mba fa 《financial accounting》 习题答案13

CHAPTER 13

THE COMPLETE INCOME STATEMENT

BRIEF EXERCISES

BE13–1

To accurately compare a company’s performance from one year to the next, non-recurring items such as restructuring charges and gains on sale of assets should be excluded from results. An analyst reviewing a company’s performance would want to see those items that should occur in every year of a company’s operations, not the one-time, special expenses and gains. In Imation’s case, an analyst would compare 2001 and 2002, focusing on recurring revenues and expenses only; those items in the two years that could not be expected to happen in future years would be excluded from the analysis. A comparison, then, of Imation’s operating results would then give the anlayst an idea toward the company’s future results.

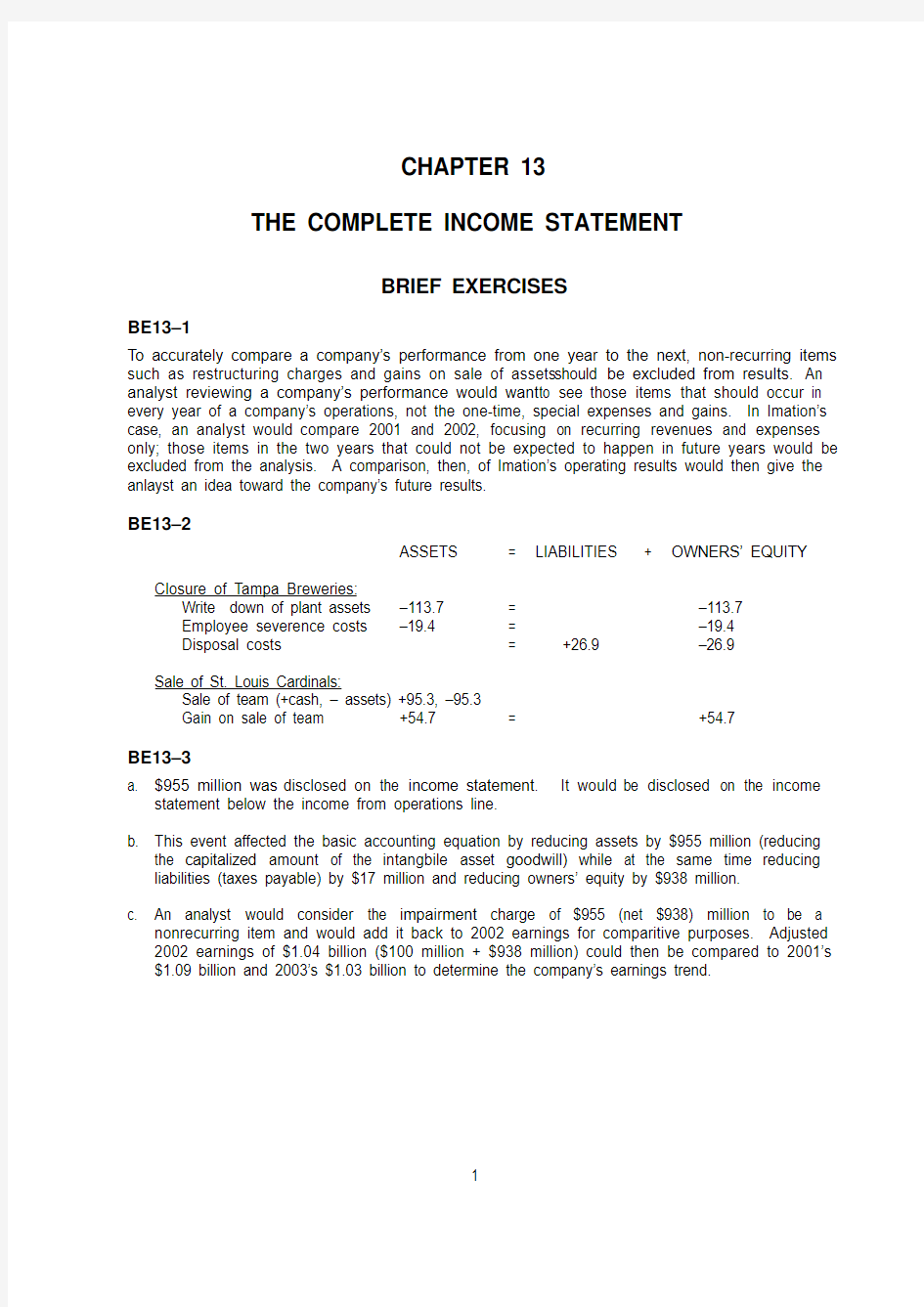

BE13–2

ASSETS = LIABILITIES + OWNERS’ EQUITY Closure of Tampa Breweries:

Write down of plant assets –113.7 = –113.7

Employee severence costs –19.4 = –19.4

Disposal costs = +26.9 –26.9 Sale of St. Louis Cardinals:

Sale of team (+cash, – assets) +95.3, –95.3

Gain on sale of team +54.7 = +54.7

BE13–3

a. $955 million was disclosed on the income statement. It would be disclosed on the income

statement below the income from operations line.

b. This event affected the basic accounting equation by reducing assets by $955 million (reducing

the capitalized amount of the intangbile asset goodwill) while at the same time reducing liabilities (taxes payable) by $17 million and reducing owners’ equity by $938 million.

c. An analyst would consider the impairment charge of $955 (net $938) million to be a

nonrecurring item and would add it back to 2002 earnings for comparitive purposes. Adjusted 2002 earnings of $1.04 billion ($100 million + $938 million) could then be compared to 2001’s $1.09 billion and 2003’s $1.03 billion to determine the company’s earnings trend.

EXERCISES

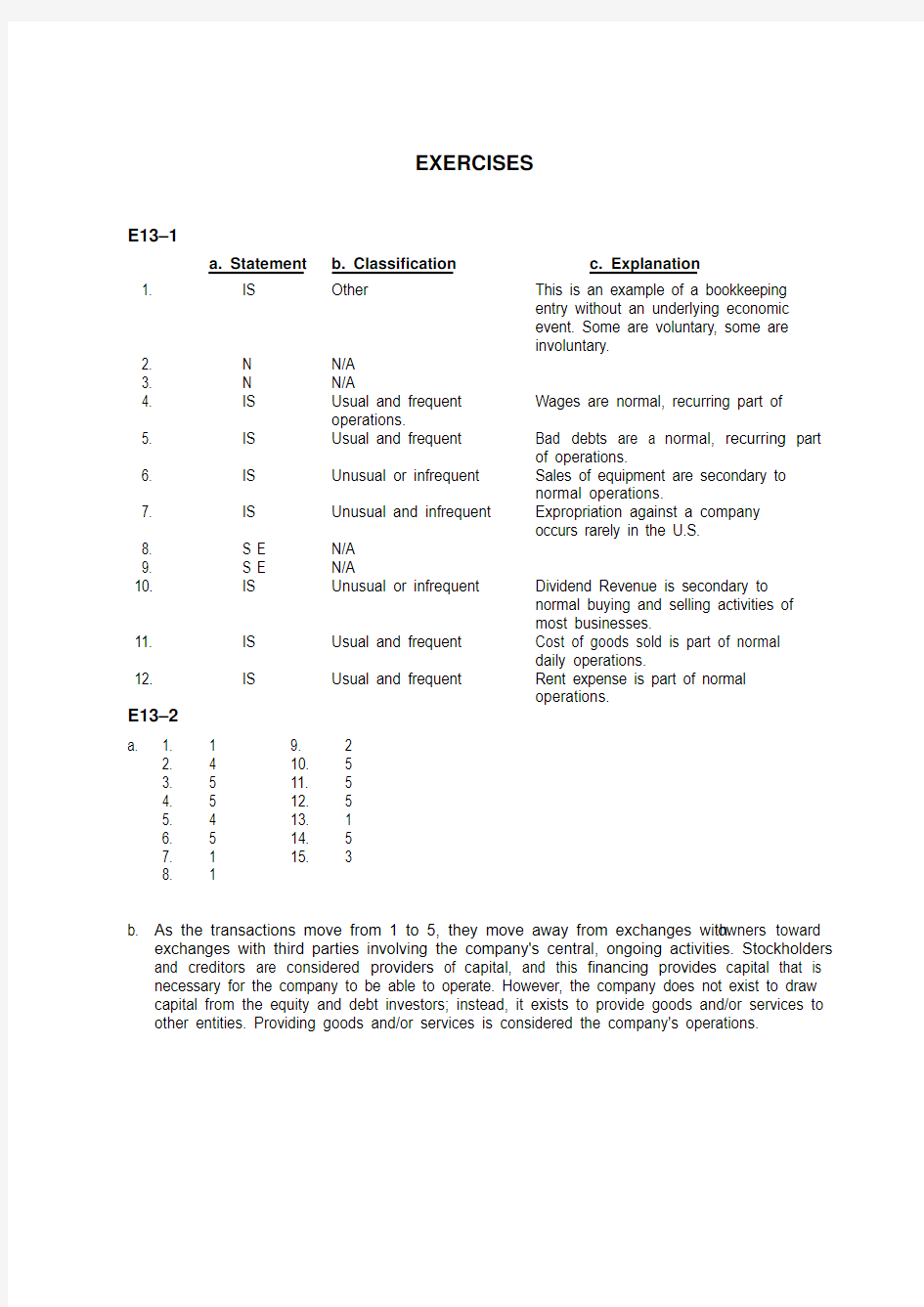

E13–1

a. Statement

b. Classification

c. Explanation

1. IS Other This is an example of a bookkeeping

entry without an underlying economic

event. Some are voluntary, some are

involuntary.

2. N N/A

3. N N/A

4. IS Usual and frequent Wages are normal, recurring part of

operations.

5. IS Usual and frequent Bad debts are a normal, recurring part

of operations.

6. IS Unusual or infrequent Sales of equipment are secondary to

normal operations.

7. IS Unusual and infrequent Expropriation against a company

occurs rarely in the U.S.

8. S E N/A

9. S E N/A

10. IS Unusual or infrequent Dividend Revenue is secondary to

normal buying and selling activities of

most businesses.

11. IS Usual and frequent Cost of goods sold is part of normal

daily operations.

12. IS Usual and frequent Rent expense is part of normal

operations.

E13–2

a. 1. 1 9. 2

2. 4 10. 5

3. 5 11. 5

4. 5 12. 5

5. 4 13. 1

6. 5 14. 5

7. 1 15. 3

8. 1

b. As the transactions move from 1 to 5, they move away from exchanges with owners toward

exchanges with third parties involving the company's central, ongoing activities. Stockholders and creditors are considered providers of capital, and this financing provides capital that is necessary for the company to be able to operate. However, the company does not exist to draw capital from the equity and debt investors; instead, it exists to provide goods and/or services to other entities. Providing goods and/or services is considered the company's operations.

