CFA二级公式表

CFA 公式表-Level II

Quantitative Methods

1. Simple Linear Regression Correlation: ()()xy

xy x y Cov r s s =

t-test for r (df = n-2): t = Estimated slope coefficient: 2xy

x Cov σ Estimated intercept: 01

??b y b =-x Confidence interval for predicted Y-value: ^

c y t SE ±?of forecast

2. Multiple Regression

0112233()()()i i i Y b b X b X b X i i ε=+?+?+?+

● Test statistical significance of b; 0:0

?,1b

H b b t df n k s ===-- Reject if t or p-value < 0h ||t critical >α

● Confidence Interval: ?()j

j c b b t s ±?●

SST = RSS+SSE ●

MSR = RSS/k ●

MSE = SSE / (n-k-1) ● Test statistical significance of regression: F = MSR / MSE with df k and

n-k-1 (1-tail)

●

Standard error of estimate (SEE =), Smaller SEE means better fit. ● Coefficient of determination (2/R RSS SST =). % of variability of Y

explained by X’s; Higher R 2 means better fit.

3. Regression Analysis-Problems

● Heteroskedasticity. Non-constant error variance. Detect with Breusch-Pagan

test. Correct with White-corrected standard errors.

● Autocorrelation. Correlation among error terms. Detect with Durbin-Watson

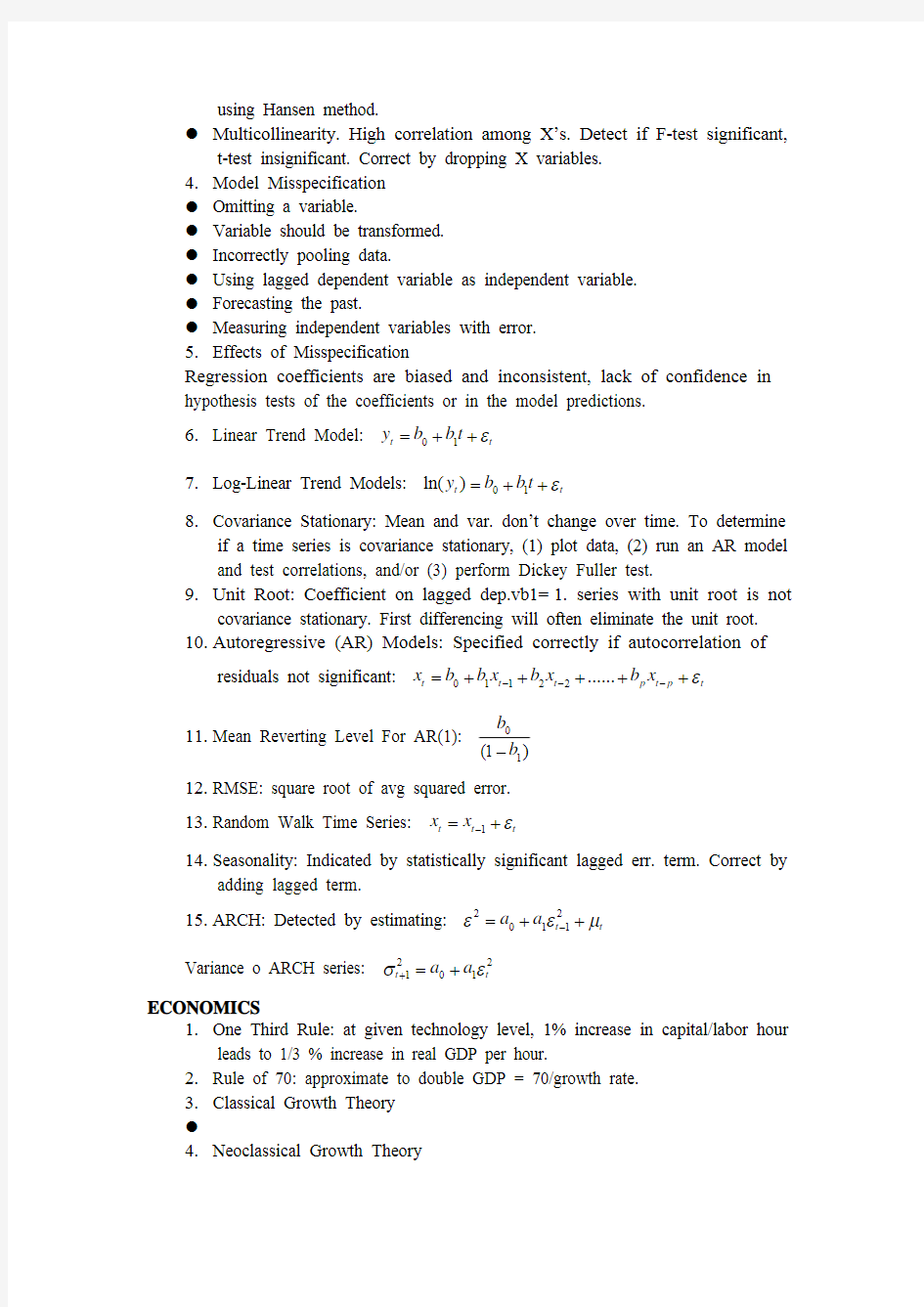

test; positive autocorrelation if DW using Hansen method. ● Multicollinearity. High correlation among X’s. Detect if F-test significant, t-test insignificant. Correct by dropping X variables. 4. Model Misspecification ● Omitting a variable. ● Variable should be transformed. ● Incorrectly pooling data. ● Using lagged dependent variable as independent variable. ● Forecasting the past. ● Measuring independent variables with error. 5. Effects of Misspecification Regression coefficients are biased and inconsistent, lack of confidence in hypothesis tests of the coefficients or in the model predictions. 6. Linear Trend Model: 01t t y b b t ε=++ 7. Log-Linear Trend Models: 01ln()t t y b b t ε=++ 8. Covariance Stationary: Mean and var. don’t change over time. To determine if a time series is covariance stationary, (1) plot data, (2) run an AR model and test correlations, and/or (3) perform Dickey Fuller test. 9. Unit Root: Coefficient on lagged dep.vb1=1. series with unit root is not covariance stationary. First differencing will often eliminate the unit root. 10. Autoregressive (AR) Models: Specified correctly if autocorrelation of residuals not significant: 01122......t t t p t p x b b x b x b x t ε---=+++++ 11. Mean Reverting Level For AR(1): 01(1) b b - 12. RMSE: square root of avg squared error. 13. Random Walk Time Series: 1t t x x t ε-=+ 14. Seasonality: Indicated by statistically significant lagged err. term. Correct by adding lagged term. 15. ARCH: Detected by estimating: 22011t t a a εεμ-=++ Variance o ARCH series: 22101t t a a σε+=+ ECONOMICS 1. One Third Rule: at given technology level, 1% increase in capital/labor hour leads to 1/3 % increase in real GDP per hour. 2. Rule of 70: approximate to double GDP = 70/growth rate. 3. Classical Growth Theory ● 4. Neoclassical Growth Theory ● Economic growth stops when real return = target return. ● Pop. Growth independent of economic growth. 5. New Growth Theory ● Economic growth continues indefinitely ad technology advances. ● ↓real rate => incentive to discover new products and methods. ● Discovery => real return > target return. 6. Nominal & Real Exchange Rate ● Nominal ex. Rate (E): price of one currency in terms of another; observed in EX markets. ● Real exchange rate = E ×(P/P *) 7. Balance of Payment: current account + capital account + official reserve account = 0 8. Foreign Exchange: Direct quotes: ● if quote is ? per $ (or USD:GBP), this is a direct quote from the perspective of the pound. ● Bid-ask spread stated as percent of asking price: %(100)askprice bidprice spread askprice -= ● Foreign currency is at forward discount (premium) if F is below (above) S, using direct quotes: 360(/)(1)()day min fwdrate fwdprem disc spotrate ter s =-● Currency appreciates due to: (1) Lower relative income growth rate. (2) Lower relative inflation rate. (3) Higher domestic real interest rate. (4) Improved investment climate. 9. Unanticipated shift to exp. Monetary Policy: Higher income, accelerated inflation, lower real interest rates, leads to currency dept, current acct surplus, and financial acct deficit. 10. Unanticipated shift to exp. Fiscal Policy: currency appr, current acct deficit, & financial account surplus. 11. Purchasing Power Parity: ● Law of one price: a single, clearly comparable good should have same real price in all countries. ● Relative PPP: Countries with high inflation rates should see their currencies depreciate. 01()1CounterCurrency t BaseCurrency I S E I ??+= ? ?+?? S 12. International Fisher Relation: Assumes real interest rates are equal across borders, so interest differential equals expected inflation difference. 11(11(b b a a r E I r E I ???++= ? ++???))??? ()()b a b a r r E I E I -≈- 13. Uncovered Interest Rate Parity: Countries with high nominal interest rates should see their currencies depreciate. 01360()1360CounterCurrency n BaseCurrency n r S E n r ????+ ? ??????=????+ ? ???? ?S 14. Interest Rate Parity: Countries with high nominal interest rates will have their currencies sell at forward discount to prevent arbitrage. ()() 11b a r F S r +=+ 15. Currency Arbitrage: up the bid and down the ask Financial Statement Analysis 1. Accounting for InterCorp Investments a) Minority passive: < 20% owned, no significant influence. i. Held-to-maturity at cost on B/S; interest and realized gain/losses on I/S ii. Available-for-sale at FMV with unrealized gains/loss in equity on B/S; dividends, interest, realized gains/losses on I/S iii. Held-for-trading at FMV , dividend, interest, realized and unrealized gains/losses on I/S. b) Minority active: 20-50% owned, significant influence. With equity method, pro-rata share of the investee’s earnings increase, B/S investment account, also in I/S. Div. received decrease investment account. (div. not in I/S) c) Controlling: >50% owned, control. Consolidation, all assets, liability, revenue, and expense of sub combined with parent, excluding d) preferred, similar to regular consolidation, except only include pro-rata share. US GAAP: equity method. 2. Financial Effect of Choice of Method: equity, consolidation, proportionate consolidation. a) All three methods report same net income. b) All three methods report same ROE c) Asset, liabilities, sales are highest under consolidation; lowest under equity method; proportionate consolidation in between. 3. a) b) c)Pension expense components: current service cost, interest cost, expected return on plan assets, prior (past) service cost, net actuarial gains/losses. d) Aggressive assumptions/low earnings quality: high discount rate, low compensation growth rate, high expected return. 