2016年11月FRM一级报名时间

2016年11月FRM一级报名时间2016年的时间转瞬间已经快过一半了。2016年的FRM考试时间也依然只剩下了11月份的一次了,即11月19日。一级和二级可同时报考。那么frm一级报名时间是什么时候?赶紧跟着FRM君来了解一下:

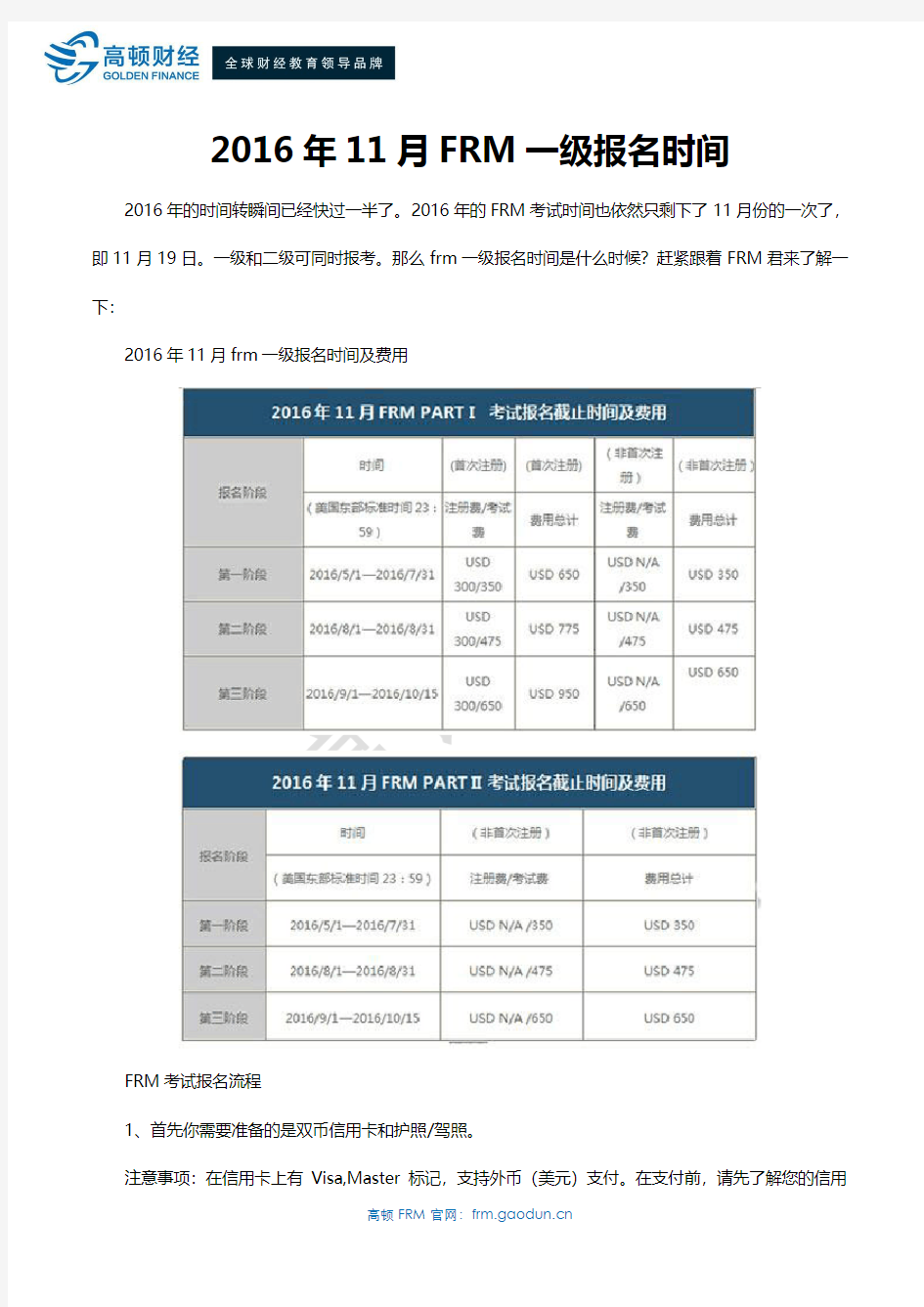

2016年11月frm一级报名时间及费用

FRM考试报名流程

1、首先你需要准备的是双币信用卡和护照/驾照。

注意事项:在信用卡上有Visa,Master标记,支持外币(美元)支付。在支付前,请先了解您的信用

卡额度是否能支付考试费用。

其次就是需要护照或者驾照了。这里需注意,当你报名的时候,一定要牢记,你报名所准备的证件,在考试的时候要带同一证件。

2、登录GARP协会官网,点击register now,注册报名。

注意:若不需要购买教材则不需要勾选,此外,在Membership Auto-Renewal的部分也一定不要选中,否组GARP协会每年会自动从账户中扣取会费。

3、支付成功后,请查收您注册的邮箱,您会收到GARP发出的确认函。若收到确认函,那就恭喜你:考试报名成功啦!

FRM一级模考

FRM一级模拟题 1 . Which of the following statements regarding the lease rate in commodity futures contracts is incorrect? I The lease rate is the return required by the lender in exchange for lending a commodity. II Assuming it is positive, as the lease rate increases, the futures price for a commodity increases. III In a cash-and-carry arbitrage, the lease rate is earned whether or not the underlying commodity is actually loaned. IV Lease rates are similar to dividends paid lo the lender of a share of common stock. V If the lease rate is less than the risk-free rate, the forward market is said to be in contango. A . II and III B . III and V C . I, III, and V D . II and IV Answer: A The lease rate is the amount that a lender requires as compensation for Jending a commodity. In determining the price of a commodity futures contract, the lease rate, 81, is subtracted from the risk-free rate, r, as follows: Assuming a positive lease rate, the lease rate effectively reduces the futures price, all else constant. This also assumes that there is an active market for lending the commodity underlying the futures contract. The lease rate can only be earned by actually lending the underlying commodity. 