E13–3

a. (1) Financing

(2) Operating

(3) Operating

(4) Financing

(5) Financing

Smedley Company

Income Statement

For the Year Ended December 31, 2007

Fees earned..............................................................................................$ 50,000

Expenses...................................................................................................24,000

Net income................................................................................................$ 26,000

b. Comprehensive Income = Change in Equity from Nonowner Sources

= Revenues – Expenses + Gains – Losses + Cumulative

Accounting Adjustments

= $50,000 – $24,000 + 0 – 0

= $26,000

* Fees and expenses represent Smedley’s only nonowner changes in equity.

c. The two are equal because Smedley’s economic events/activities do not differ from those

described in the income statement.

E13–4

a. (1) Net income

Maximum Dividend = 20% × $182,800

= $36,560

(2) Income before change in accounting method

Maximum Dividend = 20% × $130,800

= $26,160

(3) Income before extraordinary items

Maximum Dividend = 20% × $108,800

= $21,760

(4) Net operating income

Maximum Dividend = 20% × $150,000

= $30,000

b. The bank requires restrictions on dividend payments to increase the probability that Morton

Manufacturing will have sufficient cash to meet its interest and principal payments. More stringent restrictions on dividends decrease the amount that Morton Manufacturing can potentially pay out as dividends, thereby increasing the probability that the company will have sufficient cash to meet its obligations to the bank. In this particular case, basing the dividend restriction on net operating income provides the most stringent dividend restriction.

Further, managers have greater ability to manipulate items disclosed after net operating income than those items disclosed before it. For example, the decision to sell assets and realize gains is completely at a manager's discretion, as is a change in accounting principle resulting in an increase in net income. Therefore, basing the dividend restriction on net operating income limits management's ability to manipulate the restriction.

E13–5

a. Losses from equity investments: AT&T invested excess cash in the equity of other

companies; the value of these investments dropped during the course of the year;

Loss from discontinued operations: AT&T closed down or sold off business units during the year; the business units had generated losses (expenses exceeded revenues), but those units are no longer operating as part of the company;

Gain on disposition of discontinued operations: The discontinued business units were sold for a price that exceeded the book value of the units;

Gain/Loss from accounting changes: AT&T made a one-time change to its accounting treatment of particular transactions and the change resulted in either a gain or loss.

b.

2001 2002 2003

Reported net income ($ in billions) $7.7 ($13) $1.9

Loss on equity investments 7.5 0.4 0.1

Loss from discontinued operations 4.0 14.5 0.1

Gain from sale of discontinued operations (1.3) (1.3)

Gain from accounting changes (0.9) (.2)

Loss from accounting changes 0.9

Operating income $17 .0 $1.5 $1.9

Each of these special items are not part of operating income, which represents the recurring activities of the business. These special charges are one-time gains or losses and so can mislead the users of financial statements as to the future prospects of the company. The schedule above shows that the operating income of AT&T dropped significantly from 2001 levels, but that the performance between 2002 and 2003 is more consistent than shown by the net income figures. Adjusting net income for the nonrecurring items gives a clearer picture of the company’s performance; business has changed significantly from 2001 levels, but performance in the last two years has been more consistent.

E13–6

a. Cash (+A)......................................................................................... 625,000

Liabilities (–L)................................................................................... 1,400,000 Assets (–A)................................................................................. 1,850,000

Gain on Disposal of Business Segment (Ga, +SE)................... 175,000 Sold business segment.

Gain on Disposal of Business Segment (–Ga, –SE)....................... 61,250*

E13–6 Concluded

Income Tax Liability (+L)............................................................ 61,250 Recognized income tax liability on disposal of business segment.

$61,250 = Gain on disposal of $175,000 × Tax rate of 35%

Income From Operations of Discontinued Segment (–Ga, –SE).... 5,250* Income Tax Liability (+L)............................................................ 5,250 Recognized income tax benefit on net loss of discontinued segment.

* $5,250 = Net income of $15,000 × Tax rate of 35%

b. Discontinued operations:

Income from operations of discontinued segment (net

of tax expense of $5,250)......................................................... $ 9,750

Gain on disposal of business segment (net of $61,250 in taxes) 113,750 Discontinued operations...................................................... $ 123,500

E13–7

a. Mallory Services

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations (before taxes)............ $ 950,000

Income tax expense........................................................... 332,500a

Income from continuing operations................................... $ 617,500

Discontinued operations:

Income earned by discontinued segment (net of

tax expense of $4,200)................................................ $ 7,800b

Gain on disposal of discontinued segment (net of

tax expense of $13,300).............................................. 24,700c

Discontinued operations........................................... 32,500 Net income......................................................................... $ 650,000

_________________

a $332,500 = $950,000 × 35%

b Income = Revenues – Expenses × (1 – tax rate)

$7,800 = ($35,000 – $23,000 × (1– 35%)

c Gain = Sale price – Book value × (1– tax rate)

$24,700 = [$105,000 – ($93,000 – $26,000] × (1 – 35%)

Earnings persistence reflects the extent to which a particular dollar of earnings can be expected to continue in the future. A user would expect the income from continuing operations of $617,500 to continue in the future, but interpret the income and gain from the discontinued division to reflect a one-time increase in earnings that is not expected to be realized in the future.

E13–7 Concluded

b. Mallory Services

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations (before taxes)...................................$ 962,000a

Income tax expense..................................................................................336,700b

Net income................................................................................................$ 625,300

______________________________

a Income from continuing operations = Income excluding clerical division + Activities

of clerical division

$962,000 = $950,000 + ($35,000 – $23,000)

b $336,700 = $962,000 × 35%

A user would expect the entire amount of net income to persist in the future. No items are

separated out as one-time unusual and/or infrequent.

c. Sharon Sowers faces a number of trade-offs as she decides whether to complete the sale in

2006 or 2007. First, income is already positive and strong in 2006. The gain from the sale increases net income by only $24,700. If Mallory Services expects a weaker 2007, it may be more beneficial to the income statement to wait until 2007 in order to offset poorer performance.

Also, by selling in 2006, recurring income from operations isn’t as large as it could be. Users would interpret the financial statements as $617,500 persisting into the future versus $625,300 if the division isn’t sold until 2007. On the other hand, Sharon may receive bonuses on net income and may prefer to receive the bonus now or may even need the gain caused by the disposal to increase net income to some minimum amount for a bonus. Also Mallory Services may face debt convenants that need to be covered by a larger amount of income. Finally, Susan may be able to use the cash from the sale to invest in alternative projects that immediately earn a higher return than produced by the clerical division.

E13–8

a. Carmich Industries

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations (before taxes)............ $ 1,930,000

Income tax expense........................................................... 675,500a

Income from continuing operations................................... $ 1,254,500

Discontinued operations:

Income earned by discontinued segment (net of

tax expense of $8,750)................................................ $ 16,250b

Gain on disposal of discontinued segment (net of

tax expense of $45,850).............................................. 85,150c

Discontinued operations........................................... 101,400 Net income......................................................................... $ 1,355,900

a $675,500 = $1,930,000 × 35%

b Income = Revenues – Expenses × (1 – tax rate)

$16,250 =($145,000 – $120,000 × (1 – 35%)

c Gain = Sale price – Book value × (1 – tax rate)

$85,150 = [$350,000 – ($437,000 – $218,000] × (1 – 35%)

E13–8 Concluded

Earnings persistence reflects the extent to which a particular dollar of earnings can be expected to continue in the future. A user would expect the income from continuing operations of $1,254,500 to continue in the future, but interpret the income and gain from

the discontinued division to reflect a one-time increase in earnings that is not expected to be realized in the future.

b.

Carmich Industries

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations (before taxes)................................ $ 1,955,000a

Income tax expense............................................................................... 684,250b

Net income............................................................................................. $ 1,270,750

a Income from continuing operations = Income excluding clerical division + Activities of

clerical division

$1,955,000 = $1,930,000 + $25,000

b $684,250 = $1,955,000 × 35%

A user would expect the entire amount of net income to persist in the future. No items are

separated out as one-time, unusual, and/or infrequent.

c. Rob Blandig faces a number of trade-offs as he decides whether to complete the sale in 2006

or 2007. First, income is already positive and strong in 2006. The gain from the sale increases net income by only $85,150, only 6.7%,. If Carmich Industries anticipates a weaker 2007, it may be more beneficial to the income statement to wait until 2007 in order to offset poorer performance. Also, by selling in 2006, recurring income from operations isn’t as large as it could be. Users would interpret the financial statements as $1,254,500 persisting into the future versus $1,270,750 if the division isn’t sold until 2007. Also, Rob and other top management receive a 20% bonus on income from continuing operations. This means that top management earns an additional 20% on the income from the division if it is not sold in 2006. On the other hand, Carmich Industries may face debt convenants that need to be covered by a larger amount of income. Also, Rob may be able to use the cash from the sale to invest in alternative projects that immediately earn a higher return than produced by the chemical division and increase income and his bonus even higher next year.

E13–9

a. None of the items listed are both unusual and infrequent, which would qualify the item to be

treated as an extraordinary item. The loss on sale of business, equity income in affiliates and

the “other” expenses each would be treated as being unusual or infrequent. As a result these

items would not be included in the operating income of Honeywell.

b. To estimate the operating income for 2003, take net sales minus cost of goods sold, minus selling and administrative expenses to calculate the operating income:

$23,103 – 18,231 – 2,950 = $1,922.

c. Net income shows the after tax income for the business including all transactions. This would include transactions that are not expected to happen again in future years. Operating income

reflects the income from those operations that are considered to be the recurring business of the company. This gives a better indication of the future income potential of the company.

E13–10

a. Loss on Destruction of Inventory (Lo, –SE)..................................... 2,325,000

Inventory (–A)............................................................................. 2,325,000 Recognized inventory loss from earthquake.

b. Extraordinary Loss on Destruction of Inventory (Lo, –SE)............... 2,325,000

Inventory (–A)............................................................................. 2,325,000 Recognized inventory loss from earthquake.

Income Tax Liability (–L).................................................................. 813,750*

Extraordinary Loss on Destruction of Inventory (–Lo, +SE)...... 813,750 Recognized income tax benefit on inventory loss from earthquake.