4.Economic pension expense: if < firm contribution, diff = ↓ in overall pension obligation. If > firm contribution, diff = borrowing (and reclass from CFO to CFF) 5.Balance sheet: GAAP vs. IFRS: GAAP: net assets/liability = funded status = economic reality. IFRS: net assets/liab = funded status adj. for unrecognized items. 6.Underlying Economic Pension Expense: Sum of all changes in PBO (except benefits paid) less actual ROA. Also = change in funded status exclude firm’s contributions. Service cost= operating expense. Interest and actual ROA repeated as non operating income. 7.Business Combinations: a)Purchase method required under U.S. GAAP and IFRS b)Goodwill not amortized, subject to annual impairment test. 8.Purchase Method Attributes: a)Acquirer assumes assets/liabilities of acquired company. b)Excess FMV of acquired net assets allocated first to intangible assets, then goodwill. c)Prior operating results not restated. 9.Pooling Method Attributes a)Company f/s combined at book value. b)Prior operating results restated. 10.Impact of Purchase vs. Pooling a)Asset and equity higher, net income lower under purchase method. b)Profit margin, ROA, ROE lower under purchase method. 11.Entity is VIE if any of: 12.Multinational Operations: Choice of Method a)Insufficient at-risk equity investment. b)Shareholder lack decision-making rights. c)Shareholder do not absorb losses d)Shareholder do not receive residual benefits. The primary beneficiary consolidates the VIE. Qualifying SPE: GAAP allows – no consol. (use equity method). Not permitted under IFRS. 13.Multinational Operations: Choice of Method For self-contained sub, functional ≠presentation currency; use all-current method: a)Assets/liabilities at current rate. b)Common stock at historical rate. c)Income statement at average rate. d)Exposure = shareholder’s equity e) Dividend at rate when paid. For integrated sub, functional = presentation currency, use temporal method: f) Monetary assets/liabilities at current rate. g) Nonmonetary assets / liabilities at historical rate. h) Sales, SGA at average rate. i) COGS, depreciation at historical rate. j) Exposure = monetary assets – monetary liabilities Net asset position & Depr, foreign currency = loss Net liab, position & depr, foreign currency = gain. 14. Original F/S vs. All-Current a) Pure B/S and I/S ratios unchanged b) If Local currency depreciating, translated mixed ratios will be larger c) If local currency appreciating, translated mixed ratios will be smaller. 15. Hyperinflation: GAAP vs. IFRS: Hyperinflation = cumulative inflation > 100% over 3 years,GAAP, use temporal method. IFRS: 1. restate foreign currency st. for inflation. 2. translate with all-current. Net purchase power gain/losses reported in income. 16. Accrual-based income: accrual part less persistent ten cash part. 17. Measure of earning quality: ()() ()()/2/2BS END BEG END BEG BS END BEG CF END BEG Accruals NOA NOA NOA NOA AccrualsRatio NOA NOA NI CFO CFI AccrualsRatio NOA NOA =--=+--=+ 18. Mean Reversion: occurs faster with larger accrual earnings component. 19. Detecting Manipulation: a) Revenue recognize: large changes in receivable & unearned revenue. ↑ DSO, compare revenue to cash collected. b) Expense recognize: large changes in fixed assets & inventory, ↑DOH, LIFO liquidation, compare depreciation. Exp, calculate core operate margin = (sales-COGS- SG&A)/sales. c) B/S: capitalize operating lease; impaired goodwill d) CF: compare growth of operating leases to asset grow, look for ↓in discretionary spend at year end. 20. Fair value hedge: gain/loss from derivative & hedged BS item reported in IS. 21. Cash flow hedge: gain/loss from derivative bypass IS- reported in shareholder’s equity. 22. Net investment hedge of a foreign sub: gain/loss recognize in equity along with transaction gain/loss. CORPORATE FINANCE 1. Capital budgeting expansion a) Initial outlay = FCinv + WCinv b) CF = (S-C-D)(1-T) +D = (S-C)(1-T) + DT c) TNOCF = Sal T + NWCInv – ( Sal T – B T ) ×T 2. Capital budgeting replacement a) Same as expansion, except current after – tax salvage of old assets reduces initial outlay. b) Incremental depreciation is Δ in depth. 3. Projects with unequal lives a) Least common multiple of lives. b) Equivalent annual annuity (EAA): annuity equal to PC of project CFs. 4. Effects of inflation: Discount nominal (real) cash flows at nominal (real) rate; unexpected changes in inflation affect project profitability; reduces the real tax savings from depreciation; decreases value of fixed payments to bondholders; affects costs and revenues differently. 5. Capital rationing: If +NPV > capital, choose combination with highest NPV . 6. Real options: Timing, abandonment, expansion, flexibility, fundamental options. 7. Economic and accounting income a) Economic Income = AT CF + Δ in project’s MV . b) Economic depr based on Δ in investment’s MV . c) Economic income calculated before interest expense (cost of capital reflected in discount rate) d) Account income = project revenue –costs e) Account dep based on original investment cost. f) Interest (financing costs) deducted before calculating accounting income. 8. Valuation models: a) Econ profit = NOPAT -$WACC; discounted at WACC. b) Residual income = NI – equity charge; discounted at required return on equity. c) Claims valuation separates CFs based on equity claims (discounted at cost of equity) and debt holders (discounted at cost of debt). 9. Operating leverage: variable/fixed cost tradeoff %DOL %EBIT Sales ?=? ()()qty sales Q P V DOL Q P V F S VC DOL S VC F -= ---=-- 10. Financial leverage: refers to use of fixed-income securities (debt and preferred stock). %%i %()(%)EPS EBIT DFL EBIT EBIT erest EPS DFL EBIT ?= =?-?=?nt 11. Total leverage: measures effect on EPS of given change in sales. DTL=DOL ×DFL 12. Breakeven:BE F Q P V =- 13. MM Prop I (No taxes): Capital structure irrelevant (no taxes, transaction cost or bankruptcy costs). 14. MM Prop II (No Taxes): increased use of cheaper debt increases cost of equity, no change in WACC. 15. MM Proposition I (With taxes): tax shield adds value, value maximized at 100% debt. 16. MM Proposition II (With taxes): tax shield adds value, WACC minimized at 100% debt. 17. Corporate Governance Objectives a) Mitigate conflicts of interest between (1) managers and shareholders, and (2) directors and shareholders. b) Ensure assets used to benefit investors and stakeholders. 