2 . .Consider the factors that affect the price of futures contracts on various commodities. Which of the following statements does not accurately describe the relationship between a commodity's futures price and its underlying factors? A. Gold futures have an implicit lease rate which, because it is not actually paid by commodity borrowers, creates incentive to' hold physical rather than synthetic gold as ideal strategy to gain gold exposure. B. Natural gas is produced relatively consistently but has seasonal demand, causing the futures price to rise steadily in the fall months, since natural gas is too expensive to store. C. The cost of storing corn, which has relatively constant demand, causes the futures price to rise until the next harvest at which point the price falls. D. Relatively constant worldwide demand for oil and its ability to be cheaply transported keep oil prices relatively stable in the absence of short-run supply and demand. Answer: A Gold futures have an implicit lease rate, because it is not actually paid by commodity borrowers, which creates incentive to hold physical rather than synthetic gold as ideal strategy to gain gold exposure.

frm一级笔记

1.1 风险管理基础 1风险管理 01.1 解释风险的概念和比较风险管理 Risk : arise from uncertainty regarding future loss as well as gain Risk management :activities aimed to reduce or eliminate expected loss Risk taking :active assumption of incremental risk in order to generate incremental gains 01.2 描述风险管理流程,识别流程中的问题和挑战 识别风险 量化和估计风险敞口,决定合适的方法来转移风险 根据转移风险的成本来分析转移风险的方法 开发风险缓释策略 avoid 不做生意,完全避免 transfer 花钱全部转给别人 mitigate 转移部分风险 assume 承担风险 随时监控和评估风险缓释策略 01.3 评估度量管理风险的工具 VaR 在某个概率下的最大损失是多少 Economic Capital 未知一个足够的流动性储备来覆盖潜在损失 Scenario analysis 分析某个因素的经常不可计量的不确定性 Stress testing 基于某个压力的一种情景分析 01.4 区别 EL 和 UL Expected Loss在正常业务情况下有多少损失是预计会发生的,容易预测和计算Unexpected Loss在非正常业务情况下的损失,更难预测和计算