* $813,750 = Loss of $2,325,000 × Tax rate of 35%

c. If the earthquake is considered both an unusual and infrequent event, then the loss should be

classified as an extraordinary loss. However, if the loss is considered unusual or infrequent, but

not both, then it should be classified as other revenues and expenses. If the loss is considered

both usual and frequent, then it should be disclosed as part of operations.

Since Paxson Corporation's plant is located in San Francisco, then the magnitude of the

earthquake would have to be considered. To be considered an extraordinary loss, the events

that gave rise to the loss must be both unusual in nature and occur infrequently. In San

Francisco, minor earthquakes are not infrequent; they are expected to occur occasionally.

Consequently, if this loss was due to a minor earthquake, it would not be considered

extraordinary. Since earthquakes are not usual (i.e., part of the company's normal operations),

the loss should not be considered as part of operations. Instead, the loss should be classified

as an other expense. Alternatively, if the damage was due to a major earthquake, it might

qualify as an extraordinary loss. Major earthquakes, such as the 1906 and 1989 earthquakes

that devastated the Bay area, are both unusual and infrequent.

d. If Paxson’s plant was located in Miami, Florida, then any earthquake is considered both

unusual and infrequent and would qualify as an extraordinary loss.

E13–11

a. If a lawsuit is considered unusual but not infrequent, then it would be classified under other

expenses and losses. Consequently, the loss from the lawsuit would be used to compute net

income from continuing operations.

Bonus = 12% × [($800,000 – $480,000) × (1 – Tax Rate)]

= 12% × [$320,000 × (1 – 35%)]

= $24,960

b. If the loss from the lawsuit is considered extraordinary, then the loss would not be used to

compute net income from continuing operations.

Bonus = 12% × [$800,000 × (1 – Tax Rate)]

= 12% × [$800,000 × (1 – 35%)]

= $62,400

c. Gain not considered extraordinary

Bonus = 12% × [($800,000 + $480,000) × (1 – Tax Rate)]

= 12% × [$1,280,000 × (1 – 35%)]

= $99,840

Gain considered extraordinary

Bonus = 12% × [$800,000 × (1 – Tax Rate)]

= 12% × [$800,000 × (1 – 35%)]

= $62,400

d. Income figures are often used as the basis for awarding incentive compensation to managers,

or included in ratios, which are, in turn, incorporated into debt covenants. If the income figures included in incentive contracts or in debt covenants stipulate between income from continuing operations and net income, then the decision of whether or not to classify an event as extraordinary or not can have economic consequences. As demonstrated in parts (a) through

(c), how a loss or gain is classified can have a profound effect on the magnitude of a

manager's bonus.

E13–12

a. Income from continuing operations.................................. $ 0.73

Disposal of business segment*........................................ 0.33

Extraordinary loss............................................................. (0.46)

Changes in accounting method........................................ 0.40

Net earnings per share..................................................... $ 1.00

b. Income from continuing operations.................................. $ 0.44

Disposal of business segment*........................................ 0.20

Extraordinary loss............................................................. (0.28)

Changes in accounting method........................................ 0.24

Net earnings per share..................................................... $ 0.60

c. Income from continuing operations.................................. $ 0.37

Disposal of business segment*........................................ 0.16

Extraordinary loss............................................................. (0.23)

Changes in accounting method........................................ 0.20

Net earnings per share..................................................... $ 0.50

* The EPS disclosure for the disposal of the business segment includes both the income from the disposed segment and the gain on the sale of the disposed segment.

E13–13

a.

Rothrock Consolidated

Income Statement

For the Year Ended December 31, 2006

Revenue:

Operating revenues....................................................... $ 87,000

Total revenue................................................................. $ 87,000 Expenses:

Operating expenses...................................................... 32,500 Other revenue.................................................................... 5,200

Income from continuing operations (before taxes)............ $ 59,700

Income tax expense........................................................... 20,895

Income from continuing operations................................... $ 38,805

Discontinued operations:

Income earned by discontinued segment (net of

taxes of $1,050)........................................................... $ 1,950

Loss on disposal of discontinued segment (net of

tax benefit of $7,350)................................................... (13,650)

Discontinued operations................................................ (11,700) Income before extraordinary items.................................... $ 27,105

Extraordinary loss (net of tax benefit of $1,750)................ (3,250)

Income before change in accounting method.................... $ 23,855

Effect of change in accounting method (net of

taxes of $4,375)............................................................. 8,125 Net income......................................................................... $ 31,980

b.

Rothrock Consolidated

Statement of Retained Earnings

For the Year Ended December 31, 2006

Retained earnings, January 1, 2006.........................................................$ 72,000

Plus: Net income.......................................................................................31,980

Less: Dividends declared..........................................................................(18,000)

Retained earnings, December 31, 2006...................................................$ 85,980

E13–14

a.

Watson Company

Income Statement

For the Year Ended December 31, 2006

Sales revenues.................................................................. $1,385,000

Cost of goods sold............................................................. 475,000

Gross profit......................................................................... $ 910,000

Operating expenses:

Administrative expenses............................................... $ 100,000

Depreciation expense.................................................... 250,000

Selling expenses........................................................... 189,000

Total expenses.......................................................... 539,000 Income from operations..................................................... $ 371,000

Other revenues and expenses:

Rent revenue................................................................. $ 360,000

Loss on sale of fixed assets.......................................... (105,000)

Total other revenues and expenses......................... 255,000 Income from continuing operations (before taxes)............ $ 626,000

Income taxes...................................................................... 219,100

Income from continuing operations................................... $ 406,900

Extraordinary loss (net of tax benefit of $70,700).............. (131,300)

Net income......................................................................... $ 275,600

b.

Watson Company

Statement of Retained Earnings

For the Year Ended December 31, 2006

Retained earnings, January 1, 2006.........................................................$ 847,000

Plus: Net income.......................................................................................275,600

Less: Dividends......................................................................................... (460,000)

Retained earnings, December 31, 2006...................................................$ 662,600

c. If Watson Company had no tax liability as of January 1, 2006, and made no tax payments

during 2006, then the company's tax liability as of December 31, 2006 would equal the sum of the intraperiod tax allocations. Watson Company incurred $219,100 in taxes associated with income from continuing operations. The extraordinary loss provided a tax benefit, thereby reducing income taxes by $70,700. Therefore, the company's total tax liability as of December 31, 2006 would be $148,400.

E13–15

a.

Kennington Company

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations (after taxes)............... $ 235,000

Loss on lawsuit (net of tax benefit of $21,700).................. (40,300)

Income from continuing operations................................... $ 194,700

Gain on disposal of discontinued segment

(net of tax expense of $8,750)....................................... $ 16,250

Extraordinary loss on early retirement of debt

(net of tax benefit of $13,300)........................................ (24,700) (8,450) Net income......................................................................... $ 186,250

Maximum dividends Kennington can declare = Income from continuing operations × 15% $29,205 = $194,700 × 15%

b.

Kennington Company

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations (after taxes)............... $ 235,000

Gain from sale of short-term investment

(net of tax expense of $8,750)....................................... 16,250 Income from continuing operations................................... $ 251,250

Gain on disposal of discontinued segment

Extraordinary loss on lawsuit,

(net tax benefit of $21,700)............................................ $(40,300)

Extraordinary loss on early retirement of debt

(net of tax benefit of $13,300)........................................ (24,700) (65,000) Net income......................................................................... $ 186,250

Maximum dividends Kennington can declare = Income from continuing operations × 15% $37,687.50 = $251,250 × 15%

E13–16

a.

Madigan International

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations (before taxes)............ $ 865,000

Gain on sale of subsidiary.................................................. $ 42,000

Gain due to change in accounting principle....................... 25,000 67,000

Income from continuing operations................................... $ 932,000

Income tax expense........................................................... 326,200a

Income from continuing operations................................... $ 605,800

Extraordinary items:

Loss of inventory due to earthquake,

(net tax benefit of $18,550)....................................... $(34,450)

Loss due to write-off of accounts receivable,

(net tax benefit of $13,300)....................................... (24,700)

Extraordinary items.................................................... (59,150) Net income......................................................................... $ 546,650 a$326,200 = $932,000 × 35%

b. Madigan’s accountants are not presenting income statement items in accordance with

generally accepted accounting principles. Instead, they are presenting all the gain items as part of income from continuing operations and all the loss items as extraordinary. The intention is to represent to investors and other users a higher income from continuing operations than actually exists. The greater is income from continuing operations, the more income investors and users expect will exist in the future.

The gain on the sale of the subsidiary should be reported as a discontinued operation separately after income from continuing operations. The gain from the change in accounting principles should be reported separately after income from continuing operations. The loss due to the earthquake may be extraordinary as reported by Madigan, depending on the location of Madigan and the magnitude of the earthquake. The loss due to a write-off of accounts receivable, however, occurs in the ordinary course of business and should not be reported as an extraordinary item.

E13–16 Concluded

The income statement that is consistent with GAAP follows.

Madigan International

Income Statement

For the Year Ended December 31, 2006

Income from continuing operations (before taxes)............ $ 865,000 Loss due to write-off of accounts receivable..................... (38,000) Income from continuing operations................................... $ 827,000 Income tax expense........................................................... 289,450a Income from continuing operations................................... $ 537,550 Gain on discontinued operations,

(net of tax expense of $14,700)..................................... $ 27,300

Extraordinary loss on inventory due to earthquake,

(net of tax benefit of $18,550)........................................ (34,450)

Gain due to change in accounting principle,

(net of tax expense of $8,750)....................................... 16,250 9,100 Net income......................................................................... $ 546,650

a $289,450 = $827,000 × 35%

c. Madigan’s original treatment makes future income look more favorable.

PROBLEMS

P13–1

a. 1. Operating

2. Operating

3. Operating

4. Financing

5. Operating

6. Operating

7. Operating

8. Financing

9. Operating & Investing

b. 1. Normal and recurring

2. Normal and recurring

3. Other revenues and expenses

4. Issues and payments of debt

5. Normal and recurring

6. Other revenues and expenses

7. Changes in accounting principles

8. Exchanges with stockholders

9. The sale of the securities would be classified as purchases, sales, and exchanges of

assets, and the loss would be classified as other revenues and expenses.

c. Items (2), (3), (5), (6), (7), and (9) would all be disclosed on the income statement as follows.

(2) The $500,000 would be disclosed as operating revenues, and the $375,000 would be

disclosed as cost of goods sold, which is an operating expense.

(3) Minor earthquakes are not infrequent in San Francisco, although they are unusual. Thus,

the $100,000 would be disclosed as part of other revenues and expenses.

(5) The $143,000 would be disclosed as operating expenses.