18. EPS after a share repurchase tan TotalEarnings AfterTaxCostofFunds EPS SharesOuts dingAfterBurback -= If after-tax cost of debt is less then earnings yield, a share repurchase will increase EPS. If after-tax cost of debt is greater than earnings yield, a share repurchase will decrease EPS. 19. BV per share after a share repurchase: If the share price is greater than the original BVPS, a share repurchase will decrease BVPS. If the share price is less the original BVPS, a share repurchase will increase BVPS. 20. Effective tax rate on dividends: a) Double taxation or split rate systems: effective rate = corp rate + (1- corp rate)(indiv rate) b) Imputation system: effective tax rate is the shareholder’s individual tax rate. 21. Signaling Effects of Dividend Changes a) Initiation: ambiguous signa b) Increase: positive signal c) Decrease: negative signal unless management sees many profitable investment opportunities. 22. Share Repurchase a) Share repurchase is equivalent to cash dividend, assuming equal tax treatment. b) Unexpected share repurchase is good news. c) Rational for: 1) prevent EPS dilution; 2) supplement a regular dividend; 3) good investment for company; 4) positive signal to investor; 5) change capital structure. 23. Dividend Policy Approaches a)Residual dividend: dividends based on earnings less funds retained to finance capita budget. b)Longer-term residual dividend: forecast capital budge, smooth dividend payout. c)Dividend stability: dividend growth aligned with sustainable growth rate. d)Target payout ratio: long-term payout ratio target. 24.Merger Types: Horizontal, vertical, conglomerate. 25.Merger Motivations: Achieve synergies, more rapid growth, increase market power, gain access to unique capabilities, diversify, manager personal benefits, tax benefits unlock hidden value, achieving intl goals, and bootstrapping earning. 26.Pre-offer Defense Mechanisms: poison pills and puts, reincorp. In a state where restrictive takeover laws, staggered board elections, restrict voting rights, supermajority voting, fair price amendments, and golder parachutes. 27.Post-offer Defense Mechanisms: litigation, greenmail, sare repurch, leveraged recap, th “crown jewel”, ”Pac man”, and “just say no” defense, and white knight/white squire. 28.The Herfindahl-Hirschman Inex (HHI): market power = sum of squared market shres for all industry firms. High or increase HHI mean regulators more likely to challenge a merger. 29.Methods to determine Target Value a)DCF method: target performance FCF discounted at adjusted W ACC b)Comparable company analysis: target value from relative valuation metrice on similar firms + takeover premium. c)Comparable transaction analysis: target value from takeover transactionl takeover premium included 30.Merger Valuations a)Combined firm: V AT=V A + V T +S –C b)Takeover premium (to target): Gain T = TP = P T -V T c)Synergies ( to acquirer): Gain A = S- TP = S- (P T-V T) 31.Merger Risk & Reward a)Cash offer: acquirer assumes risk & receives reward. b)Stock offer: some of risks & rewards shift to target. If higher confidence in synergies; acquirer prefers cash & target prefers stock. 32.Forms of Divestitures: equity carve –outs, spin –offs, split – offs, and liquidations. EQUITY & ALTERNATIVE INVESTMETNS 1.Alpha: a)Ex ante α = expected return – required return from CAPM or APT b)Ex post α = historical holding period return – historical return on similar assets 2.Franchise value and growth process Tangible P/E =1/r Franchise P/E = franchise factor ×growth factor = FF × GF a)if ROE>r, firm has sustainable competitive advantage, franchise factor > 0. b)If ROE 3.Inflation effects on valuation a)Higher flow- through rate implies higher P/E, all else equal b)If inflation flow-through < 100%, higher inflation implies lower P/E, all else equal. 4.Porter’s Five Forces/competitive strategy a)Threat of new entrants. Increase = more pricing pressure, lower industry profits. b)Threat of substitutes. Is there a price ceiling? More cost effective, more pricing pressure. Buyer propensity to substitute. Switching costs. c)Bargaining power of buyers = function of bargaining leverage/price sensitivity. d)Bargaining power of suppliers: determined by differentiation of inputs, presence of sub. Inputs, supplier concentration, importance to supplier, threat of forward integration. e)Rivalry among existing competitors. Increasing rivalry = increasing risk of destructive price/feature/marketing wars. Function of industry growth, fixed costs, value added, product differences, branding, diversity of competitors, exit barriers. Key point: who captures value added? Eliminating rival risky, attracts competition. 5.Strategic alternatives a)Positioning firm where five forces weakest. b)Project and exploit changes in industry. c)Induce industry changes to play to firm strength. 6.Industry Analysis a)Industry life cycle: Pioneer – Growth – Mature – Decline. b)External factors: Technology, government, social change, demography, foreign influence. 7.Nominal vs. Real: distinction Matters ●Income taxes: forecast nominal earnings before taxes. ●Real cash flow from WC = Δ real WC; convert nominal WC to real CF. ●Forecast real capex, dep, and EBITDA 8.Discounted Cash flow (DCD) methods Use dividend discount models (DDM) when: ●Firm has dividend history, ●Dividend policy related to earnings, ●Minority shareholder perspective Use free cash flow (FCF) models when: ●Firm lacks stable dividend policy ●Dividend policy not related to earnings. ●FCF is related to profitability ●Controlling shareholder perspective. Use residual income (RI) when: ● Firm lacks dividend history. ● Expected FCF is negative 9. Gordon Growth Model (GGM) Assumes perpetual dividend growth rate: 10D V r g =- Most appropriate for mature, stable firms. Limitations are: ● Very sensitive to estimates of r and g ● Difficult with non-dividend stocks ● Difficult with unpredictable growth patterns (use multi-stage model) 10. Present Value of Growth Opportunities 10E V PVGO r =+ 11. Two stage Growth Model Step 1: calculate dividends in high-growth period. Step 2: use GGM for terminal value at end of high-growth period Step 3: discount interim dividends and terminal value to time zero to find stock value. 12. H- Model ()()0001L s L L D g D H g g V r g r g ?+??-???? ??=+--L ?? 