《金融随机分析》马成虎

附件:大纲模板

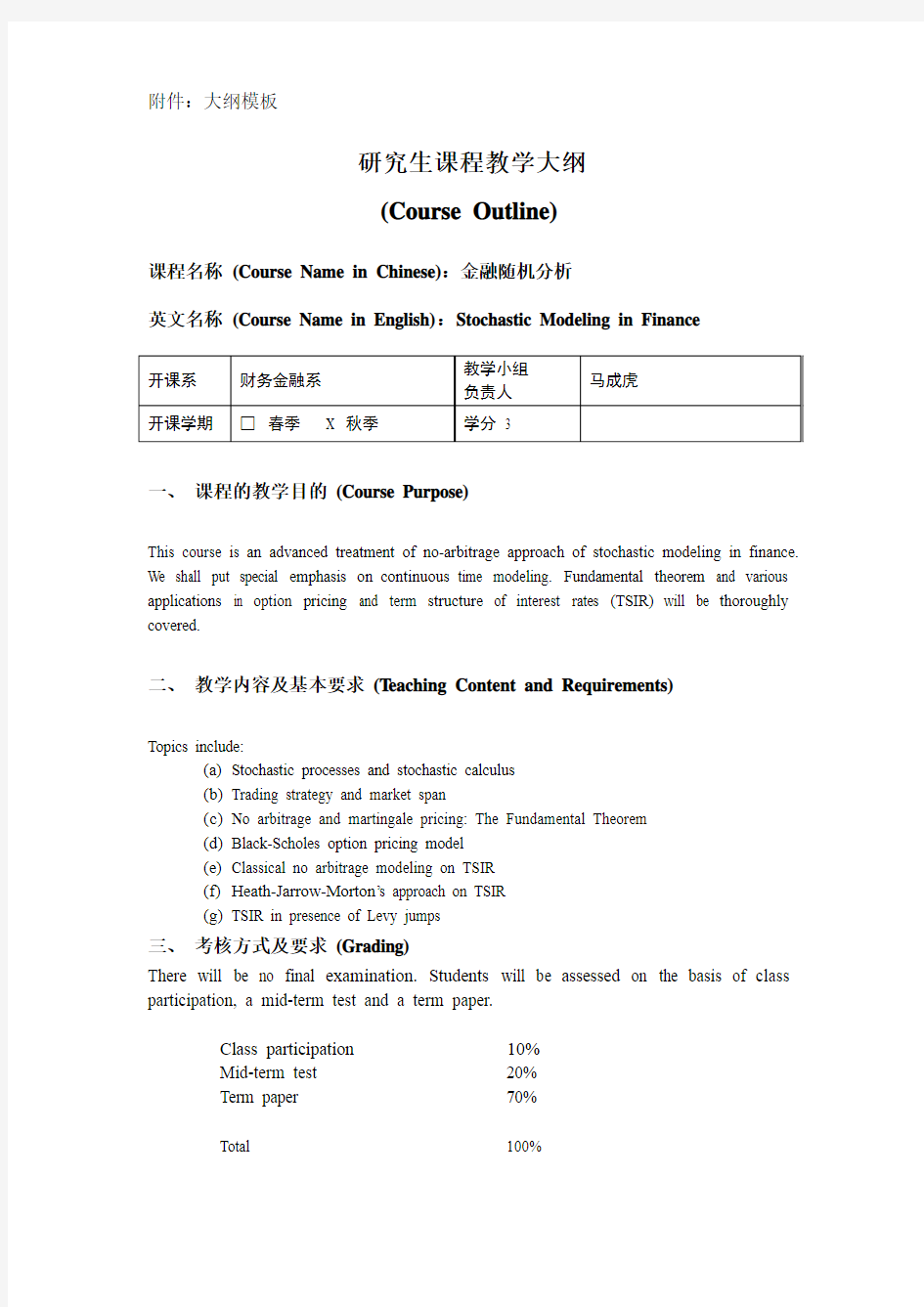

研究生课程教学大纲

(Course Outline)

课程名称(Course Name in Chinese):金融随机分析

英文名称(Course Name in English):Stochastic Modeling in Finance

一、课程的教学目的(Course Purpose)

This course is an advanced treatment of no-arbitrage approach of stochastic modeling in finance. We shall put special emphasis on continuous time modeling. Fundamental theorem and various applications in option pricing and term structure of interest rates (TSIR) will be thoroughly covered.

二、教学内容及基本要求(T eaching Content and Requirements)

Topics include:

(a)Stochastic processes and stochastic calculus

(b)Trading strategy and market span

(c)No arbitrage and martingale pricing: The Fundamental Theorem

(d)Black-Scholes option pricing model

(e)Classical no arbitrage modeling on TSIR

(f)Heath-Jarrow-Morton’s approach on TSIR

(g)TSIR in presence of Levy jumps

三、考核方式及要求(Grading)

There will be no final examination. Students will be assessed on the basis of class participation, a mid-term test and a term paper.

