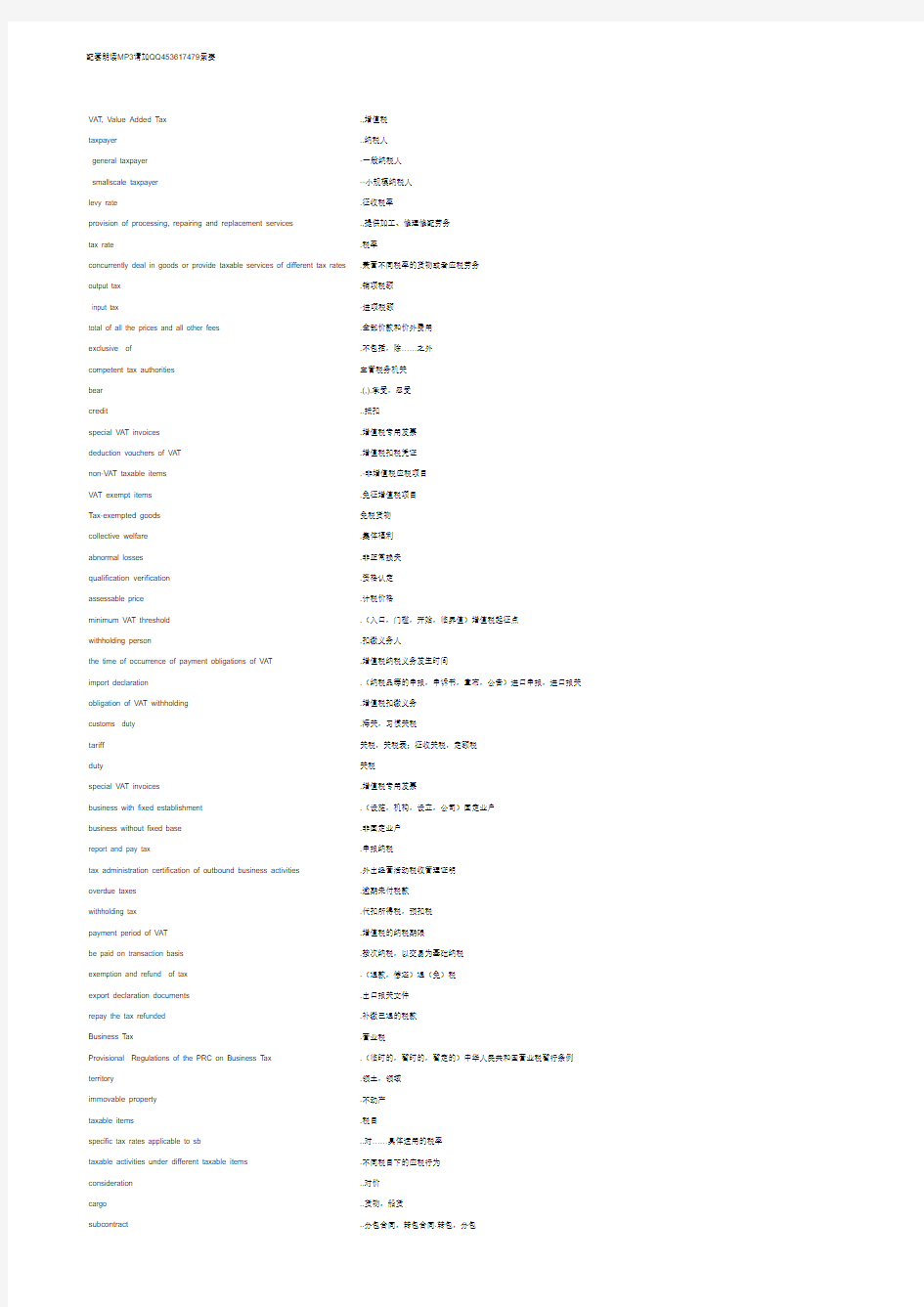

注会六科英语词汇

VAT, Value Added Tax .,增值税

taxpayer ..纳税人

general taxpayer -一般纳税人

smallscale taxpayer --小规模纳税人

levy rate .征收税率

provision of processing, repairing and replacement services .,提供加工、修理修配劳务

tax rate .税率

concurrently deal in goods or provide taxable services of different tax rates .兼营不同税率的货物或者应税劳务

