国际金融双语期末A卷

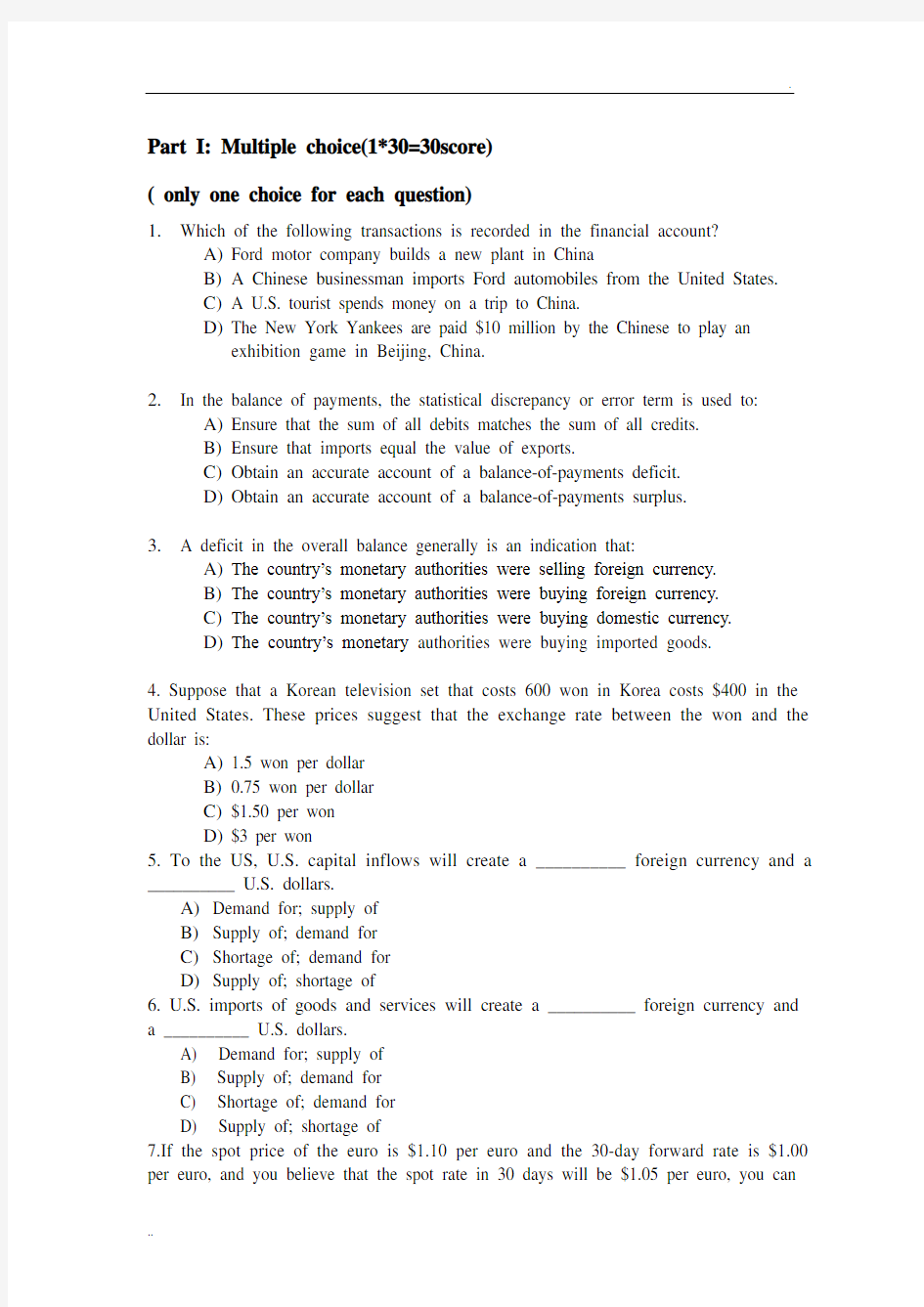

Part I: Multiple choice(1*30=30score)

( only one choice for each question)

1.Which of the following transactions is recorded in the financial account?

A)Ford motor company builds a new plant in China

B)A Chinese businessman imports Ford automobiles from the United States.

C)A U.S. tourist spends money on a trip to China.

D)The New York Yankees are paid $10 million by the Chinese to play an

exhibition game in Beijing, China.

2.In the balance of payments, the statistical discrepancy or error term is used to:

A)Ensure that the sum of all debits matches the sum of all credits.

B)Ensure that imports equal the value of exports.

C)Obtain an accurate account of a balance-of-payments deficit.

D)Obtain an accurate account of a balance-of-payments surplus.

3. A deficit in the overall balance generally is an indication that:

A)The country’s monetary authorities were selling foreign currency.

B)The country’s monetary authorities were buying foreign currency.

C)The country’s monetary authorities were buying domestic currency.

D)The country’s monetary authorities were buying imported goods.

4. Suppose that a Korean television set that costs 600 won in Korea costs $400 in the United States. These prices suggest that the exchange rate between the won and the dollar is:

A)1.5 won per dollar

B)0.75 won per dollar

C)$1.50 per won

D)$3 per won

5. To the US, U.S. capital inflows will create a __________ foreign currency and a __________ U.S. dollars.

A)Demand for; supply of

B)Supply of; demand for

C)Shortage of; demand for

D)Supply of; shortage of

6. U.S. imports of goods and services will create a __________ foreign currency and

a __________ U.S. dollars.

