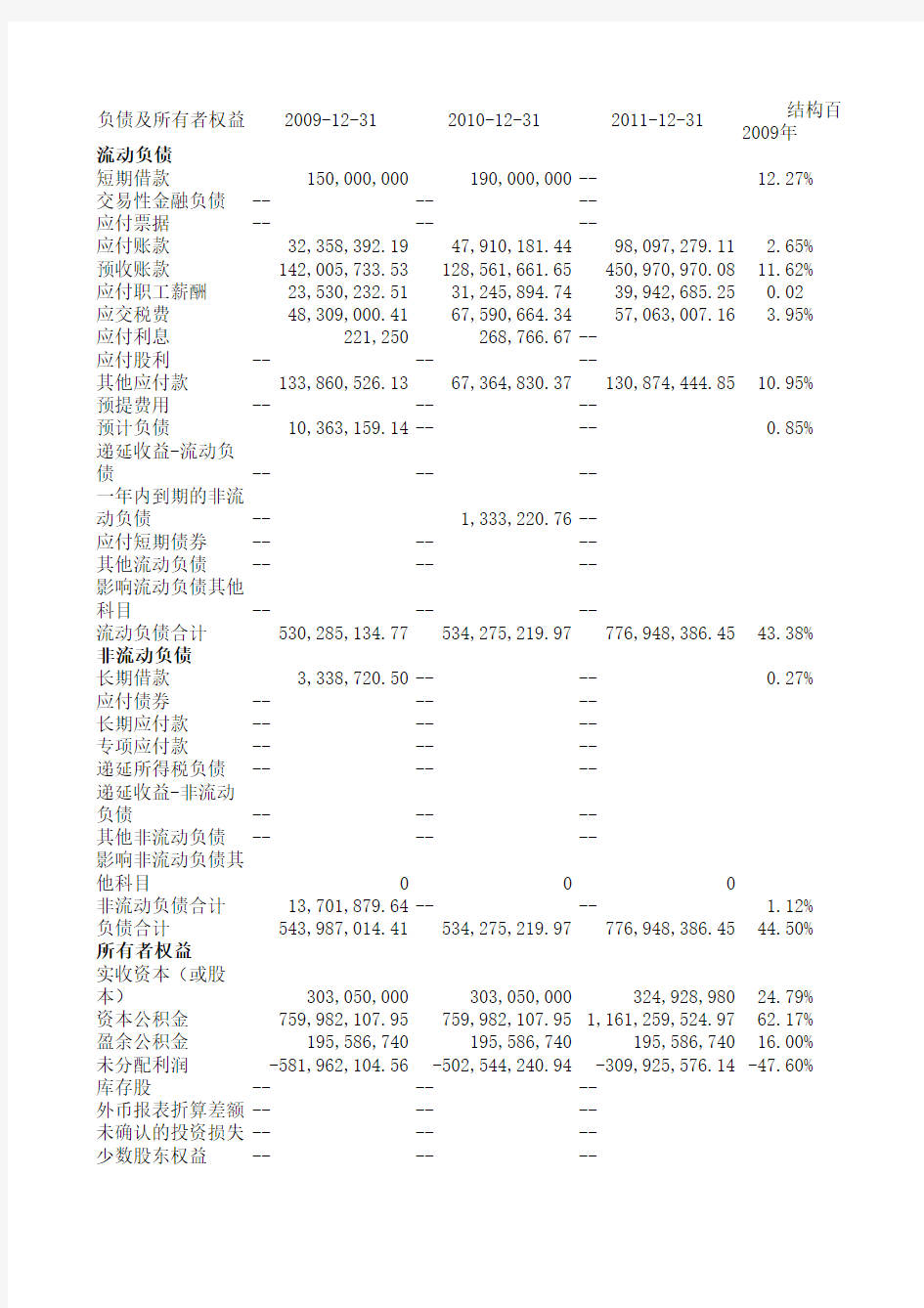

资本结构分析表

2009年流动负债短期借款

150,000,000190,000,000--12.27%

交易性金融负债------应付票据----

--应付账款32,358,392.1947,910,181.4498,097,279.11 2.65%预收账款142,005,733.53128,561,661.65450,970,970.0811.62%应付职工薪酬23,530,232.5131,245,894.7439,942,685.250.02 应交税费48,309,000.41

67,590,664.3457,063,007.16 3.95%

应付利息221,250268,766.67--应付股利------其他应付款133,860,526.1367,364,830.37

130,874,444.8510.95%预提费用------预计负债

10,363,159.14----0.85%

递延收益-流动负债

------一年内到期的非流动负债

--1,333,220.76--应付短期债券------其他流动负债------影响流动负债其他科目

----

--流动负债合计530,285,134.77

534,275,219.97

776,948,386.4543.38%非流动负债长期借款3,338,720.50----0.27%

应付债券------长期应付款------专项应付款------递延所得税负债------递延收益-非流动负债

------其他非流动负债--

--

--

影响非流动负债其他科目

000

非流动负债合计13,701,879.64---- 1.12%

负债合计543,987,014.41534,275,219.97776,948,386.45

44.50%

所有者权益实收资本(或股本)

303,050,000303,050,000324,928,98024.79%资本公积金759,982,107.95759,982,107.95

1,161,259,524.9762.17%

盈余公积金195,586,740195,586,740195,586,74016.00%未分配利润-581,962,104.56-502,544,240.94-309,925,576.14-47.60%库存股