(6) Lawsuits are unusual, but it appears that the company is frequently sued. Thus, the

$10,000 would be disclosed as part of other revenues and expenses.

(7) The effect of the change in accounting methods would be disclosed, net of any tax effect,

after extraordinary items and before net income.

(9) The amount of the loss would be disclosed as part of other revenues and expenses.

P13–2

a. Bonus = 25% × (Income from Operations Before Interest Expense – Interest Expense)

= 25% × [$1,200,000 – ($1,000,000 × 8% Interest Rate)]

= $280,000

b. Bonus = 25% × (Income from Operations Before Interest Expense – Interest Expense)

= 25% × ($1,200,000 – $0)

= $300,000

c. The decision whether to finance the plant expansion through an equity issue or through a debt

issue is worth $20,000 to the managers because the managers will receive an additional $20,000 in bonuses if the company issues equity instead of debt. Although issuing equity is in the best interest of the managers, this option may not be in the best interest of the existing stockholders. It is possible that issuing additional stock would dilute the ownership interests of the existing stockholders. Further, the interest payments on debt are tax deductible. Hence, issuing debt would reduce cash outflows for taxes.

d. If interest expense was not considered to be an operating expense, the managers' bonus would

be the same whether the company issued debt or equity. In either case the bonus would be 25% of $1,200,000, or $300,000. In this situation, the managers would, hopefully, base their decision on factors that are more relevant to the stockholders.

P13–3

a. 1. Financing

2. Operating

3. Financing

4. Operating

5. Investing

6. Financing

7. Investing & Financing

b.

Raleigh Corporation

Income Statement

For the Year Ended December 31, 2006

Fees earned....................................................................... $ 580,000

Expenses:

Wage expense............................................................... $125,000

Supplies expense.......................................................... 35,000

Depreciation expense.................................................... 80,000

Miscellaneous expense................................................. 75,000

Total expenses.......................................................... 315,000 Net income......................................................................... $265,000

P13–3 Concluded

c. Comprehensive Income = Change in Equity from Nonowner Sources

= Revenues – Expenses + Gains – Losses + Cumulative

Accounting Adjustments

= $580,000 – $315,000 + 0 – 0

= $265,000

* Fees and expenses represent Raleigh’s only nonowner changes in equity.

The two measures are equal because Raleigh’s economic events/activities do not differ from those described in the income statement.

P13–4

a.

Income Statement Classification .

Sales Yes Usual and frequent

Sales returns Yes Usual and frequent

Cost of goods sold Yes Usual and frequent

Dividends No N/A

Rent expense Yes Usual and frequent

Wages payable No N/A

Loss on sale of food services division Yes Disposal of business

segment

Loss incurred by food services division Yes Disposal of business

segment

Depreciation expense Yes Usual and frequent

Cumulative effect on income of change

in depreciation methods Yes Change in accounting

method

Gain on land appropriated

by government Yes Unusual and infrequent

Insurance expense Yes Usual and frequent

Inventory No N/A

Administrative expenses Yes Usual and frequent

Prepaid insurance No N/A

Gain on sale of short-term investments Yes Unusual or infrequent

P13–4 Concluded

Note:The loss on sale of food services division and the loss incurred by food services division would be classified as a disposal of a business segment only if the food

services division meets the requirements of being a business segment as defined

under GAAP. If the food services division does not meet these requirements, then the

loss on sale of food services division would be classified as part of other revenues and

expenses. The loss incurred by food services division would be broken down into its

components (i.e., revenues and expenses) and reported as part of operating revenues

and expenses.

b.

Crozier Industries

Income Statement

For the Year Ended December 31, 2006

Revenue:

Sales revenue................................................................ $977,000

Less: Sales returns........................................................ 9,000

Gain on sale of short-term investments........................ 142,000

Total revenue..................................................................... $ 1,110,000

Expenses:

Cost of goods sold......................................................... $496,000

Rent expense................................................................. 90,000

Depreciation expense.................................................... 100,000

Insurance expense........................................................ 12,000

Administrative expenses............................................... 109,000

Total expenses.......................................................... 807,000 Income from continuing operations (before taxes)............ $ 303,000

Income taxes...................................................................... 106,050

Income from continuing operations................................... $ 196,950

Discontinued operations:

Loss on operation of discontinued segment

(net of tax benefit of $3,500)........................................ $ (6,500)

Loss on disposal of discontinued segment

(net of tax benefit of $700)........................................... (1,300)

Discontinued operations........................................... (7,800) Income before extraordinary items.................................... $ 189,150

Extraordinary gain on appropriated land (net of

taxes of $32,200)........................................................... 59,800 Income before effect of accounting changes..................... $ 248,950

Cumulative effect of change in accounting principle

(net of tax benefit of $45,500)........................................ (84,500) Net income......................................................................... $ 164,450 Sales revenues and all the expenses (cost of goods sold, rent, depreciation, insurance, and administrative) are expected to persist into the future. The gain on the sale of short-term investments is expected to occur infrequently, as a secondary activity to the primary business operations. The losses due to the discontinued operations loss and its sale are one-time amounts, not expected to persist into the future. The extraordinary gain on appropriated land is both unusual and infrequent and is not expected to occur again. Finally, the cumulative effect of

a change in accounting principle may occur, but only infrequently. Future income statements

should not be affected by many accounting changes.

P13–5

a.

1. Hurricanes are unusual in that they are not part of a company's normal operations; however,

they occur relatively frequently in Florida. Thus, this loss probably should not be classified as an extraordinary item. Instead, it should be disclosed gross of taxes as part of other revenues and expenses.

2. A loss on the disposal of a business segment is not considered an extraordinary item. This

item should be disclosed net of taxes as a separate item on the income statement after income from continuing operations, but before extraordinary items. The classification of this item is the disposal of a business segment.

3. This loss appears to be both unusual and infrequent; consequently, it should be classified

as an extraordinary item on the income statement. Extraordinary items should be disclosed net of any tax effect.

4. Writing off an open account receivable as uncollectible should not be disclosed on the

income statement. Under GAAP, a company should use the allowance method to account for bad debts. With the allowance method, write-offs of uncollectible accounts affect only balance sheet accounts.

5. Floods are unusual in that they are not part of a company's normal operations. Although

Arizona does get flooding, particularly flash floods, the flooding would probably be considered to be infrequent. Consequently, this loss should be classified as an extraordinary item on the income statement. Extraordinary items should be disclosed net of any tax effect.

b. Extraordinary items:

Loss to employee destruction (net of tax benefit of $78,750).................. 146,250

Loss due to flood (net of tax benefit of $31,500)..................................... 58,500 Total Loss on Extraordinary Items $204,750

P13–6

a. Income from continuing operations (before taxes) $ 850,000

Income taxes 297,500

Income from continuing operations $ 552,500

Extraordinary loss (net of tax benefit of $47,250) (87,750)

Net income $ 464,750

b. Income tax expense = Income taxes on net income generated during 2006

= Income taxes on income from continuing operations + Income

tax effect of extraordinary loss

= $297,500 tax expense [from part (a)] – $47,250 tax benefit

[from part (a)]

= $250,250

P13–6 Concluded

c.

MTM Company

Statement of Retained Earnings

For the Year Ended December 31, 2006

Retained earnings, January 1, 2006........................................................ $ 1,259,000

Plus: Net income...................................................................................... 464,750

Less: Dividends declared during 2006..................................................... (175,000)

Retained earnings, December 31, 2006.................................................. $ 1,548,750

d. The balance in the Income Tax Liability account would equal the beginning balance plus the

entire amount owed to the government for income taxes as of December 31, 2006 less tax payments made during 2006. MTM has two sources of income taxes during 2006. The first source is the income tax on income from continuing operations in the amount of $297,500 [from part (a)]. The second source is the income tax benefit on the extraordinary loss in the amount of $47,250 [from part (a)]. Therefore, MTM owes the beginning balance of $70,000 plus the total of the two sources of 2006 taxes of $250,250 less the 2006 tax payments of $200,000.

Therefore, the tax liability balances of December 31, 2006 equals $120,250.

P13–7

a. This allows the user of the financial statements to try and make estimates of the future potential

results of the company. Discontinued operations will not impact future revenues and expenses so this gives more information to the user. Continuing operations gives users of the financial statements the best information for estimating the company’s future performance.

b. An estimate of the number of shares outstanding is calculated by taking net earnings ($330.3)

and dividing it by the basic net earnings per share ($1.08) or 306 million shares.

c. The distinction between basic net earnings per share and diluted net earnings per share is that

basic is calculated using the weighted average number of shares outstanding and diluted is calculated using the outstanding weighted average number of shares plus the number of shares that would be outstanding if all convertible instruments were converted to common shares. The most common financial instruments that are convertible to common shares are stock options, preferred stock and some bonds.

d. An estimate of the number of shares that would be outstanding if all other instruments were

converted to common shares is calculated by taking net earnings ($330.3) divided by diluted net earnings per share ($1.06) or 312 million shares.

P13–8

a.

Straight-Line Double-Declining

2001 $ 250,000a$ 600,000b

高中数学必修1测试题及答案

高中数学必修1测试题 一、选择题 1.设集合{}012345U =,,,,,,{}035M =,,,{}145N =,,,则()U M C N ?=( ) A .{}5 B .{}0,3 C .{}0,2,3,5 D .{}0,1,3,4,5 2、设集合2{650}M x x x =-+=,2{50}N x x x =-=,则M N 等于 ( ) A.{0} B.{0,5} C.{0,1,5} D.{0,-1,-5} 3、计算:9823log log ?= ( ) A 12 B 10 C 8 D 6 4、函数2(01)x y a a a =+>≠且图象一定过点 ( ) A (0,1) B (0,3) C (1,0) D (3,0) 5、“龟兔赛跑”讲述了这样的故事:领先的兔子看着慢慢爬行的乌龟,骄傲起来,睡了一觉,当它醒来时,发现乌龟快到终点了,于是急忙追赶,但为时已晚,乌龟还是先到达了终点…用S 1、S 2分别表示乌龟和兔子所行的路程,t 为时间,则与故事情节相吻合是 ( ) 6、函数y =的定义域是( ) A {x |x >0} B {x |x≥1} C {x |x≤1} D {x |0<x≤1} 7、把函数x 1y -=的图象向左平移1个单位,再向上平移2个单位后,所得函数的解析式应为 ( ) A 1x 3x 2y --= B 1x 1x 2y ---= C 1x 1x 2y ++= D 1 x 3x 2y ++-= 8、设x x e 1e )x (g 1x 1x lg )x (f +=-+=,,则 ( ) A f(x)与g(x)都是奇函数 B f(x)是奇函数,g(x)是偶函数 C f(x)与g(x)都是偶函数 D f(x)是偶函数,g(x)是奇函数