A) Demand for; supply of

B) Supply of; demand for

C) Shortage of; demand for

D) Supply of; shortage of

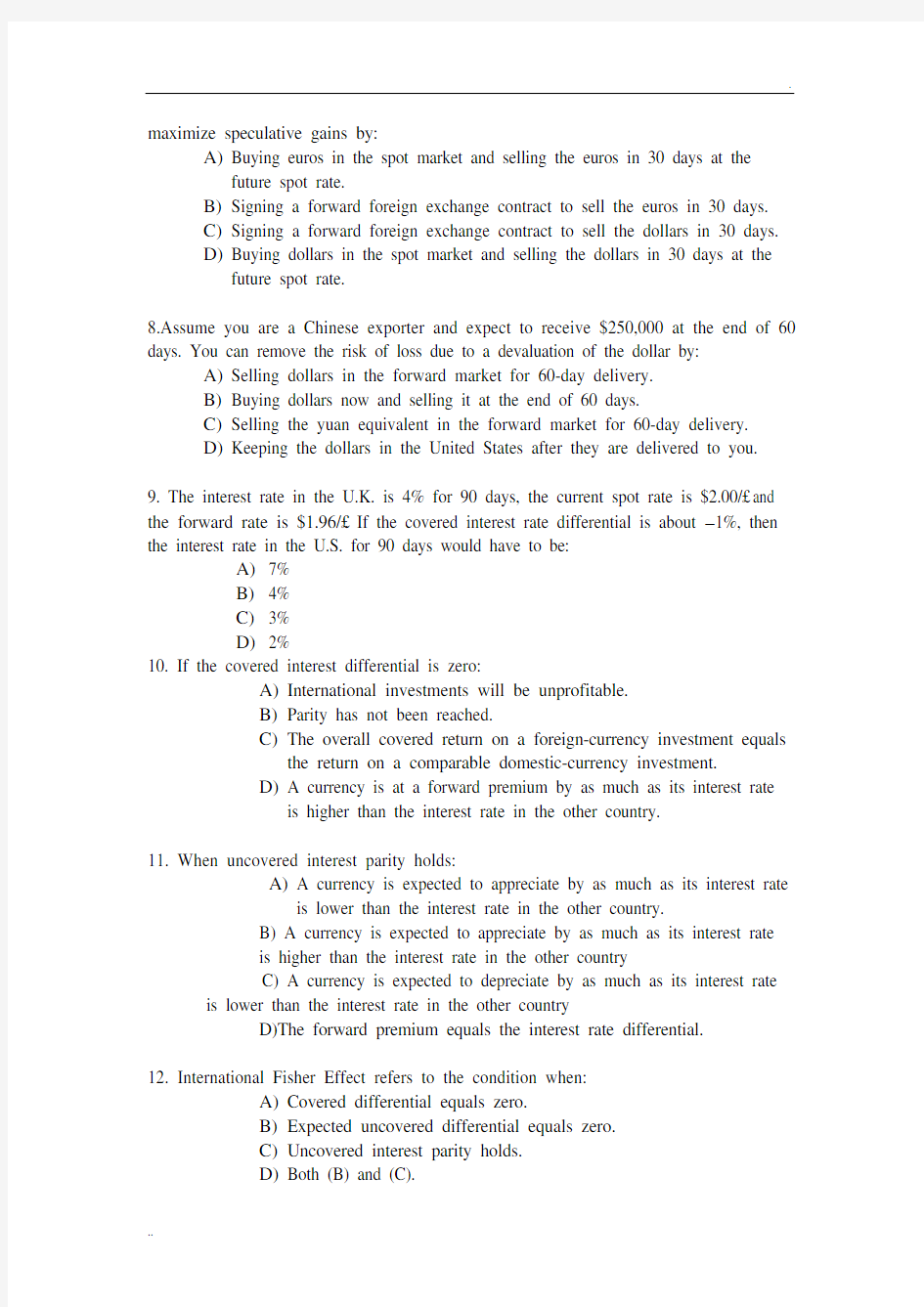

7.If the spot price of the euro is $1.10 per euro and the 30-day forward rate is $1.00 per euro, and you believe that the spot rate in 30 days will be $1.05 per euro, you can

maximize speculative gains by:

A)Buying euros in the spot market and selling the euros in 30 days at the

future spot rate.

B)Signing a forward foreign exchange contract to sell the euros in 30 days.

C)Signing a forward foreign exchange contract to sell the dollars in 30 days.

D)Buying dollars in the spot market and selling the dollars in 30 days at the

future spot rate.

8.Assume you are a Chinese exporter and expect to receive $250,000 at the end of 60 days. You can remove the risk of loss due to a devaluation of the dollar by:

A)Selling dollars in the forward market for 60-day delivery.

B)Buying dollars now and selling it at the end of 60 days.

C)Selling the yuan equivalent in the forward market for 60-day delivery.

D)Keeping the dollars in the United States after they are delivered to you.

9. The interest rate in the U.K. is 4% for 90 days, the current spot rate is $2.00/£ and the forward rate is $1.96/£. If the covered interest rate differential is about 1%, then the interest rate in the U.S. for 90 days would have to be:

A)7%

B)4%

C)3%

D)2%

10. If the covered interest differential is zero:

A)International investments will be unprofitable.

B)Parity has not been reached.

C)The overall covered return on a foreign-currency investment equals

the return on a comparable domestic-currency investment.

D)A currency is at a forward premium by as much as its interest rate

is higher than the interest rate in the other country.

11. When uncovered interest parity holds:

A)A currency is expected to appreciate by as much as its interest rate

is lower than the interest rate in the other country.

B) A currency is expected to appreciate by as much as its interest rate

is higher than the interest rate in the other country

C) A currency is expected to depreciate by as much as its interest rate

is lower than the interest rate in the other country

D)The forward premium equals the interest rate differential.

12. International Fisher Effect refers to the condition when:

A)Covered differential equals zero.

B)Expected uncovered differential equals zero.

C)Uncovered interest parity holds.

D)Both (B) and (C).

13. __________ purchasing power parity states that the difference between changes over time in product-price levels in two countries will be offset by the change in the exchange rate over this time.

A)Full

B)Partial

C)Relative

D)Absolute

14. The __________ approach to exchange rates emphasizes the importance of the supply and demand for money as a key to understanding the determinants of exchange rates.

A)Purchasing-power-parity

B)Asset market

C)Monetary

D)Balance of payments

15. Based on PPP and the quantity theory of money, if Japan’s real income rises relative to real income in the US, there should be a(n):

A)Appreciation of the dollar.

