period is expected to be 4 percent. How much can you withdraw each month from your account in real terms assuminga 25-year withdrawal period? What is the nominal dollar amount of your last withdrawal?28. Real Cash Flows Paul Adams owns a health club in downtown Los Angeles. He charges hiscustomers an annual fee of $500 and has an existing customer base of 500. Paul plans to raise the annual fee by 6 percent every year and expects the club membership to grow at a constant rate of3 percent for the next five years. The overall expenses of running the health club are $75,000 ayear and are expected to grow at the inflation rate of 2 percent annually. After five years, Paul2. How many of the coupon bonds must East Coast Yachts issue to raise the $40 million? Howmany of the zeroes must it issue?3. In 20 years, what will be the principal repayment due if East Coast Yachts issues the couponbonds? What if it issues the zeroes?4. What are the company’s considerations in issuing a coupon bond compared to a zero couponbond?5. Suppose East Coast Yachts issues the coupon bonds with a make-whole call provision. Themake-whole call rate is the Treasury rate plus .40 percent. If East Coast calls the bonds in 7 years when the Treasury rate is 5.6 percent, what is the call price of the bond? What if it is 9.1 percent?6. Are investors really made whole with a make-whole call provision?7. After considering all the relevant factors, would you recommend a zero coupon issue or aregular coupon issue? Why? Would you recommend an ordinary call feature or a make-whole call feature? Why?。

公司理财第九版罗斯课后案例答案 Case Solutions Corporate Finance

公司理财第九版罗斯课后案例答案 Case Solutions CorporateFinance1. 案例一:公司资金需求分析问题:一家公司需要资金支持其新项目。

通过分析现金流量,推断该公司是否需要向外部借款或筹集其他资金。

解答:为了确定公司是否需要外部资金,我们需要分析公司的现金流量状况。

首先,我们需要计算公司的净现金流量(净收入加上非现金项目)。

然后,我们需要将净现金流量与项目的投资现金流量进行对比。

假设公司预计在项目开始时投资100万美元,并在项目运营期为5年。

预计该项目每年将产生50万美元的净现金流量。

现在,我们需要进行以下计算:净现金流量 = 年度现金流量 - 年度投资现金流量年度投资现金流量 = 100万美元年度现金流量 = 50万美元净现金流量 = 50万美元 - 100万美元 = -50万美元根据计算结果,公司的净现金流量为负数(即净现金流出),意味着公司每年都会亏损50万美元。

因此,公司需要从外部筹集资金以支持项目的运营。

2. 案例二:公司股权融资问题:一家公司正在考虑通过股权融资来筹集资金。

根据公司的财务数据和资本结构分析,我们需要确定公司最佳的股权融资方案。

解答:为了确定最佳的股权融资方案,我们需要参考公司的财务数据和资本结构分析。

首先,我们需要计算公司的资本结构比例,即股本占总资本的比例。

然后,我们将不同的股权融资方案与资本结构比例进行对比,选择最佳的方案。

假设公司当前的资本结构比例为60%的股本和40%的债务,在当前的资本结构下,公司的加权平均资本成本(WACC)为10%。

现在,我们需要进行以下计算:•方案一:以新股发行筹集1000万美元,并将其用于项目投资。

在这种方案下,公司的资本结构比例将发生变化。

假设公司的股本增加至80%,债务比例减少至20%。

根据资本结构比例的变化,WACC也将发生变化。

新的WACC可以通过以下公式计算得出:新的WACC = (股本比例 * 股本成本) + (债务比例 * 债务成本)假设公司的股本成本为12%,债务成本为8%:新的WACC = (0.8 * 12%) + (0.2 * 8%) = 9.6%•方案二:以新股发行筹集5000万美元,并将其用于项目投资。