01.5 区别 risk 和 reward,并解释什么样的关注点冲突会影响风险管 理 通常说, the greater risk take,the greater potential reward 可以被度量的 reward 概率部分就是 risk,不能度量概率的就是uncertainty 01.6 描述和区分风险的关键类别,解释每种风险怎么产生的,评估 风险的影响 有 8 大类风险: Market risk:价格的不确定性 interest rate risk equity price risk foreign exchange risk commodity price risk Credit risk:交易对手履约的不确定性 default risk bankruptcy risk downgrade risk

FRM一级模拟题(2)

FRM一级模拟题(2) 1、Which one of the foll owing four trading strategies coul d limit the investor's upside potential while reducing her d ownsid e risk compared to a naked long position in the stock? A. A long position in a put combined with a long position in a stock B. A short position in a put combined with a short position in a stock C.Buying a call option on a stock with a certain strike price and selling a call option on the same stock with a higher strike price and the same expiration date D.Buying a call and a put with the same strike price and expiration date 2、Which one of the foll owing four statements is correct about the early exercise of American options? (1). It is never optimal to exercise an American call option on a non-divid end-paying stock before the expiration date. (2). It can be optimal to exercise an American put option on a non-dividend-paying stock early. (3). It can be optimal to exercise an American call option on a non-dividend-paying stock early. (4). It is never optimal to exercise an American put option on a non-dividend-paying stock before the expiration date. A. 1 and 2 B. 1 and 4 C. 2 and 3 D. 3 and 4 3、Mr. Black has been asked by a client to write a large option on the S&P 500 ind ex. The option has an exercise price and maturities that are not availabl e for options traded on exchanges. He therefore has to hedge the position dynamically. Which of the foll owing statements about the risk of his position is not correct? A.By selling short index futures short, he can make his portfolio delta neutral. B.There is a short position in an S&P 500 futures contract that will make his portfolio insensitive to both small and large moves in the S&P 500. C. A long position in a traded option on the S&P 500 will help hedge the volatility risk of the option he has written. D.To make his hedged portfolio gamma neutral, he needs to take positions in options as well as futures. 4、The current price of stock ABC is $42 and the call option with a strike at $44 is trading at $3. Expiration is in

FRM一级原版教材和其他常见资料分享,包含FRM学习方法

FRM一级原版教材和其他常见资料分享,包含FRM学习方法 马上2018年11月FRM报名工作就要开始了。准备报名的考生开始准备FRM一级教材了。这很有必要的。本文高顿FRM老师将为大家分享FRM一级原版教材相关的内容,帮助考生选对教材,顺利备考。 一、FRM一级官方教材 FRM一级教材不能忽略的来源就是官方了。为了帮助考生入门,协会提供很多免费的教材。下面高顿FRM 老师整理说明协会出品的有关FRM一级教材: 1、2018 FRM Learning Objectives FRM考纲提供了一个全面的框架来指导考生进行FRM考试准备。它包含了要考试的每一个领域以及学习目标。考生应在考试准备期间定期查看。 2、2018 FRM Study Guide FRM学习指南阐述了主要的科目和考试要求的。每年在GARP协会FRM委员会的指导下进行修订,以确保FRM考试仍然是一个有效的知识和技能以及管理金融风险证书。 3、2018 FRM Study Guide Changes 2018年FRM学习指南的变化是根据2017年FRM学习指南进行更改的,主要是和前一年做区别。该指南总结了在2018年FRM研究指南中添加、删除或更新的所有阅读资料。 4、2018 FRM Exam Part I Books(FRM一级原版教材) GARP协会官方出品的FRM Exam books有纸质书和电子版两种。知识点覆盖的非常的全面。购买电子版可以离线也在线访问。有效期三年。 5、2018 FRM Part I Practice Exam 协会提供的FRM一级模拟题主要是根据以前考试中的问题样本出的。这个全面的模拟考试题,代表着老师将在2018年考试FRM一级时会遇到的问题。每级别收费150美元。 二、FRM一级其他教材