B)Appreciation of the yen.

C)Interest rate parity.

D)Depreciation of the yen.

16..The __________ effect can sometimes be destabilizing because it moves the exchange rate away from its long-run equilibrium value.

A)Bandwagon

B)Bubble

C)Exchange rate

D)Arbitrage

17. The law of __________ states that a product that is easily and freely traded in a perfectly competitive global market should have the same price everywhere.

A) International trade

B) One price

C) Diminishing returns

D) Relative PPP

18..According to the relative version of purchasing power parity, when the foreign country inflation rate increases, the home country’s:

A)Currency tends to depreciate.

B)Currency tends to appreciate.

C)Inflation rate tends to decrease.

D)Inflation rate tends to stay the same.

19..Which of the following are in place when government imposes limits on or requires approvals for payments related to some (or all) international financial activities?

A)Exchange controls.

B)Capital controls.

C)Official interventions.

D)Adjustable pegs.

20. Pressures in the foreign exchange market are such as to cause the British pound to appreciate with respect to the U.S. dollar. If Britain is trying to maintain a fixed exchange rate with respect to the U.S. dollar, which of the following interventions will stem the pressures for appreciation of the pound?

A)Britain should sell pounds and buy dollars.

B)Britain should do nothing as a fixed rate will not change.

C)Britain should buy pounds and sell dollars.

D)Britain should decrease their money supply to contract the economy.

21. Faced with ever increasing outflows of gold in the late 1960’s, the United States:

A)Used contractionary fiscal policies to rid the nation of deficits.

B)Devalued the dollar in terms of gold.

C) Suspended the convertibility of dollars into gold.

D) Imposed foreign exchange controls.

22. .If the marginal propensity to save is 0.3 and the marginal propensity to import is 0.1, and the government increases expenditures by $10 billion, ignoring foreign-income repercussions(回流效应), how much will GDP rise?

A)$20 billion.

B)$10 billion.

C)$25 billion.

D)$15 billion.

23.The IS curve illustrates:

A)All combinations of domestic output levels and interest rates for which the

domestic product market is in equilibrium.

B)All combinations of domestic output levels and interest rates for which the

domestic money market is in equilibrium.

C)All combinations of domestic output levels and interest rates that results in

a zero balance for the country’s official settlements balance.

D)All combinations of domestic output levels and interest rates for which

there is full employment.

24.The LM curve has a:

A)Positive slope because a higher interest rate leads to a decrease in the

demand for money and thus a higher level of domestic production is

needed to cause people to continue to hold the same amount of

money.

B)Negative slope because a higher interest rate leads to a decrease in the

demand for money and thus a higher level of domestic production is

needed to cause people to continue to hold the same amount of

money.

C)Negative slope because a higher interest rate leads to a decrease in

aggregate demand and thus a lower level of domestic production is

needed for equilibrium.

D)Positive slope because a higher interest rate leads to a decrease in

aggregate demand and thus a higher money supply is needed for

equilibrium.

25. Official intervention in the foreign exchange market to defend a fixed exchange rate when the value of domestic currency is under downward pressure:

A)Causes international reserve holdings to rise.

B)Has no impact on the domestic money supply.

C)Causes the domestic money supply to rise.

D)Causes the domestic money supply to fall.

26. Floating exchange rates ensure:

A) Full employment domestically.

B) Domestic price stability.

C) Equilibrium in the overall balance of payments.

D) A surplus in the trade balance.

27. There are limits to the ability of monetary authorities to use sterilized intervention in the case of a surplus because:

A)The central bank may be unwilling to increase its holdings of foreign

currency.

B)Pressure from foreign countries to allow the domestic currency to

depreciate will lead to large losses.

C)The central bank is limited in its ability to obtain foreign currency.

D)There are no limits on the use of sterilized intervention.

28. Under a floating exchange rate regime, following an expansion in the money supply, monetary authorities will:

A) Buy foreign currency in the foreign exchange market.

B) Buy domestic currency in the foreign exchange market.

C) Do nothing in the foreign exchange market.

D) Sell domestic currency in the foreign exchange market.

29.Given the IS-LM-FE framework and an overall payments balance of zero, if the country implements expansionary monetary policy, the LM curve will shift to the __________ which will lead to the country's currency __________. In response, the FE and IS curves will shift to the __________ and external balance will be reestablished.

A) left; appreciating; right

B) left; depreciating; left

C) right; depreciating; right

D) right; appreciating; right

30. Under a floating exchange rate regime with a low degree of capital mobility, expansionary fiscal policy will lead to:

A) Higher interest rates.

B) Lower interest rates.

C) Capital outflows.

D) A surplus in the official settlements balance.

Part II, True or False (10*1.5=15 score)

( T for true and F For false, you are not required to give reason for your choice) 1.If a currency is at a forward premium by as much as its interest rate is lower than the interest rate in the other country, covered interest parity holds.

2. Contractionary fiscal policy with floating exchange rates and low capital mobility leads to currency depreciation.

3. Over the long-run, a country with a relatively high inflation rate tends to have a depreciating currency.

4.The quantity theory of money says that in any country the money supply is equated to the demand for money, which is directly proportional to the money value of the gross domestic product.

5.With fixed exchange rates, external capital flow shocks have little impact on the

internal economy.

6.The Bretton Woods conference created the International Monetary Fund (IMF).

7.The official settlements balance is in deficit if the IS-LM intersection is to the right of the FE curve.

8.(P f*e / P) is a useful indicator of a country’s international price competitiveness.

9.The assignment rule says that, with fixed exchange rates, fiscal policy should be assigned to stabilizing the balance of payments and monetary policy should be assigned to stabilizing the domestic economy.

10.The J curve shows a typical response of the current account balance to a drop in the exchange rate value of a country's currency.