罗斯《公司理财》第9版英文原书课后部分章节答案

罗斯《公司理财》第9版精要版英文原书课后部分章节答案详细»1 / 17 CH5 11,13,18,19,20 11. To find the PV of a lump sum, we use: PV = FV / (1 + r) t PV = $1,000,000 / (1.10) 80 = $488.19 13. To answer this question, we can use either the FV or the PV formula. Both will give the same answer since they are the inverse of each other. We will use the FV formula, that is: FV = PV(1 + r) t Solving for r, we get: r = (FV / PV) 1 / t –1 r = ($1,260,000 / $150) 1/112 – 1 = .0840 or 8.40% To find the FV of the first prize, we use: FV = PV(1 + r) t FV = $1,260,000(1.0840) 33 = $18,056,409.94 18. To find the FV of a lump sum, we use: FV = PV(1 + r) t FV = $4,000(1.11) 45 = $438,120.97 FV = $4,000(1.11) 35 = $154,299.40 Better start early! 19. We need to find the FV of a lump sum. However, the money will only be invested for six years, so the number of periods is six. FV = PV(1 + r) t FV = $20,000(1.084)6 = $32,449.33 20. To answer this question, we can use either the FV or the PV formula. Both will give the same answer since they are the inverse of each other. We will use the FV formula, that is: FV = PV(1 + r) t Solving for t, we get: t = ln(FV / PV) / ln(1 + r) t = ln($75,000 / $10,000) / ln(1.11) = 19.31 So, the money must be invested for 19.31 years. However, you will not receive the money for another two years. From now, you’ll wait: 2 years + 19.31 years = 21.31 years CH6 16,24,27,42,58 16. For this problem, we simply need to find the FV of a lump sum using the equation: FV = PV(1 + r) t 2 / 17 It is important to note that compounding occurs semiannually. To account for this, we will divide the interest rate by two (the number of compounding periods in a year), and multiply the number of periods by two. Doing so, we get: FV = $2,100[1 + (.084/2)] 34 = $8,505.93 24. This problem requires us to find the FV A. The equation to find the FV A is: FV A = C{[(1 + r) t – 1] / r} FV A = $300[{[1 + (.10/12) ] 360 – 1} / (.10/12)] = $678,146.38 27. The cash flows are annual and the compounding period is quarterly, so we need to calculate the EAR to make the interest rate comparable with the timing of the cash flows. Using the equation for the EAR, we get: EAR = [1 + (APR / m)] m – 1 EAR = [1 + (.11/4)] 4 – 1 = .1146 or 11.46% And now we use the EAR to find the PV of each cash flow as a lump sum and add them together: PV = $725 / 1.1146 + $980 / 1.1146 2 + $1,360 / 1.1146 4 = $2,320.36 42. The amount of principal paid on the loan is the PV of the monthly payments you make. So, the present value of the $1,150 monthly payments is: PV A = $1,150[(1 – {1 / [1 + (.0635/12)]} 360 ) / (.0635/12)] = $184,817.42 The monthly payments of $1,150 will amount to a principal payment of $184,817.42. The amount of principal you will still owe is: $240,000 – 184,817.42 = $55,182.58 This remaining principal amount will increase at the interest rate on the loan until the end of the loan period. So the balloon payment in 30 years, which is the FV of the remaining principal will be: Balloon payment = $55,182.58[1 + (.0635/12)] 360 = $368,936.54 58. To answer this question, we should find the PV of both options, and compare them. Since we are purchasing the car, the lowest PV is the best option. The PV of the leasing is simply the PV of the lease payments, plus the $99. The interest rate we would use for the leasing option is the same as the interest rate of the loan. The PV of leasing is: PV = $99 + $450{1 –[1 / (1 + .07/12) 12(3) ]} / (.07/12) = $14,672.91 The PV of purchasing the car is the current price of the car minus the PV of the resale price. The PV of the resale price is: PV = $23,000 / [1 + (.07/12)] 12(3) = $18,654.82 The PV of the decision to purchase is: $32,000 – 18,654.82 = $13,345.18 3 / 17 In this case, it is cheaper to buy the car than leasing it since the PV of the purchase cash flows is lower. To find the breakeven resale price, we need to find the resale price that makes the PV of the two options the same. In other words, the PV of the decision to buy should be: $32,000 – PV of resale price = $14,672.91 PV of resale price = $17,327.09 The resale price that would make the PV of the lease versus buy decision is the FV ofthis value, so: Breakeven resale price = $17,327.09[1 + (.07/12)] 12(3) = $21,363.01 CH7 3,18,21,22,31 3. The price of any bond is the PV of the interest payment, plus the PV of the par value. Notice this problem assumes an annual coupon. The price of the bond will be: P = $75({1 – [1/(1 + .0875)] 10 } / .0875) + $1,000[1 / (1 + .0875) 10 ] = $918.89 We would like to introduce shorthand notation here. Rather than write (or type, as the case may be) the entire equation for the PV of a lump sum, or the PV A equation, it is common to abbreviate the equations as: PVIF R,t = 1 / (1 + r) t which stands for Present V alue Interest Factor PVIFA R,t = ({1 – [1/(1 + r)] t } / r ) which stands for Present V alue Interest Factor of an Annuity These abbreviations are short hand notation for the equations in which the interest rate and the number of periods