一站到底题库及答案

一站到底题库及答案 《一站到底》题库及答案(20130124期) 第一轮:彭禹繁PK刘巧琴 1、在我国遇到失火要拨打什么电话号码报警?119 2、我国统一的医疗专用急救中心电话号码是哪三个数字?120 3、与“白领”相对应,我们把从事体力劳动工作的人称呼为什么?蓝领 4、我们常说的“白衣天使”一般形容的是哪类职业的人?护士 5、新婚吉庆时,通常会在新房贴上哪个字来讨好彩头?喜/囍 6、“福禄寿”三星中的寿星手里通常拿的水果是什么?桃子 7、《仙剑奇侠传三》中,外号叫“白豆腐”的徐长卿是由哪位男演员饰演的?霍建华 8、港剧《雷霆扫毒》的主题曲《幼稚完》是由哪位香港当红歌手演唱?林峰 9、姚明在一次内线投篮时被犯规而未能进球,请问他应该获得几次罚球机会?2 10、一位NBA球员在中长线后把球意外投进,请问这个球应该得几分?3分 11、“小薇啊,你可知道我多爱你,我要带你飞到天上去”

是哪位台湾男歌手的歌曲?黄品源 12、KTV点唱率极高的串烧歌曲《情歌王》《劲歌金曲》都是哪位著名香港歌手的代表作?古巨基 13、壁虎在遇到敌人攻击,很危险的情况下会舍弃身体的什么部分逃走?尾巴 14、遇到强敌时会以“喷墨”作为逃生方法的是什么海洋动物?乌贼/墨斗鱼 15、疟疾是由哪种动物传播的疾病?蚊子 16、黑死病重要的传染源是哪种动物?老鼠 第二轮:彭禹繁PK仁青拉姆 1、“全聚德”是北京一家什么食品店的字号?烤鸭店 2、“狗不理”是天津什么食品的品牌?包子 3、人们常用什么鸟类代表和平?鸽子 4、有“沙漠之舟”之称的动物是什么?骆驼 5、世界上通常用来导航的全球卫星定位系统的英文简称是什么?GPS 6、我们通常用来指代飞碟等不明飞行物的英文缩写是什么?UFO 7、《二泉映月》是用哪种传统乐器演奏的?二胡 8、舞剧“天鹅湖”中舞蹈形式是什么?芭蕾舞 9、电影《大话西游》中至尊宝对紫霞说,如果非要给这份爱加上一个期限,希望是多长时间?一万年

高一数学必修1试题附答案详解

1.已知全集I ={0,1,2},且满足C I (A ∪B )={2}的A 、B 共有组数 2.如果集合A ={x |x =2k π+π,k ∈Z},B ={x |x =4k π+π,k ∈Z},则集合A ,B 的关系 3.设A ={x ∈Z||x |≤2},B ={y |y =x 2 +1,x ∈A },则B 的元素个数是 4.若集合P ={x |3

思考题与习题答案.doc

思考题与习题 1.一台直流测速发电机,已知电枢回路总电阻R a=180Ω,电枢转速n=3000r/min ,负载电阻 R L=2000 Ω,负载时的输出电压U a=50V,则常数K e =__________,斜率 C=___________。 2.直流测速发电机的输出特性,在什么条件下是线性特性产生误差的原因和改进的方法是什么 3.若直流测速发电机的电刷没有放在几何中性线的位置上,试问此时电机正、反转时的输出特性是 否一样为什么 4. 根据上题 1 中已知条件,求该转速下的输出电流I a和空载输出电压U a0。 5.测速发电机要求其输出电压与_________成严格的线性关系。 6.测速发电机转速为零时,实际输出电压不为零,此时的输出电压称为____________ 。 7.与交流异步测速发电机相比,直流测速发电机有何优点 8. 用作阻尼组件的交流测速发电机,要求其输出斜率_________,而对线性度等精度指针的要求是 次要的。 9.为了减小由于磁路和转子电的不对称性对性能的影响,杯形转子交流异步测速发电机通常是 () A.二极电机 B.四极电机 C.六极电机 D.八极电机 10.为什么异步测速发电机的转子都用非磁性空心杯结构,而不用鼠笼式结构 11.异步测速发电机在理想的情况下,输出电压与转子转速的关系是:() A.成反比; B.非线性同方向变化; C.成正比; D.非线性反方向变化 答案 1、.一直流测速发电机,已知电枢回路总电阻R a=180Ω,电枢转速n=3000r/min ,负载电阻 R L=2000 Ω,负载时的输出电压U a=50V,则常数K e =,斜率 C=。 U a Ke n Cn =50 R a 1 R L C=50/3000= K e=C(1R a)= X (1+180/2000)= R L 2、直流测速发电机的输出特性,在什么条件下是线性特性产生误差的原因和改进的方法是什么 答:直流测速发电机,当不考虑电枢反应,且认为励磁磁通、 R 和R 都能保持为常数时可认为其特性是线性的。

考试试题1及答案

土力学及地基基础模拟考试试题 1 及 答案 一、填空题( 10 分) 1 、土(区别于其它工程材料)主要工程特性是 2 、直接剪切试验按排水条件不同,划分为 。 3、 由土的自重在地基内所产生的应力称为 内所产生的应力称为 _________________ 。 4、 建筑物地基变形的特征有沉降量、 5、 浅基础主要的类型有 _______________ 、 箱形基础。 ;由建筑物的荷载或其他外载在地基 、 ___________ 和局部倾斜四种类型。 、十字交叉基础、筏板基础、壳体基础和 二、选择题( 20 分) 1 、土的三相比例指标包括:土粒比重、含水率、重度、孔隙比、孔隙率和饱和度等,其中 哪些为直接试验指 标?( ) (A )、含水率、孔隙比、饱和度(B )、重度、含水率、孔隙比 (C )、土粒比重、含水率、重度 2、 土的变形主要是由于土中哪一部份应力引起的?( (A )、总应力(B )、有效应力(C )、孔隙应力 3、 荷载试验的中心曲线形态上,从线性开始变成非线性关系的界限荷载称为( (A )、允许荷载(B )、临界荷载(C )、 d ,水的重度为 w ,在计算地基沉降时,采用以下 哪一项计算地下水位以下的自重应力?( _、 ____________ 和渗透性大。 、固结不排水剪(固结快剪) )。 临塑荷载 4、已知土层的饱和重度 sat ,干重度为 A )、 sat ( B )、 d ( C )( sat - w ) 5、 土的体积压缩是由下述变形造成的( (A )、土孔隙的体积压缩变形(B )、土颗粒的体积压缩变形 (C )、土孔隙和土颗粒的体积压缩变形之和 6、 如果墙推土而使挡土墙发生一定的位移,使土体达到极限平衡状态,这时作用在墙背上 的土压力是何种土压力?( ) (A )、静止土压力(B )、主动土压力(C )、被动土压力 7、 已知柱下扩展基础,基础长度 I = 3.0m ,宽度b = 2.0m ,沿长边方向荷载偏心作用,基础 底面压力最小值 P min = 30k Pa ,最大值 力矩最接近以下哪一种组合。 ( ) (A )、竖向力 370kN ,力矩 159kN - m (C )、竖向力 490kN ,力矩 175kN - m )。 Pmax = 160kPa ,指出作用于基础底面上的竖向力和 (B )、竖向力 (D )、竖向力 540kN ,力矩 150kN - m 570kN ,力矩 195kN - m ) 8、 对于框架结构,地基变形一般由什么控制?( (A )、沉降量(B )、沉降差(C )、局部倾斜 9、 属于非挤土桩的是( )。 (A )、实心的混凝土预制桩(B )、钻孔桩(C )、沉管灌注桩 10、 一般端承桩基础的总竖向承载力与各单桩的竖向承载力之和的比值为( (A )、 >1(B )、 =1(C )、 <1 )。

关于一站到底题目及答案大全

关于一站到底题目及答案大全 13. .吴带当风是形容我国唐代哪个画家的笔法:吴道子 14. .人体含水量百分比最高的器官是::眼球 15. .《在那遥远的地方》是哪里的民歌: 16. .玛雅文明是古代什么文明的代表:印第安 17. .我国《合同法》规定,合作技术开发合同中,合作开发的当事人一方不同意申请专利的,其他各方::不得申请专利 18. .飞机票头等舱的票价一般为普通舱票价的::% 19. .智力的核心是::抽象思维能力 20. .中国面积最大的省份是哪一个:新疆 21. #楼回目录 22. 一站到底题库,一站到底题目大全 23. 着墨| -- : 24. .《天方夜谭》用谭字而不用谈字,原因是::古代写文章的避讳 25. .古诗的体制称为风雅颂,其中雅指::王朝正声 26. .传说中的巫山神女名叫:瑶姬 27. .我国历史上第一部编年体史书是:《春秋》 28. .燕窝中最珍贵的是::血燕 29. .被公认为体育运动和健美体魄象征的雕像是::掷铁饼者 30. .在逻辑上鲸鱼不是鱼这句话中的系词是:不是 31. .人类最早使用的工具,是什么材料的:石 32. .陕西乾陵武则天墓碑上有几个字:无一字

33. .徐霞客曾经盛赞一座山为四海名山皆过目,就中此景难图录。这座山指的是:雁荡山 34. .稀土是:金属 35. .UNESCO是什么国际组织的简称:联合国科教文组织 36. .九宫格的创始人是:欧阳洵 37. .用子弹打玻璃,是什么首先打碎了玻璃:空气 38. .中国无声影片的最高峰《神女》是谁的代表作:阮玲玉 39. .昼夜更替是由什么引起的:地球自转 40. .知天命代指什么年纪:五十岁 一站到底节目定位这档节目打破以往答题类节目的固定模式,每档节目中有各种年龄层次,不同身份,各异性格的10位守擂者和1位攻擂者参加,以PK的方式获得别人手中的奖品,一旦失败,就掉下擂台,能否一站到底,成为节目中最大悬念。 《一站到底》打破了《开心辞典》那种平民与主持人对抗的模式,而是采用了攻擂的形式让平民与平民进行激烈对抗。《一站到底》中答题错误的选手马上掉进脚下的陷阱,接受惩罚。此外,新节目也大胆地起用了新鲜的主持阵容李好、郭晓敏夫妻,他们将组成国内首个主持夫妻档。 据介绍,《一站到底》的问答题目讲求的是娱乐性。在2021年2月28日的看片会上可以看到,题目确实并不难,包括孟非主持的哪档节目和冯小刚电影同名、股票交易里的一手代表多少股、东方之珠指的是哪座城市、《喜羊羊与灰太狼》里灰太狼的老婆叫什么等问题多数选手都能马上回答出来。制片人介绍说:《一站到底》注重题目的娱乐性,不是为难选手,不管学历高低,都有可能击败