FRM一级模拟题(六)

FRM一级模拟题 1. All else held constant and assuming no change in the value of the underlying, what impact should an increase in interest rates have on the price of stock index futures? a. Increase futures prices b. Reduce futures prices c. Have no impact on futures prices d. Make futures prices same as spot Answer: a Explanation: The formula to compute futures price on a stock index future is: .All else held constant if r rises, so should F. 2. Which of the following methods will generally be effective in reducing the likelihood that your firm Is exposed to "hidden risks"? i .Reducing the flexibility traders have to r6spond to market events ii .Creating a culture of risk awareness throughout the organization Structuring https://www.360docs.net/doc/be465489.html,pensation to be aligned with the risk appetite of the firm iv. Investing heavily in quantitative risk models a. i only b. iv only c. ii and iii only d. i, ii, and iii only Answer: C Explanation: Besides eliminating flexibility within the firm, risk monitoring is costly so that at some point, tighter risk monitoring is not efficient. The effectiveness of risk monitoring and control depends crucially on an institution's culture and incentives. lf risk is everybody's business in an organization> it is harder for pockets of risk to be left unobserved. If employees' compensation is affected by how they take risks. they will take risk more judiciously. The best risk models in a firm with poor culture and poor incentives will be much less effective than in a firm where the incentives of employees are better aligned with the risk-taking objectives of the firm. 3. A hedge fund has invested USD 100 million in mortgage about prepayment risk if interest rates fall. Which of the potential loss due to a drop in interest rates? a. Short forward rate agreement (FRA), long T-bond futures b. Long FRA, short T-bond futures c. Long FRA, long T-bond futures d. Short FRA, short T-bond futures Answer: a Explanation: When rates drop, the long position in the futures and the short position in the FRA

FRM一级练习题(2)

FRM一级练习题(2) 1、If the daily, 95% confid ence l evel value at risk (VaR) of a portfolio is correctly estimated to be USD 10,000, one would expect that: A. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or l ess. B. In 1 out of 95 days, the portfolio value will decline by USD 10,000 or l ess. C. In 1 out of 95 days, the portfolio value will decline by USD 10,000 or more. D. In 1 out of 20 days, the portfolio value will decline by USD 10,000 or more. 2、By reducing the risk of financial distress and bankruptcy, a firm's use of derivatives contracts to hedge its cash fl ow uncertainty will: A. Lower its value due to the transaction costs of derivatives trading. B. Enhance its value since investors cannot hedge such risks by themselves. C. Have no impact on its value as investors can costl essly diversify this risk. D. Have no impact as only systematic risks can be hedged with derivatives. 3、An analyst at CAPM Research Inc. is projecting a return of 21% on portfolio A. The market risk premium is 11%, the volatility of the market portfolio is 14%, and the risk-free rate is 4.5%. Portfolio A has a beta of 1.5. According to the Capital Asset Pricing Model (CAPM), which of the foll owing statements is true? A. The expected return of portfolio A is greater than the expected return of the market portfolio. B. The expected return of portfolio A is less than the expected return of the market portfolio. C. The expected return of portfolio A has l ower volatility than the market portfolio. D. The expected return of portfolio A is equal to the expected return of the market portfolio. 4、Suppose portfolio A has an expected return of 8% and volatility of 20%, and its beta is 0.5. Suppose the market has an expected return of 10% and volatility of 25%. Finally, suppose the risk-free rate is 5%. What is Jensen's alpha for portfolio A? A. 10% B. 1% C. 0.5% D. 15% 5、Which of the foll owing statements regarding Metallgesellschaft's failure is incorrect?