output tax .销项税额

input tax -进项税额

total of all the prices and all other fees .全部价款和价外费用

exclusive of .不包括,除……之外

competent tax authorities 主管税务机关

bear .(,).承受,忍受

credit..抵扣

special VAT invoices .增值税专用发票

deduction vouchers of VAT .增值税扣税凭证

non-VAT taxable items .-非增值税应税项目

VAT exempt items .免征增值税项目

Tax-exempted goods 免税货物

collective welfare .集体福利

abnormal losses .非正常损失

qualification verification .资格认定

assessable price .计税价格

minimum VAT threshold .(入口,门槛,开始,临界值)增值税起征点

withholding person .扣缴义务人

the time of occurrence of payment obligations of VAT .增值税纳税义务发生时间

import declaration .(纳税品等的申报,申诉书,宣布,公告)进口申报,进口报关obligation of VAT withholding .增值税扣缴义务

customs duty .海关,习惯关税

tariff关税,关税表;征收关税,定额税

duty关税

special VAT invoices .增值税专用发票

business with fixed establishment .(设施,机构,设立,公司)固定业户

business without fixed base .非固定业户

report and pay tax .申报纳税

tax administration certification of outbound business activities .外出经营活动税收管理证明

overdue taxes .逾期未付税款

withholding tax .代扣所得税,预扣税

payment period of VAT .增值税的纳税期限

be paid on transaction basis .按次纳税,以交易为基础纳税

exemption and refund of tax .(退款,偿还)退(免)税

export declaration documents .出口报关文件

repay the tax refunded .补缴已退的税款

Business Tax .营业税

Provisional Regulations of the PRC on Business Tax .(临时的,暂时的,暂定的)中华人民共和国营业税暂行条例territory .领土,领域