are substituted into the equation and solved. We will use this shorthand notation in remainder of the solutions key. 18. The bond price equation for this bond is: P 0 = $1,068 = $46(PVIFA R%,18 ) + $1,000(PVIF R%,18 ) Using a spreadsheet, financial calculator, or trial and error we find: R = 4.06% This is thesemiannual interest rate, so the YTM is: YTM = 2 4.06% = 8.12% The current yield is:Current yield = Annual coupon payment / Price = $92 / $1,068 = .0861 or 8.61% The effective annual yield is the same as the EAR, so using the EAR equation from the previous chapter: Effective annual yield = (1 + 0.0406) 2 – 1 = .0829 or 8.29% 20. Accrued interest is the coupon payment for the period times the fraction of the period that has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are four months until the next coupon payment, so two months have passed since the last coupon payment. The accrued interest for the bond is: Accrued interest = $74/2 × 2/6 = $12.33 And we calculate the clean price as: 4 / 17 Clean price = Dirty price –Accrued interest = $968 –12.33 = $955.67 21. Accrued interest is the coupon payment for the period times the fraction of the period that has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are two months until the next coupon payment, so four months have passed since the last coupon payment. The accrued interest for the bond is: Accrued interest = $68/2 × 4/6 = $22.67 And we calculate the dirty price as: Dirty price = Clean price + Accrued interest = $1,073 + 22.67 = $1,095.67 22. To find the number of years to maturity for the bond, we need to find the price of the bond. Since we already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. We are given the current yield of the bond, so we can calculate the price as: Current yield = .0755 = $80/P 0 P 0 = $80/.0755 = $1,059.60 Now that we have the price of the bond, the bond price equation is: P = $1,059.60 = $80[(1 – (1/1.072) t ) / .072 ] + $1,000/1.072 t We can solve this equation for t as follows: $1,059.60(1.072) t = $1,111.11(1.072) t –1,111.11 + 1,000 111.11 = 51.51(1.072) t2.1570 = 1.072 t t = log 2.1570 / log 1.072 = 11.06 11 years The bond has 11 years to maturity.31. The price of any bond (or financial instrument) is the PV of the future cash flows. Even though Bond M makes different coupons payments, to find the price of the bond, we just find the PV of the cash flows. The PV of the cash flows for Bond M is: P M = $1,100(PVIFA 3.5%,16 )(PVIF 3.5%,12 ) + $1,400(PVIFA3.5%,12 )(PVIF 3.5%,28 ) + $20,000(PVIF 3.5%,40 ) P M = $19,018.78 Notice that for the coupon payments of $1,400, we found the PV A for the coupon payments, and then discounted the lump sum back to today. Bond N is a zero coupon bond with a $20,000 par value, therefore, the price of the bond is the PV of the par, or: P N = $20,000(PVIF3.5%,40 ) = $5,051.45 CH8 4,18,20,22,244. Using the constant growth model, we find the price of the stock today is: P 0 = D 1 / (R – g) = $3.04 / (.11 – .038) = $42.22 5 / 17 18. The price of a share of preferred stock is the dividend payment divided by the required return. We know the dividend payment in Year 20, so we can find the price of the stock in Y ear 19, one year before the first dividend payment. Doing so, we get: P 19 = $20.00 / .064 P 19 = $312.50 The price of the stock today is the PV of the stock price in the future, so the price today will be: P 0 = $312.50 / (1.064) 19 P 0 = $96.15 20. We can use the two-stage dividend growth model for this problem, which is: P 0 = [D 0 (1 + g 1 )/(R – g 1 )]{1 – [(1 + g 1 )/(1 + R)] T }+ [(1 + g 1 )/(1 + R)] T [D 0 (1 + g 2 )/(R –g 2 )] P0 = [$1.25(1.28)/(.13 –.28)][1 –(1.28/1.13) 8 ] + [(1.28)/(1.13)] 8 [$1.25(1.06)/(.13 – .06)] P 0 = $69.55 22. We are asked to find the dividend yield and capital gains yield for each of the stocks. All of the stocks have a 15 percent required return, which is the sum of the dividend yield and the capital gains yield. To find the components of the total return, we need to find the stock price for each stock. Using this stock price and the dividend, we can calculate the dividend yield. The capital gains yield for the stock will be the total return (required return) minus the dividend yield. W: P 0 = D 0 (1 + g) / (R – g) = $4.50(1.10)/(.19 – .10) = $55.00 Dividend yield = D 1 /P 0 = $4.50(1.10)/$55.00 = .09 or 9% Capital gains yield = .19 – .09 = .10 or 10% X: P 0 = D 0 (1 + g) / (R – g) = $4.50/(.19 – 0) = $23.68 Dividend yield = D 1 /P 0 = $4.50/$23.68 = .19 or 19% Capital gains yield = .19 – .19 = 0% Y: P 0 = D 0 (1 + g) / (R – g) = $4.50(1 – .05)/(.19 + .05) = $17.81 Dividend yield = D 1 /P 0 = $4.50(0.95)/$17.81 = .24 or 24% Capital gains yield = .19 – .24 = –.05 or –5% Z: P 2 = D 2 (1 + g) / (R – g) = D 0 (1 + g 1 ) 2 (1 +g 2 )/(R – g 2 ) = $4.50(1.20) 2 (1.12)/(.19 – .12) = $103.68 P 0 = $4.50 (1.20) / (1.19) + $4.50(1.20) 2 / (1.19) 2 + $103.68 / (1.19) 2 = $82.33 Dividend yield = D 1 /P 0 = $4.50(1.20)/$82.33 = .066 or 6.6% Capital gains yield = .19 – .066 = .124 or 12.4% In all cases, the required return is 19%, but the return is distributed differently between current income and capital gains. High growth stocks have an appreciable capital gains component but a relatively small current income yield; conversely, mature, negative-growth stocks provide a high current income but also price depreciation over time. 24. Here we have a stock with supernormal growth, but the dividend growth changes every year for the first four years. We can find the price of the stock in Y ear 3 since the dividend growth rate is constant after the third dividend. The price of the stock in Y ear 3 will be the dividend in Y ear 4, divided by the required return minus the constant dividend growth rate. So, the price in Y ear 3 will be: 6 / 17 P3 = $2.45(1.20)(1.15)(1.10)(1.05) / (.11 – .05) = $65.08 The price of the stock today will be the PV of the first three dividends, plus the PV of the stock price in Y ear 3, so: P 0 = $2.45(1.20)/(1.11) + $2.45(1.20)(1.15)/1.11 2 + $2.45(1.20)(1.15)(1.10)/1.11 3 + $65.08/1.11 3 P 0 = $55.70 CH9 3,4,6,9,15 3. Project A has cash flows of $19,000 in Y ear 1, so the cash flows are short by $21,000 of recapturing the initial investment, so the payback for Project A is: Payback = 1 + ($21,000 / $25,000) = 1.84 years Project B has cash flows of: Cash flows = $14,000 + 17,000 + 24,000 = $55,000 during this first three years. The cash flows are still short by $5,000 of recapturing the initial investment, so the payback for Project B is: B: Payback = 3 + ($5,000 / $270,000) = 3.019 years Using the payback criterion and a cutoff of 3 years, accept project A and reject project B. 4. When we use discounted payback, we need to find the value of all cash flows today. The value today of the project cash flows for the first four years is: V alue today of Y ear 1 cash flow = $4,200/1.14 = $3,684.21 V alue today of Y ear 2 cash flow = $5,300/1.14 2 = $4,078.18 V alue today of Y ear 3 cash flow = $6,100/1.14 3 = $4,117.33 V alue today of Y ear 4 cash flow = $7,400/1.14 4 = $4,381.39 To findthe discounted payback, we use these values to find the payback period. The discounted first year cash flow is $3,684.21, so the discounted payback for a $7,000 initial cost is: Discounted payback = 1 + ($7,000 – 3,684.21)/$4,078.18 = 1.81 years For an initial cost of $10,000, the discounted payback is: Discounted payback = 2 + ($10,000 –3,684.21 –4,078.18)/$4,117.33 = 2.54 years Notice the calculation of discounted payback. We know the payback period is between two and three years, so we subtract the discounted values of the Y ear 1 and Y ear 2 cash flows from the initial cost. This is the numerator, which is the discounted amount we still need to make to recover our initial investment. We divide this amount by the discounted amount we will earn in Y ear 3 to get the fractional portion of the discounted payback. If the initial cost is $13,000, the discounted payback is: Discounted payback = 3 + ($13,000 – 3,684.21 – 4,078.18 – 4,117.33) / $4,381.39 = 3.26 years 7 / 17 6. Our definition of AAR is the average net income divided by the average book value. The average net income for this project is: A verage net income = ($1,938,200 + 2,201,600 + 1,876,000 + 1,329,500) / 4 = $1,836,325 And the average book value is: A verage book value = ($15,000,000 + 0) / 2 = $7,500,000 So, the AAR for this project is: AAR = A verage net income / A verage book value = $1,836,325 / $7,500,000 = .2448 or 24.48% 9. The NPV of a project is the PV of the outflows minus the PV of the inflows. Since the cash inflows are an annuity, the equation for the NPV of this project at an 8 percent required return is: NPV = –$138,000 + $28,500(PVIFA 8%, 9 ) = $40,036.31 At an 8 percent required return, the NPV is positive, so we would accept the project. The equation for the NPV of the project at a 20 percent required return is: NPV = –$138,000 + $28,500(PVIFA 20%, 9 ) = –$23,117.45 At a 20 percent required return, the NPV is negative, so we would reject the project. We would be indifferent to the project if the required return was equal to the IRR of the project, since at that required return the NPV is zero. The IRR of the project is: 0 = –$138,000 + $28,500(PVIFA IRR, 9 ) IRR = 14.59% 15. The profitability index is defined as the PV of the cash inflows divided by the PV of the cash outflows. The equation for the profitability index at a required return of 10 percent is: PI = [$7,300/1.1 + $6,900/1.1 2 + $5,700/1.1 3 ] / $14,000 = 1.187 The equation for the profitability index at a required return of 15 percent is: PI = [$7,300/1.15 + $6,900/1.15 2 + $5,700/1.15 3 ] / $14,000 = 1.094 The equation for the profitability index at a required return of 22 percent is: PI = [$7,300/1.22 + $6,900/1.22 2 + $5,700/1.22 3 ] / $14,000 = 0.983 8 / 17 We would accept the project if the required return were 10 percent or 15 percent since the PI is greater than one. We would reject the project if the required return were 22 percent since the PI。