13. Solving for Required Return For Gordon (or stable growth) model, solving for return yields: 10 D r g P =+ 14. Free Cash flow to firm (FCFF) Assuming DEP is only NCC: ● FCFF = NI + Dep +[Int × (1- tax rate)] – FCInv – WCInv ● FCFF = [EBIT ×( 1- tax rate)] + Dep – FCInv – WCInv ● FCFF = [EBITDA × (1-tax rate)] + (Dep × tax rate) – FCInv – WCInv ● FCFF = CFO + [Int × ( 1-tax rate)] - FCInv 15. Free cash flow to Equity (FCFE) ● FCFE = FCFF - [Int × (1- tax rate)] + Net Borrowing ● FCFE = NI + Dep – FCInv – WCInv + Net Borrowing ● FCFE = NI – [(1-DR) × (FCInv -Dep)] - [(1-DR) ×WCInv]( Used to forecast) 16. Single-stage FCFF/FCFE models ● For FCFF valuation: 10FCFF V WACC g =- ● For FCFE valuation: 10FCEF V r g = - 17. Two-stage FCFF/FCFE models Step 1: Calculate FCF in high – growth period. Step 2: Use single – stage FCF model for terminal value at end of high – growth period. Step 3: Discount interim FCF and terminal value to time zero to find stock value, use W ACC for FCFF, r for FCFE. 18. Price to Earning (P/E) ratio Problems with P/E: ● If earnings < 0, P/E meaningless. ● V olatile, transitory portion of earnings makes interpretation difficult. ● Management discretion over accounting choices affects reported earnings 19. Justified P/E Leading P/E = 1b r g -- Trailing P/E = (1)(1)b g r g -+- 20. Normalization Methods: ● Historical average EPS. ● Average ROE. 21. Price to Book (P/B) ratio Advantages: ● BV almost always > 0 ● BV more stable than EPS ● Measures NA V of financial institutions. Disadvantages: ● Size differences cause misleading comparisons ● Influenced by accounting choices. ● BV ≠ MV due to inflation/technology Justified P/B = ROE g r g -- 22. Price to Sales (P/S) ratio Advantages: ● Meaningful even for distressed firms ● Sales revenue not easily manipulated ● Not as volatile as P/E ratios ● Useful in valuing mature, cyclical, and start-up firms Disadvantages: ● High sales do not imply high profits and cash flows ● Does not capture cost structure difference. ● Revenue recognition practices still distort sales. Justified P/S = 0(1)(1)PM b g r g ?-+- 23. Price to Cash Flow Ratios Advantages: ● Cash flow harder to manipulate than EPS ● More stable than P/E ● Mitigates earnings quality concerns Disadvantages: ● Difficult to estimate true CFO ● FCFE better but more volatile 24. Method of Comparables ● Firm multiple > benchmark implies overvalued ● Firm multiple < benchmark implies undervalued ● Fundamentals that affect multiple should be similar between firm and benchmark. 25. Residual Income Models 11()()t t t RI E r B ROE r B --=-?=-? Single stage RI model: ()000ROE r B V B r g -???=+??-?? Multistage RI valuation: V 0 = B 0 + (PV of interim high-growth RI) + (PV of continuing RI) 26. Economic value added EV A=NOI-$WACC NOPAT=EBIT(1-t) 27. Real estate (RE) investment analysis ● CFAT = NOI – debt service – taxes payable ● ERAT = net selling price – mortgage balance – taxes ● Recaptured depreciation: depr. Taken in anticipation of decrease in asset’s value that did not materialize 28. Types of Real estate investment Raw land: passive and illiquid; for speculators and developers. Apartments and office building: active, moderately liquid; tax-shelters for high- income investors Warehouses: passive, moderately liquid; for passive investors & those seeking tax shelter Shopping centers: moderately active, low-liquidity, for wealthy investors. Hotels and motels: active, moderately liquid; for those seeking tax shelter 29. Income Property Analysis: Cap Rate Market extraction: 0()NOI R ME MV =, use when income data is available. 30. Valuing Income Properties Direct income capitalization technique: 110NOI NOI MV r g R ==- Gross income multiplier technique MV=gross income ×income multiplier Gross income multiplier Pr ()Sales ice M GrossIncome = 31. Sustainable Growth rate: b ×ROE 32. Private Equity Sources of value creation: reengineer firm, favorable debt financing; superior alignment of interests between management and PE ownership Valuation issues (VC firms relative to Buyouts): DCF not as common; equity, not debt, primary financing. Key driver of equity return Buyout: ↑of multiple at exit, ↓ in debt VC: pre-money valuation, the investment, and subsequent equity dilution. Components of performance (LBO): earnings growth, ↑of multiple at exit, ↓in debt. Exit routes ( in order of exit value, high to low): IPOs secondary market sales; MBO; liquidation. performance measurement: Gross IRR= return from portfolio companies. Net IRR = relevant for LP, net of fees & carried interest. Performance statistics: ● PIC = % capital utilized by GP; Cumul, sum of capital called down. ● Mgmt fee: % of PIC ● Carried Interest: % carried int ×(change in NA V before distrib) ● NA V before distrib = prior yr NA V after distrib + cap. Called dwn- mgmt fees + op result ● NA V after disturb = NA V befoe distrib- carried int – distrib ● DPI mult = (cumul distrib)/PIC = LP’s realized return ● RVPI mult = (NA V after distrib)/PIC = LP’s unrealized return. ● TVPI mult = DPI mult + RVPI mult. NPV VC: IRR methods: calculate pre-money val. Post-money val. analysis for term. LBO CF. start with net income, add back non-cash depr & amoriz of def, charges. Subtract ↑in NWC and appop capex. 33.Hedge Funds Performance measurement difficult due to diff in leverage, short positions, Δ in style, & port. TO. Exposed to investment, fraud and operational risk. Use downside measure of risk, such as maximum drawdown and/or value at risk (Var) Prices: inversely related to stock prices over ec. Cycle & inflation. FIXED INCOME 1.Credit Analysis High-yield debt ●Issuer has senior, short-term, floating bank debt. ●Analyze corporate structure, debt structure. Asset-backed debt ●Quality of collateral ●Servicer quality ●Cash flow stress and payment structure ●Legal structure Municipal bonds ●Tax-backed municipal bond analysis involves: issuer’s debt structure, budgetary policy, local tax and intergovernmental revenue availability, and issuer’s socioeconomic environment. ●Municipal bond credit analysis: limits of the basic security, flow of funds structure, rate covenants, and additional bonds tests. Sovereign debt ●Local vs. foreign currency rating. ●Economic risk: ability to pay ●Political risk: willingness to pay. 2.Theories of the Term Structure Pure (unbiased) expectations. Forward rates (F) function of expected future spot rates E(S). ●If up sloping. ST spot rates rise. ●If down sloping, ST rate spot rates fall ●If flat, ST spot rates constant. Liquidity theory: F rates reflect expectations of E(S) plus liquidity premium. Preferred habitat theory: Imbalance between fund supply/demand at maturity range induces lenders to shift from preferred habitats to one with opposite imbalance. 3.Key rate duration ●%Δvalue from 100 bps Δ in key rate. ●Have several key rates (5-yr, 10-yr) ●Estimate effect of non-parallel yield curve shift on bond portfolio value. 4.Valuing Option Free Bonds To value option free bond with the binomial tree, start at end discount back through the tree (backwards induction method). Value 2-yr, option-free bond: Step 1: Find the time one up-node value: Nodal value 1,U =2,2,1,1,1211UU UD U u NodalValue NodalValue i i ?????+?? ? ? ++??????? ???? Step 2: Find time one down-node value Step 3: find time zero value: Nodal value 01,1,001211U D NodalValue NodalValue i i ??????+?? ? ?++?????? 