Part III: Questions(6*6=36 score)

1.You are provided with the following information about a country's international

transactions during a given year:

Service exports $ 346

Service imports $354

Merchandise exports $480

Merchandise imports $348

Income flow, net $153

Unilateral transfers, net $142

Increase in the country holding of foreign assets, net $352

(excluding official reserves assets)

Increase in foreign holding of foreign assets, net $252

(excluding official reserves assets)

Statistical discrepancy, net $154

Calculate the official settlements balance and the current account balance. Is the country increasing or decreasing its net holdings of official reserve assets? Why? 2. The following rates exist:

Current spot exchange rate: $1.8/£

Annualized interest rate on 90-day dollar-denominated bonds: 8% (2% for 90 days) Annualized interest rate on 90-day pound-denominated bonds: 12% (3% for 90 days)

Financial investor expect the spot exchange rate to be $1.77/£ in 90 days,

A)With the uncovered interest differential to make judgment that if he bases his decisions solely on the difference in the expected rate of return, should a U.S.-based investor make an uncovered investment in pound-denominated bonds rather than investing in dollar-denominated bonds? Why?

B) if there is substantial uncovered investment seeking higher expected returns, what pressure is placed on the current spot exchange rate?

3.What is the exchange rate overshooting, why does it occur?

4.Assume that a government has become committed to maintaining a fixed

exchange rate that officially values foreign currencies less, and the domestic currency (here the dollar) more, than the free market equilibrium rate. The official rate is, say, $1.0 per pound sterling. This exchange controls result in considerable costs to a country whose government imposes them. Describe these costs and the role that bribery and parallel markets can play in economies with exchange controls.

Figure: Welfare Losses from Exchange Controls

$/£

5. Use the standard IS-LM-FE framework and assume the country begins at a triple intersection under floating exchange rate. What effect will the following have on domestic interest rates, output levels, and the official settlements balance, assuming low capital mobility?(you are suggested explain with figure)

a.The central bank increases the money supply.

b.The government increases its spending.

6.Explain the effects of expanding the money supply on the economy of a country with fixed exchange rates. (Assume the country begins at a triple intersection ,you are suggested explain with figure)

Part III, Reading and analysis (9 score for paper1 and 10 score for paper 2)

1: China to further reform RMB exchange rate regime (体制)

The People's Bank of China(PBOC), China's central bank, has decided to proceed further with the reform of the Renminbi (RMB)exchange rate regime to enhance the RMB exchange rate flexibility, a spokesperson of the central bank said on Jun 19, 2010, Saturday Beijing.

The decision was made in view of the recent economic situation and financial market developments at home and abroad, and the balance of payments (BOP) situation in China, the spokesperson said in a statement.

In further proceeding with the reform, continued emphasis would be placed to reflecting market supply and demand with reference to a basket of currencies. The exchange rate floating bands will remain the same as previously announced in the inter-bank foreign exchange market, the spokesman said.

The spokesperson said China's external trade is becoming more balanced. The ratio of current account surplus to GDP, after a notable reduction in 2009, has been declining since the beginning of 2010.

国际金融期末试题试卷及答案

国际金融期末试题试卷 及答案 Document serial number【KKGB-LBS98YT-BS8CB-BSUT-BST108】

(本科)模拟试卷(第一套)及答案 《国际金融》试卷 一、名词解释(共 15 分,每题 3分) 1 汇率制度 2 普通提款权 3 套汇业务 4外汇风险 5 欧洲货币市场 1、汇率制度:是指一国货币当局对本国汇率真变动的基本规定。 2、普通提款权:是指国际货币基金组织的会员国需要弥补国际收支赤字, 按规定向基金组织申请贷款的权利。 3、套汇业务:是指利用同理时刻在不同外汇市场上的外汇差异,贱买贵卖,从中套取差价利 润的行为。 4、外汇风险:是指在国际贸易中心的外向计划或定值的债权债务、资产和负债,由于有关汇 率发生变动,使交易双方中的任何一方遭受经济损失的一种可能性。 5、欧洲货币市场:是指经营欧洲货币的市场。 二、填空题(共 10 分每题 1 分) 1、外汇是以外币表示的用于国际清偿的支付手段。 2、现货交易是期货交易的,期货交易能活跃交易市场。 3、按出票人的不同,汇票可分为和。 4、国际资本流动按投资期限长短分为和两种类型。 5、第一次世界大战前后,和是各国的储备资产。 三、判断题(共 10 分每题 1 分) 1、出口信贷的利率高于国际金融市场的利率。()。 2、短期证券市场属于资本市场。() 3、国际储备的规模越大越好。() 4、国际借贷和国际收支是没有任何联系的概念。() 5、信用证的开证人一般是出口商。() 6、参与期货交易就等于参与赌博。(X ) 7、调整价格法不可以完全消灭外汇风险。() 8、银行收兑现钞的汇率要高于外汇汇率。( X )

国际金融与结算期末试卷(英文)