FRM学习笔记——SchweserBookINotes

Chapter I The Need for Risk Management 风险是一种不确定性,一般来说,风险可以分为经营风险(Business Risk)和金融市场风险(Financial Risk),前者主要由于经营决策和经营环境导致,而后者则主要由金融市场传递。两者的区分从本质上说其实并不那么明显,因为金融市场的利率水平波动是多个微观主体经营决策之影响总和。 金融市场风险可以分为四种: ?市场风险(Market Risk) ?Absolute Risk (相当于同比收益率)和 Relative Risk(相当于环比收益率) ?Directional Risk (与风险因子有线性关系)和 Non-directional Risk(与风险因子有非线性关系) ?Basis Risk(基差风险) ?Volatility Risk(即,市场波动幅度发生变化的不确定性) ?流动性风险 ?Asset-liquidity Risk 指由于标的资产过度交易导致的价格波动 ?Fund-liquidity Risk 指由于流动资产小于流动负债导致的无法及时偿付 ?违约风险 ?操作风险 监管松弛(Deregulation)和全球化(Globalization)使企业面临更多的不确定性,这些不确定性的增加使得我们更加需要认识和使用风险管理工具。然而,我们必须记住的是,风险管理终究是对风险的管理,其本身并不能减少风险,而是对风险实行一种分配,以达到分散风险的效果。 金融机构是金融市场的构成者和参与者,市场中的衍生品是基于标的资产的合约,这些衍生品拥有预先约定的存续期、价格和名义本金。这些衍生品不同于金融资产,一股股票是一种非零合博弈,或者认为是一种帕累托改进。而衍生品的交易双方的收益始终等于损失,即总收益始终为零。这也从一个侧面反映了衍生品是对风险所做的一种分配,并没有减少风险。 杠杆率(Leverage)降低了交易成本,同时也放大了收益和损失的倍数。 风险估值(Value at Risk)给出在一定置信度下最大的损失,即在这个置信度水平下金融资产至少拥有的价值。VAR分为三种: ?Delta-normal VAR ?Historical VAR

FRM一级考试通过经验及各科目重点详细介绍!

FRM一级考试通过经验及各科目重点详细介绍! 因为自己就读金融工程,所以较初接触FRM一级的时候,翻看高顿的复习资料,可以说内心中还是充满了欣喜与放松。因为FRM知识点中很多的内容都是那么熟悉,比如量化分析技巧,概率论与数理统计,期货期权的内容以及资本市场的相关知识。我曾经在那么一瞬间觉得这门考试似乎就能轻松应对,甚至萌发了在考前两周再“加班”的想法。 真正想要征服FRM,就要按照FRM的规则出牌,不能想当然。我相信很多金融或者财务领域出身的人,甚至已经通过CFA考试的人会与我有过同样的经历:自诩“科班出身”,想当然的藐视一切,殊不知金融行业虽然本质相近,但是行为各异,甚至很多名词的叫法也都不一样。 分析科目侧重点 在运用高顿的内容来学习的过程中,可以发现老师们将FRM考试的备考主要分为四大部分:风险管理基础,量化分析,金融市场和金融产品,估值与风险模型。在这当中,风险管理基础和量化分析两个部分占比较少,而金融市场和金融产品与估值风险模型两个部分占比较大。其实这也为我们提供了一个很好的学习备考侧重点。 相信有一定数理基础的同学,能够很快学习掌握量化分析部分,对于概率论和数理统计的内容,其实只要掌握了技法,就可以应对任何类似的问题。因为这个部分不管数字怎么变,考法其实很单调。无非就是“用古典概率分布计算概率”,“用几何概型估算概率”,“用关键值判断假设是否成立”等等。 第YI阶段 我们可以自己总结规律:对于均值,它是一阶的特征,因此在进行均值的假