5. Value Bond with Embedded Option For bonds with embedded options, assess whether option will be exercised at each node. New step 3 is: (Callable bond). Find time 0 value assuming year 1 down-node calculated value > that call price. Nodal value 0=1,1,001211U D NodalValue NodalValue i i ?????+?? ? ++????? ??? Call = noncallable bond-callable bond Put = putable bond – nonputable bond 6. Option Adjust Spread ● “Option – removed spread” ● Compensation for liquidity and credit risk relative to benchmark ● Spread that forces model price = market price ● Nominal spread = OAS + option cost. 7. Relative Valuation Analysis If benchmark is Treasuries or higher-rated bond sector: ● Bond is undervalued if OAS > 0 ● Bond is overvalued if OAS < 0 8. Convertible Bonds ● Conversion value = stock price ×conversion ratio ● Minimum value = max (straight value, conversion value) ● Market conversion premium = straight bond + call on stock – call on bond 9. MBS Prepayment Risk Prepayment speed factors ● Spread of current vs. original mortgage rates ● Mortgage rate path (refinancing burnout) ● Housing turnover ● Loan seasoning and property location Contraction risk occurs as rates fall, prepayments rise, average life falls. Extension risk occurs as rate rise, prepayments fall (slow), average lift rises. 10. CMO Prepayment Risk ● PAC I tranches: low contraction and extension risk (due to PAC collar) ● PAC II tranches: somewhat higher contraction and extension risk. ● Support tranches: higher contraction and extension risk ● IO strips: value positively related to interest rates at low current rates. ● PO strips: negative convexity at low rates, high interest rate sensitivity. 11. Commercial MBS ● Non-recourse, so focus on property credit risk, ● Loan-level call protection: prepayment lockout; defeasance; prepayment penalty; yield maintenance charge. ● Pool-level call protection: senior and subordinated tranches. 12. ABS Credit Enhancement ● External: corporate guarantees, letters of credit, bond insurance. ● Internal: reserve funds, overcollateralization, senior/sub structure. 13. ABS Prepayment Risk ● Closed-end HEL: prepayments also affected by borrower credit traits. ● Manufactured housing loan: low prepayment risk; small balances, high depreciation, low borrower credit ratings. ● Auto loan: low prepayment risk; small balances, high depreciation ● Student loan: prepayment from default, loan consolidation. ● Credit card receivable: low prepayment risk; lockout period, no prepayment on credit cards. 14. Collateralized Debt Obligation (CDO) ● Structure: senior tranches, mezzanine tranches, equity tranche ● Arbitrage – driven cash CDO: use interest rate swap. ● Cash flow CDO: actively managed, no short-term trading. ● Synthetic CDO, Bondholders take on economic risks of assets but not legal ownership of them; link contingent payments to reference asset (e.g., a bond indee) ● Advantages of synthetic CDO: no funding, shorter ramp-up period, acquire exposure more cheaply through credit-default swap. 15. MBS/ABS Spread Analysis ● Plain-vanilla corporate: use Z-spread ● Callable corporate: use OAS (binomial model) ● MBS: use OAS (Monte Carlo model) ● Credit card/auto ABS: use Z-spread ● High-quality home equity ABS: use OAS (Monte Carlo model) DERIV ATVES 1. Forwards: No arbitrage Pricing 0(1)T f FP S R =?+ (1)long t T t f FP V S R -??=-??+???? 2. Equity Forward ()0()(1()(1)T Equity f long t t T t f FP S PVD R FP V S PVD F -=-?+??=--??+???? ) 3. Forward on Fixed Income Securities ()0()(1()(1)T FixedIncome f long t T t f FP S PVC R FP V S PVC F -=-?+??=--??+???? ) 4. Forward Rate Agreement (FRA) ● FRA is forward contract on interest rate; long wins when rates increase, loses when rates decrease. ● FRA “price” is implied forward interest rate for period beginning when FRA expires to underlying “loan ” maturity. ● FRA value at maturity is interest savings at maturity of “loan” discounted back to FRA expiration at current LIBOR. ● FRA value prior to maturity is interest savings estimated by implied forward rate discounted back to valuation date at current LIBOR. 5. Currency Forward (Interest Rate Parity) ()0(1)(1)T DC currency T FC R FP S R +=?+ F and S in DC/FC (1)(1)t long T t T t FC DC S FP V R R --???=-???++?????? 6. Futures Price 0(1)T f FP S R =?+ ● Futures > forward when rates and asset values positively correlated. ● Futures < forward when rates and asset values negatively correlated. 7. Futures Arbitrage Cash and carry: Borrow, buy spot, sell futures today; deliver asset, repay loan at end. Reverse cash and carry: short spot, invest, buy future today; collect loan, buy asset under futures contract, deliver to cover short sale. 8. Costs and Non- Monetary Benefits ● Holding costs increase futures price; non monetary benefits reduce futures price. ● Backwardation: Futures price < spot price. ● Contango: Futures price > spot price. ● Normal backwardation: Futures price < expected spot price. ● Normal contango: Futures price > expected spot price. 9. Treasury Bond Futures 1Pr (1)T f FP Bond ice R FVC CF ??=?+-??? 10. Equity Futures ()0()()0(1)T stock f R T index FP S R FVD FP S e δ-=?+-=? 11. Eurodollar Futures ● Priced as discount yield; LIBOR-based deposits priced as add-on yield → deposit value not perfectly hedged by Eurodollar contract. ● Can’t price Eurodollar futures using no-arb framework 12. Put-call party Call + RF bond = Put + Underlying 00(1) T X C P r +=+0S + 13. caps and floors ● cap = portfolio of calls on LIBOR ● floor = portfolio of puts on LIBOR ● collar = buy cap and sell floor or sell cap and buy floor. 14. Binomial Option Pricing Model Step 1: calculate option payoffs at end in all states. Step 2: calculate expected value using probabilities. 1R D U D π+-=- Step 3: Discount to today at risk-free rate. 15. BSM Assumptions & Limitations ● Assumption: Price of underlying follows lognormal distribution; (continuous) risk-free rate constant and known; σ of underlying asset constant and known; frictionless markets; underlying asset has no CF, European options. ● Limitation: Not useful for pricing options on bond prices/interest rates; σ must be estimated; σ not constant over time; frictionless markets assumption not realistic. 16. Effect of each variable on a call option: ● Asset price: positively related. ● V olatility of asset price: positively related. ● Risk free rate: positively related. ● Time to expiration: value → $0 as call → maturity ● Exercise price: negatively related. 