湖南涉外经济学院2015—2016学年度第一学期 《国际金融与结算》课程考核试题册 学院:外国语学院专业年级:2012级商英本科 考核方式:闭卷考试时量:100分钟试卷类型: A I. Multiple choices: Choose the best answer to each question, and write your answers on your answer sheet.(本大题共20小题,每小题1分,共20分) 1. A credit item in the balance of payments is . A.an item for which the country must be paid B.an item for which the country must pay C.any imported item D.an item that creates a monetary claim owned to a foreigner. 2. In a exchange rate system there is no intervention by the government or central bankers. A.fixed B. pegged C. floating D. managed float 3. The price in the foreign exchange market is called . A.the trade surplus B. the money price C. the exchange rate D. the currency rate 4. If Canadian speculators believed the Swiss franc was going to appreciate against the U.S. dollar, they would . A. puchase Canadian dollars B. purchase U.S. dollars C. purchase Swiss francs D. sell Swiss francs 5. Under a system of floating exchange rates, the Swiss franc would depreciate in value if which of the following occurs? A. price inflation in France B. an increase in U.S. real income C. a decrease in the Swiss money supply D. falling interest rates in Switzerland 6. is an example of foreign direct investment. A. Exporting to a country B. Establishing licensing arrangement in a country C. Purchasing existing companies in a country D. Investing directly (without brokers)in foreign stocks 7. The payment of a dividend by an American company to a foreign stockholder represents . A. a debit in the US capital account B. a credit in the US capital account C. a credit in the US current account D. a debit in the US current account 8. If American exports to Japan increase and American imports from Japan decreases, then, under a floating exchange rate system, we would expect the dollar to . A. weaken against the Japanese yen B. depreciate against the Japanese yen C. devalue against the Japanese yen D. appreciate against the Japanese yen 9. The term foreign exchange is best defined by the following statement; it is . A. the rate of exchange between two currencies B. an instrument such as paper currency, note, and check used to make payments between countries C. the place in which foreign currencies are exchanged D. synonymous with currency exchange 10. Which of the following is likely to exist when people are willing to pay more for dollars than the official rate? A. gray market B. black market C. gold market D. crawling peg market 11. Which of the following is NOT a way for a country to defend its fixed exchange rate? A. Engage in one-way speculative bubble B.Intervene in the foreign exchange market by buying or selling foreign currency. C.Alter domestic interest rates to influence short-term capital flows. D.Impose some form of exchange control to influence short-term capital flows. 12. If the price of British pounds in terms of US dollar is $1.80 per pound, then the price of US dollar in terms of British pounds is . A. 1.8£ per dollar B. 0.555£ per dollar C. 0.90£ per dollar D. 3.6£ per dollar 13. When a country’s currency appreciates, the country’s goods abroad become , and foreign goods in that country become . A. cheaper…more expensive B. more expensive…cheaper C. cheaper…cheaper D. more expensive…more expensive 14. Intervention in the foreign exchange market means the government . A. restricts individuals from buying and selling foreign exchange B. restricts the importation of certain goods C. or central bank buys or sells foreign exchange D. devalues the currency in the foreign-exchange market 15. A strong dollar encourages . A. travel to the United States by foreigners B. purchase of American goods by foreigners C. Americans to travel abroad D. Americans to save dollars. 16. In an exchange rate, the first currency is referred to as and the second as . A. the base currency…the quote currency B. the quote currency…the base currency C. the base currency…the exchange currency D. the trade currency…the base currency 17. When the Japanese yen appreciates, then we might expect (everything else equal) that imports in Japan will and exports will . A. rise…fall B. rise…rise C. fall…fall D. fall…rise 18. While trading in foreign exchange takes place worldwide, the major currency trading centers are located in .

国际结算期末考试试题

国际结算期末考试试题 一、名词解释(20分) 1.贴现: 2.头寸调拨: 3.信用证: 4.租船合约提单: 5.实质一致: 二、填空(每空一分,共16分) 1.如汇票金额为About Five Thousand Dollars,则此汇票为效汇票。 2.有权在保险单据上签字。 3.据UCP500,信用证若未注明是否可撤销,则默认其为。 4.某提单上注明“三箱坏损”这种提单是提单,一般情况下,银行对这种提单将。 5.按照汇款使用的支付工具不同,汇款可分为三种方式,其中以最为快捷,使用最为广泛。 6.在汇票的使用过程中,使汇票一切债务终止的环节是。 7.托收按交单条件不同,可分为和两种。其中就卖方风险而言,风险小些。 8.支票划线的作用在 于。 9.审单的两种工作方法是和。 10.信用证支付方式的特点为:信用证是、是、是。 三、选择题(每题只有一个正确答案,每题1.5分,共15分) 1.某公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张()。 A.即期汇票 B.远期汇票 C.跟单汇票 D.光票 2.属于汇票必要项目的是()。 A.“付一不付二”的注明 B.付款时间 C.对价条款 D.禁止转让的文字 3.属于顺汇方法的支付方式是()。 A.汇付 B.托收 C.信用证 D.银行保函 4.D/P·T/R意指()。 A.付款交单 B.承兑交单 C.付款交单凭信托收据借单 D.承兑交单凭信托收据借单 5.背书人在汇票背面只有签字,不写被背书人名称,这是() A.限定性背书B.特别背书 C.记名背书D.空白背书

6.承兑以后,汇票的主债务人是() A.出票人 B.持票人 C.承兑人 D.保证人 7.不可撤销信用证的鲜明特点是() A.给予受益人双重的付款承诺 B.有开证行确定的付款承诺 C.给予买方最大的灵活性 D.给予卖方以最大的安全性 8.以下关于承兑信用证的说法正确的是() A.在该项下,受益人可自由选择议付的银行 B.承兑信用证的汇票的期限是远期的 C.其起算日是交单日 D.对受益人有追索权 9.以下关于海运提单的说法不正确的是() A.是货物收据 B.是运输合约证据 C.是无条件支付命令 D.是物权凭证 10.开证行在审单时发现不符点,以下哪一项不是开征行所必须做的() A.说明全部不符点 B.拒付时必须以单据为依据 C.应用书信方式通知寄单行 D.必须在7个工作日内拒付 四、不定项选择题(每题有一个或一个以上正确答案,多选、少选、错选均不给分,每题3分,共12分) 1.本票与汇票的区别在于() A.前者是无条件支付承诺,后者则是要求他人付款 B.前者的票面当事人为两个,后者则有三个 C.前者在使用过程中需要承兑,后者则无需承兑 D.前者的主债务人不会变化,后者的主债务人因承兑而发生变化 E.前者包含着两笔交易,而后者只包含着一笔交易。 2.信用证契约中的当事人是() A.开证行 B.申请人 C.受益人 D.通知行 E.保兑行 3.属于银行信用的国际贸易结算方式是() A.信用证 B.托收 C.汇付 D.汇款 E.银行保函 4.审单工作中,银行将审查() A.单据的完整性 B.单据的真伪性 C.单据的法律效力