immovable property .不动产

taxable items .税目

specific tax rates applicable to sb ..对……具体适用的税率

taxable activities under different taxable items .不同税目下的应税行为

consideration ..对价

cargo ..货物,船货

subcontract..分包合同,转包合同.转包,分包

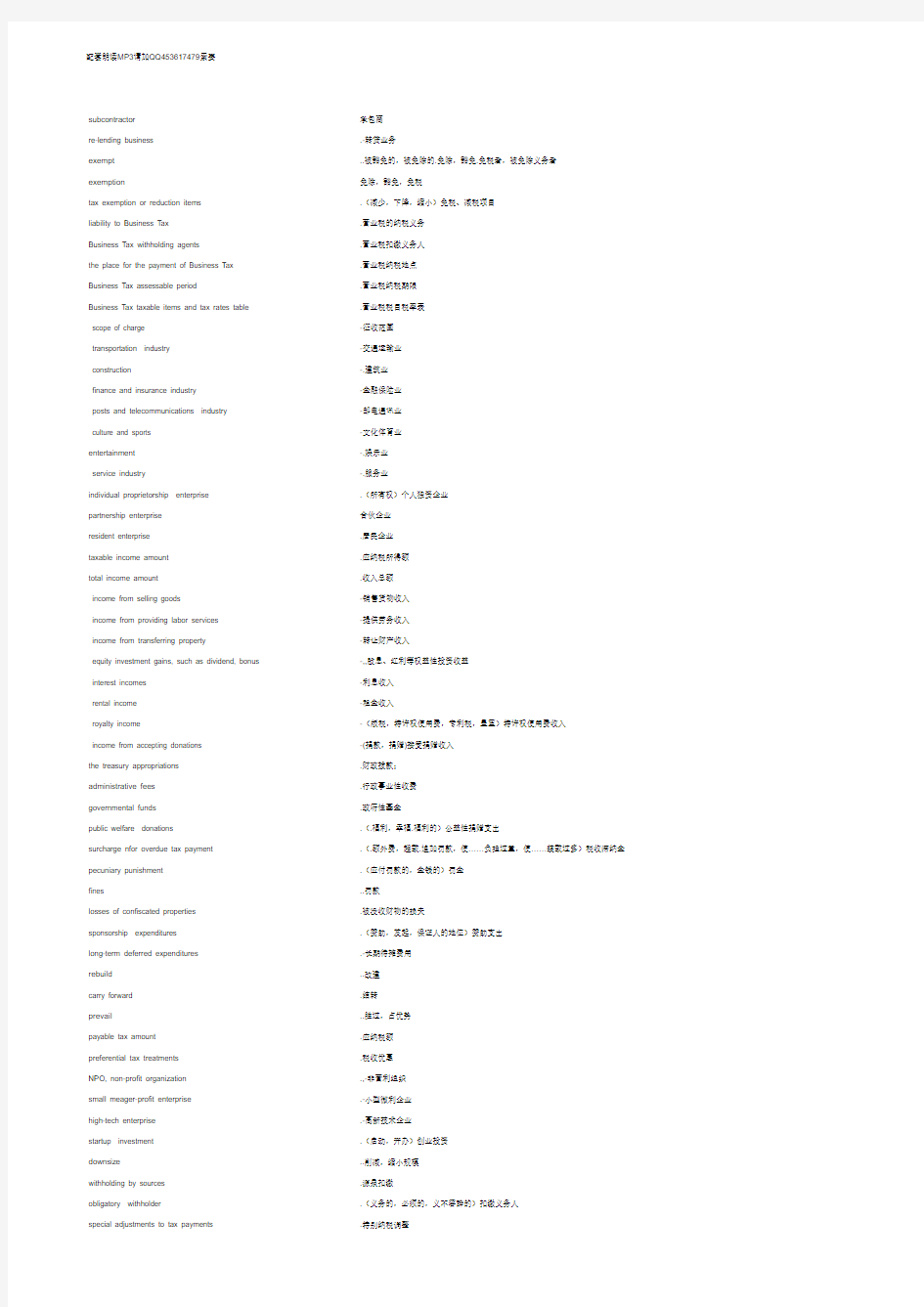

subcontractor承包商

re-lending business .-转贷业务

exempt..被豁免的,被免除的.免除,豁免.免税者,被免除义务者

exemption免除,豁免,免税

tax exemption or reduction items .(减少,下降,缩小)免税、减税项目

liability to Business Tax .营业税的纳税义务

Business Tax withholding agents .营业税扣缴义务人

the place for the payment of Business Tax .营业税纳税地点

Business Tax assessable period .营业税纳税期限

Business Tax taxable items and tax rates table .营业税税目税率表

scope of charge -征收范围

transportation industry-交通运输业

construction -.建筑业

finance and insurance industry-金融保险业

posts and telecommunications industry-邮电通讯业

culture and sports -文化体育业

entertainment -.娱乐业

service industry-.服务业

individual proprietorship enterprise .(所有权)个人独资企业

partnership enterprise 合伙企业

resident enterprise .居民企业

taxable income amount .应纳税所得额

total income amount .收入总额

income from selling goods -销售货物收入

income from providing labor services -提供劳务收入

income from transferring property -转让财产收入

equity investment gains, such as dividend, bonus -,,股息、红利等权益性投资收益

interest incomes -利息收入

rental income -租金收入

royalty income -(版税,特许权使用费,专利税,皇室)特许权使用费收入

income from accepting donations -(捐款,捐赠)接受捐赠收入

the treasury appropriations .财政拨款;

administrative fees.行政事业性收费

governmental funds .政府性基金

public welfare donations .(.福利,幸福.福利的)公益性捐赠支出

surcharge nfor overdue tax payment .(.额外费,超载.追加罚款,使……负担过重,使……装载过多)税收滞纳金pecuniary punishment .(应付罚款的,金钱的)罚金