思考题与习题答案

思考题与习题1 1-1回答以下问题: (1) 半导体材料具有哪些主要特性 (2) 分析杂质半导体中多数载流子和少数载流子的来源; (3) P 型半导体中空穴的数量远多于自由电子, N 型半导体中自由电子的数量远多于空 穴, 为什么它们对外却都呈电中性 (4) 已知温度为15C 时,PN 结的反向饱和电流I s 10 A 。当温度为35C 时,该 PN 结的反向饱和电流I s 大约为多大 (5) 试比较二极管在 Q 点处直流电阻和交流电阻的大小。 解: (1) 半导体的导电能力会随着温度、光照的变化或掺入杂质浓度的多少而发生显着改 变,即半导体具有热敏特性、光敏特性和掺杂特性。 (2) 杂质半导体中的多数载流子是由杂质原子提供的,例如 N 型半导体中一个杂质原 子 提供一个自由电子,P 型半导体中一个杂质原子提供一个空穴,因此多子浓度约等于所掺 入的杂质浓度;少数载流子则是由热激发产生的。 (3) 尽管P 型半导体中空穴浓度远大于 自由电子浓度,但 P 型半导体本身不带电。因 为在P 型半导体中,掺杂的杂质原子因获得一个价电子而变成带负电的杂质离子 (但不能移 动),价电子离开后的空位变成了空穴,两者的电量相互抵消,杂质半导体从总体上来说仍 是电中性 的。同理,N 型半导体中虽然自由电子浓度远大于空穴浓度,但 N 型半导体也是电 中性的。 (4) 由于温度每升高10 C , PN 结的反向饱和电流约增大 1倍,因此温度为35C 时, 反向 饱和电流为 35 15 I s 10 40 A (5) 二极管在Q 点处的直流电阻为 的电压当量,常温下 U T 26mV ,可见r d R D 。 1-2 理想二极管组成的电路如题 1-2图所示。试判断图中二极管是导通还是截止,并 确定各电路 的输出电压。 解 理想二极管导通时的正向压降为零, 截止时的反向电流为零。本题应首先判断二极管 的工作状态,再进一步求解输出电压。二极管工作状态的一般判断方法是: 断开二极管,求 R D U D I D 交流电阻为 r d U D U T i D 式中U D 为二极管两端的直流电压, U D U on , I D 为二极管上流过的直流电流, U T 为温度

考试试题1及答案

土力学及地基基础模拟考试试题1及答案 一、填空题(10分) 1、土(区别于其它工程材料)主要工程特性是__________、__________和渗透性大。 2、直接剪切试验按排水条件不同,划分为__________、固结不排水剪(固结快剪)、__________。 3、由土的自重在地基内所产生的应力称为__________;由建筑物的荷载或其他外载在地基内所产生的应力称为__________。 4、建筑物地基变形的特征有沉降量、__________、__________和局部倾斜四种类型。 5、浅基础主要的类型有__________、__________、十字交叉基础、筏板基础、壳体基础和箱形基础。 二、选择题(20分) 1、土的三相比例指标包括:土粒比重、含水率、重度、孔隙比、孔隙率和饱和度等,其中哪些为直接试验指标?( ) (A )、含水率、孔隙比、饱和度(B )、重度、含水率、孔隙比 (C )、土粒比重、含水率、重度 2、土的变形主要是由于土中哪一部份应力引起的?( ) (A )、总应力(B )、有效应力(C )、孔隙应力 3、荷载试验的中心曲线形态上,从线性开始变成非线性关系的界限荷载称为( )。 (A )、允许荷载(B )、临界荷载(C )、临塑荷载 4、已知土层的饱和重度 sat γ,干重度为d γ,水的重度为w γ,在计算地基沉降时,采用以下 哪一项计算地下水位以下的自重应力?( ) (A )、 sat γ(B )、d γ(C )、(sat γ-w γ) 5、土的体积压缩是由下述变形造成的( )。 (A )、土孔隙的体积压缩变形(B )、土颗粒的体积压缩变形 (C )、土孔隙和土颗粒的体积压缩变形之和 6、如果墙推土而使挡土墙发生一定的位移,使土体达到极限平衡状态,这时作用在墙背上的土压力是何种土压力?( ) (A )、静止土压力(B )、主动土压力(C )、被动土压力 7、已知柱下扩展基础,基础长度l =3.0m ,宽度b =2.0m ,沿长边方向荷载偏心作用,基础底面压力最小值Pmin =30kPa ,最大值Pmax =160kPa ,指出作用于基础底面上的竖向力和力矩最接近以下哪一种组合。( ) (A )、竖向力370kN ,力矩159kN ·m (B )、竖向力540kN ,力矩150kN ·m (C )、竖向力490kN ,力矩175kN ·m (D )、竖向力570kN ,力矩195kN ·m 8、对于框架结构,地基变形一般由什么控制?( ) (A )、沉降量(B )、沉降差(C )、局部倾斜 9、属于非挤土桩的是( )。 (A )、实心的混凝土预制桩(B )、钻孔桩(C )、沉管灌注桩 10、一般端承桩基础的总竖向承载力与各单桩的竖向承载力之和的比值为( )。 (A )、>1(B )、=1(C )、<1 三、判断题(10分) 1、根据有效应力原理,总应力必然引起土体变形。( )

一站到底题库及答案

一站到底题库及答案 2015《一站到底》题库及答案 1、“轻于鸿毛”中的“鸿毛”指哪种动物的毛?大雁 2、因为水门事件下台的美国总统是?尼克松 3、以哪种动物为原型,其“招手”形象被视为招财招福的吉祥物?猫 4、“大不列颠及北爱尔兰联合王国”是哪个国家的全称?英国 5、清朝乾隆年间是谁主持修订了《四库全书》?纪晓岚 6、医学著作《本草纲目》是由哪位人物撰写的?李时珍 7、明月几时有,把酒问青天出自宋朝哪位词人之手——苏轼 8、中国和朝鲜两国的界河叫做什么江——鸭绿江 9、因一张头发凌乱,表情冷峻的乞丐装照片而大火特火的流浪汉被网友戏称——犀利哥 10、红楼梦里八面玲珑,精明能干,以厉害著称的当家媳妇是谁?王熙凤 11、主演了《泰坦尼克号》《盗梦空间》的美国好莱坞男明星是谁?莱昂纳多·迪卡普里奥 12、坐落在敦煌,以精美的壁画和塑像而闻名于世的世界文化遗产是什么?莫高窟 13、梦工厂公司出品的绿色怪物和公主费欧娜的爱情故事系列动画电影,叫什么名字?怪物史莱克 14、.佛法说的“苦海无边”的下句是什么?回头是岸 15、扑克牌的四种花色中,除了黑桃,梅花,方块外还有哪种花色?红心 16、《老人与海》是美国哪位著名小说家的作品?海明威 17、我们常用种传说的鸟类来形窑内眼角朝下,外眼角狭长上翘的眼睛叫什么眼?丹凤眼 18、抗日战争打响第一枪的发生地是在哪座古代石桥?卢沟桥 19、源于象棋术语,现形客人们事后才采取措施,但已经于事无补的行为?马后炮 20、未名湖和博雅塔是哪所高校的标志性景点?北京大学 21、90年代中初中英语教科书里的人物,之后出了同名漫画歌曲引发集体会议的是李雷和

人教A版高中数学必修1课后习题及答案

高中数学必修1课后习题答案 第一章 集合与函数概念 1.1集合 1.1.1集合的含义与表示 练习(第5页) 1.用符号“∈”或“?”填空: (1)设A 为所有亚洲国家组成的集合,则:中国_______A ,美国_______A , 印度_______A ,英国_______A ; (2)若2 {|}A x x x ==,则1-_______A ; (3)若2{|60}B x x x =+-=,则3_______B ; (4)若{|110}C x N x =∈≤≤,则8_______C ,9.1_______C . 1.(1)中国∈A ,美国?A ,印度∈A ,英国?A ; 中国和印度是属于亚洲的国家,美国在北美洲,英国在欧洲. (2)1-?A 2 {|}{0,1}A x x x ===. (3)3?B 2{|60}{3,2}B x x x =+-==-. (4)8∈C ,9.1?C 9.1N ?. 2.试选择适当的方法表示下列集合: (1)由方程290x -=的所有实数根组成的集合; (2)由小于8的所有素数组成的集合; (3)一次函数3y x =+与26y x =-+的图象的交点组成的集合; (4)不等式453x -<的解集. 2.解:(1)因为方程290x -=的实数根为123,3x x =-=, 所以由方程290x -=的所有实数根组成的集合为{3,3}-; (2)因为小于8的素数为2,3,5,7, 所以由小于8的所有素数组成的集合为{2,3,5,7}; (3)由326y x y x =+??=-+?,得14x y =??=? , 即一次函数3y x =+与26y x =-+的图象的交点为(1,4),

大学基础物理学课后习题答案_含思考题(1)

大学基础物理课后答案 主编:习岗高等教育出版社

第一章 思考题: <1-4> 解:在上液面下取A 点,设该点压强为A p ,在下液面内取B 点,设该点压强为B p 。对上液面应用拉普拉斯公式,得 A A R p p γ20= - 对下液面使用拉普拉斯公式,得 B B 02R p p γ= - 又因为 gh p p ρ+=A B 将三式联立求解可得 ??? ? ??-= B A 112R R g h ργ <1-5> 答:根据对毛细现象的物理分析可知,由于水的表面张力系数与温度有关,毛细水上升的高度会随着温度的变化而变化,温度越低,毛细水上升的高度越高。在白天,由于日照的原因,土壤表面的温度较高,土壤表面的水分一方面蒸发加快,另一方面土壤颗粒之间的毛细水会因温度升高而下降,这两方面的原因使土壤表层变得干燥。相反,在夜间,土壤表面的温度较低,而土壤深层的温度变化不大,使得土壤颗粒间的毛细水上升;另一方面,空气中的水汽也会因为温度下降而凝结,从而使得清晨时土壤表层变得较为湿润。 <1-6> 答:连续性原理是根据质量守恒原理推出的,连续性原理要求流体的流动是定常流动,并且不可压缩。伯努利方程是根据功能原理推出的,它的使用条件是不考虑流体的黏滞性和可压缩性,同时,还要求流动是定常流动。如果流体具有黏滞性,伯努利方程不能使用,需要加以修正。 <1-8> 答:泊肃叶公式适用于圆形管道中的定常流动,并且流体具有黏滞性。斯托克斯公式适用于球形物体在黏滞流体中运动速度不太大的情况。 练习题: <1-6> 解:设以水坝底部作为高度起点,水坝任一点至底部的距离为h 。在h 基础上取微元d h ,与之对应的水坝侧面面积元d S (图中阴影面积)应为坡长d m 与坝长l 的乘积。 练习题1-6用图 d h d F