设检验的时候,就要采用一阶的分布进行检验,也就是t分布或者正态分布。其中正态分布是近似于“万金油”的分布,根据大数定律来看,当样本量足够的时候,分布都会或多或少趋近于正态。对于方差,是二阶的特征,因此在进行方差的假设检验的时候,要采用二阶的分布进行检验,也就是卡方分布。其他的特征检验以此类推,这样有助于记忆。 而风险管理基础部分就更简单了。这一部分的真谛在于市场理论和道德。对于道德内容和过往历史案例方面,这两个要放在一起联合记忆。因为道德内容如果展开讲其实几天都讲不完。 对于金融市场和金融产品,相对来讲要多下一些功夫。首先较较重要的是做好区分和联系。这一部分会涉及到很多的金融产品以及衍生品。那么,不论学员是第YI次接触这些还是以前曾经有过涉猎,在学习的过程中都要首先明确:期权,期货,互换,远期合约这些产品各自的定义和相互的区别。 而在区分他们的过程中,要妥善利用高顿提供的框架图表,因为这些衍生品的区别方式有很多,可以从权利与义务关系层面来区分,也可以从风险大小层面来区分,甚至可以从交易场所和交易合约层面进行区分。 我们说这些衍生品的掌握是这个部分的根基。只有有效掌握了它们,在之后的题目当中,提及任何一种或者多重衍生品,我们才能知道题目究竟在问什么。这是第YI阶段。 第二阶段 而紧接着的第二阶段就是每种产品对应的定价和估值。 我们说定价和估值看起来似乎是一种东西,其实实际上他们的内核是相同的:在时间价值的基础上考虑未来现金流。但是在衍生品产生时(初始交易)我们称其

2018年FRM一级考试主要公式汇总!

2018年FRM一级考试主要公式汇总! FRM一级考试公式有以下这些: 一、盈利能力分析 1.销售净利率=(净利润÷销售收入)×100%该比率越大,企业的盈利能力越强 2.资产净利率=(净利润÷总资产)×100%该比率越大,企业的盈利能力越强 3.权益净利率=(净利润÷股东权益)×100%该比率越大,企业的盈利能力越强 4.总资产报酬率=(利润总额+利息支出)/平均资产总额×100%该比率越大,企业的盈利能力越强 5.营业利润率=(营业利润÷营业收入)×100%该比率越大,企业的盈利能力越强 6.成本费用利润率=(利润总额÷成本费用总额)×100%该比率越大,企业的经营效益越高。 二、盈利质量分析 1.全部资产现金回收率=(经营活动现金净流量÷平均资产总额)×100%与行业平均水平相比进行分析 2.盈利现金比率=(经营现金净流量÷净利润)×100%该比率越大,企业盈利质量越强,其值一般应大于1 3.销售收现比率=(销售商品或提供劳务收到的现金÷主营业务收入净额)×100%数值越大表明销售收现能力越强,销售质量越高 三、偿债能力分析 1.净运营资本=流动资产-流动负债=长期资本-长期资产对比企业连续多期的值,进行比较分析 2.流动比率=流动资产÷流动负债与行业平均水平相比进行分析 3.速动比率=速动资产÷流动负债与行业平均水平相比进行分析 4.现金比率=(货币资金+交易性金融资产)÷流动负债与行业平均水平相比进行分析 5.现金流量比率=经营活动现金流量÷流动负债与行业平均水平相比进行分析 6.资产负债率=(总负债÷总资产)×100%该比值越低,企业偿债越有保证,贷款越安全

FRM一级模考

FRM一级模拟题 1 . A trader has put on a long position in a 2-year call on a stock whose strike will be determined by the value of the stock in l year's time. You can expect this position: . A. To have no delta, no gamma, and no vega B. To have no delta, no gamma, and appreciable vega C. To have small delta, no gamma, and appreciable vega D. To have small delta, no gamma, no vega Answer: C The 2-year maturity would result in a small delta, while the fact that the exercise price is not yet set would preclude gamma function. The option would, however, have considerable sensitivity to the volatility of the underlying stock price (vega as the value of the call option would increase or decrease along with the volatility of the underlying shares. 2 . A portfolio of stock A and options on stock A is currently delta neutral, but has a positive gamma. Which of the following actions will make the portfolio both delta and gamma neutral? A. Buy call options on stock A and sell stock A B. Sell call options on stock A and sell stock A C. Buy put options on stock A and buy stock A D. Sell put options on stock A and sell stock A Answer: D To reduce positive gamma, one needs to sell options. When call options are sold, the delta becomes negative and one needs to buy stock to keep delta neutrality. When put options are sold, the delta becomes positive, and one needs to sell stock to keep delta neutrality. 3 . Which position is most risky? A. Gamma-negative, delta-neutral B. Gamma-positive, delta-positive C. Gamma-negative, delta-positive D. Gamma-positive, delta-neutral Answer: C A riskier position is one that is expected to move around a lot in value. A delta neutral position should not change in value as the value of the underlying asset changes. This eliminates Choice A and Choice D Choice C is correct because a gamma-negative position means that delta and the change in the underlying asset move inversely with each other. 4 . Which of the following Greeks contributes most to the risk of an option that is close to expiration and deep in the money?