国际金融学期末试卷

国际金融学 一.选择题 1.国际收支反映了哪些关系(ABC ) A.货币收支的综合状况 B.一定时期的流量 C .居民与非居民间的交易 D.其他 2.经常项目账户包括哪些(ABCD) A.货物 B. 服务 C. 收入 D. 经常转移 3.金融账户包括哪些(ABCD ) A.直接投资 B. 证券投资 C. 其他投资 D. 储备资产 4.国际收支储备资产项目数据记录差额1000亿表示(A )A.国际收支储备增加1000亿B.国际收支储备减少1000亿C.外汇储备增加1000亿D.外汇储备减少1000亿 5.下列哪些交易活动在国际收支平衡表中可记入借方(ABCDE)A从外国获得商品与劳务B向外国私人或政府提供捐赠或援助C从国外获得长期资产(长期外国负债的减少) D国内私人获得短期外国资产(外国私人短期负债的减少) E国内官方货币当局获得短期外国资产(外国官方货币当局短期负债减少) 6. 下列哪些交易活动在国际收支平衡表中可记入贷方(ABCDE)A.向外国提供商品与劳务B.接受外国人的捐赠与援助C.放弃长期外国资产(引起长期外国负债增加) D.国内私人放弃短期外国资产(引起对外国私人的国内短期负债

增加) E.国内官方货币当局放弃短期外国资产(引起对外国官方货币当局的国内短期负债增加) 7.国际收支平衡表平衡意味着(D) A.CA=0B.KA=0 C.CA+KA=0D.CA+KA+EQO=0 8.美国财政部部长说。。。。。。CA与GDP之比不应超过(4%)9.新版外汇管理条例规定外汇包括(ABCD) A.外币现钞B.外汇支付凭证C外汇有价证券D.SDR10.现钞买入价与现汇买入价的关系(银行的现钞买入价要低于现汇买入价) 11.远期差价用什么来表示(ABC) A.升水B.贴水C.平价 12.直接标价法(远期汇率=即期汇率+升水 远期汇率=即期汇率-贴水) 13.多点套汇不成立的条件是(不等于1) 14.成立的前提条件是(两地利差须大于掉期成本,即利率差大于高利率货币的远期贴水率,利率差大于低利率货币的远期升水率。) 15.外汇风险种类(ABC) A.交易风险 B.会计风险 C.经济风险 16.金本位制包括哪些形式(ABC) A.金铸币本位制 B.金块(砖)本位制 C.金汇兑(虚金)本位制

国际金融双语期末A卷

国际金融双语期末A卷--

————————————————————————————————作者:————————————————————————————————日期:

Part I: Multiple choice(1*30=30score) ( only one choice for each question) 1.Which of the following transactions is recorded in the financial account? A)Ford motor company builds a new plant in China B)A Chinese businessman imports Ford automobiles from the United States. C)A U.S. tourist spends money on a trip to China. D)The New York Yankees are paid $10 million by the Chinese to play an exhibition game in Beijing, China. 2.In the balance of payments, the statistical discrepancy or error term is used to: A)Ensure that the sum of all debits matches the sum of all credits. B)Ensure that imports equal the value of exports. C)Obtain an accurate account of a balance-of-payments deficit. D)Obtain an accurate account of a balance-of-payments surplus. 3. A deficit in the overall balance generally is an indication that: A)The country’s monetary authorities were selling foreign currency. B)The country’s moneta ry authorities were buying foreign currency. C)The country’s monetary authorities were buying domestic currency. D)The country’s monetary authorities were buying imported goods. 4. Suppose that a Korean television set that costs 600 won in Korea costs $400 in the United States. These prices suggest that the exchange rate between the won and the dollar is: A)1.5 won per dollar B)0.75 won per dollar C)$1.50 per won D)$3 per won 5. To the US, U.S. capital inflows will create a __________ foreign currency and a __________ U.S. dollars. A)Demand for; supply of B)Supply of; demand for C)Shortage of; demand for D)Supply of; shortage of 6. U.S. imports of goods and services will create a __________ foreign currency and a __________ U.S. dollars. A) Demand for; supply of B) Supply of; demand for C) Shortage of; demand for D) Supply of; shortage of 7.If the spot price of the euro is $1.10 per euro and the 30-day forward rate is $1.00 per euro, and you believe that the spot rate in 30 days will be $1.05 per euro, you can

国际结算期末考试模拟试卷

中州大学2011-2012学年第一学期 国际结算期末考试试卷(A) 姓名_________ 班级__________ 学号___________ 一.阅读下列信用证,回答题后的问题。(共45分) :TO:1751 22BKCHCNBJA20010512 BANK OF CHINA TIANJIN :FM:1718 22CHGKJPJZAXXX28202 + CHUGOKU BANK,LTD.,THE OKAYAMA :MT:700 :27:SEQUENCE OF TOTAL: 1/1 :40A:FORM OF DOC. CREDIT: IRREVOCABLE :20:DOC. CREDIT NUMBER: 17-10-00537 :31C:DATE OF ISSUE:071022 :40E:APPLICABLE RULES: UCP LATEST VERSION :31D:EXPIRY :DATE:071216 PLACE:IN CHINA :50:APPLICANT:MARUBENI CORPORA TION 5-7 HONMACHI 2-CHOME CHUO-KU OSAKA JAPAN :59:BENEFICIARY:TIANJIN ANIMAL BY-PRODUCTS IMPORT AND EXPORT CORP. 80 YANTAI STREET,TIANJIN,CHINA :32B:AMOUNT:CURRENCY:USD AMOUNT:46530,00 :39A:PERCENTAGE CREDIT AMOUNT TOL: 05/05 :41a:A V AILABLE WITH/ BY: ANY BANK BY NEGOTIATION :42C:DRAFTS AT …: DRAFTS AT SIGHT :42a:DRAWEE:CHGKJPJZ :43P:PARTIAL SHIPMENTS:ALLOWED :43T:TRANSSHIPMENT:PROHIBITED :44E:PORT OF LOADING: FROM CHINESE PORT :44B:PORT OF DISCHARGE: TO OSAKA/NAGOY A,JAPAN :44C:LATEST DATE OF SHIP:071125 :45A:DESCRIPTION OF GOODS AND/OR SERVICES:LIGHT GREY DEHAIRED GOA TSWOOL (KVT02) CONTRACT NO.0707JW518 1000KGS. AT USD47,00/KG C.I.F.OSAKA/NAGOY A,JAPAN. :46A:DOCUMENTS REQUIRED:

《国际金融》2010期末模拟试卷-A

北京科技大学远程学院2010年期末 国际金融试卷(A ) 系 班级 学号 姓名 一、判断题(每小题 1分,共10分) 1.一国货币如果采用直接标价法,那么,汇率的上升就意味着本币的升值( ) 2.在银行间外汇市场上,若商业银行买入的外汇多于卖出的外汇,则为“空头”,反之为“多头”( ) 3.看涨期权购买者的收益一定为期权到期日市场价格和执行价格的差( ) 4.欧洲美元是一种特殊的美元,它与美国国内流通的美元是不同质的,具有不 同的流动性和相同的购买力。( ) 5.如果各国间证券投资收益的相关性非常高,那么,通过国际组合投资来规避风险的作用就不明显了。( ) 6.东道国政府往往不愿意采用股权式合营方式,因为会对国内的民族产业形成冲击。( ) 7.相对于国内企业来说,在预期收入金额相等情况下,跨国公司有较低的 价值,其资本成本更低( ) 装 订 线 内 不 得 答 题 自 觉 遵 守 考 试 规 则,诚 信 考 试,绝 不 作 弊

8.衡量一国国际收支平衡与否的标准,就是要看其调节性交易是否达到了平衡。( ) 9.固定汇率制并不意味着汇率水平永久固定不变,官方调整本币目标价值的理由往往并不局限于经济因素,所以固定汇率制下的汇率变动比浮动汇率制更加难以预测。( ) 10.发展中国家的金融体系大多以直接融资为主,所以大规模国际资本流动对其证券市场形成一定威胁。( ) 二、不定项选择题(每小题1分,共12分) 1.以下哪种资产属于外汇的范畴( ) A .外币有价证券 B.外币支付凭证 C.外国货币 D.外币存款凭证 2.如果你向中国银行询问美元/欧元的报价,回答是“1.2940/1.2960”请问:如果你要买进欧元,汇率是( ) A.1.2940 B.1.2960 C.2940.11 D. 2960 .11 3.外汇远期和期货的区别有 ( ) A.远期是场内合约,期货是场外合约 B.期货实行保证金制度而远期没有 C.远期是标准化合约 D.期货合约更加灵活 4.欧洲债券市场的特点包括( ) A.融资的成本低 B.不受各国金融法令的约束

英文版国际金融试题和答案

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分 1. If perfect markets existed, resources would be more mobile and could therefore be transferred to those countries more willing to pay a high price for them. ( T ) 2. The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. ( T ) 3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T ) 4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F ) 5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places up ward pressure on that home currency’s value. ( F ) 6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T ) 7. Covered interest arbitrage is plausible when the forward premium reflect the interest rate differential between two countries specified by the interest rate parity formula. ( F ) 8.The total impact of transaction exposure is on the overall value of the firm. ( F ) 9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T ) 10. Futures must be marked-to-market. Options are not. ( T ) PartⅡ:Cloze (20%)每题2分,答错不扣分 1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power ) 2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency. 3. Covered interest arbitrage involves the short-term investment in a foreign currency that is covered by a ( forward contract ) to sell that currency when the investment matures. 4. (Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased. 5. ( PPP) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. 6. IFE is based on nominal interest rate ( differentials ), which are influenced by expected inflation. 7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( value ) will be affected. 8. The option writer is obligated to buy the underlying commodity at a stated price if a ( put option ) is exercised 9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ). 10. Any good secondary market for finance instruments must have an efficient clearing system. Most Eurobonds are cleared through either ( Euroclear ) or Cedel. PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分 1. Assume the following information: A Bank B Bank Bid price of Canadian dollar $0.802 $0.796 Ask price of Canadian dollar $0.808 $0.800 Given this information, is locational arbitrage possible? If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%) ANSWER: Y es! One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802. With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank. These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500. 2. Assume that the spot exchange rate of the British pound is $1.90. How will this spot rate adjust in two

金融学期末考试试题

金融学期末考试试题 一、名词解释 (每小题 3 分,共 15) 1.资本与金融项目—— 2.贮藏手段— — 3.证券交易所—— 4.出口信贷—— 5.浮动利率—— 二、判断正确与错误(正确的打V,错误的打X。每小题1分,共10分。答对给分,答错扣分,不答不给分 ) 1.经济发展的商品化是货币化的前提与基础,但商品化不一定等于货币化。( ) 2.商业票据不能作为信用货币的形式。( ) 3.格雷欣法则是在金银平行本位制中发生作用的。( ) 4.当市场利率上升时,证券行市也上升。( ) 5.中央银行独占货币发行权是中央银行区别于商业银行的根本标志。 ( ) 6.银行和保险业务收支在国际收支平衡表中属于资本项目。( ) 7.现金漏损与贷款余额之比称为现金漏损率,也称提现率。( ) 8.物价上涨就是通货膨胀。( ) 9.基准利率一般属于长期利率。( ) 10.通知放款是商业银行之间的短期资金拆借。( ) 三、单项选择题 (每小题 1 分,共 10分,每小题有一项答案正确,请将正确答案的序号填写在括号内 ) 1.中国第一家现代银行是 ( ) A .汇丰银行 B .花旗银行 C .英格兰银行 D 。丽如银行 2.( ) 膨胀是引起财政赤字和银行信用膨胀的主要原因 A .消费需求 B .投资需求 C .社会总储蓄 D .社会总需求 3.银行持有的流动性很强的短期有价证券是商业银行经营中的 ( ) A .第一道防线 B .第二道防线 C .第三道防线 D 。第四道防线 4.银行在大城市设立总行,在本市及国内外各地普遍设立分支行的制度是