Class participation 10%

Mid-term test 20%

Term paper 70%

Total 100%

四、学习本课程的前期课程要求(Required Courses in advance)

Asset Pricing, Econometrics/Statistics, Optimization

五、教材(Textbook)

马成虎:高级资产定价理论。中国人民大学出版社, 2010.

六、主要参考书目、文献与资料(Reading Materials)

1.Neftci S., An Introduction to the Mathematics of Financial Derivatives, 2nd edition. Academic

Press, 2000

2.Duffie D., Dynamic Asset Pricing Theory, 3rd Edition. Princeton University Press, 2001

七、具体教学安排(Detail Schedule)

Week 1-2Continuous time Stochastic Processes

?Poisson process

?Brownian motion

?Levy measure and Poisson point process

?Martingale and semi-martingale

References:

Ma (2010), Chapter 11 and extended references

Week 3-4Stochastic Differential Equations

?Stochastic integral and stochastic differential equations

?Ito’s lemma and Kolomogorov equation

?Change of measure and Girsanov theorem

?Examples

References:

Ma (2010), Chapter 11 and extended references

Week 5Fundamental theorem: continuous-time

?Trading strategies and market span

?No-arbitrage self-financing trading strategies

?No-arbitrage and martingale representation of prices

References:

Ma (2010), Chapter 12

Delbaen F. and W. Schachermayer (1992), "Representing Martingale Measures when Asset Prices Are Continuous and Bounded", Mathematical Finance 2, 107-130.

Delbaen F. and W. Schachermayer (1994), "A General V ersion of the Fundamental Theorem of

Asset Pricing", Mathematische Annalen 300, 463-520.

Delbaen F. and W. Schachermayer (1997), "The Fundamental Theorem of Asset Pricing for Unbounded Stochastic Processes", ETH-Zentrum, Zürich.

Harrison F.M. and D. Kreps (1979), "Martingales and Arbitrage in Multi-period Securities Markets", Journal of Economic Theory 20, 381-408.

Harrison F.M. and S. Pliska (1981), "Martingales and Stochastic Integrals in the Theory of Continuous Trading", Stochastic Processes and their Applications 11, 215-260.

Week 6-7Option Pricing

●Trading strategies and market span

●Options and futures trading

●Black-Scholes option pricing model

●Cox-Ross option pricing model with Poisson jumps

●V olatility smile and money-ness biases

●Stochastic volatility and jumps: The challenge

References:

Ma (2010), Chapters 13&14 and cited references

Week 8-10 Term Structure of Interest Rates: The classical no-arbitrage approach

●Slope, curvature and information content of yield curve

●The classical expectations hypotheses

●The long-short parity

●Ho-Lee model

●V asicek & Hull-White model

●Affine model of term structure of interest rates

●Mele’s critique of the classical approach

References:

Ma (2010), Chapter 15

Campbell, John (1995), "Some lessons from the yield curve", Journal of Economic Perspectives 9, 129-152.

Cox John C., Jonathan E. Ingersoll, and Stephen A. Ross (1985), "A theory of the term structure of interest rates", Econometrica 53, 385-407.

Dai Qiang, and Kenneth J. Singleton (2003), " Term structure dynamics in theory and reality" , Review of Financial Studies 16, 631-678.

Duffee (2002), "Term premia and interest rate forecasts in affine models", Journal of Finance 57, 405-443.

Duffie Darrell, and Rui Kan (1996), "A yield-factor model of interest rates" ,Mathematical Finance 6, 379-406.

Ho T.S.Y and S.B. Lee (1986), " Term structure movements and pricing interest rate contingent claims", Journal of Finance 41, 1011-1029.

Hull J., and A. White (1993), "One-Factor Interest-Rate Models and the V aluation of Interest-Rate Derivative Securities", Journal of Financial and Quantitative Analysis 28, 235-254.

V asicek Oldrich (1977), "An equilibrium characterization of the term structure", Journal of Financial Economics 5, 177-188.

Week 11-12 Heath-Jarrow-Morton Approach on TSIR

●HJM approach in diffusion

●HJM approach in presence of jumps

●Coupon bonds: YTM, duration and modified-duration

●Interest rates contingent claims

●Information content of bond options

References:

Ma (2010), Chapter 15

Heath D., R.Jarrow, and A.Morton (1992), " Bond Pricing and term structure of interest rates: a new methodology for contingent claim valuation", Econometrica 60, 77-105.

Ma Chenghu (2003), "Term structure of interest rates in the presence of Levy jumps: the HJM approach", Annals of Economics and Finance 4, 401-426.

Term Paper:

The paper will outline a research proposal. It should identify a research topic and justify why it is worth addressing. The paper could be a theoretical paper, a numerical simulation, or an empirical test of models derived in this course.

The paper should be no more than ten thousand words (excluding references). Typewrite on A4 size paper. The paper must be handed in before the end of this semester.