FRM一级模考

FRM一级模拟题 1 . A bank has sold USD 300,000 0f call options on 100,000 equities. The equities trade at 50, the option strike price is 49, the maturity is in 3 months, volatility is 20%, and the interest rate is 5%. How does it the bank delta. hedge? (round to the nearest thousand share) A. Buy 65,000 shares B. Buy 100,000 shares C. Buy 21,000 shares D. Sell 100,000 shares we know that N(0.3770) has to be between 0.5 and l.0, which means we need to buy somewhere between 50,000 and 100,000 shares. The only answer that fits is A, buy 65,000 shares. If you did have access to a probability table, you could determine that N(0.37'/0) = 0.6469, which means we need to buy exactly 64,690 shares to delta hedge the position. ' 2 . Initially, the call option on Big Kahuna Inc. with 90 days to maturity trades at USD l.40. The option has a delta of 0.5739. A dealer sells 200 call option contracts, and to delta-hedge the position, the dealer purchases 11,478 shares of the stock at the current market price of USD 100 per share. The following day, the prices of both the stock and the call option increase. Consequently, delta increases t0 0.7040. To maintain the delta hedge, the dealer should A. sell 2,602 shares B. sell l,493 shares C. purchase l,493 shares D. purchase 2,602 shares Answer: D Changes of Stock number= (0.7040-0.5739) x200x100=2602 3 . To hedge delta, gamma, and Vega of a portfolio of derivatives, with futures, FRAs, and options, the easiest way to calculate the appropriate amount of the hedges is to evaluate the quantity of: A. futures first and FRAs second B. futures first and options second C. options first and FRAs second D. FRAs first and futures second Answer: C

FRM一级模拟题(五)

FRM一级模拟题 1. When testing a hypothesis, which of the following statements is correct when the level of significance of the test is decreased? a. The likelihood of rejecting the null hypothesis when it is true decreases. b. The likelihood of making a Type I error increases c. The null hypothesis is rejected more frequently, even when it is actually false d. The likelihood of making a Type 11 6rror deceases. Answer: a Explanation: Decreasing the level of significance of the test decreases the probability of making a Type I error and hence makes it more difficult to reject the null when it is true However, the decrease in the chance of making a Type I error comes at the cost of increasing the probability of making a Type l1 error, because the null is rejected less frequently, even when it is actually false. 2. Howard Freeman manages a portfolio of investment securities for a regional bank. The portfolio has a current market value equal to USD 6.247.000 with a daily variance of 0.0002. Assuming there are 250 trading days in a year and that the portfolio returns follow a normal distribution, the estimate of the annual VaR at the 95% confidence level is closest to which of the following? https://www.360docs.net/doc/be465489.html,D 32,595 b. USD 145.770 https://www.360docs.net/doc/be465489.html,D 2.297, 854 d. USD 2.737868 Answer: C Explanation: Daily standard deviation = sqrt(0.0002) = 0.01414. Annual VaR = 6,247,000 x sqrt(250) x 0.01414 x 1.645 = 2,297,854 3 . An investor finds that the gold lease rate is 5% and the corresponding risk free rate is 6%. Under these conditions, which of the following charts of forward prices