------外币报表折算差额------未确认的投资损失------少数股东权益

------

结构百2011-12-31

负债及所有者权益2009-12-312010-12-31

归属于母公司股东

权益合计676,656,743.39756,074,607.011,371,849,668.8355.35%影响所有者权益其

他科目------

所有者权益合计678,495,148.86756,074,607.011,371,849,668.8355.50%负债及所有者权益

总计1,222,482,163.271,290,349,826.982,148,798,055.28100.00%

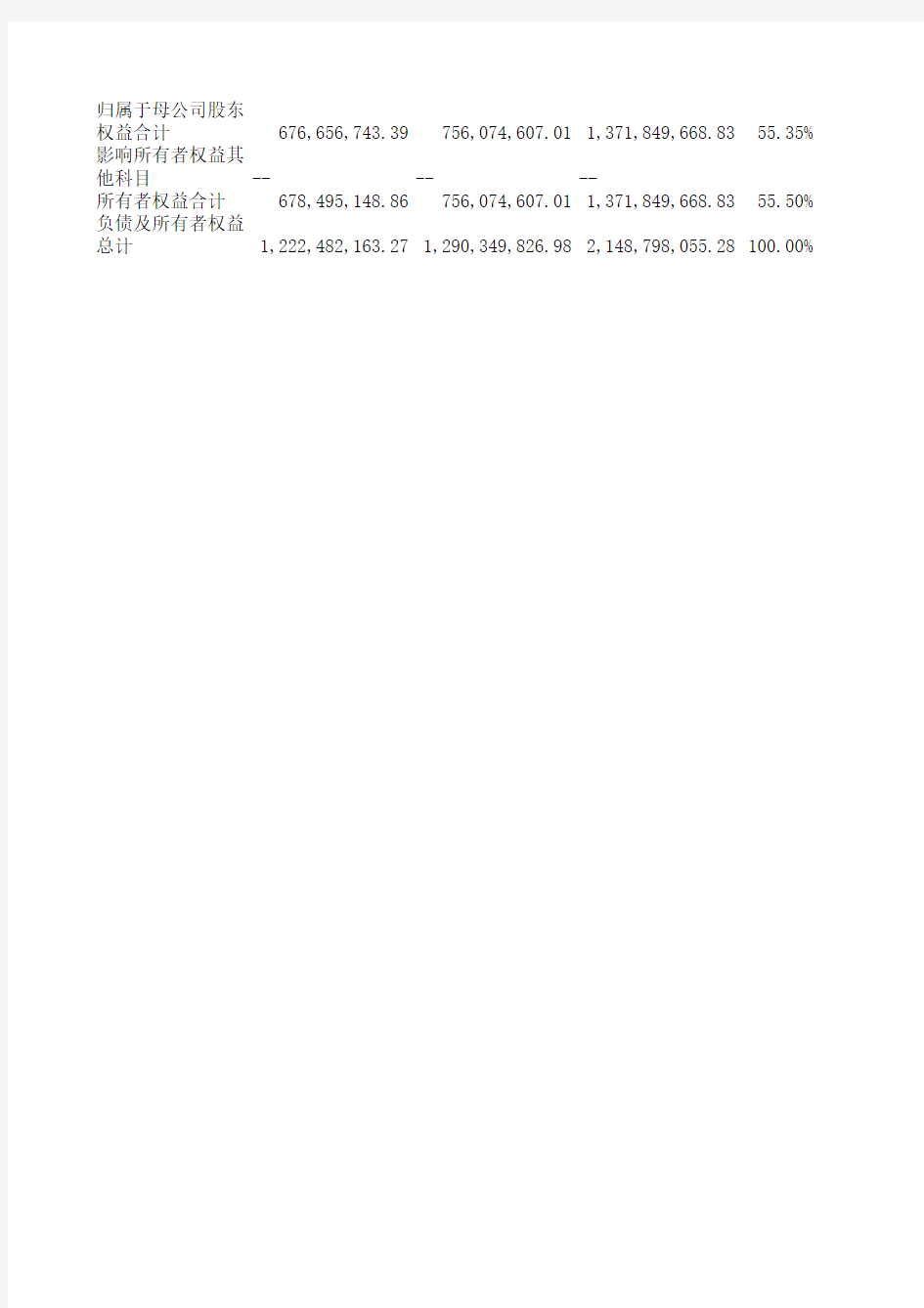

结构百分比(%)变动情况(%)2010年2011年2010-2009年2011-2010年

14.72% 2.45%-14.72%

3.71%

4.57% 1.07%0.85%

9.96%20.99%-1.65%11.02%

2.42% 1.86%0.50%-0.56%

5.24% 2.66% 1.29%-2.58%

5.22%

6.09%-5.73%0.87%

-0.85%

0.10%0.10%-0.10%

41.41%36.16%-1.97%-5.25%

-0.27%

-1.12%

41.41%36.16%-3.09%-5.25%

23.49%15.12%-1.30%-8.36%

58.90%54.04%-3.27%-4.86%

15.16%9.10%-0.84%-6.06%

-38.95%-14.42%8.66%24.52%

58.59%63.84% 3.24% 5.25% 58.59%63.84% 3.09% 5.25% 100.00%100.00%