( ) A .单一银行制 B .总分行制 C .持股公司制 D .连锁银行制 5.著名国际金融专家特里芬提出的确定一国储备量的指标是各国的外汇储备应大致相当—国 ( ) 个月的进口额 A .三 B .六 C .九 D .十 6.下列属于消费信用的是 ( ) A .直接投资 B .银团贷款 C .赊销 D 。出口信贷 7.金本位制下, ( ) 是决定两国货币汇率的基础 A .货币含金量 B .铸币平价 C .中心汇率 D .货币实际购买力 8.专门向经济不发达会员国的私营企业提供贷款和投资的国际金融组织是 ( ) A .国际开发协会 B .国际金融公司 C .国际货币基金组织 D 。国际清算银行 9.属于管理性金融机构的是 ( ) A .商业银行 B .中央银行 C .专业银行 D .投资银行 10.属于货币政策远期中介指标的是 ( ) A .汇率 B .超额准备金 C.利率 D .基础货币四、多项选择题 (每小题 2 分,共 20分,每小题有数目不等的答案正确,请将所有正确答案的序号填写在括号内 ) 1.商业银行在经营活动中可能面临的风险有 ( ) A .信用风险 B 。资产负愤失衡风险 C ,来自公众信任的风险 D .竞争的风险 E .市场风险 2.按照外汇支付方式划分的汇率是 ( ) A .卖出汇率 B .买人汇率 C .信汇汇率 D .票汇汇率 E .电汇汇率

国际结算期末试卷及参考答案

《国际结算》综合测试题一 二、单项选择题(每小题1分,共20小题20分) 1.以往的国际贸易是用黄金白银为主作为支付货币的,但黄金白银作为现金用于国际结算,存在着明显的缺陷是()。 A清点上的困难 B运送现金中的高风险 C运送货币费用较高 D以上三项 2.某公司签发一张汇票,上面注明“A 90 days after sigh”,则这是一张()。 A即期汇票 B远期汇票 C跟单汇票 D光票 3 .票据的必要项目必须齐全,且符合法定要求,这叫做票据的( .。 A无因性 B流通性 C提示性 D要式性 4 .承兑以后,汇票的主债务人是() A.出票人 B.持票人 C.承兑人 D.保证人 5 .某汇票关于付款到期日的表述为:出票日后30天付款。则汇票到期日的计算方法是() A.从出票日当天开始算,出票日作为30天的第一天 B.从出票日第二天算起,出票日不计算在内 C.从出票日第二天算起,出票日计算在内作为30天的第一天 D.可以由汇票的基本当事人约定选择按照上述何种方法计算 6.现金结算演变为非现金结算的前提是()。 A、外汇实体 B、交易票据化 C、银行信用介入结算 D、航海业从商业中分离出来 7 .无论从买价还是卖价看,电汇汇率比信汇汇率和票汇汇率都要()。 A.低 B.高 C.相等 D.买价高卖价低 8 .T/T、 M/T和 D/D的中文含义分别为()。 A.信汇、票汇、电汇 B.电汇、票汇、信汇 C.电汇、信汇、票汇 D.票汇、信汇、电汇 9 .信用证严格相符原则是指受益人必须做到() A.单证严格与合同相符 B.单据和信用证严格相符 C.单证与单据相符、单据和信用证严格相符 D.信用证与合同严格相符 10 .根据UCP500规定,转让信用证时不可变更的项目是 A.信用证的金额和单据 B.到期日和装运日期 C.货物描述 D.最后交单日期 11 .以下关于承兑信用证的说法正确的是() A.在该项下,受益人可自由选择议付的银行 B.承兑信用证的汇票的期限是远期的 C.其起算日是交单日 D.对受益人有追索权 12 .付款交单凭信托收据借单是()的融资。 A.进口商给予出口商 B.托收银行给予进口商 C.代收行给予出口商 D.代收行给予进口商 13 .甲国向乙国提供援助款100万美元,由此引起的国际结算是()。 A.国际贸易结算B.非贸易结算

国际金融期末试卷完整版

国际金融期末试卷 Document serial number【NL89WT-NY98YT-NC8CB-NNUUT-NUT108】

2K2国际金融 2K3国际金融国际金融补考试卷 国际金融期末试卷 一、填空题 (1’x15) 15’ 1.根据外汇是否具有自由兑换性划分,广义外汇可分为外汇和外汇两类。 2.汇率从银行买卖外汇的角度划分可分为:、 和。。 3.广义的外汇是指一切能用于和最终偿付逆差的对外债权 4 .汇率按照外汇买卖的交割期限划分可分为:和。 5 .浮动汇率制度从政府是否进行干预来划分,可分为: 和。 6 汇率升值有利于,不利于;汇率贬值则促进,抑 制。 7 当前我国人民币汇率制度是以为基础的、单一的、有管理的 制。 8. 所谓间接标价法,又称标价法,是指以一定单位的作为标准,折 成若干单位的来表示汇率。 9. 中间汇率是指买进汇率与卖出汇率的,其计算公式是: /2。 10.用电讯通知付款的外汇价格叫做电汇汇率,它是外汇市场的汇率,是计算其他各种汇率的。

11.如果一种的远期汇率高于即期汇率,称之为;如果一种货币的远期汇率低于即期汇率,称之为;如果远期汇率和即期汇率相等,则称之为。。 12.在期汇投机时,先卖出期汇后买进期汇的投机交易称为;先买进期汇后卖出期汇的投机交易称为。 13.套利是指在两国短期利率出现差异的情况下,将资金从的国家调到 的国家以赚取差额的行为。 14.如果一种的远期汇率高于即期汇率,称之为;如果一种货币的远期汇率低于即期汇率,称之为;如果远期汇率和即期汇率相等,则称之为。 15. 经济风险也叫外汇______ 风险 二.解释下列名词解释 (2’x10 ) 20’ 汇率 国际金融市场 浮动汇率制度 间接标价法 远期外汇交易 套汇 外汇风险 出口信贷 价格调整法 保付代理 三。选择题 (1’x15) 15’