Hk5120ProblemSet2-14L4_r1

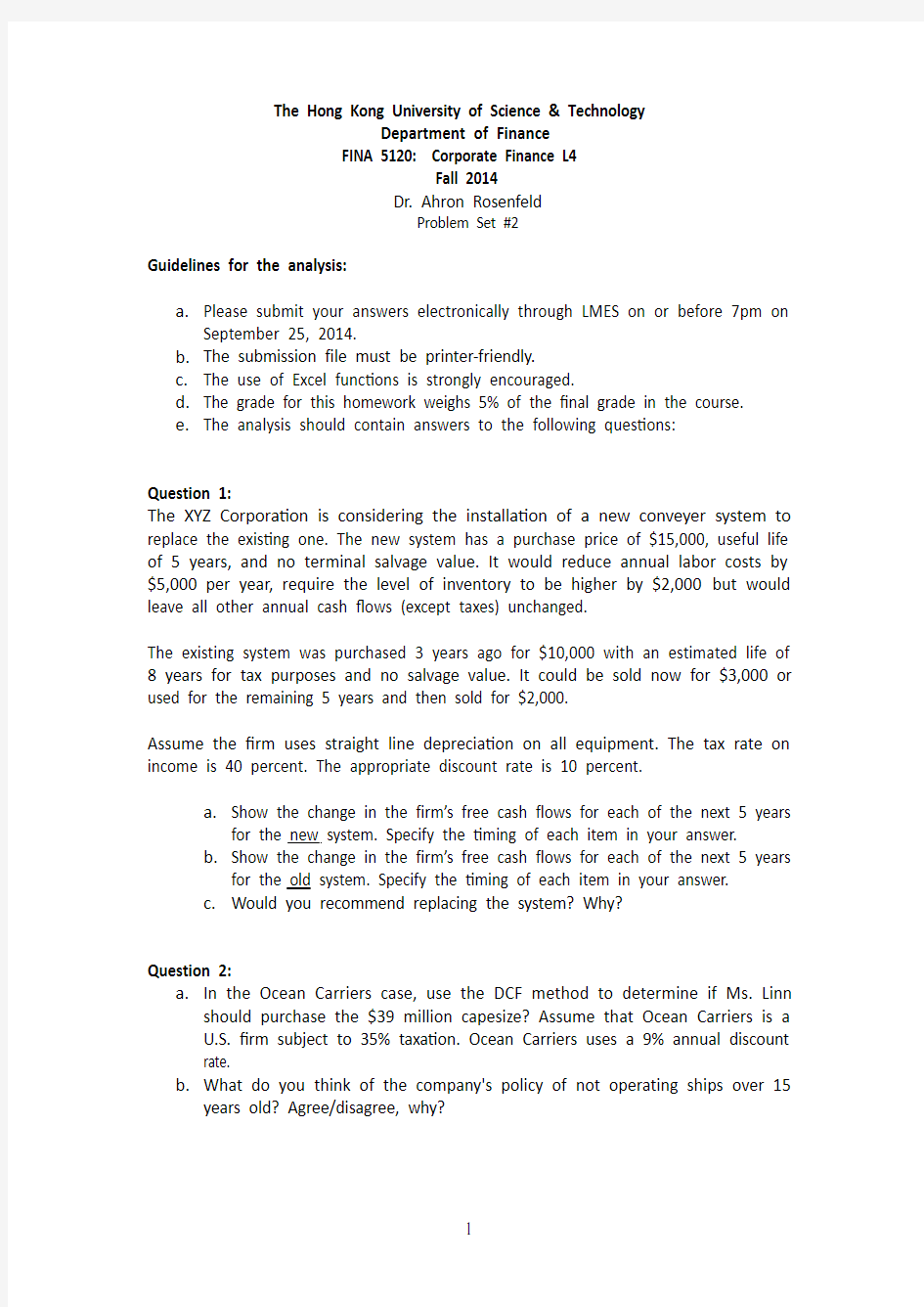

The Hong Kong University of Science & Technology

Department of Finance

FINA 5120: Corporate Finance L4

Fall 2014

Dr. Ahron Rosenfeld

Problem Set #2

Guidelines for the analysis:

a.Please submit your answers electronically through LMES on or before 7pm on

September 25, 2014.

b.The submission file must be printer‐friendly.

c.The use of Excel functions is strongly encourage

d.

d.The grade for this homework weighs 5% of the final grade in the cours

e.

e.The analysis should contain answers to the following questions:

Question 1:

The XYZ Corporation is considering the installation of a new conveyer system to replace the existing one. The new system has a purchase price of $15,000, useful life of 5 years, and no terminal salvage value. It would reduce annual labor costs by $5,000 per year, require the level of inventory to be higher by $2,000 but would leave all other annual cash flows (except taxes) unchanged.

The existing system was purchased 3 years ago for $10,000 with an estimated life of 8 years for tax purposes and no salvage value. It could be sold now for $3,000 or used for the remaining 5 years and then sold for $2,000.

Assume the firm uses straight line depreciation on all equipment. The tax rate on income is 40 percent. The appropriate discount rate is 10 percent.

a.Show the change in the firm’s free cash flows for each of the next 5 years

for the new system. Specify the timing of each item in your answer.

b.Show the change in the firm’s free cash flows for each of the next 5 years

for the old system. Specify the timing of each item in your answer.

c.Would you recommend replacing the system? Why?

Question 2:

a.In the Ocean Carriers case, use the DCF method to determine if Ms. Linn

should purchase the $39 million capesize? Assume that Ocean Carriers is a U.S. firm subject to 35% taxation. Ocean Carriers uses a 9% annual discount rate.

b.What do you think of the company's policy of not operating ships over 15

years old? Agree/disagree, why?

Question 3:

Your firm is considering two mutually exclusive projects. The firm’s cost of capital is 8%. The table below contains free cash flows for each of the projects.

Period 0 1 2 3 4 5

Project A ‐50 17 17 17 17 17

Project B ‐32 12 12 12 12 12

a.Calculate for each project the NPV and IRR.

b.Which project will the firm choose if it makes decisions based on the IRR

rule? The NPV rule?

c.What, in your opinion, is the main reason for the difference in rankings of

the projects based on NPV and IRR in this case? Explain.

d.In your opinion, which project should the firm choose? Why?

Question 4:

Consider the following information for projects A and B, which are mutually exclusive.

YEAR PROJECT A PROJECT B

0‐50,000‐80,000

115,6250

215,6250

315,6250

415,6250

515,625140,000

a.Rank the two projects based on the payback period.

b.Rank the two projects based on the IRR.

c.Determine the range of market interest rates (if any) at which you would

recommend project A over project B. Explain.