罗斯公司理财第九版课后习题答案中文版

申明:转载自第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

高比重的机构所有权导致高学历的股东和管理层讨论决策风险项目。

此外,机构投资者比私人投资者可以根据自己的资源和经验更好地对管理层实施有效的监督机制。

罗斯《公司理财》第9版笔记和课后习题(含考研真题)详解[视频详解](股票估值)【圣才出品】

【圣才出品】](https://img.taocdn.com/s3/m/e1dcbc711fb91a37f111f18583d049649b660eea.png)

罗斯《公司理财》第9版笔记和课后习题(含考研真题)详解[视频详解](股票估值)【圣才出品】罗斯《公司理财》第9版笔记和课后习题(含考研真题)详解[视频详解]第9章股票估值9.1复习笔记1.不同类型股票的估值(1)零增长股利股利不变时,一股股票的价格由下式给出:在这里假定Div1=Div2=…=Div。

(2)固定增长率股利如果股利以恒定的速率增长,那么一股股票的价格就为:式中,g是增长率;Div是第一期期末的股利。

(3)变动增长率股利2.股利折现模型中的参数估计(1)对增长率g的估计有效估计增长率的方法是:g=留存收益比率×留存收益收益率(ROE)只要公司保持其股利支付率不变,g就可以表示公司的股利增长率以及盈利增长率。