17. Delta Estimates the change in value of option for a one unit change in stock price. ● Call delta between 0 and 1; increases as stock price increases. ● Call delta close to 0 for far out-of-the-money calls; close to 1 for far in-the-money calls. ● Put delta between -1 to 0; increases from -1 to 0 as stock price increases. ● Put delta = call delta – 1 (all else equal). ● Delta close to 0 for far out-of-the-money puts; close to -1 for far in-the-money puts. 18. Delta Neutral Hedging # calls for delta hedge = #SharesOfStock DeltaOfCallOption Delta-neutral position only holds for very small changes in value of underlying stock. Delta-neutral portfolio must be frequently (continuously) rebalanced to maintain hedge; called a dynamic hedge. 19. Gamma Measures rate of change in delta as underlying stock price changes; largest when option is at-the-money. 20. Currency Swaps Parties swap payments in two currencies at fixed or floating rates. 21. Interest Rate Swaps Plain vanilla interest rate swap: trading fixed interest rate payments for floating rate payments. 22. Equity Swaps Return on stock, portfolio, or stock index is paid each period by one party in return for a fixed payment. Return can be capital appreciation or total return including dividends on the stock or portfolio. 23. Swap Pricing and Valuation ● Swap rate is set so PV of floating rate payments = PV of fixed rate payments; swap value is zero to both parties: 121...N N N Z C Z Z Z -=+++ Z n = PV of $1 on n th date ● Value to fixed pay side = PV of floating –PV of fixed; value increase when rates increase. ● Value to floating pay side = PV of fixed – PV of floating; value increase when rates decrease. 24. Credit Derivatives Credit default swap: compensates buyer when credit event occurs on referenced bond/loan. Pricing depends on credit risk of reference obligation, not interest rate risk. Strategies: basis, curve, index, options, capital structure, and correlation trades. PORTFOLIO MANAGEMENT 1. CAL: Efficient front. With R F becomes straight line. ()()T F c F T E R R E R R C σσ??-=+???? 单项式乘以多项式:a(b+c)=ab+ac 多项式乘以多项式:(a+b)(m+n)=am+am+bm+bn 5、乘法公式(反过来就是因式分解的公式): ①平方差公式:(a+b)(a-b)=a2-b2. ②完全平方公式:(a±b)2=a2±2ab+b2. ③(a+b)(a2-ab+b2)=a3+b3. ④(a-b)(a2+ab+b2)=a3-b3;a2+b2=(a+b)2-2ab,(a-b)2=(a+b)2-4ab. 6、幂的运算性质: ①a m×a n=a m+n. ②a m÷a n=a m-n. ③(a m)n=a mn. ④(ab)n=a n b n. ⑤()n=n. ⑥a-n=1 n a ,特别:()-n=()n. ⑦a0=1(a≠0). 如:a3×a2=a5,a6÷a2=a4,(a3)2=a6,(3a3)3=27a9,(-3)-1=-,5-2==,(-)-2=()2=,(-3.14)o=1,(-)0=1. 7、二次根式:①()2=a(a≥0),②=丨a丨,③=×,④=(a>0,b≥0).如:①(3)2=45.②=6.③a<0时,=-a.④的平方根=4的平方根=±2.(平方根、立方根、算术平方根的概念) 8、一元二次方程:对于方程:ax2+bx+c=0: 小学数学图形计算公式 1 、正方形C周长S面积a边长周长=边长×4 C=4a 面积=边长×边长S=a×a 2 、正方体V:体积a:棱长表面积=棱长×棱长×6 S表=a×a×6 体积=棱长×棱长×棱长 3 、长方形 C周长S面积a边长 周长=(长+宽)×2 C=2(a+b) 面积=长×宽 S=ab 4 、长方体 V:体积s:面积a:长b: 宽h:高 (1)表面积(长×宽+长×高+宽×高)×2 S=2(ab+ah+bh) (2)体积=长×宽×高 V=abh 5 三角形 s面积a底h高 面积=底×高÷2 s=ah÷2 三角形高=面积×2÷底 三角形底=面积×2÷高 6 平行四边形 s面积a底h高 面积=底×高 s=ah 7 梯形 s面积a上底b下底h高 面积=(上底+下底)×高÷2 s=(a+b)× h÷2 8 圆形 S面积C周长∏ d=直径r=半径 (1)周长=直径×∏=2×∏×半径 C=∏d=2∏r (2)面积=半径×半径×∏ 9 圆柱体 v:体积h:高s;底面积r:底面半径c:底面周长 (1)侧面积=底面周长×高 (2)表面积=侧面积+底面积×2 (3)体积=底面积×高 (4)体积=侧面积÷2×半径 一年级数学公式大全 1、加数 + 加数 = 与 2、被减数 – 减数 = 差 与 = 加数 + 加数 差 = 被减数 – 减数 与 – 加数 = 另一个加数 被减数 – 差 = 减数 另一个加数 = 与 – 加数 减数= 被减数 – 差 差 + 减数 = 被减数 被减数 = 差 + 减数 3、一个数从右边起第一位就是个位,(表示几个一) 第二位就是十位、(表示几个十)第三位就是百位、(表示几个百) 读数与写数都从高位起、读作就是写中国数字,写作就是写数学字 个的前面写数学字,个的后面写中国数字。 4、?在“︸”下面就就是求总数,用加法计算。(+) 5 比多比字前面就是大数,比少比字前面就是小数,多或少的后面都就是相差数 求大数用加法,求小数用减法 求差用减法 6、钟面上时针短,分针长。分针指着12就是整时,时针指着数字几就就是几时, 分针指着6就是半时,时针过数字几就就是几时半。 7、 8 (-) 9、交换加数的位置,与不变。 10、一个数从右边起,第一位就是个位,第二位就是十位。 11、 12、20里面有2个十,也可以说20里面有20个一。 13、10里面有1个十,也可以说10里面有10个一。 14、最小的一位数就是1,最小的两位数就是10,最大的一位数就是9。 15、尺子上的起点用0来表示。 16、找相邻数的方法:用这个数加1,再用这个数减1,得到的结果就就是它的相邻数。- 17、求数字前面的那个数减1,求数字后面的那个数加1。 18、任何数加0都得这个数,任何数减0都得这个数。一个加数不变,另一个加数增加了几,与也增加几;一个加数不变,另一个加数减少了几,与也减少几。19、两个相同的数相减,差就是0。 一年级数学公式大全(电子版),孩子做作业必备! 一、加法 加数+加数=和 和=加数+加数 和-加数=另一个加数 另一个加数=和-加数 交换加数的位置,和不变 二、减法 被减数-减数=差 差=被减数-减数 被减数-差=减数 减数=被减数-差 差+减数=被减数 被减数=减数+差 三、数位 1、一个数从右边起第一位是个位,(表示几个一) 第二位是十位.(表示几个十) 第三位是百位.(表示几个百) 2、20里面有2个十,也可以说20里面有20个一。 3、10里面有1个十,也可以说10里面有10个一。 4、读数和写数都从高位起.读作是写语文字,写作是写数学字 5、个的前面写数学字,个的后面写语文字。 四、列式计算 在“︸”下面就是求总数,用加法计算。(+) 在“︸”上面就是求部分,用减法计算。(-) 五、比大小多少 求大数比小数多多少,用减法计算。(-) 求小数比大数少多少,用减法计算。(-) 也就是:求一个数比另一个多几少几的问题 六、认时间 1、时针短,分针长。1时=60分60分=1时1刻=15分 2、分针指着12是整时,时针指着数字几就是几时, 3、分针指着6是半时,时针过数字几就是几时半。 4、钟面数字有十二个。两数之间有五小格,一周共有六十小格。 5、时针转一个数字是一时,分针转一个小格是一分, 6、时针刚过数字几,就是表示几时多。 要问多了多少分,请你仔细看分针。 七、凑十歌 凑十歌:小朋友拍拍手,大家来唱凑十歌,九凑一,八凑二,七凑三来六凑四,两五相凑就满十。 凑十法:拆小数,凑大数。拆大数,凑小数。 八、= 等于号< 小于号>大于号 大口朝大数,尖尖朝小数. 大口朝左大于号,大口朝右小于号. 两边相等用等号. 九、图文应用题 先找出已知条件和问题,再确定用加法或减法计算。最后要记得写答. 求一共是多少,用加法计算。(+) 求还有、还剩、剩下是多少,用减法计算。(-) 十、认识人民币 1元=10角1角=10分1元=100分 ),(),(y x s y x r 残差——i υ=i x -x 计算标准偏差的方法: ·“最大残差法”计算实验标准偏差为 max ,,1i n c s υ?= ·最大误差法max ,,2i n c s ??= ·极差法s= )(11min ,max ,,3,3i i n n x x c c -?=?ω ·较差法:) 1(2)()()(2 1223212--++-+-= -n x x x x x x s n n 算术平均值实验标准偏差——s n s x ?=-1 算术平均值: 实验标准偏差的估计方法: 1、贝塞尔公式: 2、最大残差法: 3、极差法: 4、较差法: 算术平均值实验标准差: 判别异常值的统计方法: 1、拉依达准则:≥3s 2、格拉布斯准则:p ;a为显著性水平,p为置信概率. 3、狄克逊准则:设所得到的观测值从小到大的规律排列为:x1,x2,…,x n,其中x1最小,x n最大; (1)在n=3~7情况下: (2)在n=8~10情况下: (3)在n=11~13情况下: (4)在n≥14情况下: 当则x n为异常值;当则x1为异常值; 加权算术平均值的计算: Wi为第i组观测结果的权,m为重复观测的组数;加权算术平均值实验标准差的计算: 符合性评定: 1、 2、 标准不确定度分量的A类评定方法: 1、基本测量标准不确定度A类评定: 2、测量过程的A类标准不确定度评定:若每次核查时测量次数n相同,每次核查时的样本标准偏差为s i,共核查k次,则有合并样本偏差: ,自由度v=(n-1)k; ,n’为测量结果时的测量次数。 3、规范化常规测量时A类标准不确定度评定:测量m个组数据,每组测量n次,第j组的平均值为,则合并样本标准偏差为: ,自由度v=m(n-1); 若每组被测次数n j不同,各组自由度v j不等,各组实验标准偏差为s j,则: 测量不确定度的传播律,不相关时: 输入量间不相关时合称标准不确定度的评定: 百化分公式表_小学数学基础知识整理一到六年级 整理表 姓名: 职业工种: 申请级别: 受理机构: 填报日期: 小学数学基础知识整理(一到六年级) 小学一年级九九乘法口诀表。学会基础加减乘。 小学二年级完善乘法口诀表,学会除混合运算,基础几何图形。 小学三年级学会乘法交换律,几何面积周长等,时间量及单位。路程计算,分配律,分数小数。 小学四年级线角自然数整数,素因数梯形对称,分数小数计算。 小学五年级分数小数乘除法,代数方程及平均,比较大小变换,图形面积体积。小学六年级比例百分比概率,圆扇圆柱及圆锥。 必背定义、定理公式 三角形的面积=底×高÷2。公式S= a×h÷2 正方形的面积=边长×边长公式S= a×a 长方形的面积=长×宽公式S= a×b 平行四边形的面积=底×高公式S= a×h 梯形的面积=(上底+下底)×高÷2 公式S=(a+b)h÷2 内角和:三角形的内角和=180度。 长方体的体积=长×宽×高公式:V=abh 长方体(或正方体)的体积=底面积×高公式:V=abh 正方体的体积=棱长×棱长×棱长公式:V=aaa 圆的周长=直径×π 公式:L=πd=2πr 圆的面积=半径×半径×π 公式:S=πr2 圆柱的表(侧)面积:圆柱的表(侧)面积等于底面的周长乘高。公式:S=ch=πdh =2πrh 圆柱的表面积:圆柱的表面积等于底面的周长乘高再加上两头的圆的面积。公式:S=ch+2s=ch+2πr2 圆柱的体积:圆柱的体积等于底面积乘高。公式:V=Sh 圆锥的体积=1/3底面×积高。公式:V=1/3Sh 分数的加、减法则:同分母的分数相加减,只把分子相加减,分母不变。异分母的分数相加减,先通分,然后再加减。 分数的乘法则:用分子的积做分子,用分母的积做分母。 分数的除法则:除以一个数等于乘以这个数的倒数。 读懂理解会应用以下定义定理性质公式 一、算术方面 1、加法交换律:两数相加交换加数的位置,和不变。 2、加法结合律:三个数相加,先把前两个数相加,或先把后两个数相加,再同第三个数相加,和不变。 3、乘法交换律:两数相乘,交换因数的位置,积不变。 4、乘法结合律:三个数相乘,先把前两个数相乘,或先把后两个数相乘,再和第三个数相乘,它们的积不变。 5、乘法分配律:两个数的和同一个数相乘,可以把两个加数分别同这个数相乘,再把两个积相加,结果不变。如:(2+4)×5=2×5+4×5 6、除法的性质:在除法里,被除数和除数同时扩大(或缩小)相同的倍数,商不变。O除以任何不是O的数都得O。 一级建造师所有计算公式大全(附图 表),人手一份! 【摘要】本文整理了建筑施工现场常用的所有公式,包括:工程量计算公式;各类钢材的重量计算公式;建筑行业常用公式图表。建议人手一份,收藏备用! 一、工程量计算公式 一、平整场地 ( 建筑物场地厚度在±30cm以内的挖、填、运、找平。) 1、平整场地计算规则 (1)清单规则:按设计图示尺寸以建筑物首层面积计算。 (2)定额规则:按设计图示尺寸以建筑物外墙外边线每边各加2米以平方米面积计算。 2、平整场地计算公式 S=(A+4)×(B+4)=S底+2L外+16 式中:S——平整场地工程量;A———建筑物长度方向外墙外边线长度;B———建筑物宽度方向外墙外边线长度;S底———建筑物底层建筑面积;L外———建筑物外墙外边线周长。 该公式适用于任何由矩形组成的建筑物或构筑物的场地平整工程量计算。 二、基础土方开挖计算 1、开挖土方计算规则 (1)清单规则:挖基础土方按设计图示尺寸以基础垫层底面积乘挖土深 度计算。 (2)定额规则:人工或机械挖土方的体积应按槽底面积乘以挖土深度计算。