考试试题答案1

2012年8月24日考试试题 一. 填空题(每空1分,计50分) 1、为患者进行鼻饲时,要评估患者鼻腔粘膜有无肿胀、炎症、鼻中隔弯曲、鼻息肉等鼻部疾患。 2、为男性患者插尿管时,当尿管经过尿道外口、膜部、尿道内口的狭窄部时嘱患者缓慢深呼吸,缓慢插入尿管。(顺序不可以颠倒) 3、PICC置管长度,上腔静脉测量法:从预穿刺点沿静脉走向至右胸锁关节、再向下至第三肋间。 4、采集动脉血的目的是进行血气分析,判断氧和情况,为治疗提供依据。 5、抢救物品要做到“五定”:即定数量品种、定点放置、定人保管、定期消毒灭菌和定期检查维修。(顺序可颠倒) 6、在心电监测过程中,要密切观察心电图波形,及时处理干扰和电极脱落。 7、咽拭子是采集咽部扁桃体、两侧腭弓的分泌物做细菌培养。(顺序可颠倒) 8、压疮分期:(炎性侵润麒)、(瘀血红润期)、(溃疡期)。 9、对于急腹症、(妊娠早期)、(消化道出血)的患者禁止灌肠,灌肠时灌肠筒内液面高于肛门约(40~60)厘米;伤寒患者灌肠量不能超过(500)毫升,液面距肛门不超过(30)厘米;肝性脑病患者禁用(肥皂水)灌肠。10、测血糖前确认血糖仪的号码与试纸号码是否(一致),确认是否符合(空腹)或者餐后(2)小时血糖测定的要求。 11、洗手时注意认真清洗指甲指尖、指缝和指关节等易污染的部位。(顺序可颠倒) 12、已打开的无菌溶液有效使用时间是 24小时。 13、为病人测量体温,一般腋下需要 10分钟;口腔需要 3 分钟;测肛温时需要 3 分钟。 14、为患者吸痰时操作动作应轻柔、(快速)(准确);插入吸痰管时不要带(负)压,每次吸痰时间小于(15秒),吸痰管最大外径不能超过气管导管内径的(1/2)。 15、轴线翻身法是协助颅骨牵引、(脊椎损伤)、(脊柱术)、髋关节术后的患者在床上翻身的方法。 16、静脉采血若患者正在进行输液、输血,不宜在(同侧)采血。如需要抗凝的血标本,应将血液与(抗凝剂)混匀。 17、物理降温时,应当避开患者的枕后、(耳廓)、(心前区)、(腹部)、(阴囊)及足底等部位 二、单项选择题(每题1分,共20分) 1、插导尿管前女性尿道口和小阴唇的消毒顺序为 (A) A 自上而下, 由内向外 B 自上而下, 由外向内 C 自下而上, 由内向外 D 自下而上, 由外向内 2、大量不保留灌肠过程中,患者如有便意下列做法正确的是(C) A拔出肛管 B移动肛管 C放低灌肠筒 D抬高灌肠筒 3、发口服药不符合要求的是( D ) A若患者不在病房或者因故暂不能服药者,暂不发药并做好交班。 B告知患者所服的药物、服用方法

高一数学必修1试题及答案

高一数学必修1质量检测试题(卷)2009.11 本试卷分第Ⅰ卷(选择题)和第Ⅱ卷(非选择题)两部分。第Ⅰ卷1至2页。第Ⅱ卷3至6页。考试结束后. 只将第Ⅱ卷和答题卡一并交回。 第Ⅰ卷(选择题 共60分) 注意事项: 1.答第Ⅰ卷前,考生务必将姓名、准考号、考试科目用铅笔涂写在答题卡上。 2.每小题选出答案后,用铅笔把答题卡上对应题目的答案标号涂黑,如需改动,用橡皮擦干净后,再选涂其它答案,不能答在试题卷上。 一、选择题:本答题共12小题,每小题5分,共60分。在每小题给出的 四个选项中,只有一项是符合题目要求的。 1.集合{0,1}的子集有 ( )个 A. 1个 B. 2个 C. 3个 D. 4个 2.已知集合2 {|10}M x x =-=,则下列式子正确的是 A .{1}M -∈ B . 1 M ? C . 1 M ∈- D . 1 M ?- 3.下列各组函数中,表示同一函数的是 A .1y =与0y x = B .4lg y x =与2 2lg y x = C .||y x =与2 y = D .y x =与ln x y e = 4.设集合{(,)|46},{(,)|53}A x y y x B x y y x ==-+==-,则B A = A .{x =1,y =2} B .{(1,2)} C .{1,2} D .(1,2) 5. 函数()ln 28f x x x =+-的零点一定位于区间 A. (1, 2) B. (2 , 3) C. (3, 4) D. (4, 5) 6.二次函数2 ()23f x x bx =++()b R ∈零点的个数是 A .0 B .1 C .2 D .以上都有可能 7.设 ()x a f x =(a>0,a ≠1),对于任意的正实数x ,y ,都有 A.()()()f xy f x f y = B. ()()()f xy f x f y =+ C.()()()f x y f x f y += D. ()()()f x y f x f y +=+

思考题是与习题参考答案(第2章)[1]

第二章溶液与离子平衡 思考题与习题参考答案 一、判断题 1. E 2. E 3. T 4. E 5. E 6. T 7. T 8. E 9. E 10. E 11. E 12. E 13. T 14. E 二、选择题 15. C 16. A 17. C 18. C 19. C 20. B 21. A 22. C 23. D 24. B 25. B 26. A 27. D 三、填空题 28. 蒸气压下降沸点升高凝固点下降渗透压29. D>C>A>B 30. 红红黄同离子效应31. K s°= (b(Ag+)/b°)2(b(CrO42-)/b°)2s = (K s°/4)1/3 33. 右34. 空轨道孤电子对35. HPO42-H[PtCl6]-SO42-[Fe(H2O)5OH]2+36. 5.68 10-10NH4+, H3PO4, H2S PO4, CO3, CN, OH, NO2-[Fe(H2O)5OH], HSO3-, HS-, H2PO4-, HPO4, H2O 四、问答题 38. 溶液的沸点升高和凝固点降低与溶液的组成有何关系? 答难挥发非电解质的稀溶液的沸点上升和凝固点下降与溶液的质量摩尔浓度成正比, 即随溶质的粒子数的增多而增大, 而与溶液的组成(溶质的本性)无关. 39. 怎样衡量缓冲溶液缓冲能力的大小? 答缓冲能力大小的衡量尺度为缓冲容量. 当缓冲组分比为1:1时, 缓冲溶液有最大的缓冲容量. 40. 试讨论怎样才能使难溶沉淀溶解. 答若要使沉淀溶解, 就必有ΠB(b B/b°)νB< K s°, 因此, 必须必须设法降低饱和溶液中某一组

分的平衡浓度. 可以根据沉淀的性质, 利用酸碱反应, 氧化还原反应或配合反应等措施, 以达到使沉淀溶解的目的. 41. 试用平衡移动的观点说明下列事实将产生什么现象. (1) 向含有Ag 2CO 3沉淀中加入Na 2CO 3. 答 根据同离子效应的原理, Ag 2CO 3沉淀的溶解度变小. (2) 向含有Ag 2CO 3沉淀中加入氨水. 答 加入氨水时, Ag +与NH 3生成了稳定的[Ag(NH 3)2]+, 使溶液中b (Ag +)降低, 平衡向沉淀溶解的方向移动, Ag 2CO 3沉淀的溶解度增大. 当氨水足够量时, Ag 2CO 3沉淀将完全溶解. (3) 向含有Ag 2CO 3沉淀中加入HNO 3. 答 加入HNO 3时, CO 32-与HNO 3反应, 使溶液中b (CO 32-)降低, 平衡向沉淀溶解的方向移动, Ag 2CO 3沉淀的溶解度增大. 当CO 32-足够量时, Ag 2CO 3沉淀将完全溶解. 42. 试说明什么叫螯合物. 答 螯合物是指含有多齿配位体并形成螯环的配合物. 43. 酸碱质子理论与电离理论有哪些区别? 答 (a) 对酸碱的定义不同; (b) 质子理论中没有盐的概念; (c) 酸碱反应的实质不同; (d) 适用的溶剂不同. 五、计算题 44. (1) 14.6% (2) 0.454 mol ?dm -1 (3) 0.54 mol ?kg -1 (4) 0.991 45. 186 g ?mol -1 46. 2327.53 Pa 326.4 kPa 47. (1) b (H +) = 9.4 10-4 mol ?kg -1 b (Ac -) = 9.4 10-4 mol ?kg -1 α = 1.88% (2) b (H +) = 3.5 10-5 mol ?kg -1 b (Ac -) = 0.025 mol ?kg -1 α = 0.07% (3) b (H +) = 0.025 mol ?kg -1 b (Ac -) = 3.52 10-5 mol ?kg -1 (4) b (H +) = 1.76 10-5 mol ?kg -1 b (Ac -) = 0.025 mol ?kg -1 48. 0.01 mol ?kg -1的某一元弱酸溶液, 在298K 时, 测定其pH 为5.0, 求: (1) 该酸的K a °和α; (2) 加入1倍水稀释后溶液的pH, K a °和α. 解: (1) pH = 5.0, b (H +) = 1 10-5 mol ?kg -1 HB = H + + B - b (eq)/mol ?kg -1 0.01-1 10-5 1 10-5 1 10-5 52 8a 5 (110)1100.01110 K ---?==?-? 5110100%0.1%0.01 α-?=?= (2) HB = H + + B - b (eq)/mol ?kg -1 0.005-x x x K a ° = 1.0 10-8, (0.005-x ) ≈ x , 28a 1100.005 x K -==? b (H +) = 7.07 10-6 mol ?kg -1 pH = 5.15 6 7.0710100%0.14%0.005 α-?=?= 49. 计算20℃时, 在0.10 mol ?kg -1氢硫酸饱和溶液中: (1) b (H +), b (S 2-)和pH; (2) 如用HCl 调节溶液的酸度为pH = 2.00时, 溶液中的为S 2-浓度多少? 计算结果说明什么问题?