(2)对折现率R的估计对于折现率R的估计为:R=Div/P0+g该式表明总收益率R由两部分组成。

其中,第一部分被称为股利收益率,是预期的现金股利与当前的价格之比。

3.增长机会每股股价可以写做:该式表明,每股股价可以看做两部分的加和。

第一部分(EPS/R)是当公司满足于现状,而将其盈利全部发放给投资者时的价值;第二部分是当公司将盈利留存并用于投资新项目时的新增价值。

当公司投资于正NPVGO的增长机会时,公司价值增加。

反之,当公司选择负NPVGO 的投资机会时,公司价值降低。

但是,不管项目的NPV是正的还是负的,盈利和股利都是增长的。

不应该折现利润来获得每股价格,因为有部分盈利被用于再投资了。

只有股利被分到股东手中,也只有股利可以加以折现以获得股票价格。

4.市盈率即股票的市盈率是三个因素的函数:(1)增长机会。

拥有强劲增长机会的公司具有高市盈率。

(2)风险。

低风险股票具有高市盈率。

(3)会计方法。

采用保守会计方法的公司具有高市盈率。

5.股票市场交易商:持有一项存货,然后准备在任何时点进行买卖。

经纪人:将买者和卖者撮合在一起,但并不持有存货。

9.2课后习题详解一、概念题1.股利支付率(payout ratio)答:股利支付率一般指公司发放给普通股股东的现金股利占总利润的比例。

罗斯《公司理财》英文习题答案DOCchap012

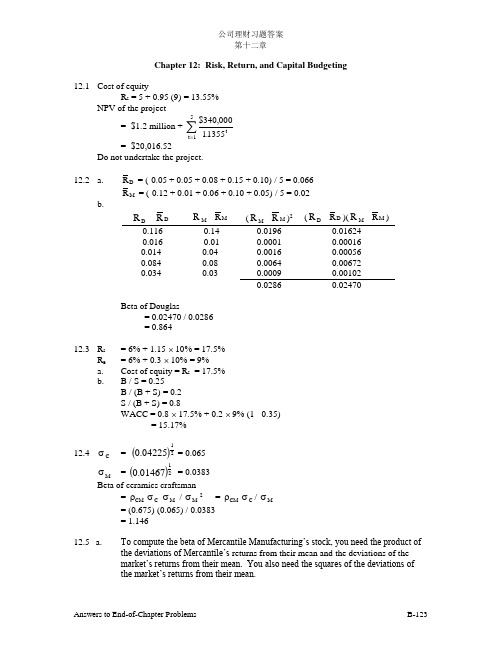

公司理财习题答案第十二章Chapter 12: Risk, Return, and Capital Budgeting12.1 Cost of equity R S = 5 + 0.95 (9) = 13.55% NPV of the project= -$1.2 million + $340,.0001135515tt =∑= -$20,016.52Do not undertake the project. 12.2 a. R D= (-0.05 + 0.05 + 0.08 + 0.15 + 0.10) / 5 = 0.066 R M = (-0.12 + 0.01 + 0.06 + 0.10 + 0.05) / 5 = 0.02b.DR- D R M R -R M(M R -M R )2 (D R -R D )(M R -R M )-0.116 -0.14 0.0196 0.01624 -0.016 -0.01 0.0001 0.00016 0.014 0.04 0.0016 0.00056 0.084 0.08 0.0064 0.00672 0.034 0.03 0.0009 0.001020.02860.02470Beta of Douglas = 0.02470 / 0.0286 = 0.86412.3 R S = 6% + 1.15 ⨯ 10% = 17.5% R B = 6% + 0.3 ⨯ 10% = 9% a. Cost of equity = R S = 17.5% b. B / S = 0.25 B / (B + S) = 0.2 S / (B + S) = 0.8WACC = 0.8 ⨯ 17.5% + 0.2 ⨯ 9% (1 - 0.35)= 15.17%12.4 C σ = ()2104225.0 = 0.065M σ = ()2101467.0 = 0.0383Beta of ceramics craftsman = CM ρC σ M σ / M σ2 = CM ρC σ/ M σ = (0.675) (0.065) / 0.0383 = 1.146 12.5a. To compute the beta of Mercantile Manufacturing’s stock, you need the product of the deviations of Mercantile’s returns from their mean and the deviations of the market’s returns from their mean. You also need the squares of the deviations ofthe market’s returns from their mean.The mechanics of computing the means and the deviations were presented in an earlier chapter.R T = 0.196 / 12 = 0.016333 R M = 0.236 / 12 = 0.019667 E(T R -R T ) (M R -R M ) = 0.038711 E(M R -R M )2 = 0.038588 β = 0.038711 / 0.038588= 1.0032b.The beta of the average stock is 1. Mercantile’s beta is close to 1, indicating that its stock has average risk.12.6 a.R M can have three values, 0.16, 0.18 or 0.20. The probability that M R takes one of these values is the sum of the joint probabilities of the return pair that include theparticular value of M R . For example, if M R is 0.16, R J will be 0.16, 0.18 or 0.22. The probability that M R is 0.16 and R J is 0.16 is 0.10. The probability that R M is 0.16 and R J is 0.18 is 0.06. The probability that M R is 0.16 and R J is 0.22 is 0.04. The probability that M R is 0.16 is, therefore, 0.10 + 0.06 + 0.04 = 0.20. The same procedure is used to calculate the probability that M R is 0.18 and the probability that M R is 0.20. Remember, the sum of the probability must be one.M RProbability 0.16 0.20 0.18 0.60 0.20 0.20 b. i.RM= 0.16 (0.20) + 0.18 (0.60) + 0.20 (0.20) = 0.18ii. 2M σ = (0.16 - 0.18) 2 (0.20) + (0.18 - 0.18) 2 (0.60) + (0.20 - 0.18) 2 (0.20)= 0.00016iii. M σ = ()2100016.0 = 0.01265c. R J Probability .18 .20 .20 .40 .22 .20 .24.10d. i. E j = .16 (.10) + .18 (.20) + .20 (.40) + .22 (.20) + .24(.10) = .20 ii. σj 2 = (.16 - .20)2 (.10) + (.18 - .20)2 (.20) + (.20 - .20)2 (.40)+ (.22 - .20)2 (.20) + (.24 - .20)2 (.10) = .00048公司理财习题答案第十二章iii. σj = ()21.0 = .0219100048e. Cov mj= (.16 - .18) (.16 - .20) (.10) + (.16 - .18) (.18 - .20) (.06)+ (.16 - .18) (.22 - .20) (.04) + (.20 - .18) (.18 - .20) (.02)+ (.20 - .18) (.22 - .20) (.04) + (.20 - .18) (.24 - .20) (.10)= .000176Corr mj = (0.000176) / (0.01265) (0.02191) = 0.635f. βj = (.635) (.02191) / (.01265) = 1.1012.7 i. The risk of the new project is the same as the risk of the firm without the project.ii. The firm is financed entirely with equity.12.8 a. Pacific Cosmetics should use its stock beta in the evaluation of the project only ifthe risk of the perfume project is the same as the risk of Pacific Cosmetics.b. If the risk of the project is the same as the risk of the firm, use the firm’s stock beta.If the risk differs, then use the beta of an all-equity firm with similar risk as theperfume project. A good way to estimate the beta of the project would be toaverage the betas of many perfume producing firms.12.9 E(R S) = 0.1 ⨯ 3 + 0.3 ⨯ 8 + 0.4 ⨯ 20 + 0.2 ⨯ 15 = 13.7%E(R B) = 0.1 ⨯ 8 + 0.3 ⨯ 8 + 0.4 ⨯ 10 + 0.2 ⨯ 10 = 9.2%E(R M) = 0.1 ⨯ 5 + 0.3 ⨯ 10 + 0.4 ⨯ 15 + 0.2 ⨯ 20 = 13.5%State {R S - E(R S)}{R M - E(R M)}Pr {R B - E(R B)}{R M - E(R M)}Pr1 (0.03-0.137)(0.05-0.135)⨯0.1 (0.08-0.092)(0.05-0.135)⨯0.12 (0.08-0.137)(0.10-0.135)⨯0.3 (0.08-0.092)(0.10-0.135)⨯0.33 (0.20-0.137)(0.15-0.135)⨯0.4 (0.10-0.092)(0.15-0.135)⨯0.44 (0.15-0.137)(0.20-0.135)⨯0.2 (0.10-0.092)(0.20-0.135)⨯0.2Sum 0.002056 0.00038= Cov(R S, R M) = Cov(R B, R M)σM 2= 0.1 (0.05 - 0.135)2 + 0.3 (0.10-0.135)2+ 0.4 (0.15-0.135)2 + 0.2 (0.20-0.135)2= 0.002025a. Beta of debt = Cov(R B, R M) / σM2 = 0.00038 / 0.002025= 0.188b. Beta of stock = Cov(R S, R M) / σM2 = 0.002055 / 0.002025= 