槽底面积应以槽底的长乘以槽底的宽,槽底长和宽是指基础底宽外加工作面,当需要放坡时,应将放坡的土方量合并于总土方量中。 2、开挖土方计算公式 (1)清单计算挖土方的体积:土方体积=挖土方的底面积×挖土深度。 (2)定额规则:基槽开挖:V=(A+2C+K×H)H×L。式中:V———基槽土方量;A———槽底宽度;C———工作面宽度;H———基槽深度;L———基槽长度。. 其中外墙基槽长度以外墙中心线计算,内墙基槽长度以内墙净长计算,交接重合出不予扣除。 基坑开挖:V=1/6H[A×B+a×b+(A+a)×(B+b)+a×b]。式中:V———基坑体积;A—基坑上口长度;B———基坑上口宽度;a———基坑底面长度;b———基坑底面宽度。 三、回填土工程量计算规则及公式 1、基槽、基坑回填土体积=基槽(坑)挖土体积-设计室外地坪以下建(构)筑物被埋置部分的体积。 式中室外地坪以下建(构)筑物被埋置部分的体积一般包括垫层、墙基础、柱基础、以及地下建筑物、构筑物等所占体积 2、室内回填土体积=主墙间净面积×回填土厚度-各种沟道所占体积 主墙间净面积=S底-(L中×墙厚+L内×墙厚) 式中:底———底层建筑面积;L中———外墙中心线长度;L内———内 ) ()(),(),(y s x s y x s y x r 残差——i υ=i x -x 计算标准偏差的方法: ·“最大残差法”计算实验标准偏差为 max ,,1i n c s υ?= ·最大误差法max ,,2i n c s ??= ·极差法s= )(11min ,max ,,3,3i i n n x x c c -?=?ω ·较差法:) 1(2)()()(2 1223212--++-+-=-n x x x x x x s n n Λ 算术平均值实验标准偏差——s n s x ?=-1 算术平均值: 实验标准偏差的估计方法: 1、贝塞尔公式: 2、最大残差法: 3、极差法: 4、较差法: 算术平均值实验标准差: 判别异常值的统计方法: 1、拉依达准则:≥3s 2、格拉布斯准则:p ;a为显著性水平,p为置信概率. 3、狄克逊准则:设所得到的观测值从小到大的规律排列为:x1,x2,…,x n,其中x1最小,x n最大;(1)在n=3~7情况下: (2)在n=8~10情况下: (3)在n=11~13情况下: (4)在n≥14情况下: 当则x n为异常值;当则x1为异常值; 加权算术平均值的计算: Wi为第i组观测结果的权,m为重复观测的组数; 加权算术平均值实验标准差的计算: 符合性评定: 1、 2、 标准不确定度分量的A类评定方法: 1、基本测量标准不确定度A类评定: 2、测量过程的A类标准不确定度评定:若每次核查时测量次数n相同,每次核查时的样本标准偏差为s i,共核查k次,则有合并样本偏差: ,自由度v=(n-1)k; ,n’为测量结果时的测量次数。 3、规范化常规测量时A类标准不确定度评定:测量m个组数据,每组测量n次,第j组的平均值为,则合并样本标准偏差为: 小学级数学公式大全文档编制序号:[KK8UY-LL9IO69-TTO6M3-MTOL89-FTT688] 小学一至六年级数学公式大全一.图形计算公式 1.周长公式 类型公式字母表示 长方形周长=(长+宽)×2 (a+b)×2 正方形周长=边长×4 a×4=4a 圆的周长=直径×π= 2×π×半径c=π×d =2×π×r 2,面积公式 类型公式字母表示 长方形面积=长×宽s=a×b 正方形面积=边长×边长s=a×a 平行四边形面积=底×高s=a×h 梯形面积=(上底+下底)×高÷2 s=(a+b)×h÷2 三角形面积=底×高÷2 s=a×h÷2 长方体表面积(长×宽+长×高+宽×高)×2 S=(a×b+a×h+b×h)×2 正方体表面积=棱长×棱长×6 s= a×a×6 圆面积=π×半径的平方 s=πr2 圆柱体侧面积=底面周长×高 s=π×直径×高 =2×π×半径×高=c×h =π×d×h =2×π×r×h 圆柱体表面积=侧面积+2×底面积 =底面周长×高+2×π×半径的平方 =π×直径×高+2×π×半径的平方 =2×π×半径×高+2×π×半径的平方 =c×h+2πr2 =π×d×h+2πr2 =2×π×r×h +2πr2 3.体积公式 类型公式字母表示 长方形长×宽×高 a×b×h 正方体棱长×棱长×棱长 a×a×a 圆柱体底面积×高Πr2h 圆锥体底面积×高÷3 π×半径的平方×高÷3 s×h÷3 πr2h÷3 补充说明: 长方体棱长和=(长+宽+高)×4 正方体棱长和=棱长×12 二.熟记下列正反比例关系: 正比例关系:y=kx 正方形的周长与边长成正比例关系 2016中信小学五年级数学总复习资料 常用的数量关系式姓名:———— 1、速度×时间=路程路程÷速度=时间路程÷时间=速度 2、单价×数量=总价总价÷单价=数量总价÷数量=单价 3、工作效率×工作时间=工作总量工作总量÷工作效 率=工作时间工作总量÷工作时间=工作效率 4、加数+加数=和和-一个加数=另一个加数 5、被减数-减数=差被减数-差=减数差+减数=被减数 6、因数×因数=积积÷一个因数=另一个因数 7、被除数÷除数=商被除数÷商=除数 小学数学图形计算公式 8、正方形的周长=边长×4 C=4a 边长=周长÷4 面积=边长×边长S=a2 3、长方形的周长=(长+宽)×2 C=2(a+b) 长=周长÷2-宽 宽=周长÷2-长 面积=长×宽s=a×b 长=面积÷宽宽=面积÷长 4、三角形的面积=底×高÷2 s=ah÷2 三角形的高=面积×2÷底三角形的底=面积×2÷高 6、平行四边形的面积=底×高s=ah 底=面积÷高高=面积÷底 7、梯形的面积=(上底+下底)×高÷2 s=(a+b)× h÷2 梯形的高=面积×2÷(上底+下底)梯形的上底=面积×2÷高-下底梯形的下底=面积×2÷高-上底 11、总数÷总份数=平均数 12、相遇问题:相遇路程=速度和×相遇时间 相遇时间=相遇路程÷速度和 速度和=相遇路程÷相遇时 常用单位换算 13.长度单位换算 1千米=1000米1米=10分米1分米=10厘米1米=100厘米1厘米=10毫米 14.面积单位换算 1平方千米=100公顷1公顷=10000平方米1平方米=100平方分米1平方分米=100平方厘米1平方厘米=100平方毫米15.重量单位换算 1吨=1000 千克1千克=1000克1千克=1公斤 16.人民币单位换算 1元=10角1角=10分1元=100分 17.时间单位换算 1世纪=100年1年=12月大月(31天)有:1,3,5,7,8,10,12月小月(30天)的有:4,6,9,11月 平年2月28天, 闰年2月29天平年全年365天, 闰年全年366天1日=24小时 1时=60分1分=60秒1时=3600秒 人教版小学数学概念公式大全 一、图形计算公式 1、三角形的面积=底×高÷2。公式 S= a×h÷2 2、正方形的面积=边长×边长公式 S= a2或S=a×a 3、长方形的面积=长×宽公式 S= ab 4、平行四边形的面积=底×高公式 S= ah 5、梯形的面积=(上底+下底)×高÷2 公式 S=(a+b)h÷2 6、内角和:三角形的内角和=180度。 7、长方体的体积=长×宽×高公式:V=abh 8、长方体(或正方体)的体积=底面积×高公式:V=Sh 9、正方体的体积=棱长×棱长×棱长公式:V=aaa=a3 10、圆的周长=直径×π公式:L=πd=2πr 11、圆的面积=半径×半径×π公式:S=πr2 12、圆柱的侧面积:圆柱的侧面积等于底面的周长乘高。公式:S=ch=πdh=2πrh 13、圆柱的表面积:圆柱的表面积等于底面的周长乘高再加上两头的圆的面积。公式:S=ch+2s=ch+2πr2 14、圆柱的体积:圆柱的体积等于底面积乘高。公式:V=Sh 15、圆锥的体积=1/3底面×积高。公式:V=1/3Sh 二、数量关系 1、单价×数量=总价 2、单产量×数量=总产量 3、速度×时间=路程 4、工效×时间=工作总量 5、加减乘除 加数+加数=和 一个加数=和-另一个加数 被减数-减数=差 减数=被减数-差 被减数=减数+差 因数×因数=积 一个因数=积÷另一个因数 被除数÷除数=商 除数=被除数÷商 被除数=商×除数 有余数的除法:被除数=商×除数+余数 三、计算法则 1、加法交换律:两数相加交换加数的位置,和不变。 2、加法结合律:三个数相加,先把前两个数相加,或先把后两个数相加,再同第三个数相加,和不变。 最新的小学二年级数学公式大全 二年级数学公式 ①加数+加数=和 和-一个加数=另一个加数 ②被减数-减数=差 被减数-差=减数 差+减数=被减数 ③因数因数=积 积一个因数=另一个因数 ④被除数除数=商 被除数商=除数 商除数=被除数 除数商+余数=被除数.比 比的意义:两个数相除又叫作两个数的比。 根据比的意义可以求比值;求比值的方法:用前向除以后项。 比的基本性质:比的前项和后项都乘或除以相同的数(0除外)比值不变。应用比的基本性质可以化简比。 .四则混合运算 ①在四则运算中,加法和减法称为第一级运算,乘法和除法称为第二级运算。 ②在没有括号的算式里,如果只含有同一级运算,要从左往右一次计算;如果含有两级运算,要先做第二级运算,再做第一级运算。 ③在有括号的算式里,要先算括号里面的,如果既有小括号又有 中括号,要先算小括号里面的,再算中括号里面的,最后算括号外面的。 39.分数、百分数应用题 单位1已知,用乘法。单位1未知,用除法。 ①求一个数是另一个数的几(百)分之几? 最新的小学二年级数学公式大全:基本公式:前一个数后一个数(比较量标准量) ②求一个数的几(百)分之几或几倍是多少?(单位1已知) 基本公式:单位1的量分率=分率对应的量 ③已知一个数的几(百)分之几是多少,求这个数.(单位1未知用除法或方程) 基本公式:分率对应的数量分率=单位1的量或者列方程解。 ④已知两个数,求一个数比另一个数多几分之几。 已知两个数,求一个数比另一个数多百分之几。 已知两个数,求一个数比另一个数少几分之几。 已知两个数,求一个数比另一个数少百分之几。 基本公式:两个数的差单位1的量(标准量本金:存入银行的钱叫本金。利息:取款时银行多支付的钱叫利息。利率:利息与本金的百分比叫做利率。 分享到:新浪微博腾讯微博 QQ空间 QQ好友人人网百度贴吧复制网址 ②利息计算公式:利息=本金时间利率 利息税=本金时间利率5% 第一章工程造价构成 一、我国现行建设项目投资构成 二、设备及工器具费用的构成及计算 1.国产非标设备原价的计算 材料费=净重*(1+损耗系数)*材料综合单价 加工费=设备总重*设备加工费单价 辅助材料费=设备总重*辅助材料费指标 专用工具费=(1+2+3)*百分比 废品损失费=(1+2+3+4)*百分比 外购配套件费,根据相应价格加运杂费计算 包装费=(1+2+3+4+5+6)*百分比 利润=(1+2+3+4+5+7)*百分比 税金(增值税)=当期销项税额-进项税额 当期销项税额=销售额*税率 销售额=(1+2+3+4+5+6+7+8) 非标设备设计费,按国家规定收费标准计算 设备原价={【(材料费+加工费+辅助材料费)*(1+专用工具费率)*(1+废品损失费率)+外购配套件费】*(1+包装费率)-外购配套件费}*(1+利润率)+销项税额+非标设备设计费+外购配套件费 2.进口设备原价的计算CIF=FOB+国际运费+保险费=CFR+保险费CIF=(FOB+运费)/(1-保险费费率%) 国际运费=FOB*保险费率保险费=(FOB+运费)*保险费率/(1-保险费率) 银行财务 费=FOB*费率*汇率外贸手续费=CIF*费率*汇率关税= CIF*费率*汇率消费税=(CIF*汇率+关税)*消费税率/(1-率) 增值税=(CIF+关税+消费税)*税率车辆购置税=(CIF+关税+消 费税)*税率银外关消增车(增关消)三、建筑安装工程费用构成 1.环境保护费、文明施工费、安全施工费(二次搬运费、冬雨季施工增加费)=直接工程费*费率费率=本项费用年度平均支出/全年建安产值*直接工程费占总造价比例 2. 临时设施费=(周转使用临建费+一次使用临建费)*(1+其他临时设施所占比例)周转使用=∑(临建面积*每平米造价*工期天数/使用年限*365*利用率)+一次性拆除费一次性=∑(临建面积*每平米造价*(1-残值率))+一次性拆除费 3.大型机械进出场及安拆费=一次进出场及安拆费*年平均安拆次数/年工作台班 4.模板摊销量=一次使用量*(1+施工损耗)*(0.5+补损率*(周转次数-0.5))/周转次数 5.脚手架摊销量=单位一次使用量*(1-残值率)*一次使用期/耐用期 6.规费费率(直接费)= ∑规费缴纳标准*每万元发承包价计算基数*人工费占直接费比例/每万元发承包价中的人工费含量规费费率(人机费)= ∑规费缴纳标准*每万元发承包价计算基数/万元发承包价中的人机费含量规费费率(人工费)= ∑规费缴纳标准*每万元发承包价计算基数/万元发承包价中的人工费含量7.管理费费率(直接费)=生产工人年平均管理费*人费占直接费比例/年有效施工天数*人工单价管理费费率(人机费)=生产工人年平均管理费/年有效施工天数*(人工单价+每工日机械使用费管理费费率(人工费)=生产工人年平均管理费/年有效施工天数*人工 单价8.市税率=1/1-3%-3%*7%-3%*3%-1 =3.3%/(1-3.3%) 综合税率3.41% 县镇税率 =1/1-3%-3%*5%-3%*3%-1 =3.24%/(1-3.24%) 综合税率3.348% 非县镇税率 =1/1-3%-3%*1%-3%*3%-1 =3.12%/(1-3.12%) 综合税率3.22% 四、国外建筑安装工程费用构成 1.分包工程费各分包工程费、总包利润和管理费2.单项工程开办费(施工用水电机具费、清理费、周转材料摊销费、临时设施摊销费、驻地工程师办公费、现场 一年级数学公式 一、加法 加数+加数=和 和=加数+加数 和-加数=另一个加数 另一个加数=和-加数 交换加数的位置,和不变 二、减法 被减数-减数=差 差=被减数-减数 被减数-差=减数 减数=被减数-差 差+减数=被减数 被减数=减数+差 三、数位 1、一个数从右边起第一位是个位,(表示几个一) 第二位是十位.(表示几个十) 第三位是百位.(表示几个百) 2、20里面有2个十,也可以说20里面有20个一。 3、10里面有1个十,也可以说10里面有10个一。 4、读数和写数都从高位起.读作是写语文字,写作是写数学字 5、个的前面写数学字,个的后面写语文字。 四、列式计算 ?在“︸”下面就是求总数,用加法计算。(+) ?在“︸”上面就是求部分,用减法计算。(-) 五、比大小多少 求大数比小数多多少,用减法计算。(-) 求小数比大数少多少,用减法计算。(-) 也就是:求一个数比另一个多几少几的问题 六、认时间 1.时针短,分针长。1时=60分60分=1时1刻=15分 2.分针指着12是整时,时针指着数字几就是几时, 3.分针指着6是半时,时针过数字几就是几时半。 4.钟面数字有十二个。两数之间有五小格,一周共有六十小格。 5.时针转一个数字是一时,分针转一个小格是一分, 6.时针刚过数字几,就是表示几时多。 要问多了多少分,请你仔细看分针。 七、凑十歌 凑十歌:小朋友拍拍手,大家来唱凑十歌,九凑一,八凑二,七凑三来六凑四,两五相凑就满十。 凑十法:拆小数,凑大数。拆大数,凑小数。 八、= 等于号< 小于号>大于号 大口朝大数,尖尖朝小数. 大口朝左大于号,大口朝右小于号. 两边相等用等号. 九、图文应用题 先找出已知条件和问题,再确定用加法或减法计算。最后要记得写答. 求一共是多少,用加法计算。(+) 求还有、还剩、剩下是多少,用减法计算。(-) 十、认识人民币 1元=10角1角=10分1元=100分 十一、认识位置 头在上,脚在下,胸在前,背在后,左手按,右手写,上下楼梯靠右走,位置认清不能错! 