fines ..罚款

losses of confiscated properties .被没收财物的损失

sponsorship expenditures .(赞助,发起,保证人的地位)赞助支出

long-term deferred expenditures .-长期待摊费用

rebuild..改建

carry forward .结转

prevail..胜过,占优势

payable tax amount .应纳税额

preferential tax treatments .税收优惠

NPO, non-profit organization .,-非营利组织

small meager-profit enterprise .-小型微利企业

high-tech enterprise .-高新技术企业

startup investment .(启动,开办)创业投资

downsize..削减,缩小规模

withholding by sources .源泉扣缴

obligatory withholder .(义务的,必须的,义不容辞的)扣缴义务人

special adjustments to tax payments .特别纳税调整

arm's length transaction .’公平交易

arm's length principle公平原则

fair deal公平交易

pricing arrangement .定价安排

transitional preferential tax treatments .(变迁的,过渡期的)(优先的,选择的,特惠的)过渡性税收优惠administration of tax levy .征收管理

the Law of PRC on Administration of Tax Collection .中华人民共和国税收征收管理法

tax year .纳税年度

pay in advance .预缴

enterprise income tax return .企业所得税纳税申报表

payable or refundable taxes .应缴应退税款

deregistration formalities .办理注销登记手续

deregistration撤销注册,取消登记

formalities ..手续

domicile..住宅,住所,永久居住地.使定居

wages and salaries .工资、薪金

individual industrial and commercial households.(.家庭.家庭的,日常的)个体工商户

contracted or leased operation .承包、承租经营

remuneration for personal service .劳务报酬

author's remuneration .’稿酬

royalty .特许权使用费

contingent income .偶然所得

progressive rate .(.先进的,进步的)累计税率

flat rate .比例税率

excessively high .畸高的

additional tax can be levied at a rate .加成征收

treasury bond / national debt ./国债

financial debentures金融债券

welfare benefits .福利费

survivorn pensions .(.幸存者,生还者)抚恤金

relief payments .(救济,减轻,解除,安慰)救济金

insurance indemnities .保险赔款

international conventions .(约定,协定,惯例,大会)国际公约

income exempt from tax .免税所得

taxable income .应纳税所得

the additional deduction for expenses .附加减除费用

creditable amount .扣除额

file one's tax return .’办理纳税申报

withholding in full for all taxpayers .全员全额扣缴

self-reporting taxpayer .-自行申报纳税人

tax authorities .税务机关

pay in advance in monthly installment .分月预缴

excess payment refunded and deficiency repaid .多退少补

savings deposit .(.存款,保证金.存放,沉淀)储蓄存款

handling fees .手续费

schedule of individual income tax rates .个人所得税税率表

tax base .税基

tax avoidance .避税

tax evasion -逃税

refund after collection .先征后退

collect and remit tax .代收代缴

withhold and remit tax .代扣代缴

the first profit-making year .-第一个获利年度

temporary trips out of the country .临时离境

state treasury .国库

refund of the income tax paid on the reinvested amount .再投资退税

export-oriented enterprise .-出口型企业

special economic zone .经济特区

non-deductible expenses .-不可抵扣的费用

temporary differences .暂时性差异

excise duty .(消费税,货物税,动词时,意为收税,切除)消费税ad valorem collection .从价计征

quantity-based collection从量计征

city maintenance and construction tax .(维修,维护,保持)城市维护建设税

duty paid price .完税价格

resource tax .资源税

urban and township land use tax .(城市的)(镇区,小镇)城镇土地使用税

house property tax .房产税

farmland conversion tax .耕地占用税

vehicle acquisition tax .车辆购置税

vehicle and vessel usage tax .车船使用税

vehicle and vessel tax .车船税

stamp ntax .(.邮票,印记,标志.铭记,标出)印花税

deed tax .(法律术语:契据,证书,动词时,意为立契转让)契税fuel tax .(燃料)燃油税

security transaction tax .证券交易税

social insurance tax .社会保险税

urban real estate tax .城市房地产税

agriculture tax .(农业)农业税

animal husbandry tax .(饲养,务农,耕种,家政)牧业税

SAT, State Administration of Taxation .,国家税务总局

tax inspection report .纳税检查报告

tax planning .税务筹划