1.015c. B / S = 0.5Thus, B / (S + B) = 1 / 3 = 0.3333S / (S + B) = 2 / 3 = 0.6667Beta of asset = 0.188 ⨯ 0.3333 + 1.015 ⨯ 0.6667= 0.73912.10 The discount rate for the project should be lower than the rate implied by the use ofthe Security Market Line. The appropriate discount rate for such projects is theweighted average of the interest rate on debt and the cost of equity. Since theinterest rate on the debt of a given firm is generally less than the firm’s cost ofequity, using only the stock’s beta yields a discount rate that is too high. Theconcept and practical uses of a weighted average discount rate will be in a laterchapter.12.11i. RevenuesThe gross income of the firm is an important factor in determining beta. Firmswhose revenues are cyclical (fluctuate with the business cycle) generally have highbetas. Firms whose revenues are not cyclical tend to have lower betas.ii. Operating leverageOperating leverage is the percentage change in earnings before interest and taxes(EBIT) for a percentage change in sales, [(Change in EBIT / EBIT) (Sales / Changein sales)]. Operating leverage indicates the ability of the firm to service its debt andpay stockholders.iii. Financial leverageFinancial leverage arises from the use of debt. Financial leverage indicates theability of the firm to pay stockholders. Since debt holders must be paid beforestockholders, the higher the financial leverage of the firm, the riskier its stock.The beta of common stock is a function of all three of these factors. Ultimately, theriskiness of the stock, of which beta captures a portion, is determined by thefluctuations in the income available to the stockholders. (As was discussed in thechapter, whether income is paid to the stockholders in the form of dividends or it isretained to finance projects are irrelevant as long as the projects are of similar riskas the firm.) The income available to common stock, the net income of the firm,depends initially on the revenues or sales of the firm. The operating leverageindicates how much of each dollar of revenue will become EBIT. Financialleverage indicates how much of each dollar of EBIT will become net income.12.12 a. Cost of equity for National Napkin= 7 + 1.29 (13 - 7)= 14.74%b. B / (S + B) = S / (S + B) = 0.5WACC = 0.5 ⨯ 7 ⨯ 0.65 + 0.5 ⨯ 14.74= 9.645%12.13 B = $60 million ⨯ 1.2 = $72 millionS = $20 ⨯ 5 million = $100 millionB / (S + B) = 72 / 172 = 0.4186S / (S + B) = 100 / 172 = 0.5814WACC = 0.4186 ⨯ 12% ⨯ 0.75 + 0.5814 ⨯ 18%= 14.23%12.14 S = $25 ⨯ 20 million = $500 millionB = 0.95 ⨯ $180 million = $171 million公司理财习题答案第十二章B / (S + B) = 0.2548 S / (S + B) = 0.7452 WACC = 0.7452 ⨯ 20% + 0.2548 ⨯ 10%⨯ 0.60 = 16.43%12.15 B / S = 0.75 B / (S + B) = 3 / 7 S / (S + B) = 4 / 7 WACC = (4 / 7) ⨯ 15% + (3 / 7) ⨯ 9%⨯ (1 - 0.35) = 11.08%NPV = -$25 million + $7(.)m illion tt 10110815+=∑= $819,299.04 Undertake the project.12.16 WACC = (0.5) x 28% + (0.5) x 10% x (1 - 0.35)= 17.25%NPV = - $1,000,000 + (1 - 0.35) $600,000 51725.0A = $240,608.50Mini Case: Allied ProductsAssumptionsPP&E Investment 42,000,000 Useful life of PP&E Investment (years) 7NEW GPWS price/unit (Year 1) 70,000 NEW GPWS variable cost/unit (Year 1) 50,000 UPGRADE GPWS price/unit (Year 1) 35,000 UPGRADE GPWS variable cost/unit (Year 1) 22,000Year 1 marketing and admin costs 3,000,000 Annual inflation rate 3.00% Corporate Tax rate 40.00%Beta (9/27 Valueline) 1.20 Rf (30 year U.S. Treasury Bond) 6.20%NEW GPWS Market Growth (Strong Growth) 15.00%NEW GPWS Market Growth (Moderate Growth) 10.00%NEW GPWS Market Growth (Mild Recession) 6.00%NEW GPWS Market Growth (Severe Recession state of economy) 3.00%Total Annual Market for UPGRADE GPWS (units) 2,500Allied Signal Market Share in each market 45.00%公司理财习题答案第十二章Year 0 1 2 3 4 5 SalesNEWUnits 97 107 118 130 144 Price 70,000 72,100 74,263 76,491 78,786 Total NEW 6,772,500 7,688,654 8,736,317 9,935,345 11,308,721 UPGRADEUnits 1,125 1,125 1,125 1,125 1,125 Price 35,000 36,050 37,132 38,245 39,393 Total UPGRADE 39,375,000 40,556,250 41,772,938 43,026,126 44,316,909 Total Sales 46,147,500 48,244,904 50,509,254 52,961,470 55,625,630 Variable CostsNEW 4,837,500 5,491,896 6,240,226 7,096,675 8,077,658 UPGRADE 24,750,000 25,492,500 26,257,275 27,044,993 27,856,343 Total Variable Costs 29,587,500 30,984,396 32,497,501 34,141,668 35,934,001SG&A 3,000,000 3,090,000 3,182,700 3,278,181 3,376,526 Depreciation 6,001,800 10,285,800 7,345,800 5,245,800 3,750,600EBIT 7,558,200 3,884,708 7,483,253 10,295,821 12,564,503 Interest 0 0 0 0 0 Tax 3,023,280 1,553,883 2,993,301 4,118,329 5,025,801 Net Income 4,534,920 2,330,825 4,489,952 6,177,493 7,538,702EBIT + Dep - Taxes 10,536,720 12,616,625 11,835,752 11,423,293 11,289,302 Less: Change in NWC 2,000,000 307,375 104,870 113,218 122,611 (2,648,074) Less: Captial Spending 42,000,000 (10,948,080) CF from Assets: (44,000,000) 10,229,345 12,511,755 11,722,534 11,300,682 24,885,455 Discounted CF from Assets 9,304,480 10,351,583 8,821,741 7,735,381 15,494,120Total Discounted CF from Assets 51,707,305Results。