公式计算 (1)公式(公式可以对工作表数值进行加、减、乘、除等运算) 定义:对单元格中数据进行计算的等式。(输入公式必须以等号“=”开头)。 方法: 选择存放计算结果的单元格——在该单元格中或编辑栏中输入“=”号——输入需要的公式(如=C4+B4+D4)——按“Enter”键。 (2)运算符及其优先级 运算符对公式中的元素进行特定类型的运算。Excel 2000包含四种类型的运算符:算术运算符、比较少运算符、文本运算符、引用运算符。 (3)算术运算符 可以完成基本的数学运算,如加、减、乘(*)、除(/)、乘幂(^),可以连接数字,并产生数字结果。 (4)比较运算符 可以比较两个数值并产生逻辑值TRUE(成立)或FALSE(不成立)。比较运算符有=(等号)、>(大于号)、<(小于号)、>=(大于等于号)<=(小于等于号)。 (5)文本运算符“&” 可以将一个或多个文本连接为一个组合文本例如:&(连字符)将两个文本值连接或串起来产生一个边续的文本值例如“SEA”&“GATE”产生“SEAGATE”。 (6)引用运算符 可以将单元格区域合并计算。表12-2引用运算符的含义和示例。 8、函数的使用(牢记以下函数的功能及用法) (1)SUM(求和函数):求出一组数据的和。 格式:=SUM(起始单元格:终止单元格) (2)A VERAGE(求平均值函数):求出一组数据的平均值。 格式:=A VERAGE(起始单元格:终止单元格) (3)MAX(最大值函数):求出一组数据中的最大值。 格式:=MAX(起始单元格:终止单元格) (4)MIN(最小值函数):求出一组数据中的最小值。 格式:=MIN(起始单元格:终止单元格) (5)TODAY(日期年份函数):显示系统日期。 格式:=TODAY(不填写表达式) (6)NOW(日期时间函数):显示系统日期和时间。 格式:=NOW(不填写表达式) (7)RANK(排位函数):给一组数据排序。 (8)COUNTIF(统计函数):计算满足给定单元格的数目。 格式:=COUNTIF(起始单元格:终止单元格,条件) (9)IF(逻辑函数):根据条件的逻辑判断的真假结果。 格式:=IF(条件表达式,“条件成立返回值”,“条件不成立返回值”) (10)AND(逻辑函数):返回逻辑值,参数的结果为逻辑“真”时,返回值为“TRUE”;否则返回逻辑“假”,值则为“FALSE”。 逻辑函数:真真为真,真假为假,假假为真。 格式:=AND(条件表达式) (11)INT(取整函数):对数据进行取整,但不进行四舍五入。 格式:=INT(数值单元格) (12)ABS(绝对值函数):求出相应数字的绝对值。 格式:=ABS(数值单元格) (13)COUNTA(统计函数):计算参数列表所包含数值个数及非空单元格的数目。 格式:=COUND(起始单元格:终止单元格) (14)ROUND(四舍五入函数):对数据进行四舍五入。 格式:=ROUND(n,d) n代表数据,d代表小数位。 (15)PMT(统计函数):求投资或贷款的等额分期偿还额 格式:=PMT(利率,时间,本金) (16)SUMIF(条件求和函数):根据条件求出一组数据的和。 格式:=SUMIF(条件区域,条件,求和区域) (17)DATEDIF(日期函数):计算机两个日期参数的差值。 格式:=DATEDIF(date1,date2,"y") =DATEDIF(date1,date2,"m") =DATEDIF(date1,date2,"d") 说明:date1代表前面一个日期,date2代表后面一个日期;y(m、d)要求返回两个日期相差的年(月、天)数。 一年级数学公式大全集团档案编码:[YTTR-YTPT28-YTNTL98-UYTYNN08] 一年级数学公式大全 1、加数+加数=和 2、被减数–减数=差 和=加数+加数差=被减数–减数 和–加数=另一个加数被减数–差=减数 另一个加数=和–加数减数=被减数–差 差+减数=被减数 被减数=差+减数 3、一个数从右边起第一位是个位,(表示几个一) 第二位是十位.(表示几个十)第三位是百位.(表示几个百) 读数和写数都从高位起.读作是写中国数字,写作是写数学字 个的前面写数学字,个的后面写中国数字。 4、?在“︸”下面就是求总数,用加法计算。(+) 5比多比字前面是大数,比少比字前面是小数,多或少的后面都是相差数 求大数用加法,求小数用减法求差用减法 6、钟面上时针短,分针长。分针指着12是整时,时针指着数字几就是几时, 分针指着6是半时,时针过数字几就是几时半。 7、 8. -) 9、交换加数的位置,和不变。 10、一个数从右边起,第一位是个位,第二位是十位。 11、12、20里面有2个十,也可以说20里面有20个一。 13、10里面有1个十,也可以说10里面有10个一。 14、最小的一位数是1,最小的两位数是10,最大的一位数是9。 15、尺子上的起点用0来表示。 16、找相邻数的方法:用这个数加1,再用这个数减1,得到的结果就是它的相邻数。- 17、求数字前面的那个数减1,求数字后面的那个数加1。 18、任何数加0都得这个数,任何数减0都得这个数。一个加数不变,另一个加数增加了几,和也增加几;一个加数不变,另一个加数减少了几,和也减少几。19、两个相同的数相减,差是0。 20、被减数不变,减数越大,差越小;被减数不变,减数越小,差越大。 二、立体图形 1、长方形有4条边,正方形有4条边,三角形有3条边。 2、至少要用6相同的小根小棒可以摆一个长方形。 3、至少要用4根相同的小棒可以摆一个正方形。 4、至少要用3相同的小根小棒可以摆一个三角形。 5、硬币是圆的。 6、至少要8个小正方体可以拼成一个大的正方体。 7、正方体有6个面,6个面都相等,6个面都是正方形。 8、长方体有6个面,相对的两个面相等。 9、圆柱上下有两个平平的面,这两个面的大小相同。 三、练一练 1、○△○△△○△△△_________________ 2、(2) 3、6、9、12、()(3)19、17、15、13、()(4)1、3、2、6、3、9、()、()(5)12、5、13、5、1 4、 5、()、()(6)1、4、7、10、13、()(7)10、1、9、2、8、3、7、4、()、()(8)5、10、15、20、()(9)2、 6、10、14、18、()(10)5、50、6、51、 7、52、 8、53、()、()(11)5、8、11、14、17、()(12)2、3、5、8、13、()(13)4、8、12、16、()(14)1、6、2、7、3、8、4、 9、()、()(15)1、2、3、5、8、13、()(16)3、4、7、11、18、()(17)20、3、19、6、18、9、17、12、()、()(18)*1、2、4、7、11、16、() 3、20前面的数是(),15后面的数是() 1个。 4、4人,后面有3 ①18的前面是(),后面是()。②与15相邻的数是()和()。 ③比12大,又比17小的数有()。 一年级数学公式大全 1、加数 + 加数 = 和 2、被减数 – 减数 = 差 和 = 加数 + 加数 差 = 被减数 – 减数 和 – 加数 = 另一个加数 被减数 – 差 = 减数 另一个加数 = 和 – 加数 减数= 被减数 – 差 差 + 减数 = 被减数 被减数 = 差 + 减数 3、一个数从右边起第一位是个位,(表示几个一) 第二位是十位.(表示几个十)第三位是百位.(表示几个百) 读数和写数都从高位起.读作是写中国数字,写作是写数学字 个的前面写数学字,个的后面写中国数字. 4、?在“︸”下面就是求总数,用加法计算.(+) ?在“︸”上面就是求部分,用减法计算.(-) 5、 比多比字前面是大数,比少比字前面是小数,多或少的后面都是相差数 求大数用加法,求小数用减法 求差用减法 6、钟面上时针短,分针长.分针指着12是整时,时针指着数字几就是几时, 分针指着6是半时,时针过数字几就是几时半. 7、凑十歌:小朋友拍拍手,大家来唱凑十歌,九凑一,八凑二,七凑三来六凑四,两五相凑就满十. 凑十法:拆小数,凑大数.拆大数,凑小数. 8、图文应用题:先找出已知条件和问题,再确定用加法或减法计算.最后要记得写答. 求一共是多少,求总数、求和、求原来的用加法计算.(+) 求还有、求还要、求还剩、剩下、求其中的、求差,用减法计算.(-) 9、交换加数的位置,和不变. 10、一个数从右边起,第一位是个位,第二位是十位. 11、12、20里面有2个十,也可以说20里面有20个一. 13、10里面有1个十,也可以说10里面有10个一. 14、最小的一位数是1,最小的两位数是10,最大的一位数是9. 15、尺子上的起点用0来表示. 同学们,请记住, 钟面数字有十二个. 两数之间有五小格,一周共有六十小格。 时针转一个数字是一时,分针转一个小格是一分, 一时是六十分,六十分是一时。 时针刚过数字几,就是表示几时多。 要问多了多少分,请你仔细看分针。 也就是:求一个数比另一个多(少)几的问题 小学数学级公式大全 Document serial number【NL89WT-NY98YT-NC8CB-NNUUT-NUT108】 第一部分概念 1.加法交换律:两数相加交换加数的位置,和不变。 2.加法结合律:三个数相加,先把前两个数相加,或先把后两个数相加,再同第三个数相加,和不变。 3.乘法交换律:两数相乘,交换因数的位置,积不变。 4.乘法结合律:三个数相乘,先把前两个数相乘,或先把后两个数相乘,再和第三个数相乘,它们的积不变。 5.乘法分配律:两个数的和同一个数相乘,可以把两个加数分别同这个数相乘,再把两个积相加,结果不变。如:(2+4)×5=2×5+4×5 6.除法的性质:在除法里,被除数和除数同时扩大(或缩小)相同的倍数,商不变。0除以任何不是0的数都得0。简便乘法:被乘数乘数末尾有0的乘法,可以先把0前面的相乘,零不参加运算,有几个零都落下,添在积的末尾。 7.什么叫等式?等号左边的数值与等号右边的数值相等的式子叫做等式。等式的基本性质:等式两边同时乘以(或除以)一个相同的数,等式仍然成立。 8.什么叫方程式?答:含有未知数的等式叫方程式。 9.什么叫一元一次方程式?答:含有一个未知数,并且未知数的次数是一次的等式叫做一元一次方程式。学会一元一次方程式的例法及计算。即例出代有X的算式并计算。 10.分数:把单位“1”平均分成若干份,表示这样的一份或几分的数,叫做分数。 11.分数的加减法则:同分母的分数相加减,只把分子相加减,分母不变。异分母的分数相加减,先通分,然后再加减。 12.分数大小的比较:同分母的分数相比较,分子大的大,分子小的小。异分母的分数相比较,先通分然后再比较;若分子相同,分母大的反而小。 13.分数乘整数,用分数的分子和整数相乘的积作分子,分母不变。 14.分数乘分数,用分子相乘的积作分子,分母相乘的积作为分母。 15.分数除以整数(0除外),等于分数乘以这个整数的倒数。 16.真分数:分子比分母小的分数叫做真分数。 17.假分数:分子比分母大或者分子和分母相等的分数叫做假分数。假分数大于或等于1。 18.带分数:把假分数写成整数和真分数的形式,叫做带分数。 小学数学三年级公式总结 图形计算公式 1、正方形: C=周长、S=面积、a=边长 周长=边长×4 C=4a ;面积=边长×边长S=a×a 边长=面积÷边长边长=周长÷4 2、长方形: C=周长、 S=面积、a=边长 周长=(长+宽)×2 ;C=2(a+b);面积=长×宽;S=ab 长=周长÷2-宽;宽=周长÷2-长 长=面积÷宽宽=面积÷长 长度单位换算 1公里=1千米;1千米=1000米;1米=10分米;1分米=10厘米; 1米=100厘米;1厘米=10毫米 面积单位换算 1平方千米=100公顷;1公顷=10000平方米; 1平方米=100平方分米; 1平方分米=100平方厘米; 1平方厘米=100平方毫米1公顷=10000平方米;1亩=666.666平方米 重量单位换算 1吨=1000 千克;1千克=1000克;1千克=1公斤;1公斤 = 2市斤 人民币单位换算1元=10角;1角=10分;1元=100分 时间单位换算 1世纪=100年;1年=12月 大月(31天)有:1\3\5\7\8\10\12月 小月(30天)的有:4\6\9\11月 平年2月28天, 闰年2月29天 平年全年365天, 闰年全年366天 1日=24小时;1时=60分;1分=60秒;1时=3600秒 分数的加、减法则 同分母的分数相加减,只把分子相加减,分母不变。异分母的分数相加减,先通分,然后再加减。 分数的乘法则 用分子的积做分子,用分母的积做分母。 分数的除法则 除以一个数等于乘以这个数的倒数。 数量关系计算公式方面 1、每份数×份数=总数; 总数÷每份数=份数;总数÷份数=每份数 2、 1倍数×倍数=几倍数; 几倍数÷1倍数=倍数;几倍数÷倍数=1倍数 3、速度×时间=路程;路程÷速度=时间;路程÷时间=速度 4、单价×数量=总价;总价÷单价=数量;总价÷数量=单价 5、工作效率×工作时间=工作总量; 工作总量÷工作效率=工作时间; 工作总量÷工作时间=工作效率 6、加数+加数=和;和-一个加数=另一个加数 7、被减数-减数=差;被减数-差=减数;差+减数=被减数 8、因数×因数=积;积÷一个因数=另一个因数 9、被除数÷除数=商被除数÷商=除数商×除数=被除数 小学数学定义定理公式 一、算术方面 小学1-6年级数学公式(收藏) 01 几何公式 ?长方形的周长=(长+宽)×2 C=(a+b)×2 ?长方形的面积=长×宽 S=ab ?正方形的周长=边长×4 C=4a ?正方形的面积=边长×边长 S=a.a=a ?三角形的面积=底×高÷2 S=ah÷2 ?三角形的内角和=180度 ?平行四边形的面积=底×高 S=ah ?梯形的面积=(上底+下底)×高÷2 S=(a+b)h÷2 ?圆的直径=半径×2(d=2r) ?圆的半径=直径÷2(r=d÷2) ?圆的周长=圆周率×直径=圆周率×半径×2 C=πd=2πr ?圆的面积=圆周率×半径×半径 S=πr×r ?长方体的体积=长×宽×高 V=abh ?正方体的体积=棱长×棱长×棱长V=aaa ?圆柱的侧面积:圆柱的侧面积等于底面的周长乘高 S=ch=πdh=2πrh ?圆柱的表面积:圆柱的表面积等于底面的周长乘高再加上两头的圆的面积S=ch+2s=ch+2πr×r ?圆柱的体积:圆柱的体积等于底面积乘高 V=Sh ?圆锥的体积=1/3底面×积高V=1/3Sh 02 单位换算 ?1公里=1千米=1000米 1米=10分米 1分米=10厘米 1厘米=10毫米 ?1平方米=100平方分米 1平方分米=100平方厘米 1平方厘米=100平方毫米 ?1立方米=1000立方分米 1立方分米=1000立方厘米 1立方厘米=1000立方毫米 ?1吨=1000千克 1千克=1000克=1公斤=2市斤 ?1公顷=10000平方米 1亩=666.666平方米 ?1升=1立方分米=1000毫升 1毫升=1立方厘米 ?1元=10角 1角=10分 1元=100分 ?1世纪=100年 1年=12月 大月(31天)有:18月 小月(30天)的有:49月 平年2月28天,闰年2月29天 平年全年365天,闰年全年366天一级建造师 数学公式大全

一年级数学公式大全

小学生一年级数学公式大全

一级注册计量师考试相关公式大全

整理百化分公式表_小学数学基础知识整理一到六年级

一级建造师所有计算公式大全(附图表),人手一份!_471

一级注册计量师考试相关公式大全

小学级数学公式大全

人教版小学六年级数学公式大全91760

人教版数学一至六年级概念公式大全

最新的小学二年级数学公式大全

一级造价工程师案例公式大全

一年级数学公式大全(电子版)

计算机一级(公式计算)

一年级数学公式大全

一年级数学公式大全及概念

小学数学级公式大全完整版

小学数学级公式大全打印版

小学1-6年级数学公式大全(收藏)_PDF压缩