试题答案1

试卷一 (每题2分,共60分) 一、单选题 1、D 2、C 3、B 4、A 5、A 6、B 7、B 8、C 9、B 10、D 11、C 12、B 13、C 14、A 15、B 16、A 17、B 18、D 19、B 20、C 二、多选题 21、ACE 22、ABC 23、ACD 24、ACD 25、ACDE 26、ABCD 27、DE 28、ABCD 29、ABDE 30、BCE 三、论述题(每题10分,共30分) 1、进入大学后,不少同学对大学生活存在不适应,请结合自己的专业谈谈 应如何调整心态规划好自己的大学人生、尽快适应大学新生活的挑战? (1)讲述自己进入大学后遇到的不适应。(2分) (2)大学新生活的特点及其要求。(4分) (3)结合自己对专业的认识和了解,讲述自己是如何调整心态规划自己的大学人生。(4分) 2、当今社会生活条件下,不少人变得“功利、实际、追求实惠”,今天 理想的空间丧失了吗?请结合实际,谈谈理想信念对大学生成长成才的重要意义? (1)什么是理想?理想的含义与特征。(2分) (2)正确认识理想与现实的矛盾关系,克服用现实来否定理想的认识

偏向,防止出现丧失理想信念、陷入拜金主义、个人主义(4分)(3)结合自身或社会实际,阐述理想信念对大学生成长、成才的重要意义(从人生的奋斗目标、前进动力和精神境界几方面选择其中 一至两点加以阐述)。(4分) 3、请从你与父母相处的往事经历,谈谈当代大学生应如何处理好与父母 的关系,传承中华民族优良传统、弘扬家庭美德? (1)讲述自己与父母相处的一段往事经历。(2分) (2)结合自己的经历,谈谈自己是如何处理与父母的关系的。(4分) (3) 谈谈大学生应如何继承发扬传统家庭美德并赋予时代新内涵。 (4分) 四、案例分析(10分) (1)此案例体现了财大学子乐于奉献、积极参加爱心志愿者活动,展现了当代大学生的人生追求与精神境界。(2分) (2)社会主义核心价值观的具体内容:富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善。(4分)(3)当代大学生的人生价值目标要与社会主义核心价值观的践行结合起来,要走向社会,与人民群众相结合,传播正能量,在社会实践 中创造有价值的人生。(4分)

一站到底题库及答案

一站到底题库及答案20170410期 1 评估钻石的国际标准4C是指颜色、净度、重量和什么? 切工 2 横琴口岸是珠海通往哪座城市的口岸? 澳门 3 2017年欧冠中,以总分6比5惊天逆转晋级八强的是哪支俱乐部? 巴塞罗那 4 在哲学“阿基里斯桲论”中,阿基里斯永远也追不上哪种动物? 乌龟 5 “嗟乎,大丈夫当如此也”是刘邦看到谁出行巡游时发出的感慨?

秦始皇 6 收孙悟空为徒,并传授七十二变和筋斗云的是哪位神仙? 菩提祖师 7 小说《孽海花》的主人公傅彩云是以哪位清末女子为原型塑造的人物? 赛金花 8 中国在北极建立的第一个科学考察站是哪个站? 黄河站 9 儿童文学作家洪训涛创作的善于绘画的放牛娃叫什么名字? 神笔马良 10 《还珠格格》是琼瑶在游览北京哪个地方时萌发的灵感? 公主坟

11 被誉为“中国近代文化双子星”的是北京大学和哪个出版机构? 商务印书馆 12 图片题:叶子是绿水,三角形,两边有很多小凹槽,花是十字白色小花。这是哪种水生蔬菜的叶子?A菱角B荸bi荠qi A菱角 13 “葵花大斩肉”是哪道扬州名菜的别称? 狮子头 14 “冻死不拆屋,饿死不掳掠”是古代哪支著名军队的严格纪律? 岳家军 15 目前唯一禁止女司机开车的是哪个国家?

沙特阿拉伯 16 金州勇士队的哪位球星被网友戏称为“佛祖”? 汤普森 17 别名“阿帕契之泪”,墨西哥的国石是哪种宝石? 黑曜石 18 诺贝尔经济学奖获得者,被誉为“欧元之父”的是哪位经济学家? 蒙代尔 19 美国的“麻省”指的就是哪个州? 马萨诸塞州 20 在冷战中开启了“星球大战计划”的是哪位美国总统? 里根

高中数学必修1各章节测试题全套含答案

(数学1必修)第一章(上) 集合 [基础训练A 组] 一、选择题 1.下列各项中,不可以组成集合的是( ) A .所有的正数 B .等于2的数 C .接近于0的数 D .不等于0的偶数 2.下列四个集合中,是空集的是( ) A .}33|{=+x x B .},,|),{(22R y x x y y x ∈-= C .}0|{2≤x x D . },01|{2R x x x x ∈=+- 3.下列表示图形中的阴影部分的是( ) A .()()A C B C B .()()A B A C C .()()A B B C D .()A B C 4.下面有四个命题: (1)集合N 中最小的数是1; (2)若a -不属于N ,则a 属于N ; (3)若,,N b N a ∈∈则b a +的最小值为2;(4)x x 212=+的解可表示为{ }1,1; 其中正确命题的个数为( )A .0个 B .1个 C .2个 D .3个 5.若集合{},,M a b c =中的元素是△ABC 的三边长, 则△ABC 一定不是( ) A .锐角三角形 B .直角三角形 C .钝角三角形 D .等腰三角形 6.若全集{}{}0,1,2,32U U C A ==且,则集合A 的真子集共有( ) A .3个 B .5个 C .7个 D .8个 二、填空题 1.用符号“∈”或“?”填空 (1)0______N , 5______N , 16______N (2)1 ______,_______,______2 R Q Q e C Q π- (e 是个无理数) (3{} |,,x x a a Q b Q =∈∈ 2. 若集合{}|6,A x x x N =≤∈,{|}B x x =是非质数,C A B =,则 C 的 非空子集的个数为 。 3.若集合{}|37A x x =≤<,{}|210B x x =<<,则A B =_____________. A B C

第一章思考题与习题解答

第一章思考题与习题 1.大地水准面所包围的地球形体,称为地球椭球体。(错) 答:错。大地水准面所包围的地球形体称为大地体。旋转椭球面包围的地球形体称为地球椭球体。 2.设A点的横坐标Y=19779616.12,试计算A点所在6o带内中央子午线的经度,A点在中央子午线的东侧,还是西侧,相距多远? 答:A点在6°带内中央子午线的经度:L0=6N-3=6*19-3=111° 求A点自然值:用通用值减去带号19再减500km,也就是:779616.12m-500km=779616.12-500000=229616.12m>0 所以在中央子午线东侧,相距229616.12m 3.靠近赤道某点的经度为116o 28′,如以度为单位按赤道上1o为111km弧长估算,试问该点分别在6o带和3o带中的横坐标通用值为多少? 答: 1)求该点在6°带中的横坐标通用值: 该点在6°带中的带号N=int(116o 28’/6)+1=20 中央子午线经度:L0=6N-3=117° 该点在中央子午线西边,经差是117°-116o 28′=0°32′=0.5333333333333333°相距中央子午线距离是:111*0.5333333333333333=59.2km 向西移500km后坐标是:500km-59.2km=440.8km=440800m 该点横坐标通用值是:20440800m 2)求该点在3°带中的横坐标通用值: 该点在3°带中的带号N=int((116o 28’-1°30′)/3)+1=39 中央子午线经度:L0=3N=117° 3°带和6°带中央子午线重合,因此,坐标是一样的,只是带号不同 则3°带中横坐标通用值为:39440800m 4.某地的经度为116°23′,试计算它所在的6o带和3o带带号,相应6o带和3o带的中央子午线的经度是多少? 答: 1)求该点在6°带中带号N=int(116o 23′/6)+1=20 中央子午线经度:L0=6N-3=117° 2)该点在3°带中的带号N=int((116o 23’-1°30′)/3)+1=39 中央子午线经度:L0=3N=117° 3°带和6°带中央子午线重合

一站到底题库及答案一站到底题库

一站到底题库及答案一站到底题库 一站到底题库 一站到底题库(一) 第一轮 1.“铁观音”茶的原产发源地在中国的哪个省份?福建 2.奢侈品牌 LV 路易威登是哪个国家的品牌?法国 3 欧洲的哪个城市被世界公认为“雾都”?伦敦 4.西藏布达拉宫最初是松赞干布为了迎接谁而兴建的?文成公主 4. 电影《碟中谍 4》中汤姆布鲁斯挑战的世界第一高的摩天大楼位于哪个城市?迪拜 5.电影《变形金刚》中,与擎天柱作对的反派首领叫什么?威震天 6.金庸小说《射雕英雄传》中第一次华山论剑的胜利者是哪一位?王重阳 7.美国阿姆斯特朗登上月球后,说了“个人的一小步” ,后一句是什么?人类的一大步 8.法国巴黎有名的凯旋门是为了纪念哪位名人建造的?拿破仑 9.世界上出现麦田怪圈最多的国家是?英国 10.意大利有一座被活火山活埋的城市,叫什么?庞贝

11.电影《泰坦尼克号》中,年老的 Rose 扔进海里的蓝色钻石叫什么名字?海洋之心 12.美国奥斯卡奖历史上只有一人连续两届获得最佳男演员奖,这个人是谁?汤姆汉克斯 13.世界上公认的第一架实用飞机的发明者是美国的什么人?莱特兄弟一站到底题库 14.二战过后,审判法西斯的德国法庭在哪一个城市?纽伦堡 第二轮 1.江苏卫视孟非主持的哪一档知名节目与冯小刚导演的电影同名?非诚勿扰 2.武术冠军出身,以出演黄飞鸿、方世玉等角色为国人所熟知的武打明星是谁?李连杰 3.与刘德华,张学友,郭富城合称为香港“四大天王”的人是谁?黎明 4.歌词“东方之珠,我的爱人”中,东方之珠指的是哪座城市?香港 5.一站到底的题库网站是多少? 6.我国的吉利汽车公司成功收购了外国哪家汽车公司 100%的股权?沃尔沃 7.在“小虎队”成员中,吴奇隆被称为什么虎?霹雳虎 8.在《三国演义》中,“一个愿打一个愿挨”形容的是周瑜与哪位将领的故事?黄盖