(完整版)公司理财-罗斯课后习题答案

(完整版)公司理财-罗斯课后习题答案-CAL-FENGHAI-(2020YEAR-YICAI)_JINGBIAN第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。

7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。

较少的私人投资者能减少不同的企业目标。

罗斯公司理财版课后答案对应版

第五章:净现值和投资评价的其他方法1.如果项目会带来常规的现金流,回收期短于项目的生命周期意味着,在折现率为0 的情况下,NPV 为正值。

折现率大于0 时,回收期依旧会短于项目的生命周期,但根据折现率小于、等于、大于IRR 的情况,NPV 可能为正、为零、为负。

折现回收期包含了相关折现率的影响。

如果一个项目的折现回收期短于该项目的生命周期,NPV 一定为正值。

2.如果某项目有常规的现金流,而且NPV 为正,该项目回收期一定短于其生命周期。

因为折现回收期是用与NPV 相同的折现值计算出来的,如果NPV为正,折现回收期也会短于该项目的生命周期。

NPV 为正表明未来流入现金流大于初始投资成本,盈利指数必然大于1。

如果NPV 以特定的折现率R 计算出来为正值时,必然存在一个大于R 的折现率R’使得NPV 为0,因此,IRR 必定大于必要报酬率。

3.(1)回收期法就是简单地计算出一系列现金流的盈亏平衡点。

其缺陷是忽略了货币的时间价值,另外,也忽略了回收期以后的现金流量。

当某项目的回收期小于该项目的生命周期,则可以接受;反之,则拒绝。

回收期法决策作出的选择比较武断。

(2)平均会计收益率为扣除所得税和折旧之后的项目平均收益除以整个项目期限内的平均账面投资额。

其最大的缺陷在于没有使用正确的原始材料,其次也没有考虑到时间序列这个因素。

一般某项目的平均会计收益率大于公司的目标会计收益率,则可以接受;反之,则拒绝。

(3)内部收益率就是令项目净现值为0 的贴现率。

其缺陷在于没有办法对某些项目进行判断,例如有多重内部收益率的项目,而且对于融资型的项目以及投资型的项目判断标准截然相反。

对于投资型项目,若IRR 大于贴现率,项目可以接受;反之,则拒绝。

对于融资型项目,若IRR 小于贴现率,项目可以接受;反之,则拒绝。

(4)盈利指数是初始以后所有预期未来现金流量的现值和初始投资的比值。

必须注意的是,倘若初始投资期之后,在资金使用上还有限制,那盈利指数就会失效。

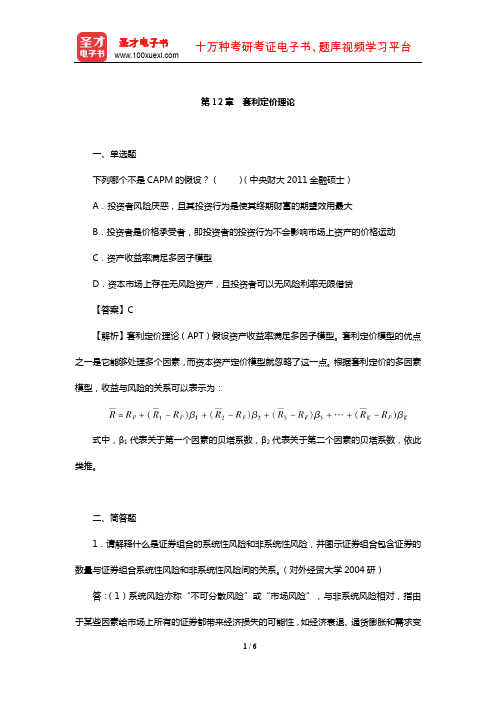

罗斯《公司理财》(第9版)配套题库【章节题库-套利定价理论】

第12章套利定价理论一、单选题下列哪个不是CAPM的假设?()(中央财大2011金融硕士)A.投资者风险厌恶,且其投资行为是使其终期财富的期望效用最大B.投资者是价格承受者,即投资者的投资行为不会影响市场上资产的价格运动C.资产收益率满足多因子模型D.资本市场上存在无风险资产,且投资者可以无风险利率无限借贷【答案】C【解析】套利定价理论(APT)假设资产收益率满足多因子模型。

套利定价模型的优点之一是它能够处理多个因素,而资本资产定价模型就忽略了这一点。

根据套利定价的多因素模型,收益与风险的关系可以表示为:式中,β1代表关于第一个因素的贝塔系数,β2代表关于第二个因素的贝塔系数,依此类推。

二、简答题1.请解释什么是证券组合的系统性风险和非系统性风险,并图示证券组合包含证券的数量与证券组合系统性风险和非系统性风险间的关系。

(对外经贸大学2004研)答:(1)系统风险亦称“不可分散风险”或“市场风险”,与非系统风险相对,指由于某些因素给市场上所有的证券都带来经济损失的可能性,如经济衰退、通货膨胀和需求变化给投资带来的风险。

这种风险影响到所有证券,不可能通过证券组合分散掉。

即使投资者持有的是收益水平及变动情况相当分散的证券组合,也将遭受这种风险。

对于投资者来说,这种风险是无法消除的。

系统风险的大小取决于两个方面,一是每一资产的总风险的大小,二是这一资产的收益变化与资产组合中其他资产收益变化的相关关系(由相关关系描述)。

在总风险一定的前提下,一项资产与市场资产组合收益变化的相关关系越强,系统风险越大,相关关系越弱,系统风险越小。

非系统风险,亦称“可分散风险”或“特别风险”,是指那些通过资产组合就可以消除掉的风险,是公司特有风险,例如某些因素对个别证券造成经济损失的可能性。

这种风险可通过证券持有的多样化来抵消,因此,非系统风险是通过多样化投资可被分散的风险。

多样化投资之所以可以分散风险,是因为在市场经济条件下,投资的收益现值是随着收益风险和收益折现率的变化而变化的。

Cha03 罗斯公司理财第九版原版书课后习题